If you’re wondering how do I buy bitcoins with a credit card, you’re in the right place. For crypto-curious users in 2025, credit cards offer instant access, but come with higher fees and safety considerations.

This step‑by‑step guide helps you move from learning to confident BTC ownership.

1. Why credit cards are a popular way to buy Bitcoin

Buying Bitcoin with a credit card has become a go-to method for beginners entering the crypto world. Unlike bank transfers, credit cards provide immediate settlement, removing the delay of traditional payment rails. This convenience is a key reason many first-time investors choose this route, especially when prices are moving fast.

However, this speed and ease often come at the expense of higher costs and potential financial pitfalls. Users must weigh the benefits of instant access against the realities of fees, fraud risks, and potential cash advance classifications.

We’ll explore the appeal and dangers of using a credit card to buy Bitcoin, insights that are crucial before diving into the practical steps.

2. How do I buy Bitcoins with a credit card: step-by-step

Each step below guides you through a smooth and secure BTC purchase using your credit card. Following these actions will help you avoid fees, scams, and frustration as a first-time crypto buyer.

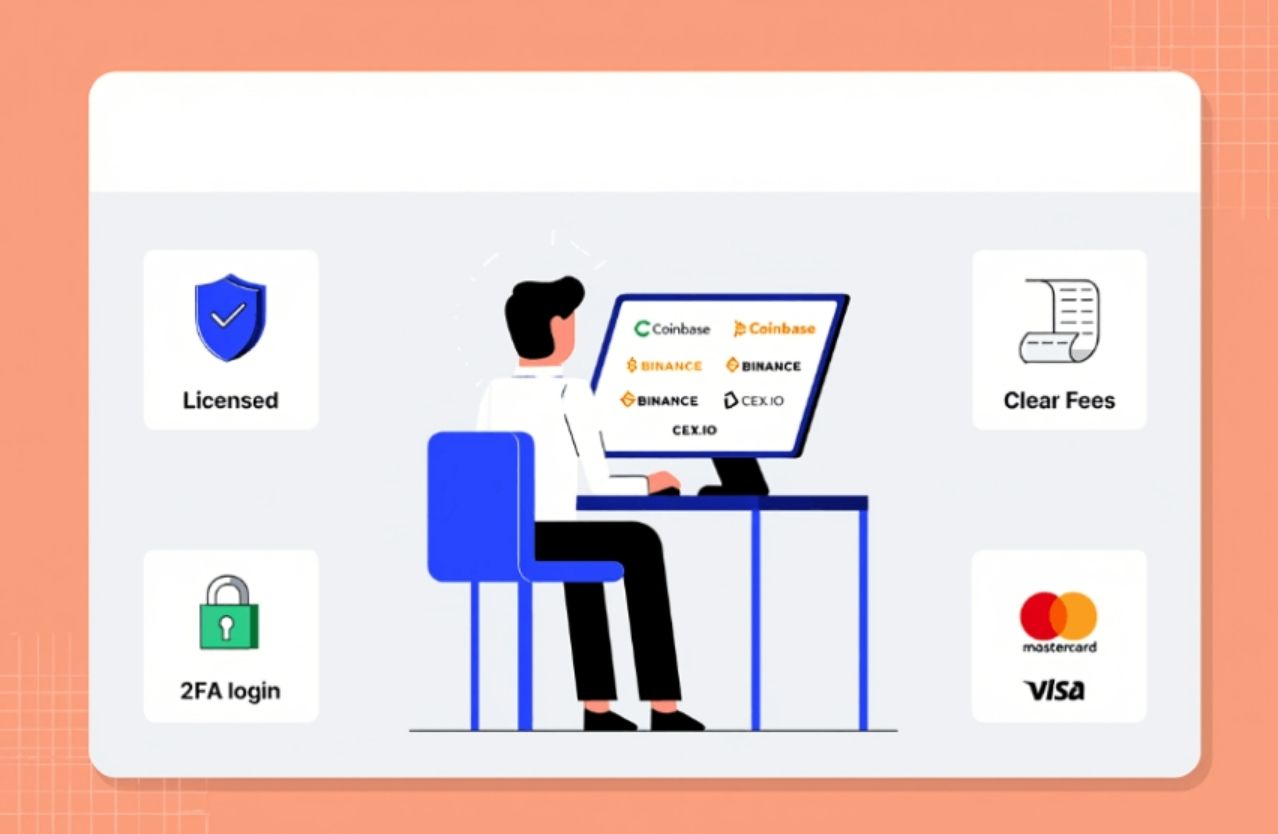

2.1. Step 1 – Choose a regulated and reputable exchange

Your first task is selecting a safe, compliant crypto exchange. Platforms like Coinbase, Binance, BitPay, Coinmama, or CEX.IO are well-known for accepting credit cards and maintaining strong security standards.

Always check for:

- Licensing or regulatory approval in your jurisdiction

- Transparent fee disclosures (avoid surprise charges)

- SSL encryption, PCI compliance, and 2FA login protection

- Verified credit card support (Visa, Mastercard preferred)

Choosing a credible exchange not only protects your funds but also ensures smoother onboarding and fewer transaction hiccups.

2.2. Step 2 – Create and verify your account (KYC)

Before buying any crypto, you must verify your identity. This is required by law on most reputable platforms. Expect to submit:

- A government-issued ID

- Proof of address (e.g., utility bill)

- A selfie or video verification

The process usually takes 10–20 minutes depending on your country and platform. Verification ensures compliance with anti-money laundering (AML) laws and protects users from fraud.

2.3. Step 3 – Add and verify your credit card

Once verified, navigate to your account’s payment settings and link your credit card. Supported card types are generally Visa and Mastercard, though some platforms may accept AmEx.

You may be prompted to:

- Complete SMS confirmation

- Approve a micro-deposit

- Verify ownership via a temporary authorization hold

Double-check that your bank supports crypto-related purchases and doesn’t classify them as cash advances to avoid extra fees.

2.4. Step 4 – Make your purchase

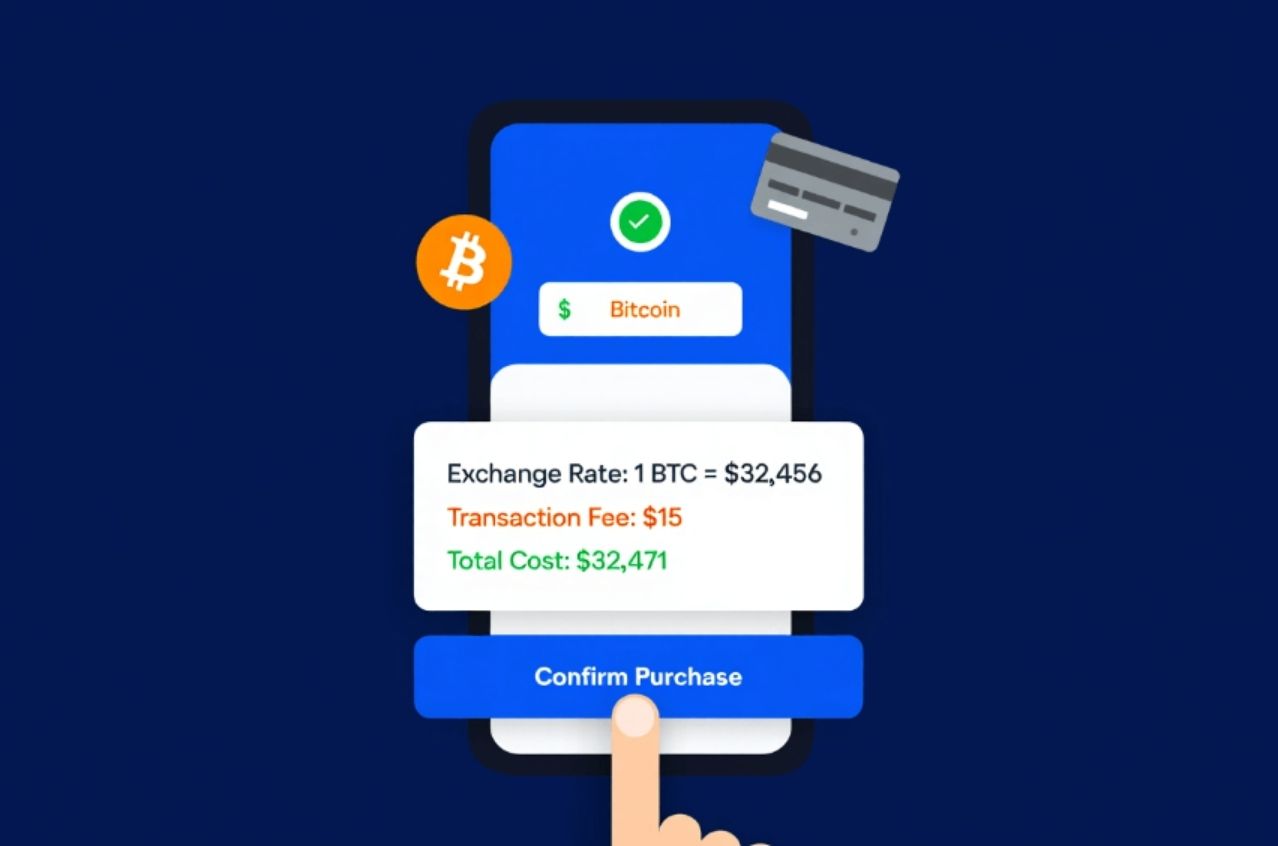

With your card ready, select Bitcoin (BTC) from the list of available cryptocurrencies. Enter the dollar amount you wish to purchase.

At checkout, confirm the following:

- Live exchange rate

- Credit card processing fee

- Total cost including FX spread (if any)

Some exchanges also allow recurring purchases, perfect for dollar-cost averaging. Confirm the transaction, and BTC will appear in your exchange wallet shortly.

View more:

- What is Bitcoins potential over the next decade? Stay ahead to succeed

- What is Payeer Wallet? Essential Information About Payeer Wallet

- What Happens When Bitcoin Halves? Explained Simply

2.5. Step 5 – Transfer Bitcoin to a secure wallet

It’s strongly advised not to keep your Bitcoin on an exchange long term. Instead, move it to a secure wallet you control.

Recommended wallets include:

- Hardware wallets like Ledger or Trezor for ultimate offline security

- Mobile wallets like Exodus or Trust Wallet for convenience and accessibility

This step completes your purchase cycle, ensuring your BTC is both yours and safe from platform breaches.

3. Top crypto exchanges that accept credit cards

If you’re ready to buy Bitcoin with a credit card, choosing the right exchange is crucial. Each platform comes with its own pros, fee structures, and regional limitations. The table below helps you compare them quickly:

| Exchange | Avg. Card Fee | Card Types | KYC Required | Country Support |

| Binance | ~2.0% | Visa, Mastercard | Yes | Global |

| Coinbase | 3.99% | Visa, Mastercard | Yes | USA, EU |

| Coinmama | 4.5–5.9% | Visa, Mastercard | Yes | Global |

| CEX.IO | 2.99% | Visa, Mastercard | Yes | 180+ countries |

| BitPay | ~3% | Visa, Mastercard | Yes | Limited regions |

Pro tip: Always check if your local bank allows crypto transactions using credit cards. Some banks in countries like Canada and India may block them or classify them as cash advances with high fees.

Each exchange serves a different type of user. Consider the following before making your decision:

- Best for beginners: Coinbase offers a smooth user experience with clear onboarding and simple interface.

- Lowest fees: Binance stands out with the most competitive rates among major platforms.

- Simplest UX: Coinmama is great for quick, no-frills purchases, especially for first-time users.

Choosing the right platform helps you minimize cost, reduce verification friction, and gain confidence when entering the Bitcoin market with your credit card.

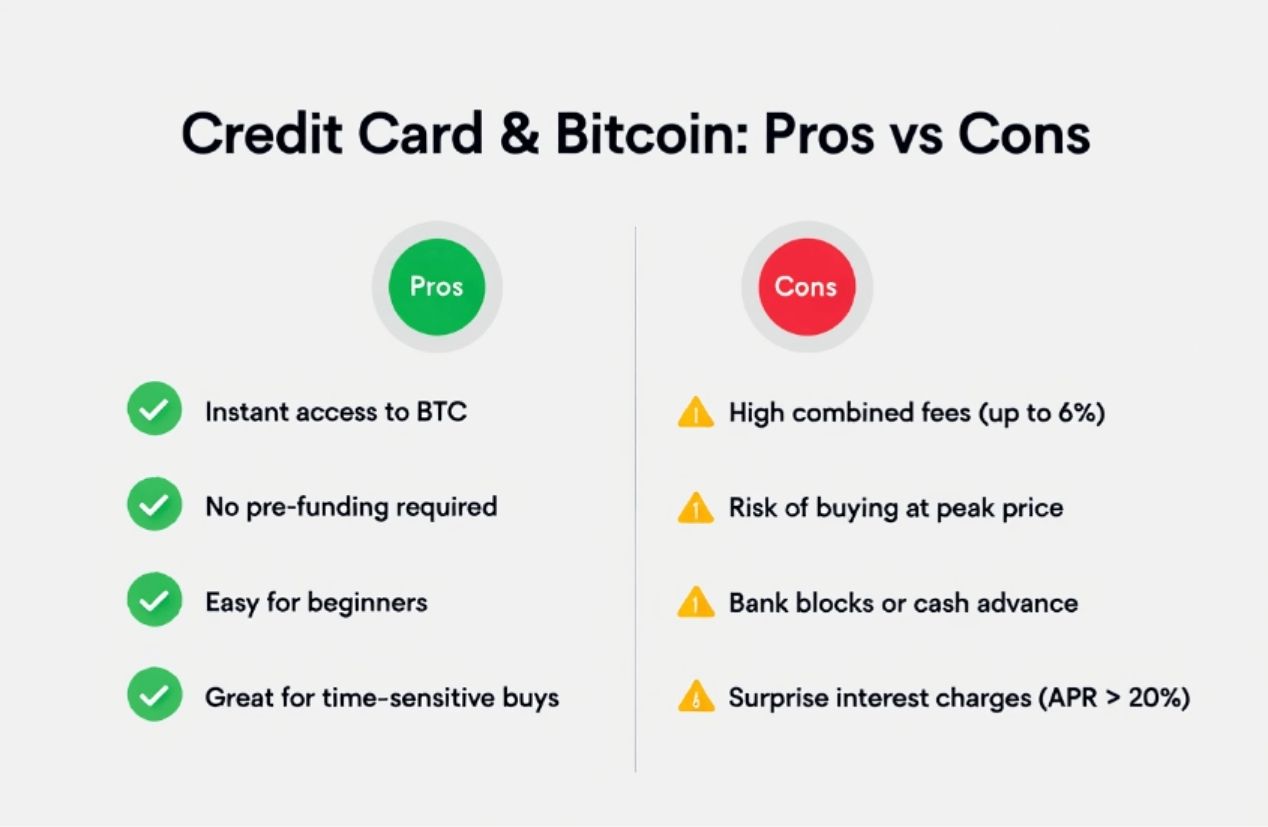

4. Pros and cons of using a credit card to buy Bitcoin

While credit cards provide one of the fastest ways to access Bitcoin, they also carry distinct risks and limitations. First-time buyers are often drawn to the instant gratification, but unaware of the cost structures or security implications.

A well-rounded understanding of both benefits and drawbacks can help you decide if this method suits your goals.

4.1. Pros

For many beginners, using a credit card is the easiest entry point into the crypto world.

- Instant settlement allows users to lock in BTC prices during fast-moving markets

- No need to pre-fund a fiat wallet, simply enter your card and buy

- Ideal for small, spontaneous purchases or experimentation without heavy commitment

Real example: During bull runs, traders have used cards to buy Bitcoin during weekend spikes when bank transfers were unavailable. This helped some lock in early gains, but only when done with awareness of costs.

4.2. Cons

That convenience, however, comes at a steep price. Several risks can trip up new buyers if they’re not careful.

- Combined fees from the exchange, card processor, and issuer can total up to 6%

- Price volatility can cause buyers to unknowingly purchase at a short-term peak

- Some banks block crypto transactions, while others may classify them as cash advances

- Cash advance APRs often exceed 20% annually and lack a grace period, leading to expensive surprises

Real example: A user in Canada unknowingly triggered a $75 cash advance fee after purchasing $500 of BTC on Coinmama, not realizing their bank treated the transaction as a loan.

This contrast between ease and cost defines the credit card method. It can be a useful entry point, but only if approached with knowledge, fee awareness, and a clear risk tolerance.

5. All the fees you might pay

Before completing your purchase, it’s crucial to be aware of every cost component, you’ll avoid surprises and overspending.

| Fee Type | Typical Range | Notes |

| Exchange fee | 1.5% – 5% | Varies by platform and purchase amount |

| Credit card processing | 0.5% – 3% | Depends on card network and country |

| Foreign exchange (FX) | 2% – 5% | Applies when the platform’s currency differs from your card’s currency |

| Spread/markup | Variable | Hidden cost in exchange rate |

| Bank cash advance fee | Up to 10–30% APR | Often lacks grace period, expensive if carried over time |

Knowing these can help you minimize costs and compare methods effectively.

6. Is it safe to buy Bitcoin with a credit card?

Buying Bitcoin with a credit card is safe, if done through regulated, secure platforms. Unfortunately, scammers target this method precisely because it feels familiar and convenient.

- Use exchanges with verified licenses and two-factor authentication

- Avoid unknown links on social media or messaging apps

- Double-check URLs for typosquatting or fake login pages

- Never share OTP codes or logins with anyone claiming to be support

Pro tip: Save a bookmark of the official exchange page and only use that link to log in. This avoids phishing attacks through fake Google ads or scam links.

Below are related articles that might interest you.:

- How does Ethereum relate to Bitcoin? Differences, similarities, and impact [2025]

- How many Bitcoins have been lost forever?

- What are Bitcoin Runes and how do they compare to Ordinals and BRC-20 tokens?

7. Common mistakes when buying Bitcoin with a credit card

Even seasoned users have made costly mistakes when using credit cards to buy BTC. Here’s what to avoid:

- Choosing non-regulated platforms that look legitimate

- Ignoring all-in costs, especially hidden FX or spread fees

- Leaving BTC on the exchange instead of withdrawing to a secure wallet

- Falling for support impersonators on Telegram or WhatsApp

These mistakes often happen when you’re in a rush. Always pause to verify every step, especially on mobile.

Real example: A user in the Philippines completed a KYC verification with a fake Binance support link shared in a Telegram group. The link captured login details and drained their BTC wallet within hours.

8. Alternatives to buying Bitcoin with a credit card

If credit cards feel too risky or expensive, consider these alternative payment methods:

| Method | Speed | Cost | Risk Level | Best For |

| Bank Transfer | 1–3 days | Low | Low | Large, planned investments |

| Debit Card | Instant | Medium | Medium | Safer daily purchases |

| Apple Pay | Instant | Medium | Medium | Mobile-first users |

| Peer-to-Peer | Variable | Low | High | Experienced traders |

| Bitcoin ATM | Instant | High | Low | Anonymous local buyers |

Pro tip: For long-term investing, look at lower-cost methods. Speed is nice, but fees add up.

9. Legal and tax considerations by country

When you buy Bitcoin with a credit card, you’re creating a taxable event in most countries. Make sure you’re complying with the law:

- United States: Report all crypto purchases and gains to the IRS. Banks may flag large crypto card transactions under FinCEN rules.

- EU: MiCA (Markets in Crypto Assets) is rolling out, regulations vary by member state for now, but will be unified soon.

- Asia & Australia: Tax treatment differs; most consider BTC as an asset, not currency. Profits must be declared in annual returns.

Real example: An American student earned $800 trading BTC bought via credit card. They didn’t report it. A year later, IRS issued a fine and back taxes, using crypto exchange reports submitted under KYC compliance.

10. FAQs – Quick answers to common concerns

Q1: Can I buy Bitcoin with a prepaid card?

A: Some platforms accept prepaid cards, though availability varies, and limits may apply.

Q2: Will my bank allow this purchase?

A: It depends, some issuers block crypto transactions or treat as cash advances.

Q3: Is it legal in my country?

A: Most countries allow it, but always check local regulations and KYC obligations.

Q4: Does buying BTC affect my credit score?

A: Typically no, unless it triggers a cash advance fee or your issuer treats it as such.

Q5: Can I refund a BTC purchase?

A: No, crypto purchases are irreversible, so double-check before confirming.

Q6: How fast will the Bitcoin arrive in my wallet?

A: Most purchases are processed within minutes, but confirmation time depends on network congestion and payment method.

Q7: Are prepaid card BTC purchases more expensive?

A: Yes. Prepaid cards often come with higher processing fees or markup rates compared to bank transfers or direct deposits.

11. Conclusion

Understanding how do i buy bitcoins with a credit card equips you for informed decisions. It’s a fast and convenient method, ideal for one-time or small purchases, but expect higher fees and some risks.

If you value speed and simplicity, ensure you:

- Choose a regulated and transparent exchange

- Fully understand all associated fees

- Withdraw your BTC to a secure wallet you control

For long-term investment or large sums, consider alternatives like bank transfers or debit cards to save on costs.

At Vietnam-UStrade, we aim to deliver clear, unbiased guides for every crypto journey.

Explore our Bitcoins, alternative buy methods, and crypto tax coverage next to build a safer, smarter approach to ownership.