How a layer foundation wallet large transfer to exchange deposit address affects crypto markets? These movements often spark speculation and even panic as they involve millions in tokens moved to exchanges. Whether for funding, liquidity, or treasury strategy, such transfers usually reflect high-stakes decisions from blockchain foundations.

Understanding why these wallets initiate massive token transfers and where they send them can help you decode market sentiment, prepare for price changes, and avoid misinformation.

In this guide by Vietnam-UStrade, we’ll break down what these large transactions mean, why they happen, and how they impact token price and trust. Let’s dive in.

1. What is a layer foundation wallet?

A layer foundation wallet is a special crypto wallet owned and managed by a blockchain’s foundation or core project team. Unlike regular wallets, they hold large amounts of native tokens reserved for official project use (see what is a bitcoin wallet). Control is typically distributed among trusted leaders using security measures like multi-signature approvals.

These wallets serve multiple roles, including:

- Funding developer grants and ecosystem partnerships

- Holding treasury reserves for long-term project sustainability

- Covering operational expenses such as staffing and research

- Supporting token liquidity and exchange listings

For example, the Ethereum Foundation manages ETH tokens in such wallets to finance protocol upgrades and ecosystem grants, while Solana Labs operates similarly to support Solana network development. This treasury hierarchy ensures responsible management of project funds, which informs the purpose behind layer foundation wallet large transfer to exchange deposit address a common pattern observed when foundations prepare to provide liquidity, fund strategic initiatives, or execute planned token disbursements via centralized platforms.

2. Exchange deposit address: Function and importance in crypto transfers

An exchange deposit address is a unique wallet address that a cryptocurrency exchange assigns to each user. It allows users or institutions to transfer tokens into their exchange accounts. This address is often linked to a specific blockchain network, making accuracy critical. Sending tokens to the wrong network or address can lead to permanent loss of funds due to blockchain’s irreversible nature.

Below is a comparison highlighting key differences between foundation wallets and exchange deposit addresses:

| Feature | Foundation Wallet | Exchange Deposit Address |

|---|---|---|

| Purpose | Manage project treasury and official funds | Receive tokens into exchange user accounts |

| Control | Multi-signature teams or custodians | Controlled by exchange operators |

| Transfer Flexibility | Large, planned transfers with approvals | For deposits/redeposits, often require network compatibility |

| Risk | High security risk if mismanaged | Risk of irreversible errors if incorrect address or network used |

For instance, Binance and Kraken provide detailed instructions and visual confirmations to help users correctly input deposit addresses. Understanding these distinctions helps explain the mechanics and risks of large foundation wallet transfers.

Learn the exact steps via our guide on how do I deposit bitcoins.

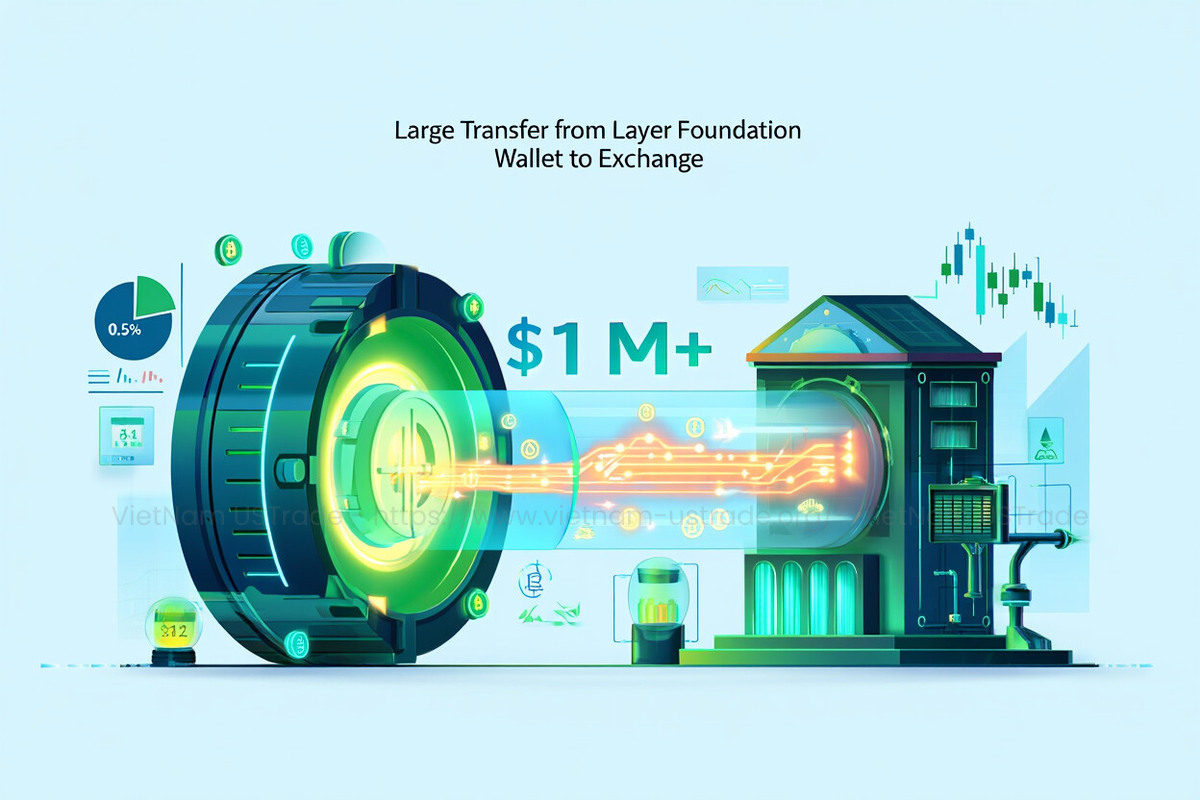

3. Layer foundation wallet large transfer to exchange deposit address: Detailed explanation

A large transfer from a layer foundation wallet to an exchange deposit address refers to moving a significant portion of the project’s tokens onto an exchange for various strategic purposes. These transfers are considered “large” based on either their absolute dollar value commonly over $1 million or relative size, such as exceeding 0.5% of a token’s circulating supply.

Key elements defining these large moves include:

- Absolute Value: Transfers typically surpass million-dollar thresholds to qualify as notable.

- Percentage of Supply: Movements involving a meaningful share of total supply attract attention.

- Timing: Transfers around market events or announcements may signal strategic intent.

- Transparency: Foundations often alert communities to these transfers for trust.

- Market Impact: Large transfers can affect token liquidity and price volatility.

Noteworthy instances include Ethereum Foundation’s ETH movements supporting grants and operational liquidity, attracting market observation during 2022–2024. These transfers draw focus because they often precede sales or liquidity provisioning, making understanding their scale and purpose essential for investors and analysts.

4. Main reasons behind layer foundation wallet large transfers to exchange deposit addresses

Several factors drive a layer foundation wallet large transfer to exchange deposit address. These transfers are not random or ad hoc, but usually reflect planned strategic decisions by the project’s foundation or core team. Here are the primary reasons:

- Funding Ecosystem Grants and Partnerships: Foundations convert tokens to fiat or crypto to fund developers and ecosystem growth.

- Supporting Token Liquidity and Exchange Listings: Large transfers help maintain active trading pools by ensuring sufficient token supply on exchanges.

- Treasury Management: Diversification or swapping assets to optimize project fund value often requires moving tokens to exchanges.

- Paying Operational Costs: Running core teams and infrastructure involves converting tokens into operational budgets.

- Strategic Sales or Fundraising: Foundations may sell tokens strategically to raise funds or manage market exposure.

- Regulatory or Compliance Needs: Responding to audits, tax requirements, or legal adjustments sometimes involves on-chain transfers.

- Liquidity Events: Preparation for token unlocks or staking releases may require temporary exchange deposits.

- Partnership Strategies: Collaborating with exchanges or projects could involve transferring tokens clearly on-chain.

For example, Solana has moved tokens to fund grants, and Polygon’s treasury frequently adjusts assets to sustain network incentives. Celo’s treasury updates have also highlighted such transfers for transparency.

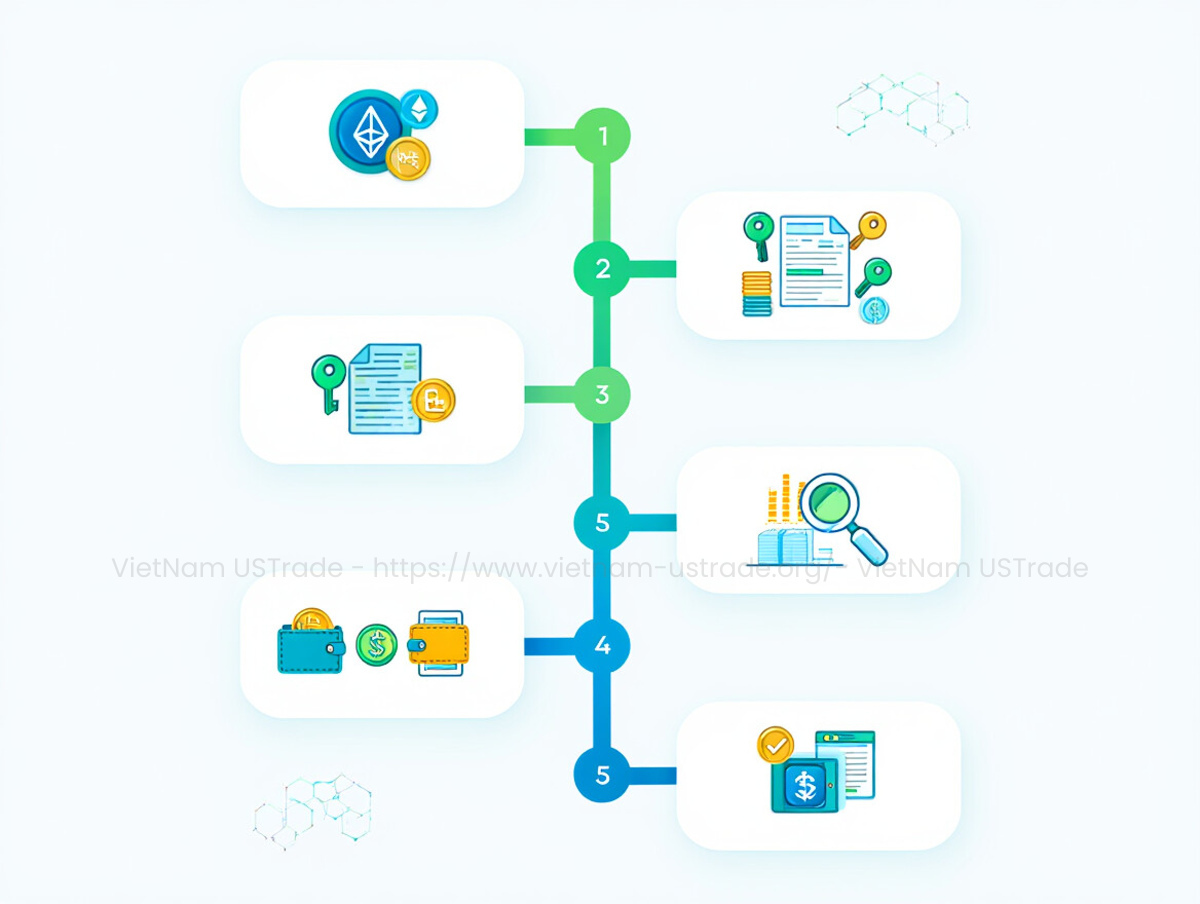

5. The step-by-step process: How are large transfers made?

- Selecting the Correct Blockchain/Network: Confirming the token’s network (e.g., Ethereum mainnet, Solana) to avoid irreversible loss.

- Approval Process: Obtaining authorization through multi-signature wallets or multi-party computation (MPC) custody setups to ensure security.

- Retrieving and Verifying the Exchange Deposit Address: Double-checking the exchange wallet address and ensuring it matches the correct network and token.

- Conducting a Small Test Transfer: Sending a minimal token amount first to confirm accuracy and prevent large losses.

- Confirmation, Monitoring, and Reporting: Watching the transaction through blockchain explorers, then notifying stakeholders or community as appropriate.

This structured method ensures security and transparency when executing a layer foundation wallet large transfer to exchange deposit address.

Large institutions employ visual workflows and redundant checks to avoid errors. Such structured processes reduce operational risks and maintain trust.

6. Security risks and best practices for foundation-to-exchange transfers

Large transfers carry several security risks, but following best practices helps mitigate them. Key points include:

- Beware of phishing attempts targeting wallet keys or exchange addresses.

- Confirm network compatibility to avoid irreversible token loss.

- Segregate duties among team members to prevent unauthorized transfers.

- Use multi-signature wallets or MPC custody for transaction approvals.

- Implement whitelisting of known addresses to reduce errors.

- Run small test transfers before moving large sums.

- Maintain clear audit trails and transparent logs of all actions.

- Regularly update software and security protocols to patch vulnerabilities.

- Engage third-party audits for added assurance.

- Communicate openly with the community to build trust in treasury management.

Recent incidents in crypto highlight the consequences of weak security. Employing these practices helps safeguard both project funds and community confidence. To avoid critical mistakes during a layer foundation wallet large transfer to exchange deposit address, always verify the address and run a test transaction.

7. How to track and verify large foundation wallet transfers on-chain

Monitoring a layer foundation wallet large transfer to exchange deposit address is possible using several blockchain tools and public resources. These methods help ensure transparency and accountability in how project treasuries are managed. Steps include:

- Identify Foundation Wallet Addresses: Use official communications, reliable databases, or public disclosures to know foundation wallets.

- Use Blockchain Explorers: Platforms like Etherscan (Ethereum), Blockscout (various networks), or Nansen offer transaction data and wallet analytics.

- Follow Whale Alerts: Services that broadcast large on-chain movements provide timely updates.

- Verify Transaction Paths: Look for transfers from foundation wallets to known exchange deposit addresses.

- Set Up Alerts: Some platforms allow custom notifications for wallet activity to stay informed.

- Use Public Dashboards: Certain projects maintain dashboards showing treasury movements and balances for transparency.

These tools empower investors, analysts, and community members to track large transfers accurately and build trust in project governance.

8. Market impact: How do large foundation-to-exchange transfers affect token price and community sentiment?

A layer foundation wallet large transfer to exchange deposit address often triggers market reactions, both in price dynamics and community perception. These effects include:

- Volatility: Sudden large moves can lead to increased price swings as traders anticipate potential sales or liquidity changes.

- Market Interpretation: Traders may see these transfers as signals of upcoming sales or funding rounds, affecting buying or selling pressure.

- Community Sentiment: Transparent communication reduces speculation and maintains confidence, while sudden unexplained transfers can create uncertainty.

Historically, Ethereum Foundation transfers have caused short-term price fluctuations as the market digests the increased exchange supply. Projects like Solana and Polygon have used proactive disclosures to minimize negative reactions by explaining transfer reasons.

9. Proactive transparency: Best practices for foundation communication

Maintaining community trust requires clear and timely communication about any layer foundation wallet large transfer to exchange deposit address. These high-value movements, if left unexplained, can lead to speculation and erode credibility. Best practices include:

- Publishing regular treasury and grant updates.

- Using public dashboards to show ongoing token movements and balances.

- Documenting transfers with explanations on official channels or social media.

- Engaging the community through Q&As or AMAs to clarify transfer purposes.

- Aligning transfer timings with planned announcements to avoid surprises.

- Involving independent audits or third-party verifications for accountability.

Projects like Uniswap and Aave have set strong examples by implementing transparent treasury reporting, inspiring greater investor confidence and legitimacy.

Continue learning with these articles:

- How much are bitcoins worth in us dollars

- How much bitcoin did ross ulbricht have

- How much bitcoin does elon musk own

10. FAQs

Here are some of the most common questions related to the layer foundation wallet large transfer to exchange deposit address process.

10.1. Why do layer foundation wallets transfer large amounts of tokens to exchanges?

To fund development, provide liquidity, pay operational costs, or prepare for token sales. These moves are usually strategic and planned.

10.2. Are large transfers from foundation wallets always a bad sign?

Not necessarily. While they can affect short-term market sentiment, they often support healthy project growth and ecosystem funding.

10.3. How can I track large foundation wallet transfers in real time?

Use tools like Etherscan, Nansen, or Whale Alert to monitor on-chain activity and set up alerts for large movements.

10.4. What risks are involved in transferring tokens to an exchange deposit address?

Mistakes in address input or choosing the wrong blockchain network can lead to irreversible loss. Security protocols are crucial.

10.5. Can regular users access foundation wallet data?

Yes. Most foundation wallet activities are on-chain and publicly accessible via blockchain explorers and project dashboards.

11. Conclusion

Large transfers from layer foundation wallet large transfer to exchange deposit address reflect critical strategic decisions in blockchain treasury management. Understanding what they mean, why they happen, and how they’re executed helps you better interpret market signals and maintain confidence in project operations.

This guide has covered essential aspects including the purpose of foundation wallets, how exchange deposit addresses function, reasons behind large-scale token movements, execution processes, security best practices, and market impact. Here’s a quick checklist to remember:

- Layer foundation wallets typically hold large reserves for project development and sustainability.

- Large transfers to exchanges often signal funding needs, liquidity provisioning, or potential sell-offs.

- Proper execution includes security verification, accurate address matching, and community transparency.

- Tracking these movements on-chain helps investors stay informed and avoid misinterpretation.

- Transparent communication from project foundations preserves trust and reduces unnecessary market panic.

Don’t forget to follow the Trader & Trading category on Vietnam-UStrade for the latest updates!

Have you ever tracked a major token movement from a foundation wallet? We hope this guide empowers you to better understand and evaluate significant crypto transfers. Feel free to leave a comment or question if you need further clarification!