Trimming, also known as a partial close, is an essential risk management tool in modern trading. It allows traders to close a portion of their open positions rather than exiting a trade entirely. This practice helps secure profits, reduce exposure, and maintain flexibility in market strategies. In fast-moving markets or around major economic news, trimming gives traders the agility to protect gains while staying engaged with potential further upside.

Learning earning how to trim while in trade on TradingView is crucial for effective position management, especially for traders looking to balance risk and reward dynamically is crucial for effective position management, especially for traders looking to balance risk and reward dynamically. This guide focuses on live, active trades executed on TradingView, one of the most popular platforms for traders worldwide, including growing communities in Vietnam and the US. We will walk you through practical, visual, and troubleshooting steps to safely trim your positions on TradingView, empowering you to control risk confidently and adapt your trades as market conditions evolve.

- Trimming means partially closing a trade to lock in profits or reduce risk.

- It is vital for managing trades during volatile markets or uncertain news events.

- TradingView’s live trading interface supports trimming with compatible brokers.

- This guide covers step-by-step actions, common issues, and expert tips.

1. What Does “Trim” Mean in the Context of TradingView?

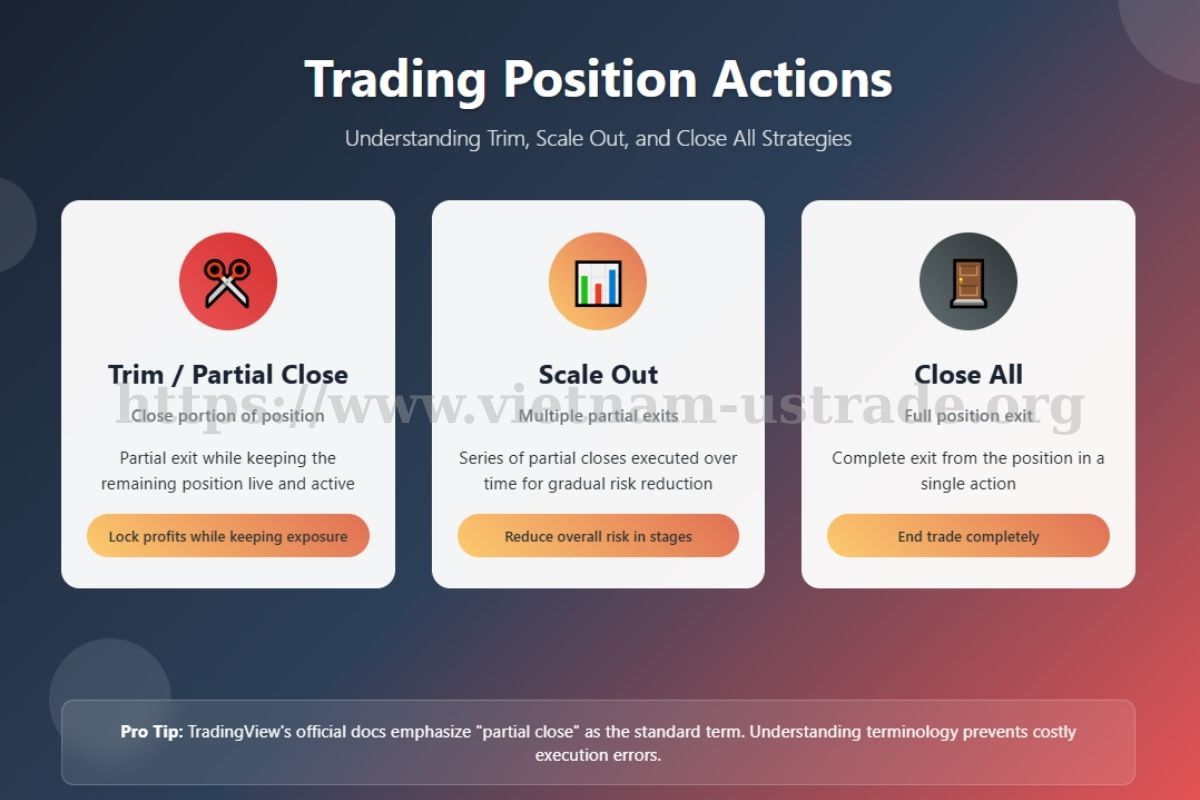

Trimming a trade means closing a part of an open position rather than the entire amount. This method allows traders to take profits or reduce risk gradually, rather than fully exit.

- Trim / Partial Close: Close a portion of the position. Keeps the rest open.

- Scale Out: Similar to trim; often used to describe multiple partial closes.

- Close All: Exiting the entire position in one action.

| Action | Effect | Typical Use Case |

|---|---|---|

| Trim / Partial Close | Partial exit; remaining position stays live | Locking profits while keeping some exposure |

| Scale Out | Multiple partial exits over time | Reducing overall risk in stages |

| Close All | Full exit from position | Ending trade completely |

Terminology can vary by region and broker, but TradingView’s official docs emphasize “partial close” as the standard term. Understanding these differences helps ensure your orders match your intended actions and risk management strategy. Similar to how traders need to understand the difference between futures and options, knowing trimming terminology prevents costly execution errors.

2. Prerequisites for Trimming a Trade on TradingView

- Use a live trading account linked to a TradingView-supported broker or connector.

- Access TradingView via web, desktop, or mobile app with trading permissions enabled.

- Crucial Step: Disable “Instant Order Placement”. Go to “Chart Settings”, in the “Trading” section uncheck the “Instant order placement”

- Meet margin requirements and minimum order sizes set by your broker.

- Remember: Demo mode simulates execution but does not replicate real slippage or fees.

Before attempting a trim, confirm your broker supports partial closes through TradingView. Visit TradingView’s official broker compatibility page for updates. Note that demo accounts offer valuable practice but differ from live environments due to lack of real execution factors.

3. How to Trim While in Trade on TradingView (Step-by-Step 2025 Workflow)

Step 1: Accessing Your Open Trade or Position

Open TradingView and locate the “Open Positions” panel, usually found at the bottom or right sidebar depending on your layout. Here, you will see all active trades across stocks, forex, or crypto.

Identify the trade you wish to trim by checking the symbol, entry price, and current size. For accessibility, TradingView supports screen readers and keyboard navigation to help visually impaired users locate open positions quickly.

Step 2: Initiating a Partial Close/Trim Order

- Click the position you want to modify to bring up the order menu.

- Select the option labeled “Close Position” or “Modify Order.”

- Choose “Partial Close” to avoid accidentally exiting the full position.

- Watch for the two buttons: “Close All” (full exit) and “Partial Close.” Double-check before clicking.

Step 3: Adjusting the Position Size for the Partial Close

Enter the amount you want to trim in the input field, representing contracts, shares, or lots depending on asset class.

- For instance, if you hold 3 lots and want to close half, input 1.5.

- Some brokers may require whole units only; rounding may apply.

- Check if a dropdown selector or manual input is used based on the TradingView 2025 interface update.

Step 4: Confirming and Executing the Partial Close

- After setting the trim amount, click “Confirm” or “Submit.”

- A pop-up confirmation will appear, asking “Are you sure?” Review details carefully.

- Verify symbol, size, and price to prevent costly errors.

Step 5: Verifying the Successful Trim (Post-Execution)

Once executed, check the Open Positions panel to see the updated size reflecting your trimmed trade. Review order history to confirm partial close execution.

Note that stop-loss or take-profit orders may adjust automatically depending on broker settings. Sometimes, you’ll need to reset these manually to match your new position size.

| Before Trim | After Trim |

|---|---|

| 3 lots open | 1.5 lots open |

| Stop-loss @ $50 | Stop-loss may require manual update |

Once executed, check the Open Positions panel to see the updated size reflecting your trimmed trade. Review order history to confirm partial close execution. Note that stop-loss or take-profit orders may adjust automatically depending on broker settings. Sometimes, you’ll need to reset these manually to match your new position size.

Mastering trade management on platforms like TradingView is an important step toward professional-level trading. If you’re aiming to become a funded trader, you should also learn strategies on how to pass prop firm challenge since effective order handling and risk control are key to success.

4. Advanced Tips and Best Practices for Trimming Trades on TradingView

- After trimming, always review and adjust stop-loss and take-profit levels to maintain proper risk control.

- Use TradingView’s hotkeys and quick trade panels to speed up partial closes, especially during volatile market moves.

- Be cautious when trimming on mobile devices where screen space and responsiveness can lead to accidental orders.

- Avoid trimming in illiquid markets where partial closes might execute at unfavorable prices or delays.

- Consider trimming before major economic events to secure profits while maintaining upside potential. Understanding market timing is as crucial as knowing what a golden cross pattern means for identifying optimal entry and exit points.

- Watch your maintenance margin levels; partial closes can help avoid margin calls by freeing up funds.

5. Troubleshooting: Why Can’t I Trim My Position in TradingView?

- Broker Not Supported: Your broker doesn’t allow partial closes via TradingView. Check compatibility.

- Asset Restrictions: Some assets or symbols don’t support partial close orders.

- Minimum Order Sizes: The trim amount is below broker’s minimum lot or contract size.

- Trading Permissions: Your account or connection lacks required trading rights.

- Platform Issues: Temporary server or connectivity problems blocking trade modifications.

- Demo Account Limitations: Partial close may not be enabled or simulated realistically.

If you encounter these issues, contact your broker’s support or TradingView help desk with detailed error messages for faster resolution.

6. Comparative Table: Partial Close vs. Full Close vs. Scaling Out

| Feature | Partial Close (Trim) | Full Close | Scaling Out |

|---|---|---|---|

| Definition | Close part of position | Close entire position | Multiple partial closes over time |

| Typical Use | Lock profits, reduce risk | Exit trade completely | Gradual risk reduction |

| Functional Steps | Modify order size, confirm | One click close | Series of partial closes |

| Risk Impact | Partial exposure remains | No exposure left | Phased risk control |

| Platform Support | Depends on broker and platform | Widely supported | Depends on trader action |

7. Visual & Learning Aids: Annotated Images, Videos, and Resources

For visual learners, TradingView offers official video tutorials on partial closes embedded on their help site. These cover both desktop and mobile workflows with clear annotations and real-time demos.

A downloadable PDF checklist summarizing the trimming process is also available on TradingView’s resource page to keep at your desk for quick reference.

All images and videos include alt text for screen readers, ensuring accessibility for all traders.

8. Expert Tips, Author Perspective, and Further Resources

“Trimming your positions on TradingView gives you a practical way to manage risk without leaving the trade entirely. It’s especially useful during volatile periods,” says a verified TradingView trader. “Mastering this helps maintain flexibility and confidence in fast markets.”

With over a decade in trading and market analysis, I’ve seen how partial closes can save profits and limit losses when used thoughtfully. This guide aims to make the process clear and easy, so you trade smarter.

For more advanced trading strategies, explore our comprehensive guide on What happens when call options expire in the money, and visit the official TradingView documentation for platform-specific updates.

9. Frequently Asked Questions about Trimming in TradingView

9.1. Does trimming affect my stop-loss or take-profit?

It can. Some brokers adjust orders automatically; others require manual updates.

9.2. Can I partially close multiple times?

Yes, you can trim multiple times as long as minimum order sizes are respected.

9.3. Are fees or slippage different when trimming?

Generally, fees and slippage apply per order, so multiple partial closes may cost more than a single full close.

9.4. Is the workflow the same on desktop and mobile?

Mostly yes, but interfaces and button placement may vary slightly.

9.5. Can I trim trades on all brokers?

No, only brokers integrated with TradingView and supporting partial closes allow this.

10. Conclusion

Trimming positions is a crucial skill that separates disciplined traders from emotional ones. This guide has shown you the complete process—from accessing open positions to executing partial closes and troubleshooting common issues.

Key takeaways: always disable instant order placement, verify broker compatibility, and manually adjust stop-loss levels after trimming. Practice in demo mode first, then apply these techniques to live trades gradually.

Mastering how to trim while in trade on TradingView gives you the flexibility to lock profits while maintaining market exposure—essential for volatile markets and major news events. Don’t forget to follow the Trader & Trading category on Vietnam-UStrade for the latest TradingView updates and risk management strategies.