With daily volumes surpassing $6.6 trillion, the foreign exchange market is the most dynamic and liquid financial market on the planet. Forex trading allows investors to buy and sell currency pairs, aiming to profit from ever changing exchange rates. Thanks to its 24/5 accessibility, high liquidity, and flexible strategies, forex has become a top choice not only for individual traders but also for institutional investors.

Before stepping into the forex market, understanding what forex trading is and how it works is a crucial foundation for getting started effectively. This article offers a clear and comprehensive overview of the forex landscape from how the market functions to smart trading strategies that help you manage risks and seize global financial opportunities.

1. What Is Forex Trading?

At its core, forex trading means exchanging one currency for another to profit from price movements a dynamic way to tap into the world’s largest financial market..

For example:

A trader might buy the EUR/USD pair if they believe the euro will rise against the U.S. dollar. This market is massive, with over $6.6 trillion traded daily, according to the Bank for International Settlements.

1.1 The Evolution of the Forex Market

The modern forex market began in 1971 when the Bretton Woods system collapsed, allowing currencies to float freely. Since then, technological advancements and deregulation have made forex accessible to individual traders globally.

1.2 Why Forex trading matters today

Forex trading is essential for global trade and investment. It enables currency conversion for international businesses, and it allows investors to hedge or speculate on currency movements. As economist Paul Krugman notes, “In the modern economy, exchange rates are as important as interest rates.”

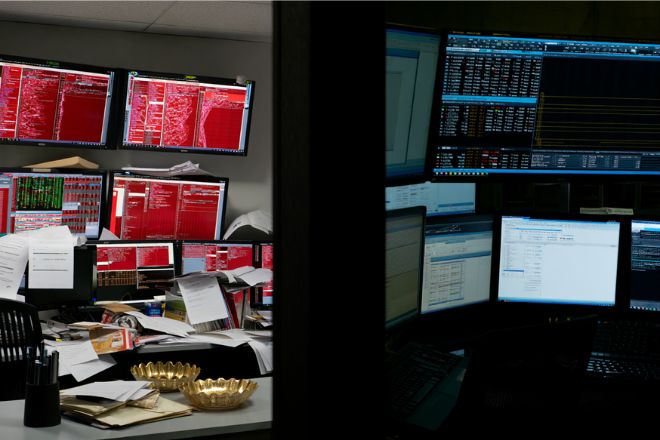

1.3 Who Trades Forex?

Forex is traded by:

- Retail traders: Retail traders accessing the market via online platforms. These traders seek to profit from currency fluctuations and typically trade with small capital and leverage. They benefit from easy access to trading tools, mobile apps, and educational content.

- Institutional players: Banks, hedge funds, multinational corporations, and governments. These entities make up the majority of forex volume. They use the forex market for international transactions, risk management, speculative investments, or monetary policy implementation..

2. How the Forex Market works

Understanding what is forex trading and how does it work operates is crucial before placing your first trade. It’s a decentralized marketplace where currencies are traded in real time across different global sessions, and where prices are influenced by macroeconomic forces, technical patterns, and investor behavior.

This section explains the mechanics behind every trade, helping you grasp what really moves forex prices and how opportunities emerge.

2.1 How currency pairs are traded

In the forex market, currencies are always traded in pairs such as EUR/USD because you’re simultaneously buying one currency and selling another. The first currency listed (EUR) is known as the base currency, while the second (USD) is the quote currency. If the EUR/USD exchange rate is 1.10, it means that one euro is worth 1.10 U.S. dollars. This structure helps traders clearly understand the relative value between two currencies and make informed trading decisions.

Currency pairs fall into three main categories:

- Major pairs (like EUR/USD, USD/JPY): Involving the U.S. dollar and high liquidity.

- Minor pairs (like EUR/GBP, AUD/CAD): Less traded but still liquid.

- Exotic pairs (like USD/TRY, EUR/ZAR): Include a major and a currency from a smaller or emerging economy.

These pairs reflect the global nature of the market and give traders options depending on volatility, spreads, and strategy preferences. Knowing how to read and interpret currency pairs is a core skill in learning what forex trading is and how it works.

2.2 The role of exchange rates

Exchange rates tell you exactly how much of one currency you’ll receive in return for another they’re the heartbeat of every forex transaction. Whether you’re swapping euros for dollars or yen for pounds, the exchange rate determines the real value behind your trade. These rates are influenced by supply and demand in the market.

They are constantly changing due to economic factors like:

- Interest rate differentials

- Inflation expectations

- Trade and capital flows

Understanding these movements helps traders assess value and anticipate future price directions.

2.3 What influences Forex prices

Forex prices are dynamic and can change rapidly in response to a variety of influences:

- Economic news: Releases such as inflation data, nonfarm payrolls, and GDP reports can cause sharp moves.

- Central banks: Monetary policies and interest rate announcements from institutions like the Federal Reserve, ECB, or BoJ significantly sway currency values.

- Market sentiment: Risk appetite or fear among investors can drive demand for safe-haven currencies like USD, JPY, or CHF.

These drivers are essential to understand for anyone learning how forex trading works in real time.

2.4 Understanding market hours and global sessions

The forex market operates 24 hours a day, five days a week, split across four major global trading sessions:

- Sydney Session: Opens the trading week; quieter volume.

- Tokyo Session: Important for trading JPY pairs; overlaps slightly with Sydney.

- London Session: Most active session, major news releases, high liquidity.

- New York Session: Overlaps with London, which leads to peak trading volumes and volatility.

Knowing when to trade based on these sessions can significantly improve your strategy. For example, short term traders may prefer the London New York overlap, while news traders focus on scheduled releases during these hours.

3. Mastering key Forex trading terms

Understanding forex terminology is vital to becoming a confident and informed trader. Whether you’re just starting out or refining your knowledge, grasping these core concepts is essential to understanding what forex trading is and how it works.

3.1 Understanding Pips: The smallest price movement

A pip is the smallest unit of movement in a currency pair’s price. For most major pairs, one pip equals 0.0001. For instance, if EUR/USD rises from 1.1000 to 1.1005, it has moved 5 pips. This micro movement can make a significant difference in high volume trades and is a key metric for calculating gains and losses in forex.

3.2 Lot Sizes: Determining your trade volume

Lot size refers to the number of currency units you’re trading. It determines the scale of your position and directly impacts your profit and loss potential:

- Standard Lot: 100,000 units of the base currency

- Mini Lot: 10,000 units

- Micro Lot: 1,000 units

Choosing the right lot size is a crucial step in risk management, especially for new traders entering the market.

3.3 Leverage and Margin: Amplifying your trading power

Leverage empowers traders to control positions far larger than their initial investment, magnifying both potential profits and risks. For example, with 100:1 leverage, a $1,000 deposit controls $100,000 in currency.

Margin is the portion of your funds required to open and maintain a leveraged position. Leverage can be a double edged sword while it boosts your earning potential, it equally magnifies the risk of losses. This is why understanding how leverage works is fundamental when learning what forex trading is and how it works.

3.4 The Bid/Ask spread: The real cost of trading

The bid price is what buyers are willing to pay for a currency, while the ask price is what sellers demand. The difference between the two is known as the spread, which serves as a transaction cost and a primary revenue source for brokers. Narrower spreads often signal a highly liquid and efficient market where buyers and sellers are actively engaged.

3.5 What Is a Forex Broker?

A forex broker serves as the crucial link between retail traders and the vast interbank forex market, providing access to real time pricing, liquidity, and trading platforms. They provide access to trading platforms, real-time quotes, and often educational resources. It’s essential to choose a broker regulated by reputable authorities like the FCA (UK), ASIC (Australia), or CFTC (U.S.) to ensure transparency, safety of funds, and fair trading conditions.

These foundational terms help traders navigate the complex but rewarding landscape of forex. When combined with experience, strategy, and continuous learning, they form the bedrock of a successful forex trading journey.

4. Why Forex trading is an opportunity for everyone

Forex is more than just a market it’s a global, accessible, and dynamic financial ecosystem. Understanding what forex trading is and how it works reveals why millions of individuals and institutions engage in currency trading daily. This section explores the unique advantages of forex and why it appeals to traders of all backgrounds.

4.1 Currency speculation: Profit from market movements

One of the core reasons traders enter the forex market is to speculate on currency price movements. By analyzing economic data, political developments, or technical indicators, traders can forecast whether a currency will strengthen or weaken. For instance, if you believe the U.S. dollar will rise against the Japanese yen, you might buy the USD/JPY pair. This strategy underpins much of what forex trading is and how it works on a day to day basis.

4.2 Hedging against international currency risk

Forex isn’t just for speculators it’s also a powerful tool for hedging risk. Multinational companies, importers, and exporters use forex trading to protect themselves from adverse currency fluctuations. For example, a U.S. company importing goods from Europe might hedge against a potential rise in the euro to stabilize costs. This demonstrates how forex trading supports real world financial stability in a globalized economy.

4.3 Trade anytime: The 24 hour global market

One of the most appealing aspects of forex trading is its round-the clock accessibility. Because the market operates across global financial centers from Sydney to Tokyo to London to New York it remains open 24 hours a day, five days a week. This means traders can find opportunities at nearly any time, adapting trading strategies to their schedules and time zones. This flexibility is a key component of what makes forex trading unique compared to other financial markets.

4.4 Easy access for new traders

Unlike other financial markets that often require significant capital or experience, forex trading is beginner friendly. Many brokers offer demo accounts, free educational resources, and low minimum deposits. With access to trading platforms, tutorials, and global liquidity, anyone with a computer and internet connection can start learning what forex trading is and how it works without a steep learning curve.

Forex trading’s combination of accessibility, flexibility, and real-world application makes it an attractive choice for both novice and experienced traders looking to diversify or expand their financial strategies.

View more:

- How can you buy bitcoins with a credit card in 2025

- Who owns the most Bitcoins? Top holders 2025

- Who Has the Most Bitcoins in 2025?

5. Pros and Cons of Forex trading: Weighing the rewards and risks

Forex trading has unique advantages and serious challenges. Understanding both sides is critical to navigating this fast paced market effectively. Below is a comparison table between the advantages and disadvantages for you to easily understand.

| Pros | Cons |

| High Liquidity: The forex market sees over $6.6 trillion traded daily, allowing easy entry and exit even for large positions. | High Volatility: Prices can swing rapidly in response to news, economic data, or central bank policies, increasing risk. |

| Leverage: Traders can control larger positions with a small deposit. For example, 100:1 leverage means $1,000 controls $100,000. | Overleverage Risk: While leverage amplifies profits, it also magnifies losses, especially without sound risk management. |

| 24 Hour Market: The market runs continuously from Monday to Friday, offering flexibility across time zones | Emotional Stress: Fast price movements and financial pressure can lead to impulsive decisions and trading burnout. |

| Accessibility for Beginners: Low entry barriers, free demo accounts, and educational content make forex ideal for newcomers | Steep Learning Curve: Understanding market dynamics, analysis, and psychology takes time, patience, and consistent effort. |

Forex trading offers unmatched flexibility, liquidity, and global access, making it attractive to both beginners and seasoned investors. However, it also comes with significant risks, such as high volatility and emotional pressure. Weighing the benefits against the potential pitfalls is crucial before diving into this fast paced financial market.

6. Core Forex strategies & risk management essentials

To fully grasp what forex trading is and how it works, you need to understand not only how currencies move, but how traders make decisions. Whether you’re aiming to ride trends or capitalize on price consolidation, strategy and risk control are the pillars of success.

6.1 Basic Forex trading strategies for every trader

Trend following

This strategy involves identifying a clear upward or downward trend in a currency pair and entering trades in the direction of that momentum. Tools like moving averages, trendlines, and momentum indicators help confirm the trend’s strength and direction. Trend following works best in strong market conditions with clear directional bias.

Breakout trading

Breakout traders look for price levels where markets have previously failed to break through such as suresistance and enter trades when those levels are breached. For example, if GBP/USD breaks above its previous high, traders might go long, expecting further upward momentum. Volume and volatility are key components for validating breakouts.

Range trading

In quiet, sideways markets, traders apply range strategies by buying at support and selling at resistance within a defined price channel. This method works well during low volatility sessions, particularly in the Asian trading session when price tends to consolidate. Oscillators like RSI or Stochastic can help confirm overbought or oversold conditions.

6.2 Risk management tips for new Forex traders

Understanding risk management is fundamental when learning what forex trading is and how it works. Even the best strategy fails without proper protection. These tips are essential:

- Use Stop-Loss Orders: Always define your exit to limit losses.

- Risk Only 1–2% Per Trade: Preserve your account balance by managing position size relative to your capital.

- Avoid Trading During Major News (Unless Prepared): Volatility can spike unpredictably during releases like Non Farm Payrolls or central bank decisions.

- Set Realistic Expectations: Focus on long term consistency, not overnight success.

7. Key mistakes to avoid in Forex trading

Entering the forex market without preparation can lead to costly mistakes. Many beginners fall into common traps that compromise their capital and hinder long term growth. Recognizing these errors early helps build a more disciplined and sustainable trading approach.

7.1. Excessive use of Leverage

Leverage acts like a double edged sword while it can amplify your profits, it can just as easily magnify your losses.What is forex trading and how does it work. Using too much leverage can drain your trading account in the blink of an eye. Always assess the risk before increasing position size.

7.2. Why economic news and global events matter in Forex trading

Interest rate decisions, inflation reports, and geopolitical developments can move markets rapidly. Staying informed is essential for timing trades and managing volatility.

7.3. Trading without a clear plan

Lacking a structured trading plan often results in emotional, inconsistent decisions. A solid plan outlines entry/exit rules, risk tolerance, and goals.

7.4. Letting emotions drive decisions

Fear and greed can derail trading strategies. Holding onto losing trades too long or closing profitable trades too early are signs of emotional interference

In short, steering clear of these common forex trading mistakes is essential for protecting your capital and building a consistent, long term trading strategy.

8. Essential Tools and Chart types for Forex trading

Understanding the right tools and chart types is crucial for making informed trading decisions. Whether you’re tracking price trends or preparing for news-driven volatility, these resources will help improve your forex trading strategy.

8.1 Candlestick charts

These display price action using open, high, low, and close values for a specific time period. Candlestick patterns can signal market sentiment, trend continuation, or reversals, making them a favorite among forex traders.

8.2 Line & Bar charts

- Line charts: Connect daily closing prices with a simple line, ideal for spotting long term trends.

- Bar charts: Offer more detail by showing open, high, low, and close prices in each bar, helping traders assess volatility and momentum.

8.3 Mountain Charts

Mountain charts, also known as area charts, fill the space below the line chart with color visually emphasizing cumulative price movement. These charts are especially helpful for identifying macro level trends and sentiment shifts. What is forex trading and how does it work . They’re simple, user friendly, and often used in trading platforms for quick analysis of performance over time.

8.2 Economic calendars & Technical indicators

- Economic calendars list upcoming news releases and data such as interest rate decisions, GDP, and employment figures. Timing trades around these events can help traders prepare for increased volatility.

- Technical indicators like the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) help identify overbought/oversold conditions and momentum shifts.

To fully understand what forex trading is and how it works, traders must become fluent in reading charts and using the right tools. Whether analyzing candlestick formations, scanning mountain charts for long-term trends, or reacting to news via economic calendars, these instruments turn raw data into actionable insights..

9. FAQs: Everything You Need to Know About What Is Forex Trading and How Does It Work?

Whether you’re exploring currency trading for the first time or looking to strengthen your foundation, these frequently asked questions will help you better understand what forex trading is and how it works in today’s global market.

9.1 What is a forex trader and how does it work for beginners?

Forex trading is the act of exchanging one currency for another to profit from shifts in exchange rates. It works through a decentralized global market that operates 24 hours a day, five days a week. For beginners, it’s best to start with a demo account, study key terms like pips, leverage, and margin, and gradually practice with small real money trades while applying solid risk management.

9.2 How much money do I need to begin trading forex?

Technically, you can start with as little as $50 depending on the broker. However, most professionals recommend starting with at least $500–$1,000 to allow for more realistic position sizing, better risk control, and room for learning through experience.

9.3 Is forex trading high risk?

Yes. Like any speculative market, forex trading carries risk especially due to volatility and the use of leverage. But with a structured trading plan, disciplined execution, and risk limiting tools like stop loss orders, the risks can be managed effectively over time.

9.4 When is the best time to trade forex?

The most favorable trading hours are during the London–New York session overlap (8 AM to 12 PM EST). This window sees the highest liquidity and market movement, making it ideal for traders looking for short-term opportunities.

9.5 Do I need a license to trade forex?

No license is required to trade with your own funds. However, if you plan to manage money for others or operate as a broker, proper licensing and regulatory compliance are essential.

10. Conclusion: Building Confidence in the Forex Market

Understanding what forex trading is and how it works is the first step toward building long-term success in the world’s most liquid financial market. From the foundational concepts of currency pairs and exchange rates to essential strategies and risk management, this guide has walked you through every core aspect needed to begin your forex journey with clarity and confidence.

Let’s recap the key takeaways:

- Forex trading involves speculating on currency price movements in a global, 24-hour decentralized market.

- New traders can start with demo accounts, study basic terminology (like pips, leverage, spreads), and grow gradually into live trading with proper planning.

- Successful forex trading demands discipline, risk control, and a clear trading plan not luck or guesswork.

- Avoiding emotional decisions and overleveraging is just as important as knowing when to enter or exit a trade.

- Tools like economic calendars, charting platforms, and staying updated on global news are critical for making informed decisions.

With years of industry experience and proven insights from seasoned professionals, this guide reflects what truly matters when entering the forex market. Whether you’re trading for income, financial freedom, or professional growth, your commitment to learning and practicing responsibly is your greatest asset.

Related reads to deepen your knowledge:

- How Expensive Are Bitcoins? Understanding Bitcoin’s Cost and Value

- How do I buy Bitcoins for cash? A 2025 beginner’s guide

- What is Bitcoins address? A beginner-friendly guide to crypto wallets

Begin by applying what you’ve learned in this guide. Open a demo account, follow live charts, and create your first trading plan. Step by step, you’ll gain both the skills and confidence needed to grow as a forex trader.

Want to stay informed with credible, bilingual financial reporting and forex updates?

Visit VN-US Trade your trusted source for currency analysis, and investment trends. Explore our dedicated Bitcoins category for expert guides, real time insights, and educational tools tailored for traders at every level.