How can I invest in Bitcoin safely? Want to get started with Bitcoin but unsure where to begin? You’re not alone. As digital assets go mainstream in 2025, many first-time investors are asking the same question: Whether you’re curious about buying your first BTC, choosing a reliable exchange, or avoiding common beginner mistakes, this guide breaks everything down step-by-step. Let’s explore smart, secure ways to invest in Bitcoin, without getting lost in the hype.

This guide explains how to invest in bitcoin for beginners step-by-step.

1. Bitcoin is a digital asset that draws global investors

Bitcoin is a decentralized cryptocurrency that operates without a central bank. It runs on blockchain technology, where transactions are recorded transparently and publicly across a distributed network of computers. With a total supply capped at 21 million coins, Bitcoin is often seen as “digital gold.” So how can i invest in bitcoin?

Its limited supply fuels its scarcity and perceived long-term value. Many investors view it as a hedge against inflation or unstable fiat currencies. In the past decade, Bitcoin’s average annual return has been over 49%, though it has also faced drops as steep as 80%.

Why is Bitcoin so appealing?

- High upside potential as adoption and recognition grow.

- Financial independence: users control their funds without intermediaries.

- FOMO effect: seeing others profit encourages newcomers to join.

- Institutional interest: companies like BlackRock and Tesla have added Bitcoin to their balance sheets.

Real Example: In 2021, Tesla invested $1.5 billion in Bitcoin and briefly accepted it as payment for vehicles. While they later paused Bitcoin payments, this move signaled strong institutional interest and helped push Bitcoin’s price to an all-time high.

However, it is critical to acknowledge the risks. Bitcoin is not a guaranteed win. Its high volatility means investors should approach it with caution and preparedness.

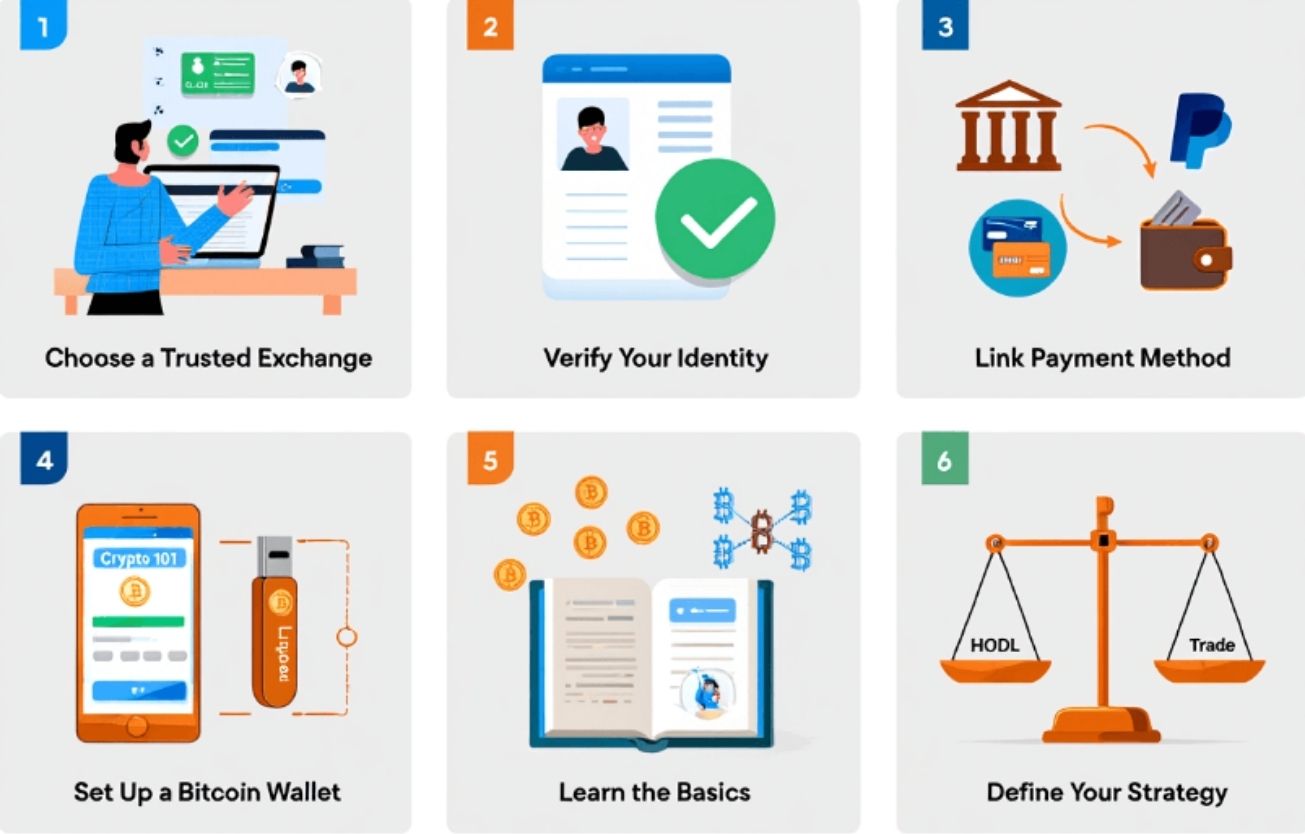

2. How can I invest in Bitcoin: What to prepare before getting started

Before buying Bitcoin, it’s essential to have the right tools and understanding to ensure a smooth and safe experience.

Choose a trustworthy cryptocurrency exchange: In the U.S., Coinbase, Kraken, and Gemini are reputable platforms. Look for exchanges that are registered with regulatory bodies and offer insurance protection.

Verify your identity: Exchanges require KYC (Know Your Customer) verification. Be ready to provide a government-issued ID, SSN, and a selfie. This ensures compliance with anti-money laundering laws.

Set up payment methods: Link your bank account, debit card, or digital payment system like PayPal. Bank transfers are ideal for large sums due to lower fees. Debit cards are faster but more expensive.

Understand Bitcoin wallets: These are tools to store your Bitcoin. Hot wallets are online and convenient, but cold wallets like Ledger and Trezor are more secure for long-term holdings.

Learn the basics: Take time to understand blockchain, private keys, and how transactions work. This knowledge will help prevent mistakes such as sending coins to the wrong address.

Mental preparation and strategy: Decide on your goals. Are you in for the long haul or short-term trading? Start small with money you can afford to lose.

These steps build a strong starting point and reduce unnecessary risks when entering the crypto space.

Check out our Articles for more information about these:

- How do you redeem Bitcoins for cash? A step-by-step Guide (2025 US Edition)

- How do I sell my Bitcoins for cash quickly, easily and securely

- What are Bitcoins made of? Understanding how Bitcoin really works [2025]

3. Step-by-Step Guide to Buying Bitcoin

The most direct way to invest in Bitcoin is by purchasing it. Here is a simple guide to help you through your first transaction.

Ready to make your first Bitcoin purchase? Follow these practical steps below. Each one brings you closer to becoming a confident crypto holder.

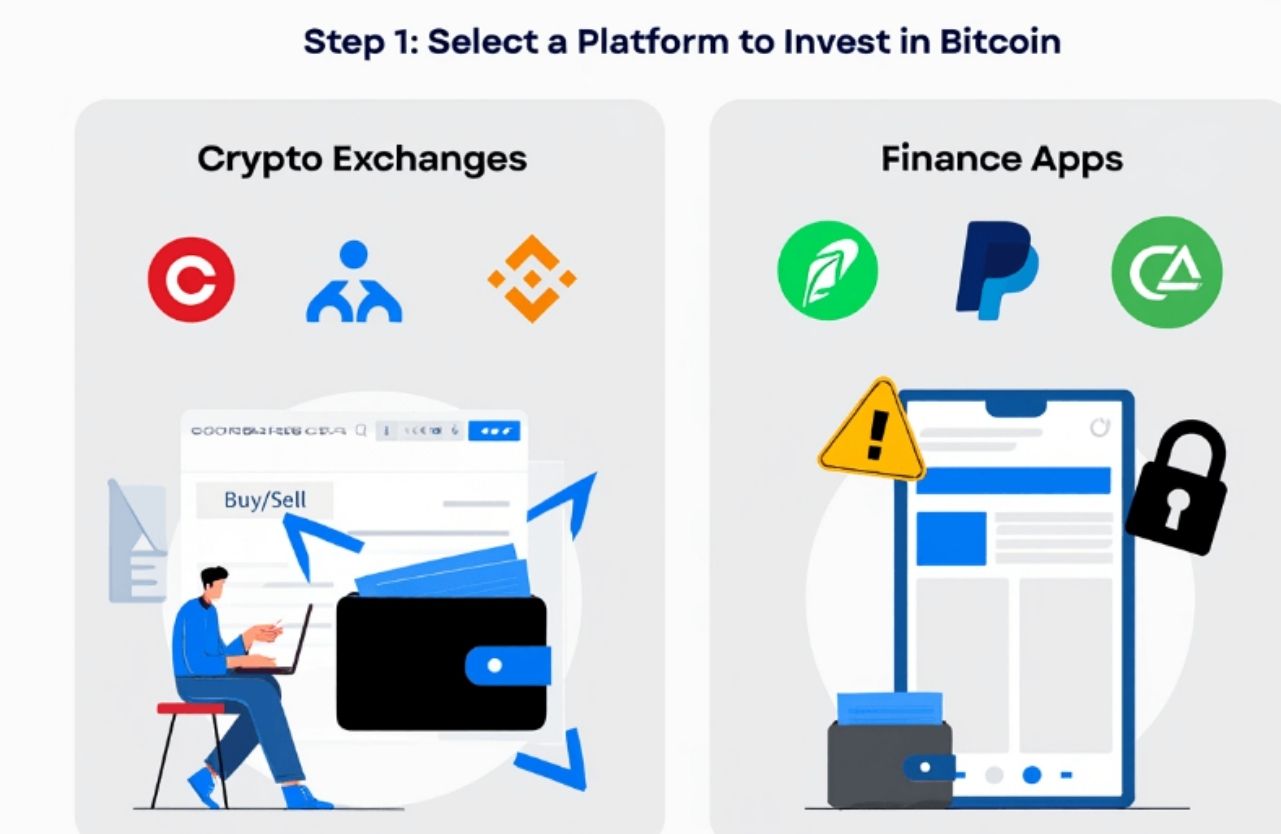

3.1. Step 1: Select a platform

There are different types of platforms where you can start investing in Bitcoin. Here are the two most common:

- Crypto exchanges: Coinbase, Kraken, Binance.US offer full crypto services.

- Finance apps: Robinhood, PayPal, Cash App are easier but offer limited withdrawal options.

Tip: If you want full control over your coins, use a dedicated crypto exchange. Apps are suitable for casual investors.

Choosing the right platform at the beginning helps prevent restrictions later when managing your assets.

3.2. Step 2: Create and verify your account

Before you can trade, you’ll need to register and verify your identity. Most platforms follow this standard process:

- Sign up with your email and password.

- Complete KYC by uploading ID, entering SSN, and taking a selfie.

Finishing verification ensures your account is compliant and unlocks full functionality.

3.3. Step 3: Fund your account

After registration, you’ll need to deposit funds into your account. Below are your typical funding options:

- Link your bank or debit card.

- Deposit USD or use instant buy options.

- Be aware of fees: bank transfers are cheaper; cards are faster but costlier.

Funding your account sets you up for your first Bitcoin purchase and gives you flexibility in timing.

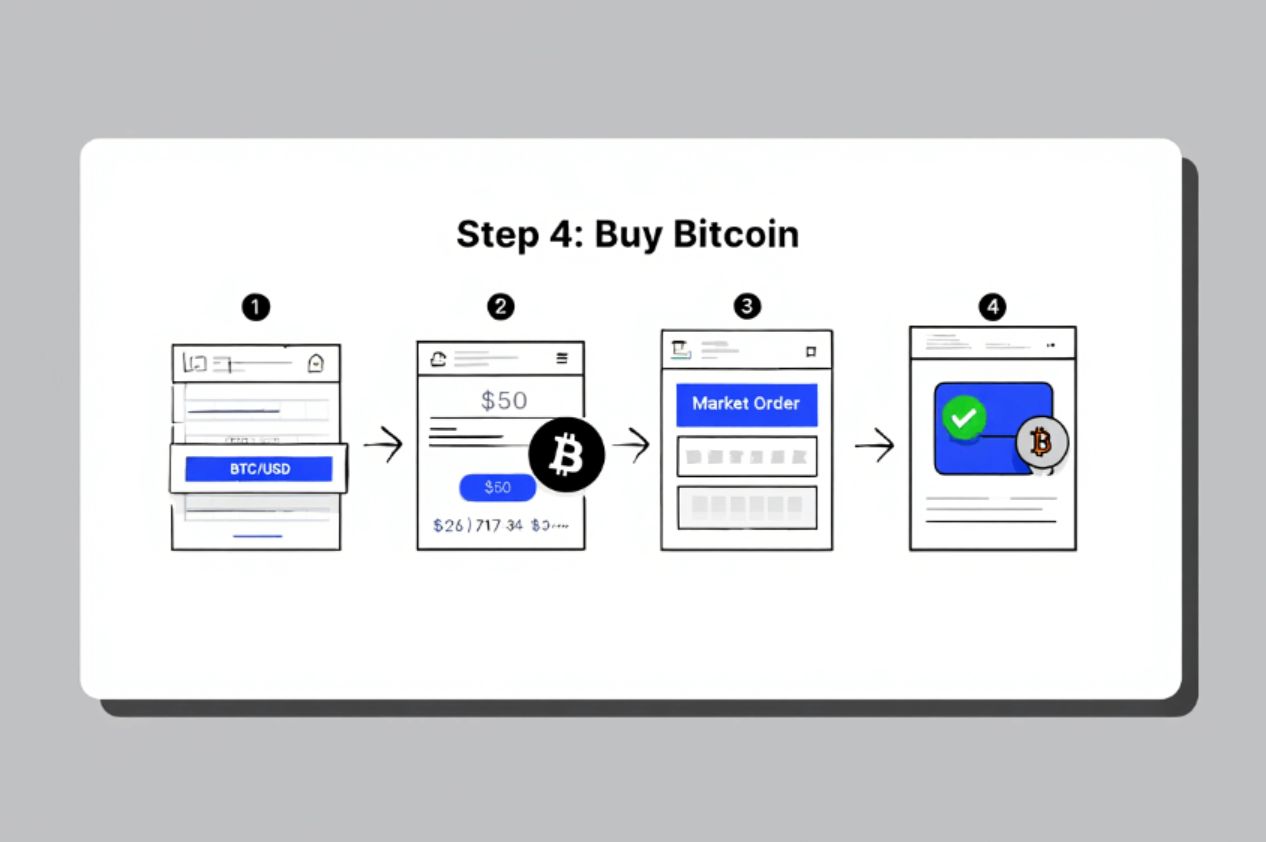

3.4. Step 4: Buy Bitcoin

Once you’re funded, you’re ready to buy your first BTC. Follow these steps:

- Locate the BTC/USD trading pair.

- Enter the amount (e.g., $50 = 0.001 BTC at $50,000/BTC).

- Choose Market Order for simplicity.

- Confirm and receive Bitcoin in your account.

Congratulations, you’ve bought your first Bitcoin! That brings you to the next step: securing your asset.

3.5. Step 5: Store your Bitcoin securely

After buying, the next big decision is how to store your Bitcoin. Consider your time horizon and level of security needed:

- Short-term: keep on the exchange, but enable 2FA and use strong passwords.

- Long-term: transfer to a personal wallet. Always double-check your BTC address. Withdraw a small test amount first.

Cold wallets are highly secure. Devices like Trezor and Ledger keep your private keys offline. You must physically confirm transactions, which adds protection from hackers.

Congratulations, you’ve made your first Bitcoin purchase! Now it’s about responsible management.

4. Other Ways to Invest in Bitcoin

The best way to invest in bitcoin depends on your goals and risk tolerance.

Not everyone wants to buy Bitcoin directly. Fortunately, there are indirect ways to gain exposure to Bitcoin’s performance.

Let’s explore the most common alternatives and their pros and cons.

4.1. Bitcoin ETFs and ETPs

ETFs and ETPs track Bitcoin’s price and trade like traditional stocks. They offer Bitcoin access without managing a wallet.

- These track Bitcoin’s price and trade like stocks.

- Examples: BITO (futures ETF), GBTC (Grayscale Trust).

- Can be held in retirement accounts like IRAs.

No need to manage a wallet or worry about private keys.

Pros:

- Convenient for traditional investors

- Integrated with brokers like Fidelity or Schwab

Cons:

- May have management fees

- Don’t allow Bitcoin withdrawals

These funds suit long-term investors who want price exposure without handling crypto.

4.2. Buy Bitcoin-related stocks

Another option is to invest in companies closely linked to Bitcoin’s growth.

- Coinbase (COIN), MicroStrategy (MSTR), Marathon Digital (MARA)

- These companies benefit from Bitcoin’s growth

This method lets you ride Bitcoin’s momentum via equity markets.

4.3. Mining Bitcoin

Mining allows investors to earn Bitcoin directly by validating blockchain transactions.

- Involves setting up high-powered computers to validate transactions

- Costly and complex for individuals due to equipment and electricity

- Alternative: invest in mining firms’ stock

Alternative: invest in publicly traded mining firms.

Mining is best suited to technically inclined investors or institutional setups.

4.4. Use financial apps

Financial apps make Bitcoin investing accessible for everyday users.

- PayPal and Cash App offer easy BTC access

- Convenient but may have high fees and withdrawal limits

These methods let you gain exposure to Bitcoin without directly managing the coins. Choose based on your comfort level and goals.

5. Managing Risks When Investing in Bitcoin

Bitcoin is volatile. Smart investors don’t just chase returns, they plan for risks.

Below are risks and how you can cope with it:

5.1. Price swings

Price volatility is the most well-known risk in Bitcoin investing. Prices can change drastically within hours or even minutes.

- Bitcoin can drop 20% or more in days.

- Solution: only invest what you can afford to lose.

- Avoid margin trading unless you’re experienced.

Accepting volatility prepares you for the emotional side of investing and builds resilience over time.

5.2. DCA strategy

If you’re worried about market timing, Dollar-Cost Averaging (DCA) offers a steady approach to entry.

- DCA means investing fixed amounts regularly.

- This smooths out volatility and avoids buying at the peak.

A DCA strategy creates consistency and removes emotion from your investment process, making it ideal for beginners.

5.3. Security risks

Security remains one of the biggest threats in crypto. Poor protection leads to hacks, phishing, and permanent losses.

- Exchanges and wallets can be hacked.

- Use 2FA, strong passwords, and hardware wallets.

- Be cautious with phishing emails or fake apps.

Taking security seriously helps preserve your capital long term and gives you peace of mind when markets are turbulent.

Pro Tip: Use a dedicated hardware wallet for long-term storage and write your seed phrase on paper, never store it digitally. Also, split the phrase into parts and store them in different physical locations for added security.

5.4. Regulatory uncertainty

Cryptocurrency operates in a shifting legal environment. Policies can change quickly depending on region and administration.

- Laws can change fast and affect crypto access.

- Stay informed about policy updates in the U.S.

Staying compliant and aware protects you from sudden restrictions, tax implications, or loss of access to platforms.

5.5. Scams:

The crypto space is filled with high-risk offers, fake platforms, and impersonators. New investors are often targeted.

- Watch for promises of guaranteed returns or high-yield Bitcoin programs.

- Never share your private key. If it sounds too good to be true, it is.

Recognizing scams early is a powerful defense for every investor and prevents irreversible losses.

5.6. Emotional risks

Your mindset can be your greatest asset or your weakest link. Emotional decision-making leads to poor outcomes.

- FOMO and panic selling are common.

- Stick to your strategy. Don’t make impulsive trades.

A calm mindset is just as important as any technical strategy in crypto investing, especially during market volatility.

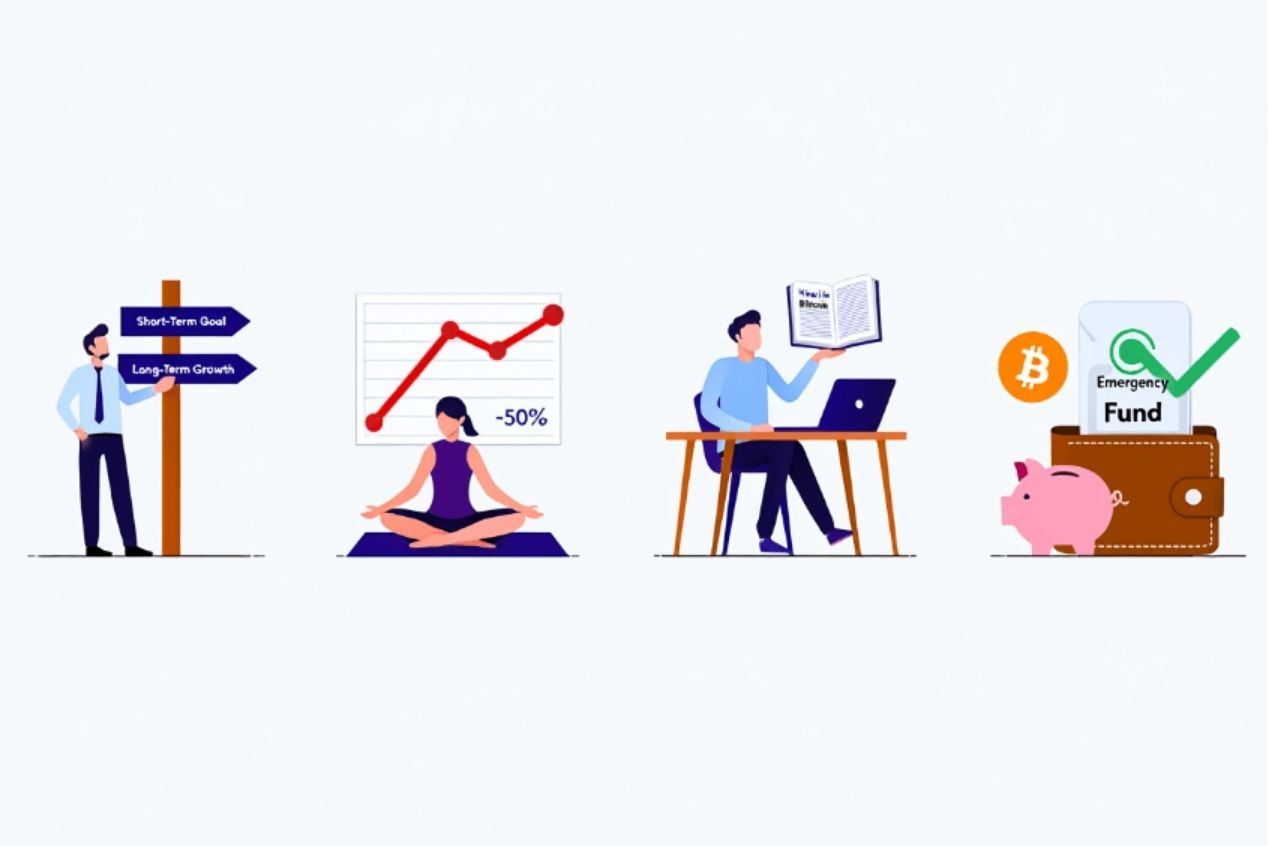

6. Is Bitcoin a Good Fit for You?

Before you invest, ask yourself: So, is Bitcoin a good investment for you?

- What’s your goal? If you’re saving for a house in two years, Bitcoin might be too risky. For long-term growth, a small BTC allocation may be reasonable.

- Risk tolerance: Can you handle a 50% drop without panic?

- Tech interest: Bitcoin requires some tech knowledge. Are you willing to learn?

- Financial readiness: Only invest after clearing debts and having an emergency fund.

As with any form of cryptocurrency investing, research and risk management are essential.

Bitcoin isn’t for everyone. It can be rewarding, but only if you understand what you’re doing and why. If your answers show openness to risk and learning, Bitcoin might be worth adding to your portfolio.

7. FAQs

Q1: How can I invest in Bitcoin if I’m a total beginner?

A: Start by choosing a regulated exchange, verify your identity, and use a small amount like $10 to get familiar.

Q2: Do I need a wallet to buy Bitcoin?

A: No, but it’s recommended for long-term storage. Exchanges provide temporary wallets.

Q3: What’s the safest way to store Bitcoin?

A: Hardware wallets like Ledger and Trezor offer top-tier security for holding BTC offline.

Q4: Can I invest in Bitcoin using my IRA or retirement account?

A: Yes, through Bitcoin IRAs and ETFs available via brokers like Fidelity or BitIRA.

Q5: How much to invest in Bitcoin?

A: Only what you can afford to lose. Many start with 1–5% of their portfolio.

Q6: Is Bitcoin mining still profitable?

A: For individuals, it’s usually not, but investing in mining companies may be a better route.

Q7: Should I invest in Bitcoin now or wait?

A: Timing is personal, focus on long-term potential rather than short-term price swings.

8. Conclusion

Bitcoin investing offers huge potential, but it comes with its own set of challenges. In this guide, we’ve walked you through every major step about how can i invest in Bitcoin: from setting up an account, buying BTC safely, to protecting your funds and exploring alternative strategies.

Start small, even $10 is enough, to understand how buying and storing Bitcoin works in practice. As you take each step, your confidence and competence will grow naturally.

To recap, here are the key points to remember before starting your Bitcoin investing journey:

- Bitcoin is a scarce digital asset with high upside but strong volatility.

- Get prepared before investing: choose a trusted exchange, verify identity, set up wallets and payment methods.

- The simplest way to invest is buying BTC directly and storing it securely.

- Indirect options exist like ETFs, Bitcoin-related stocks, and financial apps.

- Risks are real: price swings, scams, regulations, security threats, emotional traps.

- Long-term tools like DCA and cold wallets provide safety and discipline.

- Bitcoin isn’t for everyone, only invest if you’re informed, ready, and willing to learn.

Above all, protect your assets. Follow security best practices, and never invest more than you’re willing to lose. Bitcoin can be both a technological adventure and a financial opportunity, approach it wisely, and it might become one of your most exciting long-term investments.

If this guide helped you get started, share it with others. For more trusted crypto insights, visit Vietnam-ustrade or explore our Bitcoins category for the latest beginner and expert-level resources.