In today’s advanced technology era, online transactions are increasingly trending and showcasing their beneficial aspects. To serve users’ online transaction needs, developers have launched various electronic wallets with different features and advantages and disadvantages. The proliferation of wallet options can confuse users, especially newcomers learning about online transactions. This article will introduce you to a wallet with many excellent features widely appreciated in the market today, which is Moca Wallet. Let’s explore what Moca Wallet is, what features it offers over other wallets, how to register an account, and how to use the wallet, along with answers to some common user questions in the following article.

What is Moca Wallet?

Moca Wallet is an electronic wallet known for its ability to pay for shopping bills from shopping centers, supermarkets, taxi fares, internet bills, phone card recharge, etc.

Moca gained more fame after being linked with Grab’s services. After using Grab’s services, you can pay directly or online via GrabPay by Moca.

People started noticing Moca in the market from February 2016.

What are the outstanding uses of Moca Wallet?

The most notable feature is that Moca makes paying utility bills, shopping, internet, and television service fees convenient, quick, and completely free.

You don’t always have the opportunity to visit transaction points to make direct payments; sometimes online payments are necessary, and Moca helps you do that.

Especially, Moca helps you remember the service providers’ necessary information, customer codes, and reminds users of upcoming bills.

Moreover, during the most anticipated sale events like Black Friday, 11-11, Moca is a powerful tool to hunt for sales, close orders, and make quick payments.

Advantages of Moca Wallet over other electronic wallets

To objectively compare with other electronic wallets, we find that Moca has 2 outstanding points:

- Moca is linked with Grab via the GrabPay by Moca service, increasing convenience and attracting a large user base.

- Moca helps Grab expand services such as food ordering and delivery, transportation, etc., to meet diverse user needs.

Moca is among the few e-wallets that can connect with up to 21 banks, making it easier for users to link accounts and attract more users to the wallet.

Detailed guide to register for a Moca account

To register for a Moca account, first, you need to download the Moca app onto your phone. The app supports iOS and Android operating systems. Simply search for “Moca” in the search bar and install it normally.

After successfully installing the app, open it and on the main menu interface, enter your phone number.

It is recommended to enter the phone number registered with your frequent banking internet banking.

Then, you will receive a verification code.

Set up a password for your wallet.

That’s it, you’ve successfully registered a Moca account. To use Moca Wallet, you need to link your wallet with your bank account by clicking on “Link card”.

Guide to link Moca Wallet with your bank account

Enter your ATM card number.

Make sure to accurately input the bank’s information supported by Moca, such as the card number, expiry date, and cardholder’s name.

Enter the correct OTP code received.

Once you receive a message like this, it means you have successfully linked your bank account.

Guide to deposit/withdraw money from Moca Wallet

On the main menu interface, select “Personal” then “Moca Wallet”

Choose deposit or withdrawal as desired.

Moca does not set a minimum deposit limit per transaction, so you can deposit any amount and then enter your bank account PIN.

The above image shows the interface for depositing money.

And this is the interface for withdrawing money, note that for deposits, the minimum amount is 50,000 VND.

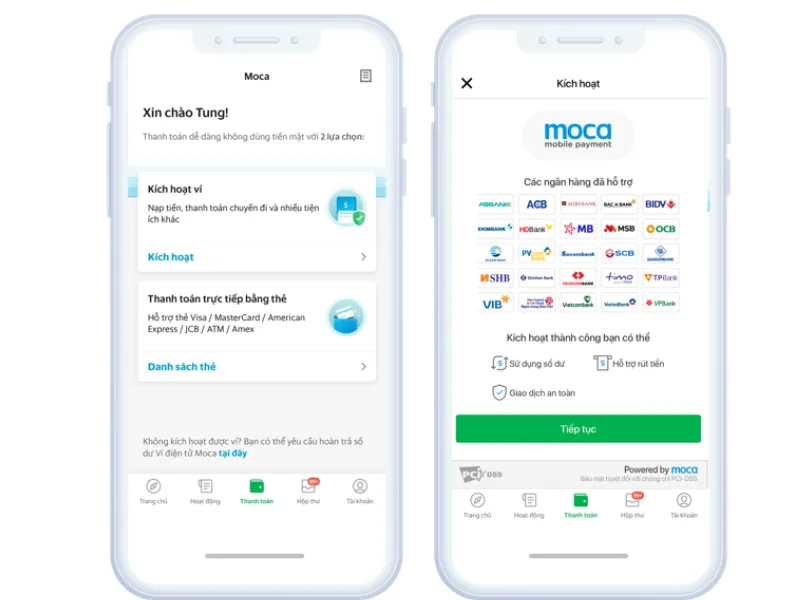

How to use GrabPay by Moca

Moca cooperates with Grab to create an online payment method for Grab services called GrabPay by Moca. This method is so useful and popular that GrabPay by Moca is often called Grab’s electronic wallet.

To use GrabPay by Moca, you do not necessarily need to download the Moca app; you can also use the Grab app for convenience.

Here, we will guide you on how to use GrabPay by Moca within the Grab app.

Simply enter your ATM card details correctly and completely in the linked card interface to activate GrabPay by Moca.

Open the Grab app and tap on “Activate” on the interface.

Then, activate the wallet.

You can link ATM cards from various banks with GrabPay by Moca, including MBBank, BIDV, OCB, Sacombank, SHB, Vietcombank, VietinBank, SCB, VPBank, Timo Powered by VPBank, ACB, HDBank.

Press “Continue”.

Read the “Notes” section carefully and then press “Confirm”.

Then, enter the accurate details from your card, including:

- Card number

- Cardholder’s name

- Depending on the bank, the card may display the issue date or expiry date.

Enter the OTP or bank card PIN received.

Once activated successfully, the GrabPay by Moca wallet can top up from the Moca app, and the balance on Moca and Grab by Moca can be synchronized.

You can add money to GrabPay by Moca by clicking on “Add Money”.

If activation of GrabPay by Moca fails, your wallet balance will be returned either via bank transfer to the linked bank or as a travel voucher of greater value than the wallet balance. You do not need to download the Moca app as GrabPay by Moca and Moca are unrelated from the beginning.

To unlink your bank from GrabPay by Moca, simply tap the ATM card icon at the top right of the screen.

Select the bank, tap “Delete,” and then “Confirm.”

How to set security for the account

Because Moca Wallet holds a certain amount of user assets, there are many concerns regarding account security policies. Here, we will guide you in establishing basic security layers for your account.

Set up a PIN code

Step 1: Tap on “Account” on the main interface.

Step 2: Choose “Settings”.

Step 3: On the settings interface, select “Set PIN”.

Step 4: Enter your PIN accurately to proceed with authentication.

Email verification

Email verification is straightforward by following these steps:

Step 1: On the main menu, select “Account”.

Step 2: On the next screen, select “Edit Account”.

Step 3: Enter your email address; the system will send a message to the provided address. Simply log into your email and follow the instructions.

Answers to some questions about Moca

Is using Moca Wallet safe?

This is a matter of great concern, especially the account security and safety issues, which are top criteria for users when exploring a new wallet. This is understandable because the electronic wallet directly involves the assets stored and is linked to banks and personal information.

Regarding this, we have researched and found that Moca uses the best security technologies to ensure your account safety. Moca is certified to meet PCI-DSS (Payment Card Industry Data Security Standard) standards.

This certification encompasses criteria related to security, policies, network architecture, etc., mainly aimed at data security. This is a foundation for you to trust Moca’s security system.

Who created Moca?

Moca Wallet was created and developed by Moca Technology and Service Joint Stock Company. By 2018, Grab acquired 3.523% of the shares, and since then, Moca has become part of the Grab network.

How are transaction fees calculated at Moca?

Money transfer and top-up services via linked bank, Moca wallet, or domestic cards are completely free.

However, some banks like HDBank, VPBank, Sacombank, ACB charge a fee of 2000 VND per transaction.

International cards like Visa/MasterCard incur a fee of 2% of the transaction volume each time.

How to contact support?

There are many ways to contact support: you can call the wallet’s helpline at 028 7109 8588 or via email at support@moca.vn, or more easily, visit Moca’s fanpage here.

What are Moca’s transaction limits?

The maximum transaction limit at Moca is 5,000,000 VND per transaction and up to 3 transactions per day.

Conclusion

The above article provides comprehensive information about Moca e-wallet, including what Moca Wallet is, its advantages over other wallets, how to create an account and use basic features, security settings for the wallet account, and answers to common questions. We hope this article meets your informational needs and assists in your work and daily life.

Read more: ETH wallet