If you’ve been exploring the world of cryptocurrency investing, you’ve probably asked yourself an important question: what is Bitcoins Market Cap, and what does market cap mean in cryptocurrency? It’s a key indicator of value, stability, and investment potential. In this article, VN-US Trade’ll break down everything you need to know about Bitcoin’s Market Cap and show you how to use that knowledge to make smarter financial decisions in a volatile market.

1. What is Bitcoins market cap? A clear and comprehensive explanation

If you’re just stepping into the world of cryptocurrency, one of the first and most important concepts to understand is Bitcoin’s market cap, but what does cryptocurrency market capitalisation mean, exactly?. So, what is Bitcoins Market Cap, and why should every investor, whether beginner or experienced, care about it?

In simple terms, Bitcoin’s market cap is the total dollar value of all the Bitcoins currently in circulation. It’s calculated using a straightforward formula:

Circulating Supply × Current Price.

For example, if there are 19.7 million Bitcoins in circulation and each one is worth $60,000, the total market cap would be $1.182 trillion.

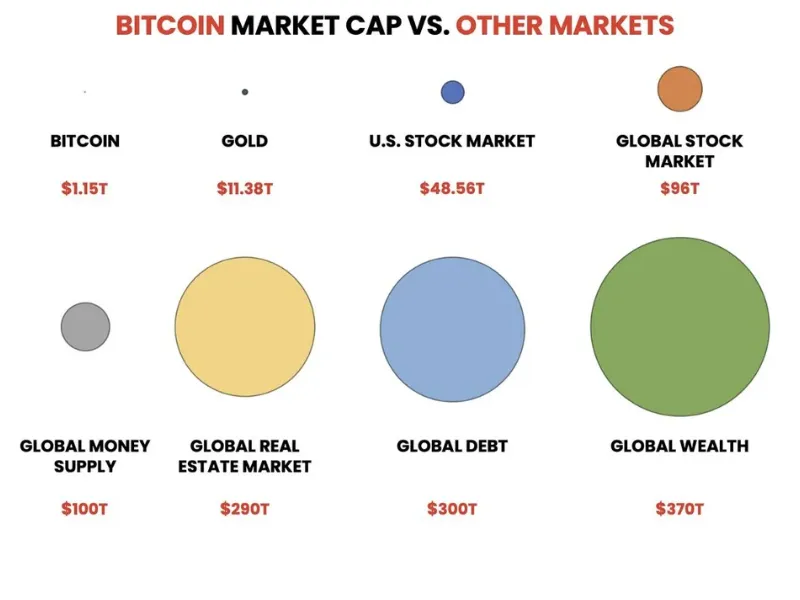

That number isn’t just for show, it represents Bitcoin’s overall strength, dominance, and perceived value in the global crypto market. Just like investors use a company’s market capitalization to evaluate its size and importance (think Apple or Amazon), crypto investors use Bitcoin’s market cap to measure its position and influence among thousands of digital assets.

Two Ways to Measure Bitcoin’s Market Cap

There are two primary methods used to understand what is Bitcoins market cap:

- Circulating Supply Market Cap: This reflects the total value of coins that have already been mined and are actively in use, currently about 19.7 million BTC.

- Fully Diluted Market Cap: This considers the maximum potential supply of Bitcoin, 21 million coins, assuming every coin is eventually mined.

Some analysts prefer the fully diluted view for long-term forecasting, but if you’re actively trading or investing today, focusing on the circulating supply offers a more realistic, real-time picture.

2. What is Bitcoin’s current market cap?

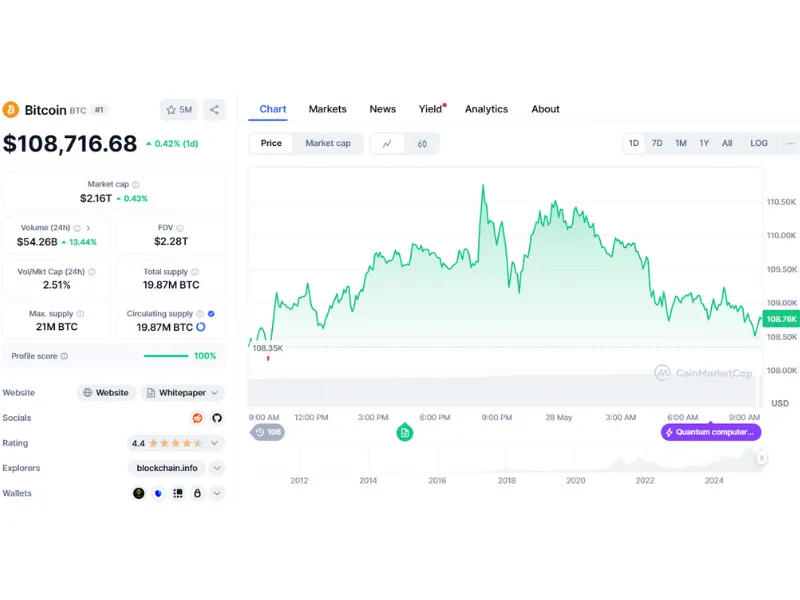

As of now, Bitcoin’s market capitalization stands at approximately $2.16 trillion. This figure reflects a slight daily decline of 0.40%, down from $2.176 trillion on May 26, 2025. However, when viewed on a year-over-year basis, the growth is remarkable — up nearly 60% from around $1.36 trillion just a year ago.

You can take a closer look through the data from CoinMarketCap as follows:

3. Why investors need to understand what is Bitcoins market cap to succeed?

Many new investors make the mistake of only looking at a coin’s price to determine its value. But here’s the reality: Price alone can be misleading.

Let’s say you’re comparing two cryptocurrencies:

- Crypto A has 400,000 coins in circulation, each priced at $1, making its market cap $400,000.

- Crypto B has 100,000 coins in circulation, each priced at $2, resulting in a market cap of $200,000.

Even though Crypto B has a higher price per coin, Crypto A is actually worth more in total. That’s why market cap offers a more complete and accurate snapshot of a cryptocurrency’s overall value.

From my personal investing journey, I’ve seen how easy it is to chase cheap coins, thinking they’re “undervalued.” But without checking market cap, you’re flying blind. It’s like trying to judge a company’s worth based only on its stock price, without knowing how many shares exist.

3.1. Bitcoin’s market cap reflects trust and stability

Bitcoin consistently holds the highest market cap in the crypto space, often representing over 40% of the entire digital asset market. That dominance means more investor trust, greater liquidity, and less risk of manipulation.

While Bitcoin isn’t immune to volatility, news headlines, regulations, and global economic shifts can all affect its price; its high market cap acts as a cushion. That’s why long-term investors often use Bitcoin’s market cap as a signal of relative safety and resilience.

4. Expert guidance: What can investors do with Bitcoin’s market cap?

So what can you actually do with this information?

Understanding what is Bitcoins Market Cap helps you classify crypto assets and fine-tune your portfolio based on risk tolerance and long-term goals. Here’s a simple breakdown of the three main crypto categories based on market cap:

- Large-cap (Over $10 billion): Includes Bitcoin and Ethereum. These are considered lower-risk assets due to their maturity, liquidity, and consistent performance.

- Mid-cap ($1 billion – $10 billion): These coins often show strong potential for growth but come with added risk.

- Small-cap (Under $1 billion): These projects can be highly volatile and are often driven by hype or speculation.

Personally, I treat Bitcoin’s market cap as one of my key benchmarks when allocating funds. If I want stability in my portfolio, I lean toward assets with higher caps. If I’m looking for growth, I might explore mid-cap coins, but I never ignore the role market cap plays in assessing real value and risk.

That said, market cap isn’t the only metric that matters. Smart investors also consider price trends, trading volume, use case, developer activity, and macroeconomic conditions. Still, market cap is a strong starting point, a north star to guide your decision-making process.

5. Where can you find reliable sources to check Bitcoin’s market cap?

Now that you know “what is Bitcoins market cap” and “what does market cap mean in cryptocurrency”, where can you track it?

Here are three reliable and regularly updated platforms I use and recommend:

- CoinMarketCap: Offers comprehensive data on thousands of cryptocurrencies, including real-time market cap, trading volume, supply, and historical charts.

- CoinGecko: Similar to CoinMarketCap, but adds community metrics and developer data for deeper insights.

- Coinbase: Ideal for beginners. While mainly an exchange, it features a clean interface to track Bitcoin’s price, market cap, and historical movement.

I often cross-reference between these platforms to ensure accuracy. A minor data delay on one site can lead to big differences during volatile moments, so being thorough pays off.

See more related articles:

- What do you do with bitcoins

- How to Buy Bitcoins in 2025 – Step-by-Step Guide for Beginners

- What is bitcoin trading for

6. What is Bitcoins market cap’s history? Latest market cap update

If you’re asking what is Bitcoins Market Cap, it’s important to understand how this number has changed over time and why it matters for your investments.

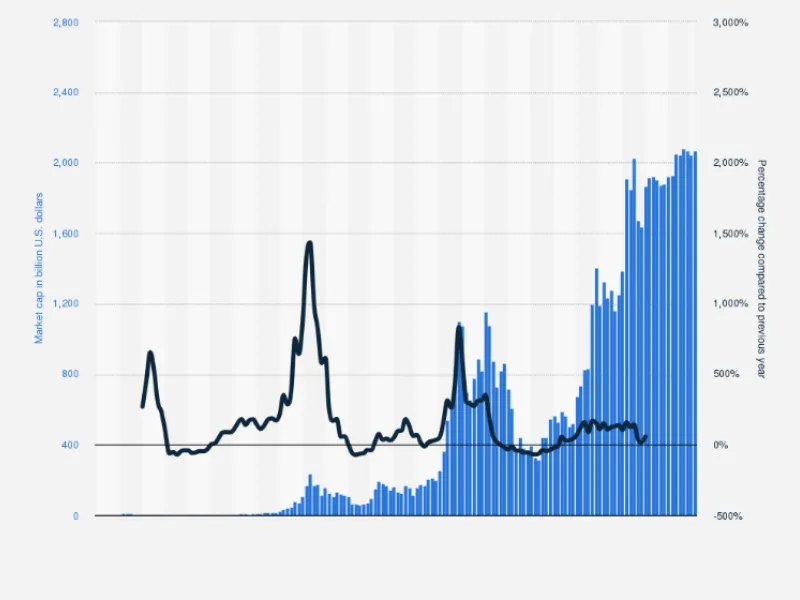

Bitcoin’s market capitalization started small, back in 2013, it was just around 1 billion dollars. Since then, it has grown dramatically. As of May 2025, Bitcoin’s market cap reached over 2.1 trillion dollars.

This means the total value of all Bitcoins currently in circulation is more than two trillion dollars. Just last year, it was around 1.36 trillion, so that’s a huge jump of almost 57%. This shows how Bitcoin continues to gain popularity and trust among investors worldwide.

This historical trend helps explain why “what does cryptocurrency market capitalisation mean” isn’t just a theoretical concept; it’s a real-world indicator of maturity and adoption.

6.1. Bitcoin’s dominance: Why it matters

When you learn what is Bitcoins Market Cap, you’ll also hear about “Bitcoin dominance.” This means the percentage of the total cryptocurrency market’s value that Bitcoin controls. As of 2025, Bitcoin holds more than 50% of the entire crypto market. This is important because it shows how strong and influential Bitcoin is compared to thousands of other cryptocurrencies, often called altcoins.

From my experience, tracking Bitcoin dominance can help you see when investors are moving money into safer assets (like Bitcoin) or riskier altcoins. A rising dominance usually means confidence in Bitcoin’s stability, while a falling dominance might signal people are chasing bigger gains elsewhere.

7. FAQs: Common questions for beginners exploring what is Bitcoins market cap

- 1. What’s the difference between Circulating Supply Market Cap and Fully Diluted Market Cap?

Circulating Supply Market Cap counts only the Bitcoins currently mined and available, while Fully Diluted Market Cap assumes all 21 million Bitcoins will be mined. The circulating supply is more relevant for current trading, whereas the fully diluted value helps with long-term forecasting.

- 2. Why shouldn’t I judge Bitcoin’s value by price alone?

Price alone can be misleading because it doesn’t reflect how many coins are available. Market Cap gives you the total value of all coins combined, providing a clearer picture of Bitcoin’s true market size and value compared to other coins.

- 3. Can Market Cap predict Bitcoin’s future price?

Market Cap itself isn’t a price prediction tool, but it provides context on Bitcoin’s overall market size and maturity. Combined with other metrics like volume and trends, it helps investors make more informed decisions.

- 4. Is a higher Market Cap always better?

Not necessarily. A higher Market Cap usually means stability and liquidity, but smaller-cap coins can offer higher growth potential, albeit with higher risk. Balance your portfolio based on your risk tolerance and goals.

- 5. How can I use Market Cap to diversify my crypto portfolio?

You can classify coins into large-cap, mid-cap, and small-cap categories by Market Cap. Large-cap coins like Bitcoin are usually more stable, while mid and small caps may offer growth opportunities. Diversifying by cap size helps manage risk effectively.

8. Conclusion: Why understanding what is Bitcoin market cap helps you invest better

To sum up, knowing what is Bitcoins Market Cap gives you a clear picture of Bitcoin’s size, strength, and importance in the crypto world. It shows you not only how much Bitcoin is worth overall but also how it compares to other cryptocurrencies.

From my own investing journey, I can say that paying attention to market cap helps you make smarter decisions. Whether you’re a beginner or an experienced investor, understanding Bitcoin’s market cap can guide you in managing risk and spotting opportunities.

If you want to learn more about what is Bitcoins Market Cap or have questions, don’t hesitate to reach out to us at VN-US Trade. Check out our other guides too, we’re here to help you succeed in your Bitcoin investments.