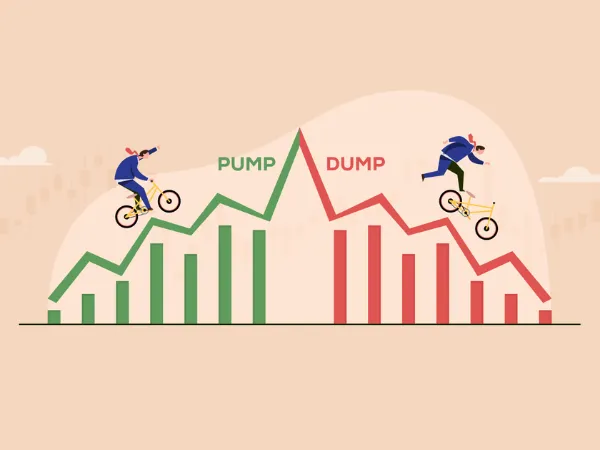

Pump and Dump is a fraud act in trading, aiming to artificially inflate the price of a certain coin by the “whales” (traders holding large amounts of coins capable of manipulating the market). By actively promoting false information and advertising the good aspects of the coin they possess, once the price peaks, the “whales” start selling off in bulk or even dumping to cause market decline. To gain a deeper understanding of Pump and Dump, its plan scenarios, and how to avoid becoming a victim of these schemes, please follow the article below.

What is a Pump?

In English, Pump means to inflate or boost. In this context, it refers to the act of pushing the price (also called pumping) of a coin up by collecting cheap coins within a few hours. This can be done because the manipulators are usually “sharks” (traders with large capital) or “whales” (traders with very large capital).

What is a Dump?

Dump means to unload or sell off. This term is used in Tradecoin to describe the act of aggressively selling a coin by “sharks” or “whales” after they have gained from the Pump. This causes the market to drop, and the Pump and Dump plan is a way for “sharks” and “whales” to manipulate the market.

How does the “Pump and Dump” plan work?

Let’s explore the entire Pump and Dump process: the plan consists of two phases:

1. Pump phase: Large capital owners (“sharks” and “whales”) buy up cheap coins, often low-volume coins that are easier to manipulate, in a short time (just a few hours). As trading volume increases, the coin’s price also rises (pumping), until reaching a level desired by the manipulators (peak), then the Pump phase ends.

2. Dump phase: After the Pump phase concludes, the “sharks” release good news and promote the “beautiful” aspects of their owned coins. This can be through media channels, marketing activities, or simply creating many accounts to participate in discussions in seed rooms to spread rumors, etc. However, these may just be fabrications to sell off the coins quickly (dump). The Pump and Dump plan causes market downturns, and after reaping significant profits, the manipulators withdraw, leaving the market in chaos. The dumping occurs, and many traders find their sell orders do not match the current market, forcing them to cut losses.

The result of the entire Pump and Dump process is that after a coin’s price is driven up by pumping, it will return to its pre-pump level after completing the process.

How to recognize Pump and Dump

If you are a beginner, here are some tips to help you recognize and detect Pump and Dump if it is about to happen or is happening:

- At the early stage, the price fluctuates very slightly.

- Next, there will be many accounts discussing a certain coin in chatrooms to spread rumors and attract attention to the coin they want to pump.

- When the coin’s price hits a certain threshold, people will sell off, but not all at the same time, which is a sign that pumping is happening.

How to avoid the Pump and Dump trap?

If you are a small fish and want to avoid the trap set by the “sharks,” consider the following methods:

- Limit purchases of low-volume coins, or coins with small trading volume: As mentioned above, small volume coins are easier tools for “sharks” to pump and dump. Prefer larger-volume coins like BTC, ETH, etc.

- Coins that have already been pumped to a green level should not be bought if you do not want to chase the peak, meaning the price when you bought and the difficulty for it to recover.

- Avoid investing with an “All in” approach, investing solely in one coin: Diversify your investments into multiple coins, and as mentioned earlier, prioritize large volume coins like BTC, ETH to reduce risks.

- Stay alert and rational:

You will constantly participate in Pump and Dump chat groups spreading good rumors about huge profits from investing in a certain coin. Keep a cool head because this is merely part of the Pump phase by the “sharks,” who exploit FOMO psychology and the naive, gullible “small fish” like you. Sometimes, they might be able to give you some good trades initially, but that’s just a “carrot and stick” tactic. Therefore, think carefully before making any big investment.

- Select your groups carefully: Not all Telegram groups are used for Pump and Dump. Some “good” groups honestly share trading tips. Of course, to access that, you need to know how to choose the right group, set permissions that only allow others to add you with your consent.

Although Pump and Dump can help you make money, it requires seasoned experience and extensive trading knowledge. For beginners, my sincere advice is to be cautious and prioritize safety, “slow and steady.”

Conclusion

This article provided you with essential information about Pump and Dump tricks, including what Pump and Dump are, detailed plans of Pump and Dump, detection methods, and more importantly, how to avoid becoming a victim. I hope this helps you develop a solid investment strategy in cryptocurrencies. Vietnam-ustrade.org wishes you success.