More and more individuals are stepping into the world of digital money, leading to a common question: how do I pay for Bitcoins? As Bitcoin becomes a bigger part of the global financial scene, it is vital to know the many ways you can get it.

When we talk about “paying” for Bitcoin, we mean the different methods you can use to exchange regular money, or sometimes other digital assets, to buy and own this leading cryptocurrency. This full guide will explain your choices, giving you clear insights and simple steps to help you start with confidence.

1. What does it mean to “pay for Bitcoin”?

To pay for Bitcoin means to complete a transaction that results in you owning some of this digital currency. It is important to know that this is different from “paying with Bitcoin,” which means using Bitcoin to buy goods or services. Here, our focus is only on how to get it, guiding you through the different financial paths available to turn your regular money (like USD, EUR, GBP) or other digital assets into Bitcoin.

If you’re wondering how do I pay for Bitcoins, think of it like buying any other valuable asset, but with a unique set of digital payment rules. This difference is key to understanding the process and avoiding common misunderstandings.

Getting Bitcoin has changed a lot, moving from difficult, specialized steps to simpler, user friendly experiences. Modern platforms and payment systems have made it open to more people, closing the gap between old style finance and the digital world of cryptocurrency.

Knowing the small details of each payment method how fast it is, its fees, and its safety issues is essential for making a good choice that fits your money goals and how much risk you are willing to take. This basic knowledge helps you move through the market with confidence and make your first Bitcoin purchase, clarifying the question of how do I pay for Bitcoins.

2. Most popular ways to pay for Bitcoin in 2025

The ways to pay for cryptocurrency have become much better, offering many choices to fit different needs, priorities, and places. Whether you want speed, low fees, or ease, there is a method for you when thinking about how do I pay for Bitcoins. Knowing the good and bad points of each will help you pick the best way for your buying plan. Each method has its own rules, processing times, and costs, making a detailed look very helpful for anyone wanting to buy.

2.1 Debit or credit cards

Debit and credit cards are still one of the simplest and most used ways to get Bitcoin, especially for new users. Their familiarity comes from daily online shopping, making the move to crypto purchases smooth.

How it works: You connect your debit or credit card directly to your cryptocurrency exchange account. When you start a purchase, the money is taken from your bank account (debit card) or charged to your credit line (credit card), and the same amount of Bitcoin is added to your exchange wallet.

Supported by major exchanges: Top platforms like Coinbase, Binance, Kraken, and Crypto.com all offer strong support for card payments. They use secure payment systems to make transactions easy. This wide acceptance is a big reason for their popularity.

Key things to consider:

- Fees: While quick, card payments usually have higher fees compared to bank transfers. These can include a processing fee from the exchange (often 2-4%) and, for credit cards, possible “cash advance” fees from your card company, which can be even higher.

- Verification steps: Because of rules and fraud prevention, you will generally need to prove your identity (KYC – Know Your Customer) by showing an official ID.

- Security notes: Make sure you use a trusted exchange with strong security rules (like two-factor authentication) to keep your card details and money safe. Stay away from shady websites that promise too good to true rates.

“For most new users, using a debit card is the quickest way to try buying Bitcoin,” notes Sarah Chen, a Senior Financial Analyst at CryptoInsights Inc. “But, they must know about the fees that can quickly add up, especially for smaller, frequent buys.”

Debit and credit cards offer unmatched speed and ease, making them perfect for quick Bitcoin buys, though buyers should be aware of the higher fees involved.

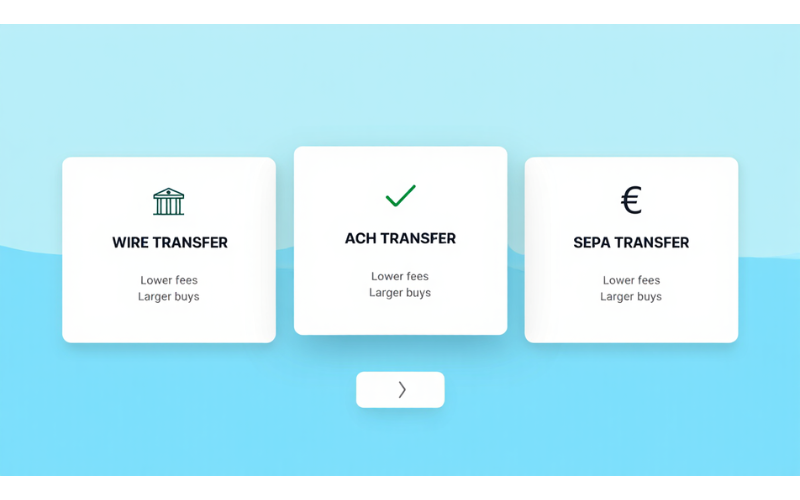

2.2 Bank transfers (wire, ACH, SEPA): lower fees, larger buys

Bank transfers are often the preferred way for those looking to buy larger amounts of Bitcoin or to keep transaction costs low. They are a more traditional financial path, connecting your bank account directly to the exchange.

How it works:

- ACH (Automated Clearing House): Common in the U.S., ACH transfers are electronic payments directly between bank accounts. They are usually free or very low-cost but can take 3-5 business days to clear.

- Wire transfers: Faster than ACH (often within 24 hours for domestic, longer for international), wire transfers are good for large sums but usually have higher fees from your bank (e.g., $15-$30 per transfer).

- SEPA (Single Euro Payments Area): For users in the Eurozone, SEPA transfers offer a fast and low-cost way to move Euros between bank accounts within the zone, usually clearing within 1-2 business days.

Benefits:

- Lower fees: Compared to cards, bank transfers usually have much lower (or even zero) processing fees from the exchange, making them cheap for larger transactions.

- Good for large buys: Exchanges often have higher purchase limits for bank transfers, allowing for bigger investments.

- More secure (in transit): While slower, the established banking system provides a strong and safe way to transfer money.

Requirements:

- Requires ID verification: All trusted exchanges will demand full KYC verification before allowing bank transfers, making sure they follow anti-money laundering (AML) rules. You will give bank account details, and sometimes even a small test deposit.

“Bank transfers are the main way for big crypto investments,” states Dr. Alex Thorne, an Economist specializing in Digital Currencies. “Though they need patience, the lower fees and higher limits make them essential for serious investors.”

Bank transfers are a cost effective and safe choice for getting large amounts of Bitcoin, though their slower processing times mean you need to wait a bit.

2.3 PayPal and e wallets: convenience with growing acceptance

Digital wallet services like PayPal, Skrill, and Neteller offer a middle ground between the speed of cards and the safety of bank transfers, adding a layer of ease for users already used to these platforms.

How it works: You connect your e-wallet account to a crypto exchange that accepts it. Money is moved from your e-wallet balance or a linked bank account/card within the e-wallet system.

Convenience: These methods are very easy for users who often use e-wallets for other online buys. The payment process is often simple and familiar.

Growing acceptance: While historically less common, major platforms are more and more adding popular e-wallets.

Keynotes:

- Slightly higher fees: Fees for e-wallet transactions can be higher than bank transfers but often lower than credit cards, changing a lot by platform and region.

- Regional availability: Acceptance of specific e-wallets depends heavily on where you are and the rules for cryptocurrency purchases in that area. Always check if your chosen e-wallet works with your chosen exchange in your country.

“The addition of major e-wallets shows a big step towards crypto becoming common,” comments Maria Santos, a Fintech Consultant. “It reduces friction for millions of users who are already comfortable with these payment systems.”

E-wallets offer an easy and increasingly available way to buy Bitcoin, providing a quick transaction, though sometimes with slightly higher fees and regional limits.

View more:

- What is a Godzilla Candle in bitcoin? A trader’s guide to spotting massive moves

- How can i buy bitcoins with debit card today? A step by step guide for beginners

- How do i deposit bitcoins securely? A beginner friendly guide

2.4 Mobile Payments with Apple Pay / Google Pay: Quick and convenient Bitcoin purchases

Mobile payment solutions have quickly become popular, offering a fast and safe way to pay for Bitcoins right from your smartphone. They rely on your saved card information, which is securely stored within your mobile device.

How it works: When an exchange or crypto ready wallet app supports Apple Pay or Google Pay, you can pick these options at checkout. The payment uses the card details you have already linked to your mobile payment system, needing only a fingerprint or face scan to finish.

Growing in popularity: The ease of instant, safe payments without typing in card details has made these methods very popular, especially for smaller, spur-of-the-moment buys.

Great for mobile users: These methods are made for mobile use, offering a smooth experience within cryptocurrency apps.

Supported wallets or exchanges: Many mobile first cryptocurrency exchanges and wallet apps (e.g., Exodus, Trust Wallet, some exchange apps) have added Apple Pay and Google Pay, allowing direct buys within their apps.

Apple Pay and Google Pay provide a very easy and safe way for mobile users to quickly get Bitcoin, making the buying process simpler with familiar security methods.

2.5 Cash or p2p (peer to peer) platforms: more anonymity, more risk

For those who want more privacy or specific payment methods not supported by central exchanges, Peer to Peer (P2P) platforms offer a direct way to pay for Bitcoins from other people.

How it works: P2P platforms like LocalBitcoins, Paxful, and Binance P2P connect buyers directly with sellers. You can find sellers offering Bitcoin for many payment methods, including cash (meeting in person), bank transfers, gift cards, and various online payment services. The platform usually acts as a middleman, holding the Bitcoin until both sides say the deal is done.

Benefits:

- More anonymity: Depending on the platform and seller’s rules, P2P can offer more privacy than central exchanges, sometimes needing less strict identity checks.

- Diverse payment options: This is where you will find the widest range of payment methods, fitting very specific or unique preferences.

Risks & how to protect yourself:

- Increased risk: P2P trading carries a higher risk of scams if not done carefully. Cheaters may try to get paid without giving Bitcoin or vice versa.

- How to protect yourself:

- Always choose a reputable P2P platform that offers escrow protection.. This is a must.

- Check seller reviews and reputation: Look for sellers who have done many successful trades and have good feedback.

- Talk clearly within the platform’s chat: Keep all talks on the platform to make sure the middleman service can help if problems come up.

- Never pay until you are sure the Bitcoin is held by the platform.

- Stay alert for offers that appear unusually generous, they’re often scams.

“While P2P platforms give unmatched freedom in payment methods, they demand more care from the user,” warns blockchain security expert, Dr. Lena Khan. “Learning and sticking to platform safety rules are key to lowering risks.”

P2P platforms offer a varied and possibly more private way to get Bitcoin, but they need you to be very aware of safety risks and only use trusted services with a middleman.

3. Step by step: how do i pay for Bitcoins safely?

Getting Bitcoin safely means following a clear plan, no matter which payment method you pick. Following these steps will help make sure your transaction is smooth and safe when you think about how do I pay for Bitcoins. Each stage is set up to keep your money safe and make sure you get your digital assets without problems, guiding you on how do I pay for Bitcoins.

Step 1: choose a reputable platform

This is the most important choice. Your platform choice affects how safe your money is and how easy your trades are.

- Centralized exchanges (CEXs): Best for new users because they are easy to use, very secure, and follow rules. Examples include:

- Coinbase: Well known for being easy to use, following rules strictly, and having insurance against some types of attacks.

- Binance: The biggest exchange globally by trade amount, offering many cryptocurrencies and good prices.

- Kraken: Known for its strong security, many crypto choices, and advanced trading features.

- Peer-to-Peer (P2P) platforms:

For more varied payment methods or privacy, but need more care. Examples include:

- LocalBitcoins (now part of Paxful): A long standing P2P platform.

- Paxful: Offers many payment methods and a middleman system.

- Binance P2P: Part of the Binance system, providing a P2P market.

Step 2: create and verify your account

Once you have picked a platform, you will need to set up your account.

- Sign up: Give your email address and make a strong password. Turn on two-factor authentication (2FA) right away using an authenticator app (e.g., Google Authenticator, Authy) for an extra layer of safety.

- Identity verification (KYC): This is required for almost all trusted exchanges to follow financial rules. You will usually need to give:

- Full legal name

- Date of birth

- Address

- Official ID (passport, driver’s license)

- Sometimes, proof of address (utility bill, bank statement)

- A selfie or video check to match your face to your ID.

- Example: On Coinbase, you might upload a picture of your driver’s license and then be asked to take a live selfie through their app. This can take a few minutes to a few days, depending on the platform and your area.

Step 3: select your payment method

Go to the “Buy Crypto” or “Deposit” part of your chosen platform. Here, you will pick how you want to pay for Bitcoins.

- The platform will show the available choices (e.g., Debit/Credit Card, Bank Transfer, PayPal, etc.) based on your area and how much your account has been verified.

Step 4: enter how much BTC to buy

Say how much Bitcoin you want to buy, either in regular money (e.g., $100 worth of BTC) or directly in Bitcoin units (e.g., 0.001 BTC).

- Example: If you type “$500” for a card purchase, the system will figure out how much Bitcoin that amount will buy after taking out fees and checking the current price. This step is key in knowing how do I pay for Bitcoins effectively.

Step 5: review fees and confirm

Before finishing your transaction, the platform will show a summary.

- Review all details carefully: This includes how much Bitcoin you will get, the current price, and very importantly, all related fees. This clear view helps you understand the total cost of your transaction.

- Confirmation: If all details are right, confirm the purchase.

Step 6: secure your coins in a wallet

Once the transaction is done, your Bitcoin will usually appear in your exchange wallet. For better safety and control, it is strongly advised to move your Bitcoin from the exchange to a private wallet that you control. This completes the essential process of how do I pay for Bitcoins and secure them.

- Types of wallets:

- Software wallets (hot wallets): Apps on your phone or computer (e.g., Exodus, Electrum). Good for smaller amounts.

- Hardware wallets (cold wallets): Physical devices (e.g., Ledger, Trezor). The safest choice for larger amounts, keeping your private keys offline.

- Example: If you bought Bitcoin on Binance, you would go to your Binance spot wallet, pick Bitcoin, and choose “Withdraw.” You would then paste the receiving address from your Ledger or Exodus wallet and confirm the transfer. Always double check the address before sending.

Paying for Bitcoin safely means picking a trusted platform, finishing needed checks, understanding fees, and quickly putting your new assets into a private wallet.

4. How to choose the right payment method

Picking the best payment method for your Bitcoin purchase depends on three things: speed, fees, and security. There is no single answer; the best choice for you depends on what you care about most and your situation.

Carefully thinking about these points will help you answer the question in a way that truly benefits you and addresses the core question of how do I pay for Bitcoins.

4.1 Speed vs. fees vs. security

- Speed:

- Fastest: Debit/Credit Cards, Apple Pay/Google Pay, Crypto-to-Crypto Swaps (if you already have crypto). Your Bitcoin is usually ready almost right away.

- Moderate: E-wallets like PayPal (if the exchange supports them).

- Slowest: Bank Transfers (ACH, SEPA, Wire). Can take several business days to clear. P2P can also vary greatly.

- Fees:

- Lowest fees: Bank Transfers (especially ACH/SEPA).

- Moderate fees: E-wallets, P2P (can change based on seller and method).

- Highest fees: Debit/Credit Cards (because of processing fees and possible cash advance fees).

- Security:

- Highest security (in terms of money groups): Bank Transfers use strong bank security.

- Good security (with trusted exchanges): Debit/Credit Cards, E-wallets, Mobile Payments. These depend on the exchange’s and payment company’s safety rules.

- User dependent security (P2P): While platforms offer a middleman, the overall safety on P2P mostly depends on how careful you are and which seller you pick.

4.2 Ideal methods based on user type

- Newbie / first-time buyer:

- Recommended: Debit/Credit Card or Mobile Payments. These are familiar, fast, and fairly simple to use, making it easy to start. The higher fees might be fine for a small initial buy.

- Why: Easy to start, quick results.

- Serious investor / large buyer:

- Recommended: Bank Transfers (ACH, Wire, SEPA).

- Why: Lower fees on bigger trades, higher limits, and the solid safety of banking.

- Privacy seeker / diverse payment seeker:

- Recommended: P2P Platforms (with care).

- Why: Offers methods like cash and less strict identity checks on some platforms, though with more personal responsibility for safety.

- Existing cryptocurrency holder:

- Recommended: Crypto to Crypto Swaps.

- Why: Very fast and efficient, letting you change your crypto assets without turning them back into regular money.

4.3 Country specific limitations

It is important to remember that not all payment methods are available everywhere. Rules, bank relationships, and local choices greatly affect what options an exchange can offer in your country.

- Always check the “Payment Methods” or “Deposit Options” section of your chosen exchange for your area.

- Some countries might have rules against using credit cards for crypto buys, or certain e-wallets might not work there.

The best way to pay for Bitcoin balances your need for speed, desire for low fees, and comfort with security, while always checking what’s available in your region and what kind of user you are.

Related reads to deepen your knowledge:

5. Common mistakes to avoid

Understanding how do I pay for Bitcoins can be simple, but like any money deal, it has possible traps. Knowing about common mistakes can save you time, money, and stress, leading to a safer and more successful Bitcoin purchase. Avoid these errors to keep your investment safe.

- Using unregulated platforms: The idea of seemingly lower fees or easier checks on unknown platforms can be tempting, but it is a very risky bet. Unregulated exchanges may lack proper safety measures, suddenly close, or even be outright scams, leading to you losing your money.

- Correction: Always stick to well-known, regulated exchanges with a good history, clear terms, and strong security rules. Look for platforms that follow local money rules.

- Sending funds before account verification is complete: Many new users try to start a bank transfer or card deposit right after making an account, only to find their money stuck or refused because their identity check is not fully done. When considering how do I pay for Bitcoins, ensuring full verification beforehand is crucial.

- Correction: Always finish all needed identity check steps and get confirmation from the exchange that your account is fully checked before trying to put in money or buy something. This makes sure the transaction goes smoothly and avoids delays or issues.

- Not securing your Bitcoin after purchase: Leaving a lot of Bitcoin on an exchange after buying it is a common mistake. While exchanges are generally safe, they are still central targets for hackers. If the exchange is hacked, your money could be at risk. This is a vital consideration after you pay for Bitcoins.

- Correction: For any large amount of Bitcoin, move your holdings from the exchange to a personal wallet (a “non-custodial” wallet) where you control the private keys. This gives you full ownership and safety over your assets. Think of the exchange as a temporary trading spot, not a long-term storage solution.

- Ignoring fees: Not looking at the fee structure can lead to unexpected costs, especially with credit card purchases or many small buys. Always be aware of the costs when deciding how do I pay for Bitcoins.

- Correction: Always check the total cost, including all transaction fees, before saying yes to a purchase. Compare fees across different payment methods and exchanges to find the cheapest choice for how much you are buying.

- Falling for “too good to be true” offers: If an offer for Bitcoin seems significantly cheaper than the market price, it is almost certainly a scam. Be skeptical when exploring how do I pay for Bitcoins.

- Correction: Stick to market prices. Trusted platforms will offer good but real prices.

“In the world of digital assets, being careful is your most valuable currency,” says Jessica Lee, a Fraud Prevention Specialist at BlockGuard. “Being watchful and knowing basic safety will stop most common problems.”

Avoiding common mistakes like using unknown platforms, forgetting checks, or not protecting your Bitcoin are key steps for a safe and successful experience when learning how do I pay for Bitcoins.

6. FAQ

6.1 Is it possible to purchase Bitcoin without using a bank account?

Yes, it is possible to pay for Bitcoins without a traditional bank account, though your choices might be fewer and could involve higher risks. P2P (Peer-to-Peer) platforms often allow purchases using cash (meeting in person), gift cards, or various online payment services that do not always need a direct bank link.

6.2 What is the safest way to pay for Bitcoin?

The safest way to pay for Bitcoins generally means using a trusted, regulated centralized cryptocurrency exchange (like Coinbase, Binance, or Kraken) along with a bank transfer (ACH, SEPA, or wire).

6.3 Are there limits on how much Bitcoin i can buy?

Yes, most platforms set limits on the amount of Bitcoin you’re allowed to purchase. These limits change a lot based on the platform, how much your identity has been checked (KYC), and the payment method you use.

- Unverified accounts: Have the lowest limits.

- Fully verified accounts: Allow for higher daily, weekly, and monthly buying limits.

- Payment method: Bank transfers often have the highest limits, while credit/debit cards and e-wallets may have lower limits due to more risk of fraud and higher processing costs. Reputable exchanges clearly outline the various limit tiers for user accounts.

6.4 What fees should i expect when buying BTC?

When you pay for Bitcoins, you can expect several types of fees:

- Exchange fees: A percentage charged by the crypto exchange for helping with the trade (e.g., 0.1% to 4%).

- Payment processor fees: Charged by the third-party service that handles your payment (e.g., credit card companies often charge 2-4%).

- Network fees: A required payment to Bitcoin miners for validating and recording your transaction on the blockchain. This is usually paid when you move Bitcoin off the exchange.

- Withdrawal fees: Some exchanges charge a set fee when you move Bitcoin to an outside wallet.

- Spread: The difference between the buying and selling price, which can act as an indirect fee, especially on platforms that are easy for new users.

Always check the fee breakdown before saying yes to your purchase.

6.5 Do i need a wallet before paying for Bitcoin?

You do not strictly need a personal wallet before your first Bitcoin purchase, as most centralized exchanges give you a built-in “exchange wallet” where your newly bought Bitcoin will first be stored.

7. Final thoughts: you’re ready to pay for Bitcoin

Knowing how do I pay for Bitcoins in 2025 has become easier and safer than ever before. We have looked at the most popular payment methods, from the instant ease of debit cards and mobile payments to the cost effectiveness of bank transfers and the flexibility of P2P platforms. The journey to getting Bitcoin is simple once you understand the basic ideas and put safety first.

Remember to always:

- Choose a reputable platform: Your first defense against fraud and technical issues.

- Complete all necessary verification: This makes sure you follow rules and gets you higher transaction limits.

- Know the fees and processing time: Choose a payment option that aligns with your budget and how quickly you need the transaction completed.

- Secure your Bitcoin in a private wallet: This is most important for keeping your investment safe in the long run.

Starting with a smaller, safe buy is a great way to get used to the process. As you feel more sure, you can increase your investments. The digital asset world keeps changing, and by following these tips, you are well-prepared to handle it with confidence.

For reliable insights, expert analysis, and up to date forecasts on Bitcoin and the broader crypto economy, visit the Vietnam-U.S. Trade Newspaper, specifically the Bitcoin category.