How to use and buy bitcoins? You can start by creating an account on a trusted exchange, completing identity verification (KYC), purchasing a small amount of Bitcoin, and storing it in a secure wallet. Using Bitcoin involves sending and receiving payments through wallet addresses, or simply holding it as a long-term investment.

But choosing the right platform, understanding risks, and securing your assets isn’t always simple especially if you’re new to crypto.

In this beginner-friendly guide, Vietnam-UsTrade breaks everything down so you can get started with clarity, safety, and confidence.

1. What makes Bitcoin work? (Blockchain and operations explained)

At the heart of Bitcoin is the blockchain a public, digital ledger that records every transaction ever made. Imagine a shared spreadsheet that’s copied and stored on thousands of computers worldwide. When you send Bitcoin, your transaction is added to this ledger after being verified by computers called miners.

If you’re learning how to use and buy Bitcoins, understanding how blockchain works is essential to grasp what makes Bitcoin secure and decentralized.

Here’s a simple step-by-step of a Bitcoin transaction:

1. You request to send Bitcoin to a friend’s address.

2. Your transaction is broadcast to the network.

3. Miners check if you have enough balance and confirm the transaction.

4. Once confirmed, it becomes part of the blockchain and your friend can see the coins in their wallet.

Bitcoin’s uniqueness comes from its fixed supply of 21 million coins, preventing inflation. It offers pseudonymity, meaning your identity isn’t directly tied to transactions, adding privacy. Its decentralized nature means no single party controls it, and transactions work across borders without bank delays.

However, Bitcoin has risks. Its price can be volatile, and there’s the threat of theft if you don’t protect your digital keys. Knowing how it works helps you use it wisely and securely.

2. Is Bitcoin right for you? Assessing suitability and risk

Before diving in, it helps to see if Bitcoin fits your goals. Ask yourself these questions:

- Are you an investor looking for alternative assets?

- Do you want to spend money digitally with privacy?

- Are you comfortable using new technology?

- Is protecting your financial freedom important to you?

Bitcoin is not for everyone. It can be volatile, with prices rising or falling quickly. Scams exist, so caution is essential. Regulations vary by country, which can affect your ability to buy or sell Bitcoin. Make sure you understand your region’s rules and only invest what you can afford to lose.

This self-checklist prepares you to move safely into buying Bitcoin if it suits your needs and risk tolerance.

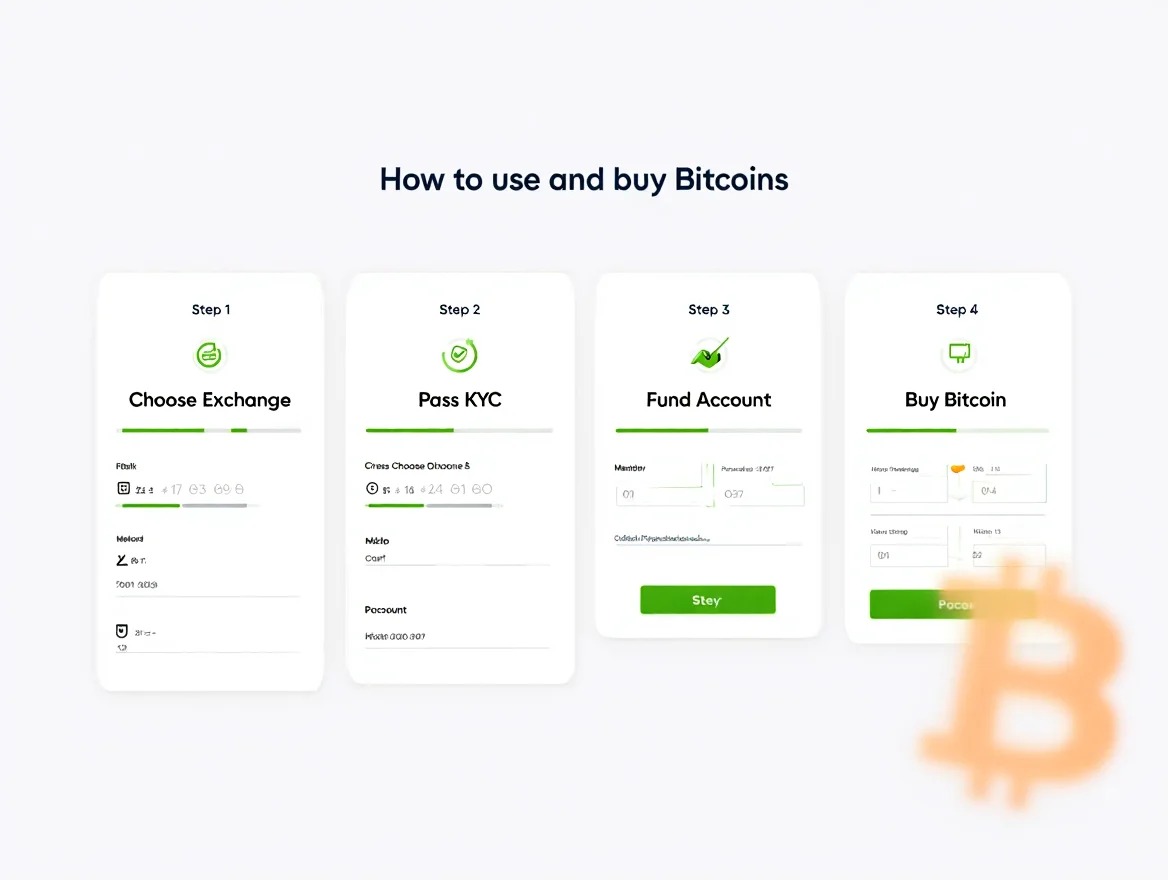

3. How to use and buy Bitcoins: Step-by-step process

Here’s how to use and buy Bitcoins in a few simple, structured steps even if you’re starting from scratch. Whether you’re aiming to invest long-term or just test out your first crypto transaction, this breakdown will guide you through each phase clearly and safely.

3.1 Comparing ways to buy Bitcoin

There are several ways to buy Bitcoin, each with pros and cons depending on your needs:

| Method | Fees | Ease | Security | Popularity (2025) |

|---|---|---|---|---|

| Exchanges (e.g., Coinbase, Binance) | Low to medium | Easy | High | Very popular globally, including US and Vietnam |

| Brokerages | Medium | Very easy | Good | Common for beginners |

| P2P Services (peer-to-peer) | Varies | Moderate | Depends on platform/trust | Used in regions with strict controls |

| Bitcoin ATMs | High | Simple | Medium | Growing but limited locations |

Select trusted providers. Watch out for platforms with no reviews or unclear fees. Match your comfort with technology and your budget.

3.2 Creating an account & passing KYC

Most platforms require you to create an account and complete KYC (Know Your Customer) checks to comply with regulations:

- Sign up with your email and create a strong password.

- Submit identification documents like a passport or driver’s license.

- Some platforms may ask for proof of address.

- Wait for verification, which can take minutes to days.

KYC helps prevent fraud and protects the entire network. For privacy, choose providers with strong data protection policies. In Vietnam and the US, KYC requirements are standard and enforced.

3.3 Funding your account

Once verified, you’ll need to add funds. Common options include:

| Method | Fees | Processing Time | Notes |

|---|---|---|---|

| Bank Transfer | Low | 1–3 business days | Common but slower |

| Credit/Debit Card | Higher | Instant | Fast but costly fees |

| E-Wallets (e.g., PayPal) | Medium | Minutes to hours | Depends on platform support |

| Cash Deposit | Varies | Varies | Less common, watch for fraud |

Be cautious of deposit reversals and high fees. In 2025, bank transfers remain most used globally, though cards dominate in fast purchases.

3.4 Making your first Bitcoin purchase

If you’ve been wondering how to use and buy Bitcoins, this is the moment it all begins—your very first transaction.

Ready to buy? Follow these steps:

- Log in to your chosen platform.

- Search for Bitcoin (BTC) and select it.

- Enter the amount you want to buy in your local currency or BTC.

- Review the transaction, including fees.

- Confirm the purchase.

After confirmation, your Bitcoin will appear in your exchange wallet. Check your holdings regularly and consider transferring to a personal wallet for safety.

View more:

- What is LetMeTrade? Comprehensive Knowledge about LetMeTrade A-Z

- What Is Forex Trading and How Does It Work? A Complete Beginner’s Guide

- How many people own 1 Bitcoin in the world? The surprising reality of the 1 BTC club

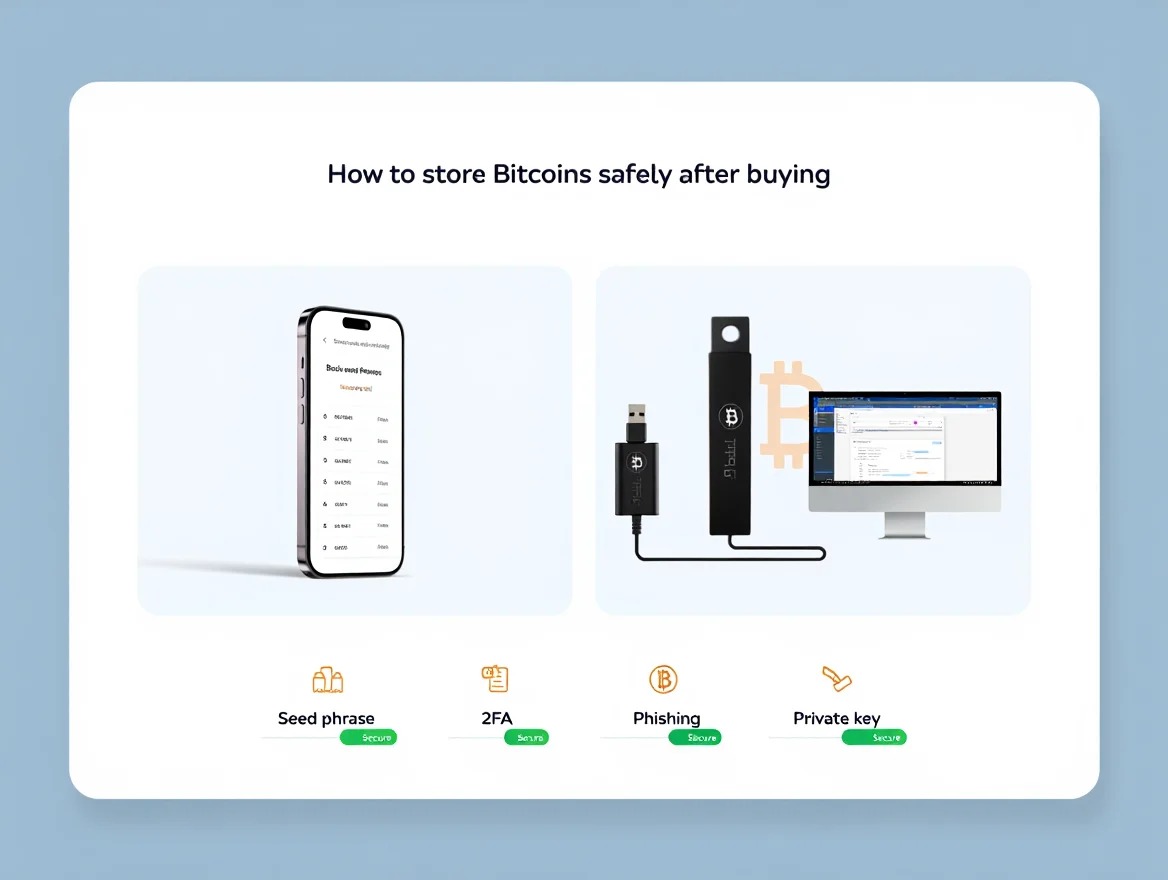

4. How to store Bitcoins safely after buying

After you’ve learned how to use and buy Bitcoins, the next essential step is making sure your digital assets are stored securely. Proper storage not only protects your investment from theft or technical failure it also gives you full control over your Bitcoin long term. Let’s explore the different wallet options available in 2025.

4.1 Introduction to Wallet types

Bitcoin wallets store your private keys, letting you access your coins. They come in two main types:

| Wallet Type | Description | Best For |

|---|---|---|

| Custodial Wallets | Managed by third parties like exchanges. | Beginners wanting convenience. |

| Non-Custodial Wallets | You control your keys; more secure. | Advanced users valuing control. |

| Hot Wallets | Connected to the internet; easy access. | Daily use and small amounts. |

| Cold Wallets | Offline devices like hardware wallets. | Long-term storage, large amounts. |

For example, a hardware wallet is a small device you plug into your computer, offering high security. Mobile apps are quick and easy but less secure.

4.2 Setting up and securing your wallet

When setting up a wallet:

- Generate and safely write down your backup (seed) phrase.

- Enable two-factor authentication (2FA) if available.

- Use strong, unique passwords.

- Avoid phishing links and fake apps.

Use devices with updated security, and never share your private keys. Losing your backup means losing access to your Bitcoin permanently.

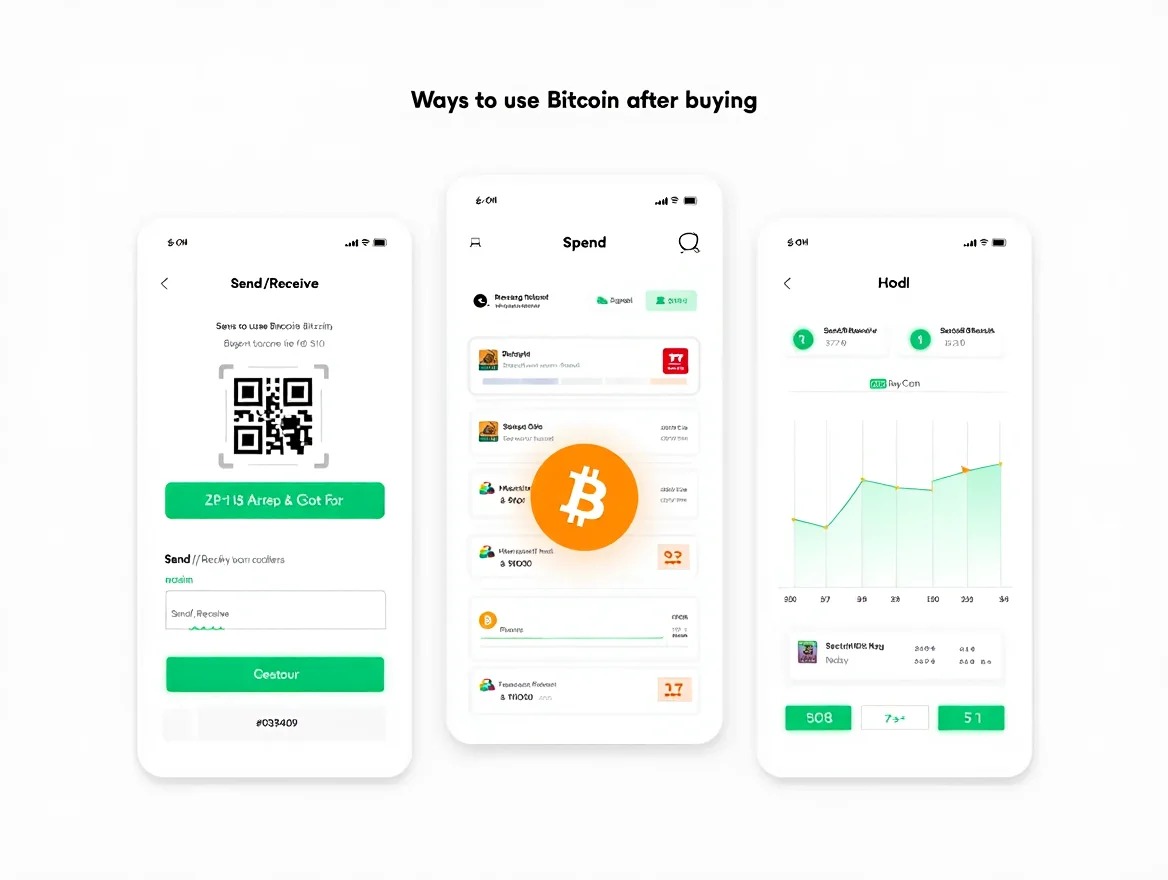

5. Ways to use Bitcoin after buying

Now that you know how to use and buy Bitcoins and have stored them securely, it’s time to explore what you can actually do with them. From sending payments across borders to using Bitcoin as an everyday spending tool, the possibilities in 2025 are broader than ever. Let’s start with the most basic use case: sending and receiving.

5.1 Sending and receiving Bitcoin

To send or receive Bitcoin:

- Get the recipient’s Bitcoin address carefully. Use QR codes to avoid errors.

- Enter the amount and confirm the transaction.

- Pay the network fee, which varies by demand.

- Wait for transaction confirmations, usually a few minutes in 2025.

Avoid sending Bitcoin to wrong addresses these transactions are irreversible. Always double-check your recipient’s address.

5.2 Where and how can you spend Bitcoins?

Bitcoin is accepted by a growing number of online and physical merchants. Common uses include:

- Paying for goods and services (retailers, restaurants).

- Peer-to-peer trades and remittances.

- Buying gift cards redeemable at major stores.

- Donations to charities supporting Bitcoin.

Verify acceptance on merchants’ websites or through directories updated in 2025. Some platforms convert Bitcoin into local currency instantly for spending.

5.3 Holding and investing (“HODL”)

For many who learn how to use and buy Bitcoins, holding or “HODLing” becomes the next strategic step.

HODLing means holding Bitcoin for the long term, betting it will increase in value. It can offer rewards but comes with risks like market swings.

| Pros | Cons |

|---|---|

| Potential for high returns | Price volatility |

| Decentralized, independent asset | Requires secure storage |

| Protection against inflation | Regulation uncertainty |

Historical charts show Bitcoin’s growth over years but also sharp drops. Always invest what you can afford to lose.

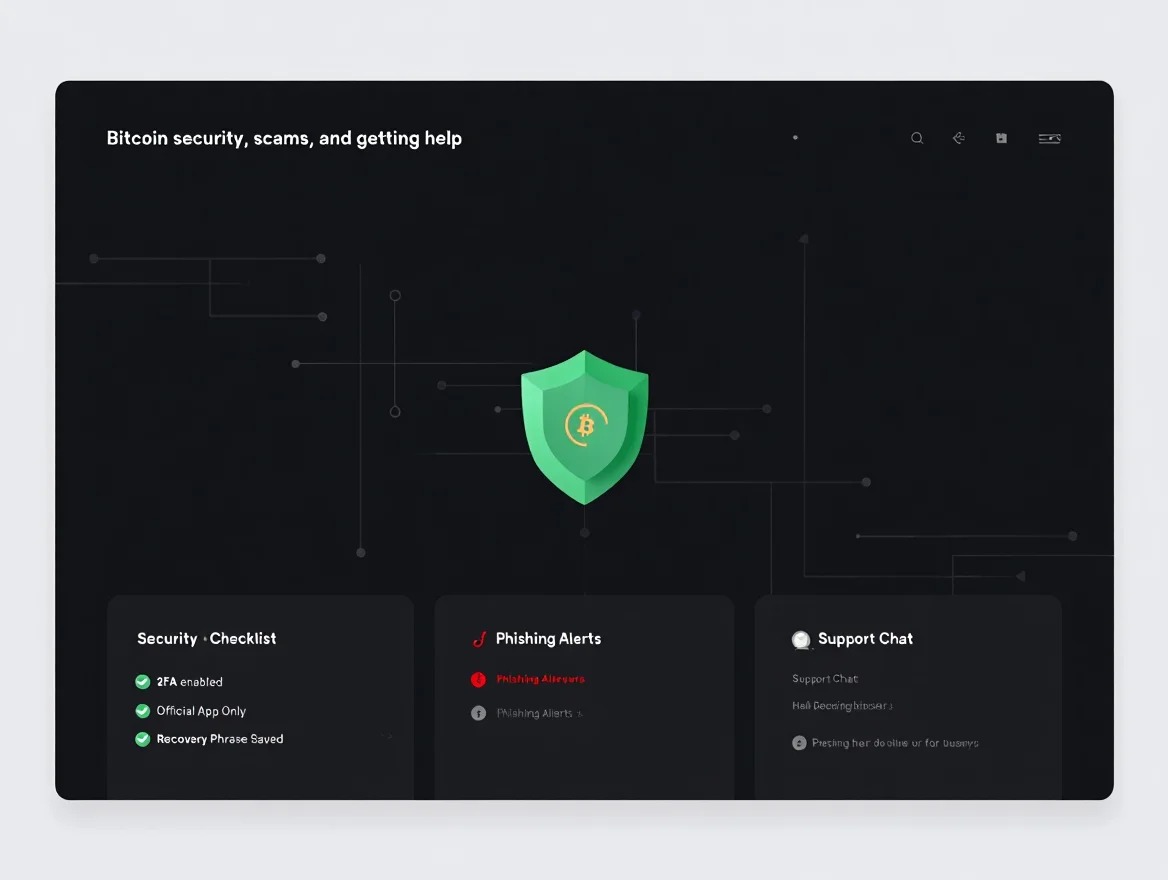

6. Bitcoin security, scams, and getting help

Keeping Bitcoin safe means being vigilant. Here’s a checklist:

- Use strong passwords and enable 2FA.

- Only download wallets or apps from official sources.

- Beware of phishing emails claiming to be exchanges.

- Don’t share private keys or recovery phrases.

- Check URLs carefully to avoid fake sites.

- Verify offers that seem too good to be true they often are.

If you lose access or suspect theft, contact your wallet or exchange support immediately. Use recovery processes and change connected passwords quickly.

Explore more trading insights:

- How many bitcoins does tesla own

- How do i send bitcoins to an address

- How do i start getting bitcoins

7. Legal, tax, and regulatory basics for Bitcoin (2025)

Before diving too deep into how to use and buy Bitcoins, it’s essential to understand the legal and tax responsibilities that come with owning crypto especially as rules vary across countries.

| Region | Licensing | Tax Reporting | Age Limit |

|---|---|---|---|

| United States | Strict regulations, licensed exchanges | Capital gains tax applies | 18+ |

| Vietnam | Limited formal regulation; warnings issued | Tax rules evolving; consult local laws | 18+ |

| European Union | Licensed under MiCA regulation | Taxes vary by country; reporting required | 18+ |

Keep records of all transactions for tax purposes. Follow your country’s compliance rules to avoid penalties.

8. FAQ: Common questions about using and buying Bitcoin

8.1 What is the minimum amount to start with?

Platforms often allow buying small fractions less than $10 is common.

8.2 Can I lose all my Bitcoin?

Yes, if you lose your private keys or if prices fall sharply.

8.3 Is there an age limit?

Usually 18 years or older, depending on your region.

8.4 Can Bitcoin transactions be reversed?

No, once confirmed, transactions cannot be undone.

8.5 Are there myths about Bitcoin?

Yes, like it being completely anonymous it is pseudonymous. Also, it’s not a guaranteed way to make money.

9. Conclusion

Learning how to use and buy Bitcoins is the first step to joining the growing world of digital assets in 2025. This guide has shown you how to use and buy Bitcoins safely from choosing a trusted exchange to securing your wallet and understanding legal basics.

To check list:

-

Understand how Bitcoin and blockchain technology work.

-

Assess whether Bitcoin fits your risk tolerance and goals.

-

Choose the right platform to buy, and complete KYC securely.

-

Store your Bitcoins in the right wallet type based on your usage.

-

Explore how to send, spend, or hold Bitcoin based on your needs.

-

Stay alert to scams, tax rules, and regional regulations.

Whether you’re holding for the long term or planning your first transaction, getting these basics right builds confidence and control.

Don’t forget to explore the Bitcoin category on Vietnam-UsTrade for the latest tips, guides, and updates tailored to crypto beginners.