Are you torn between day trading vs swing trading cryptos in 2025? Choosing the right trading style can mean the difference between stress and success in the volatile crypto market. While day trading offers rapid profits, it demands full-time focus. In contrast, swing trading provides flexibility with potentially bigger gains per trade.

This guide helps you match the right method with your time, risk level, and trading goals whether you’re just starting or refining your strategy. Especially if you’re just starting out. You might also want to learn how to earn Bitcoins before choosing your first trading style.

Let’s dive into the ultimate comparison brought to you by Vietnam-UStrade.

1. Day trading vs swing trading cryptos: Key differences

Understanding the detailed differences helps you choose the best fit for your personality and goals. Let’s break down the key features:

Trade Duration: Day trading closes positions within hours or minutes, avoiding overnight risk. Swing trading holds trades over days to weeks, riding market trends.

Time Commitment: Day traders often need several hours daily to watch price moves and execute trades. Swing traders spend less daily time, focusing on periodic analysis.

Tools and Platforms: Day traders need fast platforms with real-time data. Swing traders focus on tools for chart patterns and fundamentals.

Risk Level: Day trading brings higher short-term risk and reward. Swing trading has steadier risk but is vulnerable to sudden news.

Reward Style: Day trading targets smaller, quick profits across many trades. Swing trading aims for larger gains per trade but fewer trades overall.

Psychological Stress: The fast pace of day trading can be stressful, demanding quick decisions. Swing trading allows more breathing space but requires patience and emotional control.

Capital Requirements: Day trading often needs more capital to manage multiple positions and margin requirements. Swing trading can work well with moderate capital.

Trade Frequency: Day traders may place 10 or more trades daily. Swing traders usually make 2-5 trades weekly.

These differences reflect how each strategy matches different lifestyles and risk profiles.

2. What is crypto day trading?

In the context of day trading vs swing trading cryptos, this section explores how day traders operate. Crypto day trading means buying and selling digital assets within the same day to profit from short-term price movements. Often using techniques similar to those in traditional forex trading. Unlike traditional stock day trading, crypto markets never close.

Typical holding periods range from a few minutes to several hours. Day traders often execute 10 or more trades daily, capitalizing on volatile price swings in coins like Bitcoin (BTC) or Ethereum (ETH).

Successful day traders use fast trading platforms such as Binance or Coinbase Pro, paired with real-time charting tools like TradingView. Common tactics include scalping small gains repeatedly, using momentum indicators, and setting tight stop-loss orders to limit risks.

Pros of Day Trading Crypto:

– Potential for quick profits

– No overnight exposure to market shocks

– Many trading opportunities daily

Cons of Day Trading Crypto:

– High time commitment and stress

– Heavy reliance on technical tools and fast decisions

– Higher transaction costs may reduce profits

Example Scenario: A trader buys BTC at $28,500 and sells at $29,200 within hours, using a $28,300 stop-loss to manage risk.

3. What is crypto swing trading?

When comparing day trading vs swing trading cryptos, swing trading means holding positions for days to weeks to catch medium-term trends often faster in crypto due to 24/7 markets.

Typical holding durations range between 3 days and 3 weeks. Swing traders combine technical analysis like moving averages and chart patterns with fundamental events such as protocol upgrades or regulatory news to time entries and exits.

Platforms like Kraken or Gemini, alongside charting tools with advanced pattern recognition, are favored by swing traders. Alerts and notifications help monitor positions without constant screen time.

Advantages of Swing Trading Crypto:

– Requires less daily screen time

– Lower emotional stress due to longer holding periods

– Potential for significant gains from strong trends

Drawbacks of Swing Trading Crypto:

– Exposure to overnight and weekend market moves

– Requires patience and discipline

– May miss very short-term profit opportunities

Example Scenario: A swing trader buys Ethereum at $1,650 after identifying a bullish breakout and holds for 10 days until $1,900, capturing a 15% profit. They use stop-loss orders and monitor fundamental news to adjust their trade.

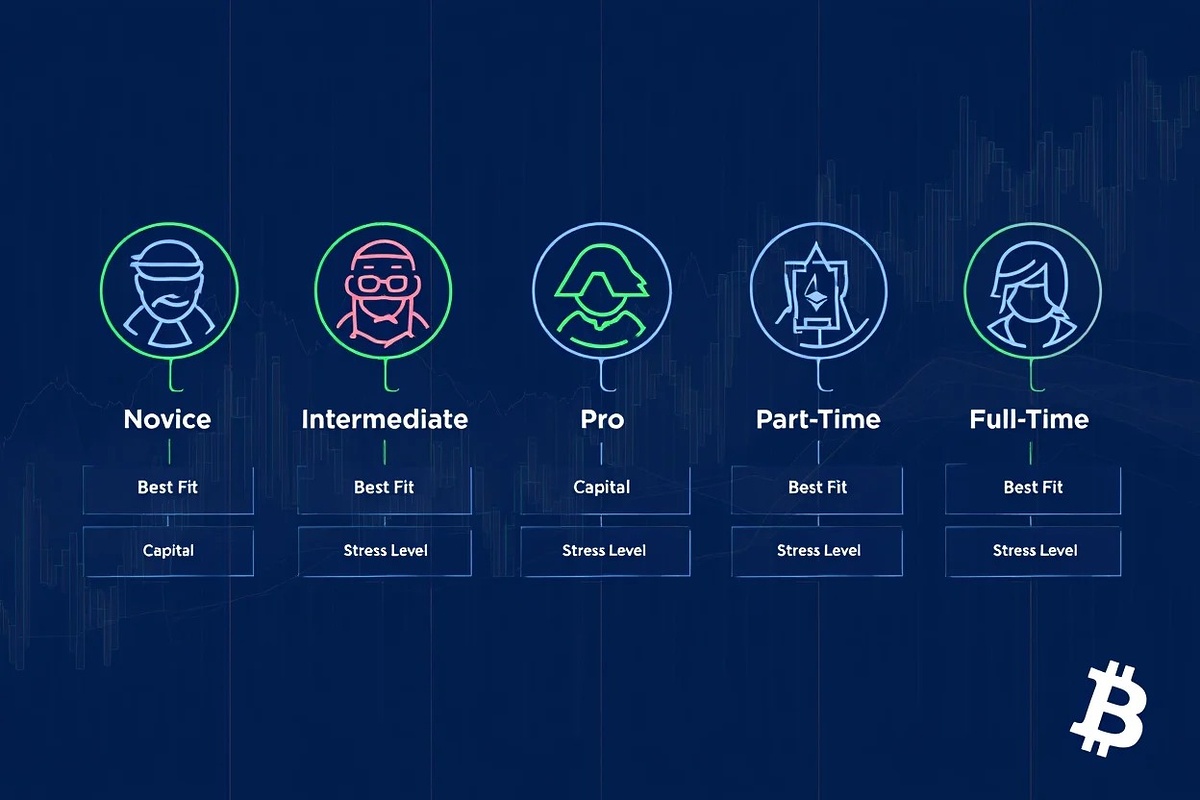

4. Deep dive: Choosing between day trading vs swing trading cryptos based on trader types

The best trading style depends on your time, experience, and risk comfort. Here’s how it fits different trader types:

Novice Traders: Is swing trading crypto better for beginners? In most cases, yes. Swing trading suits novice traders because it provides more time to learn and less pressure from rapid decisions.

Intermediate Traders: Both styles can work. Day trading offers faster feedback but demands discipline. Swing trading helps refine trend analysis skills.

Pro Traders: Many pros blend both, switching strategies with market conditions to maximize profits.

Part-Time Traders: Swing trading fits well because it requires less daily monitoring.

Full-Time Traders: Day trading can be rewarding but demanding, often becoming a full-time job.

High Risk-Tolerance Individuals: Day trading offers high reward but with higher volatility and stress.

Low Risk-Tolerance Individuals: Swing trading generally reduces stress and risk exposure per trade.

User Profile Table:

| Profile | Goal | Best Fit |

|---|---|---|

| Novice | Learning & moderate gains | Swing Trading |

| Intermediate | Growth & skill-building | Swing or Day Trading |

| Pro | Maximize profits with agility | Combined Approach |

| Part-time | Supplemental income | Swing Trading |

| Full-time | Primary income | Day Trading |

5. Understanding risks & considerations unique to crypto markets

When evaluating day trading vs swing trading cryptos, it’s important to understand the unique risks of crypto markets. These differ significantly from traditional assets and must be managed carefully.

Key Risks Include:

1. 24/7 Trading Hours: Markets never sleep, increasing the chance of unexpected moves outside normal hours.

2. Thin Liquidity: Some coins have low trading volume, causing larger price swings and slippage.

3. Leverage and Margin: Many traders use borrowed funds, magnifying gains and losses.

4. Exchange Security: Hacks and outages remain threats to funds held on platforms.

5. Regulatory Changes: New laws can quickly impact asset prices and trading options.

Day traders rely on tight stops and small positions. Swing traders use wider stops and diversify to handle volatility.

Fees and slippage affect profitability for both strategies; day traders may feel it more due to frequent trades. Knowing your platform’s fee structure helps minimize these costs.

In 2025, growing regulatory clarity means traders should stay informed on tax obligations and reporting requirements, which can differ by country.

6. Real-world examples: Case studies in crypto day & swing trading

Day Trading Case: A trader spots a sudden pump in Solana (SOL) due to positive network news. They buy at $22 and sell two hours later at $23, a 4.5% gain. However, they lose 1.5% on a quick reversal moments later on a separate trade.

This shows how quick decisions can yield both wins and losses. Key learning: Use stop-losses and manage emotions to avoid letting losses grow.

Swing Trading Case: A swing trader buys Cardano (ADA) at $0.40 after detecting an uptrend confirmed by volume increase and fundamental catalysts. Holding for 12 days, they exit at $0.48, securing a 20% profit. They avoided daily noise and stress by checking charts only a few times a day.

Key learning: Patience and combining technical with fundamental analysis pay off.

7. Pro tips for succeeding with each crypto trading style

Whether you choose day trading vs swing trading cryptos, success depends on disciplined execution, risk control, and psychological readiness.

7.1. Strategy & execution

-

Stick to a clear plan; avoid impulsive trades.

-

Focus on a few effective indicators or patterns.

-

Use multiple timeframes for better timing.

-

Set alerts to track key setups without constant screen time.

7.2. Risk & capital management

-

Always use stop-losses and adjust them as trades move.

-

Size positions based on account risk, not emotion.

-

Diversify (especially in swing trading) to reduce exposure.

-

Be cautious with leverage manage risk first.

7.3. Tools & platforms

-

Choose fast, stable platforms with real-time data.

-

Understand your fees frequent trades mean higher costs.

-

Use tools that fit your style: live execution for day trading, charting for swing trading.

7.4. Market awareness

-

Stay informed on news and major market events.

-

Trade liquid assets to avoid slippage.

-

Avoid high-volatility events unless you’re well-prepared.

7.5. Psychology & discipline

-

Control emotions don’t chase losses or FOMO.

-

Be patient, especially with longer trades.

-

Take breaks to avoid burnout.

-

Keep a journal to review and improve continuously.

8. Summary table: Pros & cons of crypto day trading vs swing trading

Here’s a quick summary of the pros and cons of day trading vs swing trading cryptos to help you decide faster.

Day Trading Pros:

- Fast profit potential

- No overnight market exposure

- High trade frequency

- Constant learning opportunities

- Potential for compounding gains

Day Trading Cons:

- High psychological stress

- Requires full-time attention

- Higher fees due to frequent trades

- Greater risk of impulsive errors

- Need for advanced tools

Swing Trading Pros:

- Less daily time commitment

- Lower stress and fatigue

- Potential for larger single-trade gains

- Easier to combine with other activities

- Flexibility in trade management

Swing Trading Cons:

- Risk of overnight price gaps

- Requires patience and discipline

- Fewer trading opportunities

- Vulnerable to sudden news events

- May need broader market understanding

9. How to choose the right crypto trading style in 2025?

Choosing between day trading vs swing trading cryptos starts with asking the right questions: How much time can I commit daily? What is my risk tolerance? Am I trading to learn or to earn quickly?

In most cases, yes it offers more time, less stress, and a gentler learning curve compared to day trading.

Use this decision tree as a guide:

| If you… | Choose |

|---|---|

| Have limited time and prefer low stress | Swing Trading |

| Can commit full-time and manage pressure well | Day Trading |

| Want to be flexible and adapt to markets | Combine both |

Being clear about your goals and resources will help you trade smarter and avoid costly mistakes in 2025’s dynamic crypto markets.

Related reads to deepen your knowledge:

- How many days after halving does bitcoin peak

- How many people own 1 bitcoin in the world

- How much are 3 bitcoins worth

10. FAQs

10.1 Is day trading more profitable than swing trading in cryptos in 2025?

It depends on the trader’s skill, capital, and time commitment. Day trading offers quick gains but higher stress and costs. Swing trading tends to be steadier with fewer trades.

10.2 Can beginners succeed at swing trading?

Yes. Swing trading allows more time to learn, lower stress, and can be a good fit for new traders.

10.3 What is the main difference between day trading and swing trading?

Day trading involves buying and selling within the same day; swing trading holds positions for days or weeks.

10.4 Which strategy has more risk?

Day trading typically carries higher short-term risk due to frequent trades and rapid market changes.

10.5 Which requires more capital?

Day trading usually requires more capital to handle multiple and rapid trades, including margin requirements.

10.6 What are other popular short-term crypto trading strategies?

Scalping, momentum trading, and algorithmic trading are common alternatives focusing on very short-term price moves.

11. Conclusion

The debate between day trading vs swing trading cryptos remains a key decision for traders in 2025. This article has compared the two approaches across risk, effort, reward, and suitability by profile.

Here’s a quick checklist:

- Choose day trading for fast-paced, full-time activity.

- Go with swing trading for flexibility and lower stress.

- Let time, risk, and skill guide your decision.

Which trading style suits you better fast profits or strategic patience? We hope this guide helps you clarify your direction. Feel free to leave a comment with your questions or experience, and don’t hesitate to explore other crypto resources and guides on our platform!

Don’t forget to follow the Trader & Trading category on Vietnam-UStrade to stay up to date with the latest insights.