How much Bitcoin does the average person have in 2025? On average, each Bitcoin owner now holds approximately 0.15 BTC a figure that reflects not only the widespread adoption of cryptocurrency but also the growing concentration of digital wealth among a small percentage of users.

Globally, there are an estimated 120 million Bitcoin owners, representing around 1.5% of the world’s population. The average per wallet stands at roughly 0.08 BTC, which suggests that many individuals manage multiple wallets for privacy and security.

In this article, Vietnam-UStrade will guide you through the most recent data on Bitcoin holdings, explore what these averages really mean for individual users, and highlight the differences across demographics and countries.

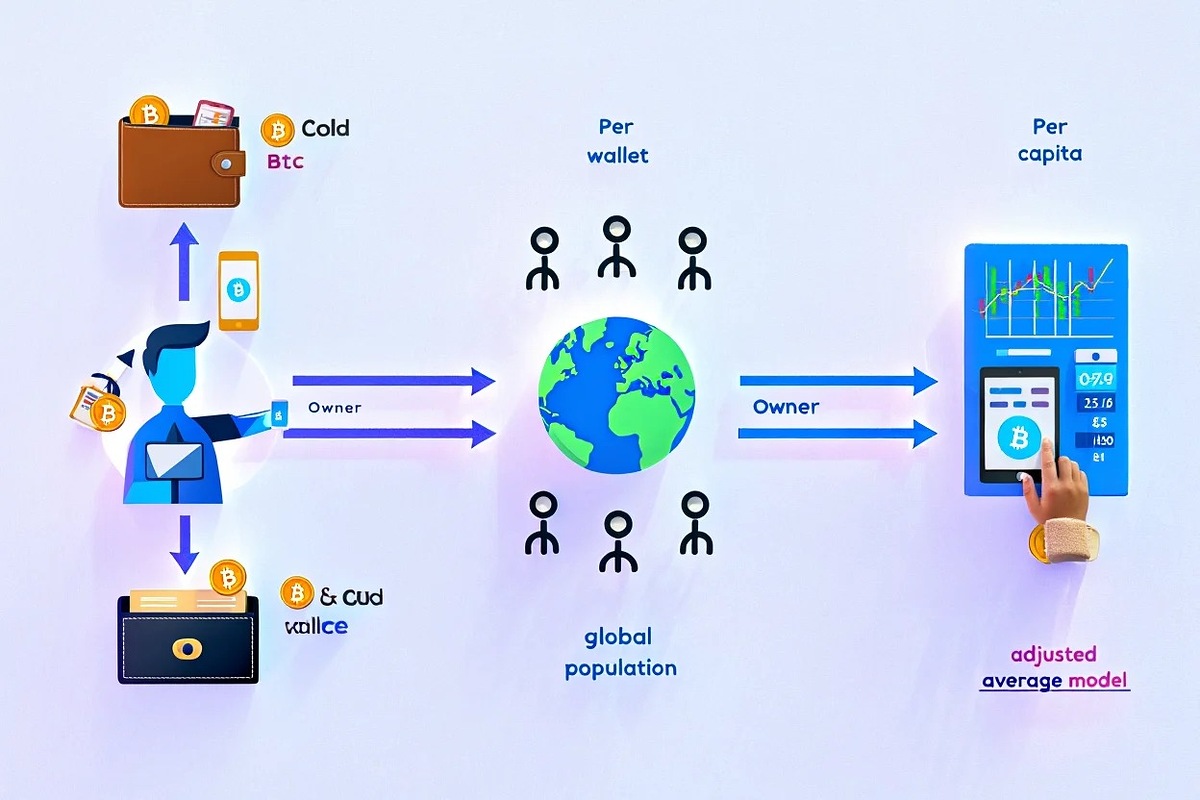

1. How is “average Bitcoin held” calculated?

Calculating average Bitcoin ownership requires understanding a few key terms and data sources. The main distinctions are:

- Per wallet: The amount of Bitcoin stored in a single address or wallet. Many users have multiple wallets.

- Per owner: Accounts for users holding Bitcoin across several wallets, more closely reflecting real individuals.

- Per capita (global population): Divides total Bitcoin by the entire world population, giving a baseline but understating actual owner holdings.

Primary data comes from blockchain analytics firms like Chainalysis and Glassnode, exchange data, and user surveys. However, challenges include:

- Custodial wallets holding funds for many users.

- Inactive or lost coins that no one can access.

- Privacy-focused users splitting funds.

These factors can skew averages, so analysts often use adjusted models to filter data for accuracy.

2. Global Bitcoin ownership statistics (2025)

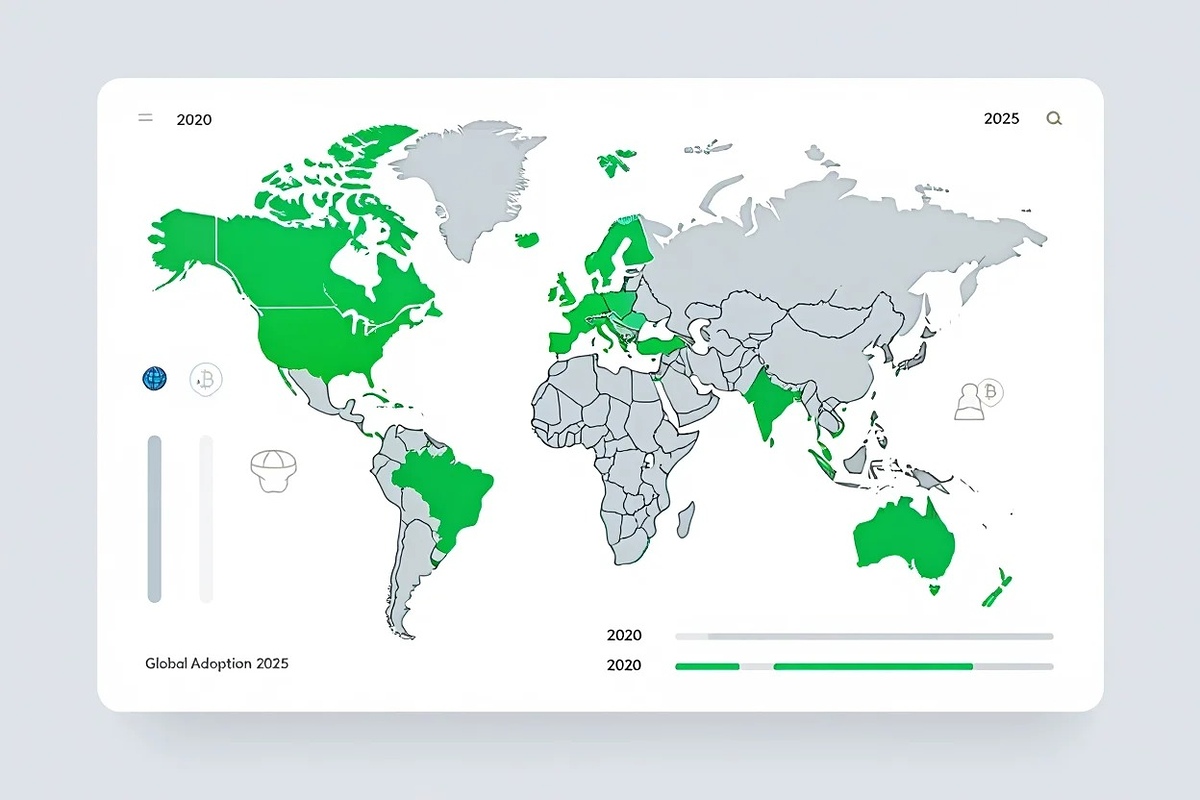

By 2025, the number of Bitcoin owners worldwide has continued rising steadily. Estimates show around 120 million unique users owning Bitcoin, representing roughly 1.5% of the global population. This marks notable growth from 2020, when ownership was closer to 80 million users.

Adoption trends vary by region. Emerging markets like Southeast Asia, especially Vietnam, and parts of Latin America show rapid increases, driven by remittance use and investment interest. North America and Europe maintain steady growth with more institutional acceptance. Africa’s share is growing, fueled by mobile payments and financial inclusion efforts.

The regional map below highlights Bitcoin ownership density and growth rates across continents.

3. How much Bitcoin does the average person have?

So, how much Bitcoin does the average person have in 2025? The answer is around around 0.15 BTC. This figure reflects total Bitcoin supply divided among unique owners, factoring in wallet consolidation. Meanwhile, the average per wallet is about 0.08 BTC since many users manage multiple wallets for security or different purposes.

Most holders own small amounts, commonly under 0.1 BTC, which explains why averages may appear modest. A small group of large holders often called “whales” skew total supply distribution but don’t dominate average ownership across all users.

Below is a comparison of average Bitcoin holdings by country, helping clarify regional differences:

- Vietnam: 0.22 BTC per owner high interest tied to local crypto regulations and remittance flows.

- United States: 0.18 BTC strong institutional and retail participation.

- European Union: 0.14 BTC steady growth with regulatory clarity.

- Latin America: 0.12 BTC growing due to economic instability driving crypto adoption.

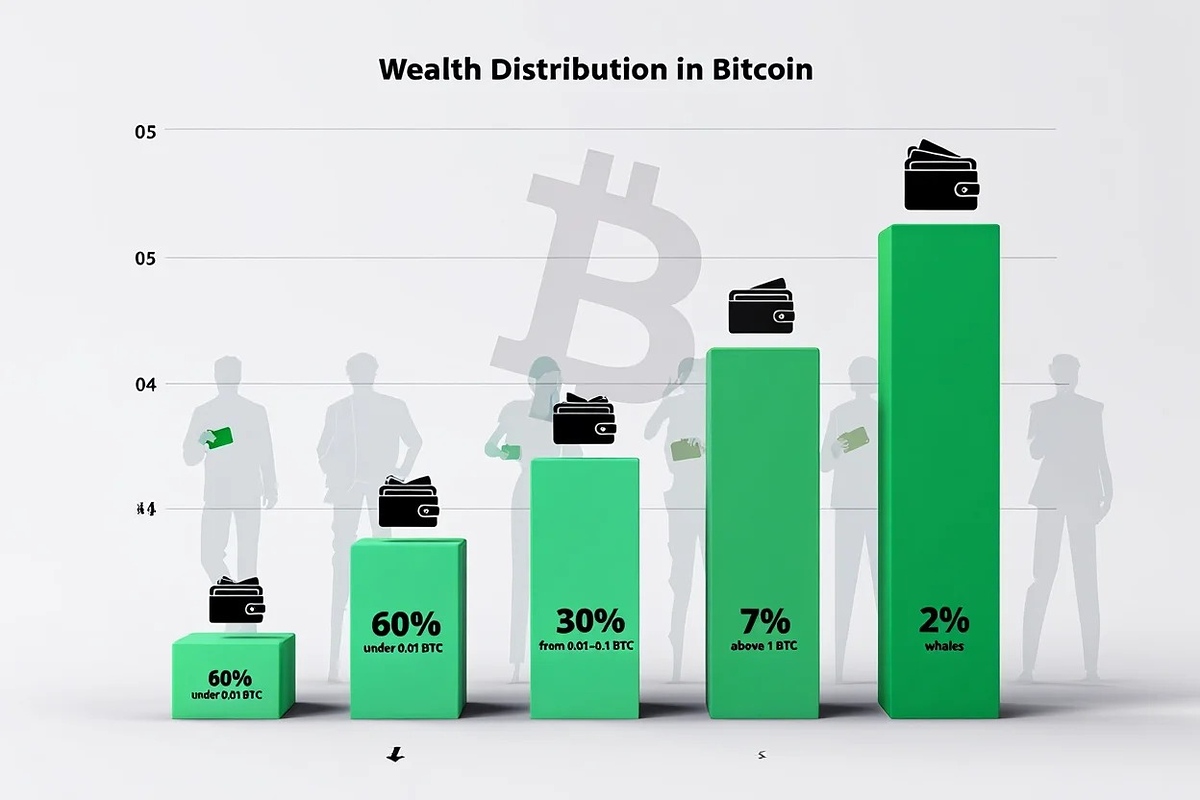

4. Distribution and inequality in Bitcoin holdings

Bitcoin ownership shows significant inequality. While the average per owner is about 0.15 BTC, the median holding is much lower closer to 0.02 BTC meaning that half of users actually hold less than this amount. This discrepancy is essential to understand when asking how much Bitcoin does the average person have, as the average can be misleading due to extreme outliers.

The Gini coefficient for Bitcoin holdings is estimated at 0.86, signaling high concentration of wealth. Here’s a breakdown of wallet sizes:

- Under 0.01 BTC: 60% of wallets

- 0.01 to 0.1 BTC: 30%

- 1+ BTC: 7%

- 10+ BTC: 2%, mostly exchanges or institutional holders

The chart below illustrates this distribution, showing why “average” numbers may not represent typical users.

5. Demographic breakdown of Bitcoin owners (2025)

Regardless of age or income, many users ask the same question: how much Bitcoin does the average person have, and how do I compare?

- Age: Majority (55%) are aged 25–44, with younger adults adopting rapidly.

- Gender: Around 85% male holders, though female adoption is rising steadily.

- Income: Higher income groups (top 40%) have larger average holdings, but middle-income users form the largest ownership base.

- Region: Asia-Pacific leads in growth rates, with Vietnam notable for above-average ownership.

Adoption by cohort shows younger users favoring Bitcoin for investment and payments. Established investors tend to hold larger quantities.

6. Country-by-country insights on average Bitcoin holdings

Looking more closely at countries, Vietnam stands out with the highest average Bitcoin holdings at 0.22 BTC per owner, driven by active trading, a youthful population, and regulatory support encouraging crypto payments and investments.

The United States follows with 0.18 BTC per owner, benefiting from strong institutional involvement and widespread retail adoption. The European Union averages around 0.14 BTC, reflecting varied regulations but steady market maturity.

Conversely, many African countries and parts of Latin America, while showing fast adoption growth, have lower average holdings (around 0.1 BTC). Unstable economic conditions and local regulations play a role here.

Local policies, economic stability, and infrastructure significantly influence Bitcoin ownership size and distribution across regions.

These numbers provide useful context if you’re wondering how much Bitcoin does the average person have in your country versus globally.

7. Related cryptocurrency ownership statistics

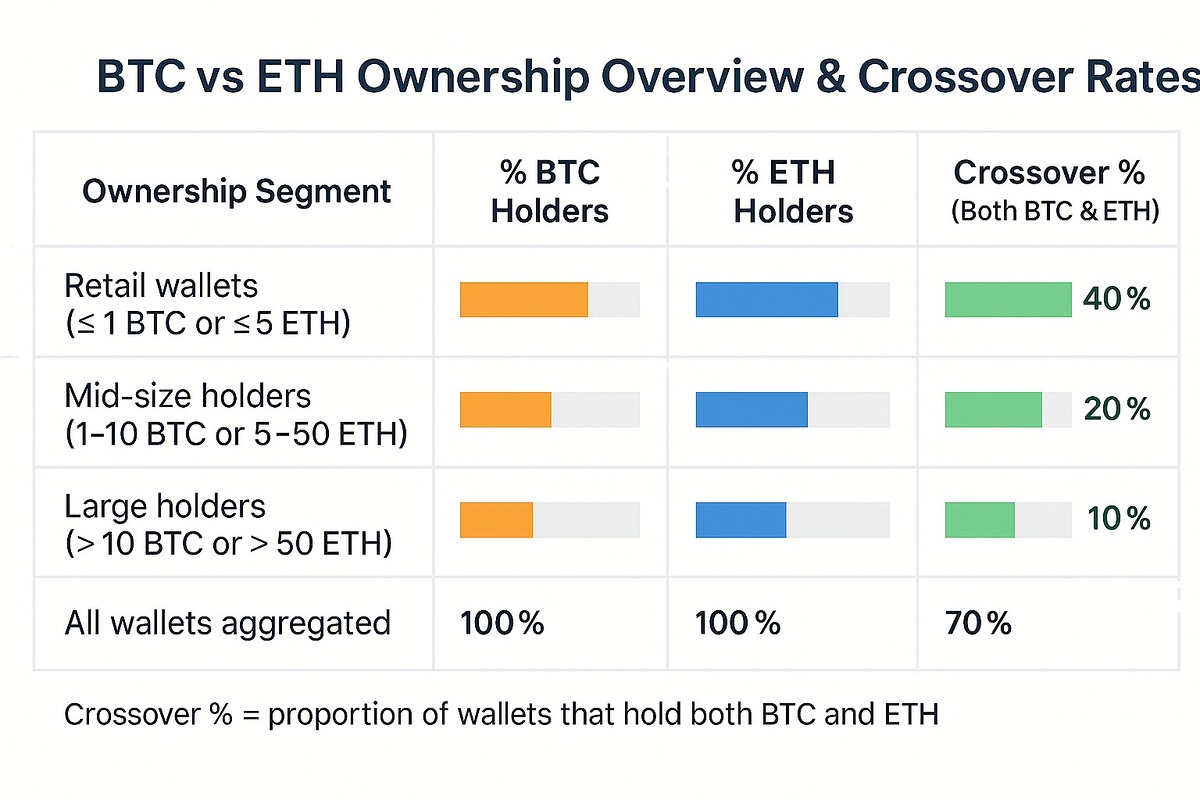

Bitcoin remains the dominant cryptocurrency, but Ethereum and others have sizable user bases. About 60% of Bitcoin owners also hold Ethereum, reflecting multi-asset portfolios. Compared to Bitcoin’s average 0.15 BTC, average ETH holdings per user are roughly 1.8 ETH.

Other altcoins have smaller but growing adoption. The table below compares average holdings and crossover ownership:

8. What does the “average” Bitcoin holding really mean?

If you’re trying to understand how much Bitcoin does the average person have, it’s important to look beyond the raw numbers. Since a few whales control large amounts, the average can seem higher than what most people hold in practice. Think of it like income: a few wealthy individuals lift average income figures above what typical workers earn.

For everyday users, Bitcoin is often a small part of their portfolio or used for payments and remittances rather than large investment. The median holding (~0.02 BTC) better reflects common user experience.

In practical terms, owning 0.1 BTC today is significant, worth several thousand dollars. But many users hold less as bitcoin adoption grows globally.

9. Expert commentary: Industry analysis & future outlook

Experts from Chainalysis and Glassnode highlight Bitcoin’s steady adoption growth despite market volatility. They point to increasing use in emerging markets and institutional interest in the US and Europe. Economists note that expanding regulatory clarity and improved wallet technologies will likely raise average holdings over the next five years.

Watch for developments in crypto-friendly policies, payment integration, and cross-border remittance use as key drivers shaping the Bitcoin ownership landscape.

Related reads to deepen your knowledge:

10. How to compare your Bitcoin holdings to the average (step-by-step)

Wondering how much Bitcoin does the average person have, and how your own balance compares? Here’s a simple process to find out:

- Use a trusted block explorer (e.g., Blockchain.com, Blockstream.info) to verify your wallet balance.

- Check wallet statistics on analytics sites like Glassnode or Chainalysis for average holding benchmarks.

- Compare your Bitcoin amount to average owner holdings (currently around 0.15 BTC) and median holdings (~0.02 BTC).

- Use portfolio apps that consolidate multiple wallets if you have more than one.

- Make note of your goals is your holding size for investment, payments, or other uses?

These steps help you understand your position in the broader Bitcoin ownership picture and see how much Bitcoin the average person has compared to your own balance.

11. Frequently asked questions: Bitcoin holdings

11.1 Is the average Bitcoin holding skewed by whales?

Yes, large holders inflate the average, so median figures offer a better user perspective.

11.2 Do most people hold less than 0.1 BTC?

Yes, over 80% of owners hold below 0.1 BTC.

11.3 Has the average changed dramatically since 2020?

It has risen moderately, reflecting growing adoption and price appreciation.

11.4 Does wallet splitting affect averages?

Yes, users holding multiple wallets can lower average per wallet but not per owner.

11.5 Are lost coins included in average calculations?

Typically, analysts adjust data to estimate and exclude lost coins where possible.

11.6 How are inactive accounts treated?

Some analyses exclude inactive wallets; others include them with adjustments.

11.7 How does Bitcoin’s average compare with Ethereum’s?

Ethereum owners typically hold around 1.8 ETH on average, reflecting different usage patterns.

12. Conclusion

How much Bitcoin does the average person have in 2025? As we’ve explored, the typical owner holds about 0.15 BTC though this number hides wide gaps in distribution, with many owning far less and a few owning much more. This average reflects the ongoing expansion of Bitcoin adoption, influenced by regional trends, income levels, and technological access.

To summarize:

- Average per owner: 0.15 BTC

- Median ownership is only 0.02 BTC, showing skewed distribution

- Most users hold less than 0.1 BTC

- Countries like Vietnam and the U.S. lead in per-owner averages

- Wallet count and user behavior affect true holding patterns

Whether you’re holding for investment, payments, or portfolio diversification, understanding how your holdings compare to the global average is a smart step toward managing your crypto strategy.

Don’t forget to follow the Bitcoin section of Vietnam-UStrade to stay updated with the latest insights and data on cryptocurrency ownership!