What happens when call options expire in the money, and how does it affect your portfolio strategy When a call option expires in the money, it’s automatically exercised or assigned leading to real profit or unexpected obligations, depending on your position.

This moment can be both an opportunity and a risk for traders. Failing to manage this correctly could result in lost gains or forced trades. But with the right plan, you can turn ITM expiry into an advantage.

In this guide, vietnam-ustrade will walk you through what happens at expiry, the decisions you need to make, and how to avoid costly mistakes.

1. Key definitions and option fundamentals

what happens when call options expire in the money? A call option allows the buyer to purchase an asset, often a stock, at a set price called the strike price. The buyer pays a fee called a premium for this right. Each option has an expiration date the deadline to use or sell it.

“In the money” means the asset’s price is above the strike price, making the option potentially profitable if exercised. Using our previous example, the $100 strike call is ITM when the stock price is $110.

Below is a quick reference table to clarify key terms:

Strike Price: The price at which the call holder can buy the stock.

Premium: The cost paid to buy the option.

Assignment: The process where the option writer must sell the stock to the holder.

Automatic Exercise: Broker’s action to exercise ITM options at expiration by default.

2. What happens when call options expire in the money?

To fully understand what happens when call options expire in the money, we’ll explore both the holder’s and writer’s perspectives.

2.1 For option holders (buyers)

2.1.1 Automatic exercise mechanics

Most brokers automatically exercise ITM call options at expiration unless instructed otherwise. This means you buy the underlying shares at the strike price. For example, with a $100 strike call when the stock is at $110, you’d pay $100 per share, immediately gaining $10 per share in value.

2.1.2 Manual exercise vs. selling position

Instead of exercising, holders can also sell their call options before expiry to lock in profit without buying shares. Alternatively, you can let the option expire, but this is only wise if it’s out of the money.

2.1.3 Capital requirements and broker practices

Exercising requires sufficient funds to buy the shares. Brokers often notify clients before expiration and may have different rules on deadline and thresholds. Some allow choosing cash settlement alternatives if available. This becomes especially important in cases of what happens when call options expire in the money, where quick action can prevent forced assignments or capital shortfalls.

2.2 For option writers (sellers)

2.2.1 Assignment: What it is and how it’s triggered

When call options expire ITM, writers may be assigned, meaning they must sell the underlying stock at the strike price. Assignment usually happens automatically after expiration.

2.2.2 Covered vs. uncovered calls – Portfolio impacts

Writers with covered calls own the underlying stock, making assignment straightforward. Writers of uncovered (naked) calls may face margin calls or need to buy shares at market price to deliver, which can be risky if prices rise sharply.

During expiry week and especially expiration day, assignment notifications are typically sent by brokers, and timelines are tight. This process varies by broker but usually follows standard industry rules.

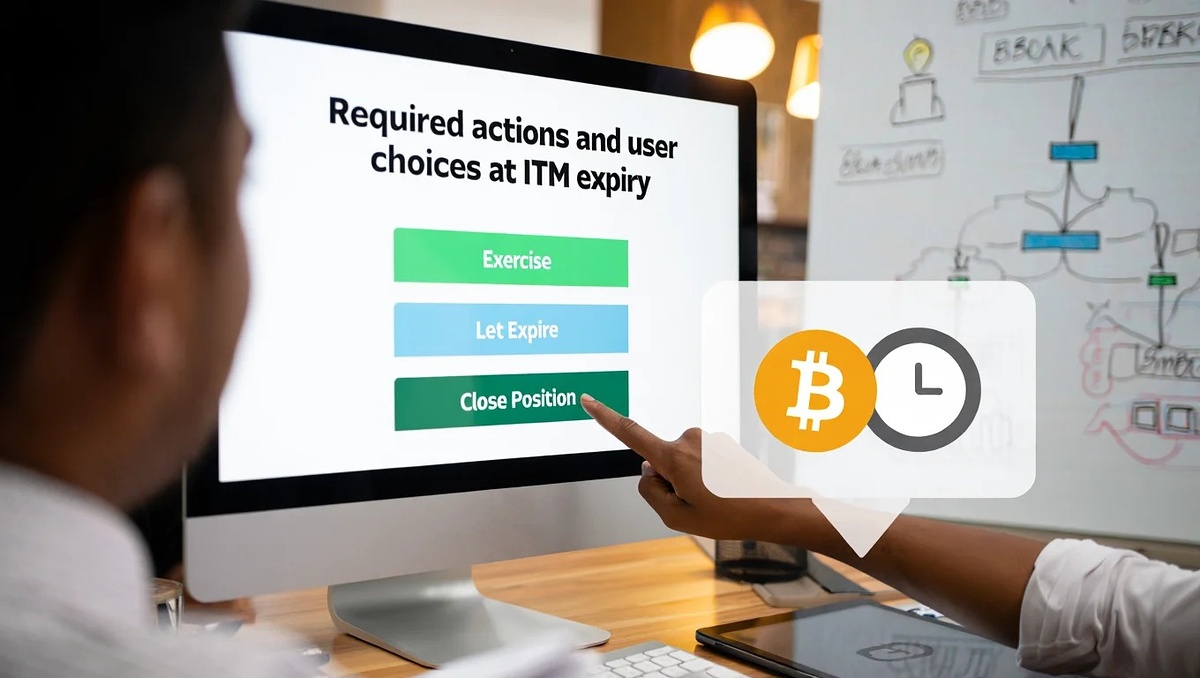

3. Required actions and user choices at ITM expiry

When a call option expires in the money, you have to choose what to do next act or let it run.

3.1 What if you don’t want to buy (or sell) shares?

Many retail investors ask what happens when call options expire in the money, but don’t realize they can act early to control outcomes. If you’re a holder but lack funds or don’t want shares, selling the call before expiry is a common choice. Sellers who don’t want to deliver shares can buy back the call to close their position.

3.2 How to unwind or close your ITM call position

Unwinding means offsetting your position by selling or buying back options before expiry. This avoids automatic exercise or assignment. Timing is crucial, so watch broker alerts and deadlines.

Learn how to use supply and demand zones when trading options to improve entry and exit timing.

3.3 Alerts, deadlines, and auto-exercise thresholds

Many brokers automatically exercise calls with at least $0.01 intrinsic value, but policies vary. Deadlines to notify brokers about your intentions can be as early as the morning of expiration day. For example, popular US brokers notify clients one day prior, while some Vietnamese platforms offer automated reminders.

Understanding what happens when call options expire in the money helps you act within these timelines confidently. Here is a simple action table to guide you:

If You Are a Holder:

– Want shares: Prepare funds, accept automatic exercise.

– Don’t want shares: Sell call before expiry or instruct broker not to exercise (if possible).

If You Are a Writer:

– Want to avoid assignment: Buy back the call before expiry.

– OK with assignment: Prepare to deliver or settle shares.

4. Cash vs. physical settlement of ITM calls

Most stock options settle physically, meaning shares are exchanged. Index options, like SPX, are cash-settled, so no shares change hands. Instead, the difference between the index and strike price is paid in cash.

This table shows the main differences:

Settlement Type: Physical (Stocks) vs. Cash (Indexes)

Example: AAPL options vs. SPX options

Investor Action: Buy/sell shares vs. receive/pay cash difference

Risk: Physical requires capital for shares; cash requires less capital but no ownership.

5. Profit and loss when call options expire ITM

To fully understand what happens when call options expire in the money, you need to know how to calculate your real profit or loss.

5.1 How to calculate your gains or losses

Profit on an ITM call equals the stock price at expiration minus the strike price, minus the premium paid. That’s why calculating your net return is a vital part of analyzing what happens when call options expire in the money. For example, if the stock closes at $110, strike is $100, and premium was $8, the net gain per share is ($110 – $100) – $8 = $2.

5.2 Example profit/loss scenarios

Here are three examples:

| Stock Price at Expiry | Strike Price | Premium Paid | Profit / Loss |

|---|---|---|---|

| $110 | $100 | $8 | +$2 gain |

| $108 | $100 | $9 | –$1 loss |

| $105 | $100 | $6 | –$1 loss |

5.3 Tax/fee implications (disclaimer)

Fees, commissions, and taxes can reduce profits. Tax rules vary by country and personal circumstances. Always consult a qualified tax professional before making decisions that affect your tax liability.

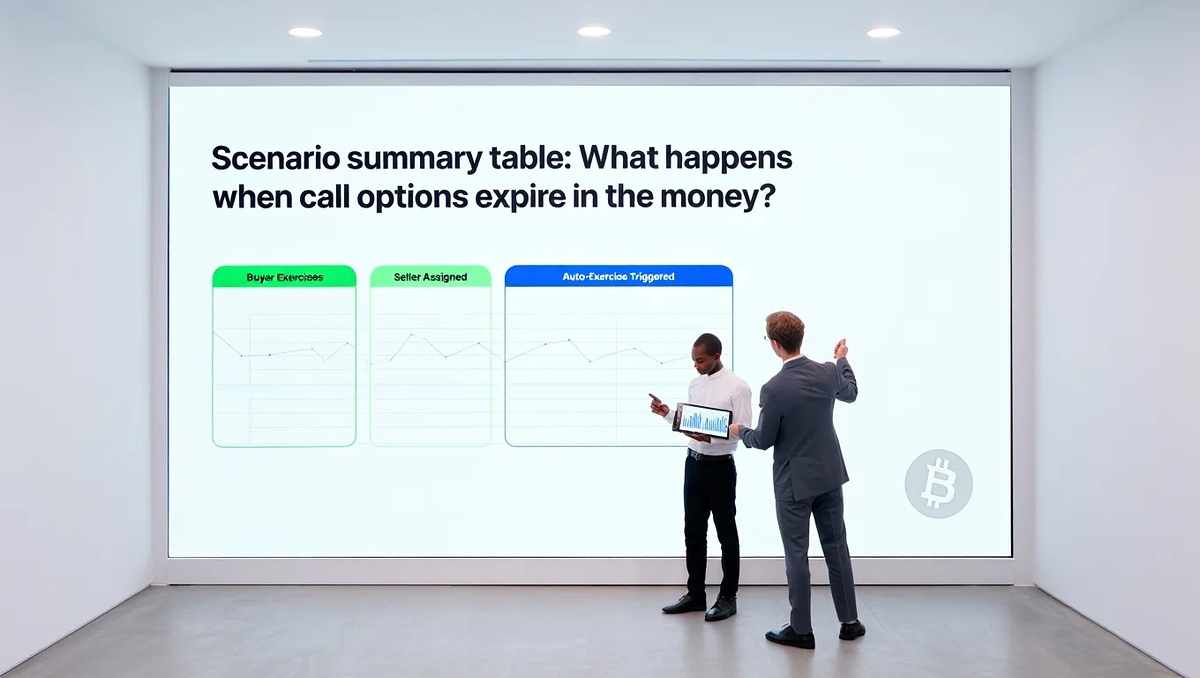

6. Scenario summary table: What happens when call options expire in the money?

Here’s a quick overview to illustrate what happens when call options expire in the money in different situations.

| Scenario | Holder’s Action | Writer’s Action | Outcome |

|---|---|---|---|

| ITM, wants to receive shares | Exercise option | Assigned automatically | Shares are delivered |

| ITM, does not want shares | Sell or close position | Option value is realized | |

| OTM (out of the money) | Let the option expire | No action needed | No shares or cash exchanged |

| ITM index option | Auto cash settlement | Auto cash settlement | Cash difference is settled |

7. Risks, tips, and mistakes to avoid when call options expire in the money

When your call options are in the money (ITM) at expiry, the outcome can either be a nice profit or an unexpected problem. To stay in control, you need to understand the common risks, smart tips, and mistakes that many traders make at this stage.

7.1 Common risks you should know

If you don’t manage your positions properly, here’s what can go wrong:

- Unexpected assignment: You might be forced to sell shares if you’re a call writer and didn’t close the position in time.

- Margin calls: If you wrote a call without owning the stock (a naked call), your broker may ask you to deposit more money.

- Low liquidity: Near expiry, it might be harder to buy or sell options quickly or at a good price.

- Auto-exercise of low-value options: Even if your call is just $0.01 ITM, your broker might still exercise it.

- Settlement confusion: Stock options usually require delivering shares, while index options settle in cash.

Other risks include missing broker emails, changes in auto-exercise policies, or reporting wrong tax numbers due to poor tracking.

7.2 Tips to manage ITM options smartly

To avoid problems and keep your strategy on track, here are some helpful tips:

- Track expiry dates carefully: Use a calendar or set alerts on your trading platform.

- Check margin rules early: Don’t wait until the last minute to prepare funds or assets.

- Ask your broker about auto-exercise: Learn their policies and deadlines ahead of time.

- Prefer covered calls: If you already own the stock, assignment is much easier to handle.

- Double-check costs and fees: Don’t forget about premiums, commissions, or taxes.

- Watch after-hours price moves: These can change whether your option finishes ITM or not.

Always plan your exit in advance and stay in touch with your broker to avoid surprises.

7.3 Mistakes to avoid

Even experienced traders sometimes make these common errors:

- Missing the cut-off time to act before expiry.

- Assuming you won’t get assigned just because you’re not paying attention.

- Forgetting to set aside enough cash or stock for exercise or delivery.

- Letting ITM options expire when you don’t want to buy or sell shares.

- Misjudging profit by ignoring the cost of the option or trading fees.

- Failing to report taxes correctly or ignoring local tax rules.

- Thinking all brokers have the same rules they don’t.

Understanding what happens when call options expire in the money helps you make better trading choices. By knowing what to expect and staying organized, you can avoid costly mistakes and use expiry to your advantage.

If you’re active in crypto, compare strategies like day trading vs swing trading cryptos to manage volatility better.

8. Common broker, market, and legal/tax variations

Top brokers in the US (like TD Ameritrade, Fidelity) generally follow automatic exercise for ITM calls at $0.01 or more, with clear notifications a day before expiry. Vietnamese brokers may have varying rules and different notification timeframes; checking your broker’s FAQ is essential.

International tax laws vary widely. US investors often pay capital gains taxes on option profits, while Vietnam has different treatments. Links to broker policies and official tax resources can help you stay informed.

For exact auto-exercise thresholds, notification methods, and settlement practices, consult your broker’s official website or customer support. Comparing US and Vietnam brokerage approaches can reveal nuances important to active traders.

Examples include:

- TD Ameritrade: Auto exercise at $0.01 ITM, alerts 1 day before expiry.

- Interactive Brokers: Supports manual exercise instructions up to morning of expiry day.

- Viet Capital Securities: May require earlier exercise notification.

- SSI Securities: Different margin policies for uncovered calls.

Being aware of these differences prevents surprises and helps you plan better.

Explore more trading insights:

9. Frequently asked questions on ITM call expiry

9.1 Will my broker exercise ITM calls automatically?

Most brokers do automatic exercise for ITM calls, usually if the option is at least $0.01 in the money.

9.2 What if I don’t have enough cash or shares?

If you are a holder, you can sell the call option before expiry instead of exercising. Writers without shares may face margin calls and must prepare to cover the position.

9.3 Can I avoid assignment as a call writer?

Yes, by buying back the call option before expiry, you may avoid assignment.

9.4 What’s the risk if my call is just barely ITM or OTM?

Options close near the strike may still be auto-exercised, depending on broker policy. Be sure to check thresholds and act accordingly.

9.5 Are there exceptions for cash or foreign accounts?

Some brokers or account types may follow different rules; always review your broker’s specific policies or contact support.

10. Conclusion

When call options expire in the money, knowing the process helps you protect your capital and maximize your return. Understanding what happens when call options expire in the money allows traders to plan effectively, whether they choose to exercise, assign, or close the position early.

Key takeaways include:

- ITM calls are usually auto-exercised unless you take action.

- Option holders need funds; writers must prepare for assignment.

- Settlement type (cash or physical) changes outcomes.

- Broker rules and tax implications vary stay informed.

- Timing, alerts, and communication are critical at expiry.

Don’t forget to follow the Trader & Trading category on Vietnam-UStrade for more insights into derivatives, crypto, and smart trading strategies.

Have you ever been caught off guard by an ITM option expiry?

Hopefully, this guide helps you stay proactive and make confident decisions next time.

Feel free to leave your questions or thoughts below or explore more advanced trading guides on our platform!

If you want to go beyond the basics and explore more about trading strategies, option contracts, and risk management, you can continue learning at H2T Funding. Our website provides in-depth guides and practical tips to help you build a solid foundation and make smarter trading decisions.