How many Bitcoins have been lost forever? Current estimates suggest that over 3 million Bitcoins are no longer accessible, effectively gone for good. These coins are lost due to forgotten keys, discarded devices, or irreversible transactions to unspendable addresses. As a result, a large portion of Bitcoin’s total supply is permanently removed from circulation.

This reality shapes not only the value of Bitcoin but also how we understand scarcity in digital assets. In this article, you’ll learn what causes Bitcoins to be lost, how experts estimate the scale of the issue, and what it all means for investors, markets, and long-term holders.

Let’s explore the full picture with Vietnam-ustrade.

1. Can Bitcoins really be lost forever?

Yes, and not only is it possible, but it’s surprisingly common. The structure of Bitcoin is designed around cryptographic security and personal ownership. That means if someone loses access to their private cryptographic code required to spend their Bitcoin, there is no recovery mechanism. Those coins remain forever on the blockchain, untouched, but unusable.

This aspect of Bitcoin’s design reflects a double-edged sword: it offers full sovereignty and decentralization, but also absolute finality. Bitcoin has no built-in failsafe for human error.

Why does this happen? Here are the key scenarios:

- Lost private keys: Without the private key, the digital signature to validate a transaction cannot be generated. This is the most common and irreversible cause.

- Discarded storage devices: Early adopters often stored their wallets on USB drives or hard disks, many of which were later lost or thrown away.

- Unspendable addresses: Some addresses are intentionally created without private keys or with mathematical properties that make them unusable.

- Inactive wallets: Some wallets haven’t shown any activity for over a decade, leading analysts to presume the owners have lost access.

One well-known case is James Howells, a British IT professional who mistakenly disposed of a hard drive containing 8,000 Bitcoins in 2013. Even though he tried many times to find the hard drive in the landfill.

The Bitcoins were never recovered; they’re still lost. Realizing that these losses can’t be reversed is the first step to truly understanding why Bitcoin’s limited supply matters so much.

2. How many Bitcoins have been lost forever? Estimates and analysis

Estimating the number of Bitcoins that are truly lost involves a combination of forensic blockchain analysis and educated assumptions. While Bitcoin’s ledger is transparent, it does not record intent or accessibility. Analysts, therefore, rely on patterns of wallet activity, coin movement, and historical data.

Several blockchain data analytics firms have attempted to quantify lost Bitcoins. While numbers vary, the broad consensus is that between 17% and 20% of the total supply may be permanently out of circulation.

| Category | Description | Estimated BTC lost |

| Dormant wallets (inactive >7 years) | Presumed abandoned or inaccessible | ~2.5 million |

| Satoshi’s coins | Never moved since they were mined in 2009–2010 | ~1.1 million |

| Burned addresses | Sent to addresses with no private keys or access mechanism | ~300,000 |

| Unknown/Other causes | Device loss, forgotten seed phrases, user error | Not quantifiable |

Sources for these estimates include well-established firms like Chainalysis, Glassnode, and Coin Metrics. Their methodologies typically include:

- Looking at Bitcoins that haven’t been moved or used for a very long time called unspent transaction outputs (UTXOs) is one way experts try to figure out how many coins might be lost.

- Flagging known “burn” addresses

- Excluding coins known to be in cold storage by active exchanges or custodians

These numbers aren’t absolute. But given that the total cap of Bitcoin is 21 million, a potential reduction of over 3 million coins significantly alters the real supply. This realization has profound implications on scarcity and market dynamics, which we will explore later in the article.

View more: How do you exchange bitcoins for dollars

3. What causes Bitcoins to be lost?

Lost Bitcoins aren’t the result of malicious hacks or theftthey’re largely the result of user mistakes, poor storage practices, or lack of foresight. Bitcoin is built to offer autonomy, but that also means there is no safety net.

Here are the most common causes:

- Private key loss: Without the private key, even owning the wallet is meaningless. Many early users stored their keys in local text files or printed on papermethods prone to loss or damage.

- Destroyed or misplaced hardware: Hard drives and USB devices used to store wallet files can easily be discarded, formatted, or damaged beyond recovery.

- Forgotten seed phrases: Modern wallets use a recovery phrase (typically 12–24 words) to regenerate the private key. If this is lost, the wallet is unrecoverable.

- Sending BTC to incorrect or burn addresses: Bitcoin transactions are irreversible. Mistakenly sending coins to a wallet with no known private key means permanent loss.

- Deliberate burning: Some users and communities intentionally “burn” Bitcoins by sending them to known unspendable addresses. This is sometimes done as a symbolic gesture to reduce supply.

- Death without inheritance planning: If a user dies without sharing wallet access or recovery methods with heirs, the coins are likely lost permanently.

- Obsolete wallet software or compatibility issues: Wallets developed in the early 2010s are sometimes incompatible with modern systems, and recovering access may be impossible without technical intervention.

- Intentional deletion or sabotage: Some users delete wallets out of frustration, protest, or erroreffectively burning their own holdings.

These causes reveal a key lesson: Bitcoin’s design empowers users but does not protect them from themselves. Responsibility and education are paramount to avoid joining the ranks of those who have permanently lost their assets.

4. How do lost Bitcoins affect the market and investors?

The permanent loss of a large number of Bitcoins is not just a technical curiosity has meaningful consequences for both the market and investors.

4.1. Reduced circulating supply

Bitcoin has a fixed supply cap of 21 million coins, a core principle that supports its long-term value proposition. However, once we account for the millions of coins lost forever, the actual supply in circulation is significantly lower.

Some estimates suggest that only 17–18 million Bitcoins are actually accessible, and possibly fewer than that are actively traded.

This effective reduction in supply makes Bitcoin scarcer than its design implies, amplifying its store-of-value characteristics, similar to goldbut with provable scarcity via blockchain.

4.2. Price impact and investor behavior

The deflationary nature of Bitcoin is enhanced when a portion of coins becomes permanently unavailable. Here’s why this matters:

- Higher scarcity can drive up prices over time, assuming steady or growing demand.

- Long-term holders (HODLers) are incentivized to keep coins off the market, anticipating appreciation.

- Investors see Bitcoin not only as a medium of exchange but increasingly as a long-term hedge against inflation.

4.3. Implications for institutional investors

For institutions evaluating Bitcoin, the idea that a portion of the supply is irrevocably gone may strengthen their conviction in its scarcity model. However, it also emphasizes the need for robust custody solutions, inheritance planning, and operational security protocols to avoid contributing to the lost coin total themselves.

Explore more trading insights:

5. How to avoid losing your Bitcoins

As we’ve seen, the loss of Bitcoins is usually the result of human error rather than system failure. Fortunately, such loss is preventable with the right practices.

5.1. Best practices for Bitcoin security

- Back up your seed phrase and private keys securely.

- Use reputable hardware wallets like Ledger or Trezor

- Avoid storing keys in cloud services or email.

- Test your backups regularly.

- Consider multisig wallets for added protection.

- Plan for inheritance by documenting access securely.

5.2. Organizational tips

- Keep your wallet and firmware software up to date.

- Use cold storage for long-term funds.

- Limit the use of hot wallets.

- Educate yourself and trusted family members.

6. Why are these lost Bitcoin only estimates?

Even though Bitcoin operates on a transparent and public blockchain, the exact number of lost coins is impossible to pinpoint. So, why are all figures about how many Bitcoins have been lost forever merely estimates?

6.1. No “lost” status exists on the blockchain

Bitcoin’s ledger records transactions, not intentions or accessibility. A wallet that hasn’t moved funds in 10 years could belong to a long-term HODLer or it could be completely inaccessible. There’s no way to tell definitively.

6.2. Wallets are anonymous

There is no personal data attached to Bitcoin addresses. Blockchain analytics firms like Chainalysis and Glassnode can only estimate losses based on behavior patterns, not on direct confirmation of lost access.

6.3. Causes of loss are private and varied

Private key loss, destroyed devices, or coins sent to unspendable addresses do not generate unique blockchain signatures. Therefore, experts must rely on inactive and known burn addresses to estimate how many Bitcoin have been lost.

This is why numbers like “3 to 4 million Bitcoins lost forever” should be viewed as educated guesses not hard facts.

7. How many Bitcoins are left to be mined?

Bitcoin has a hard cap of 21 million coins, which means there will never be more than that in existence. But as of 2025, how many remain to be mined?

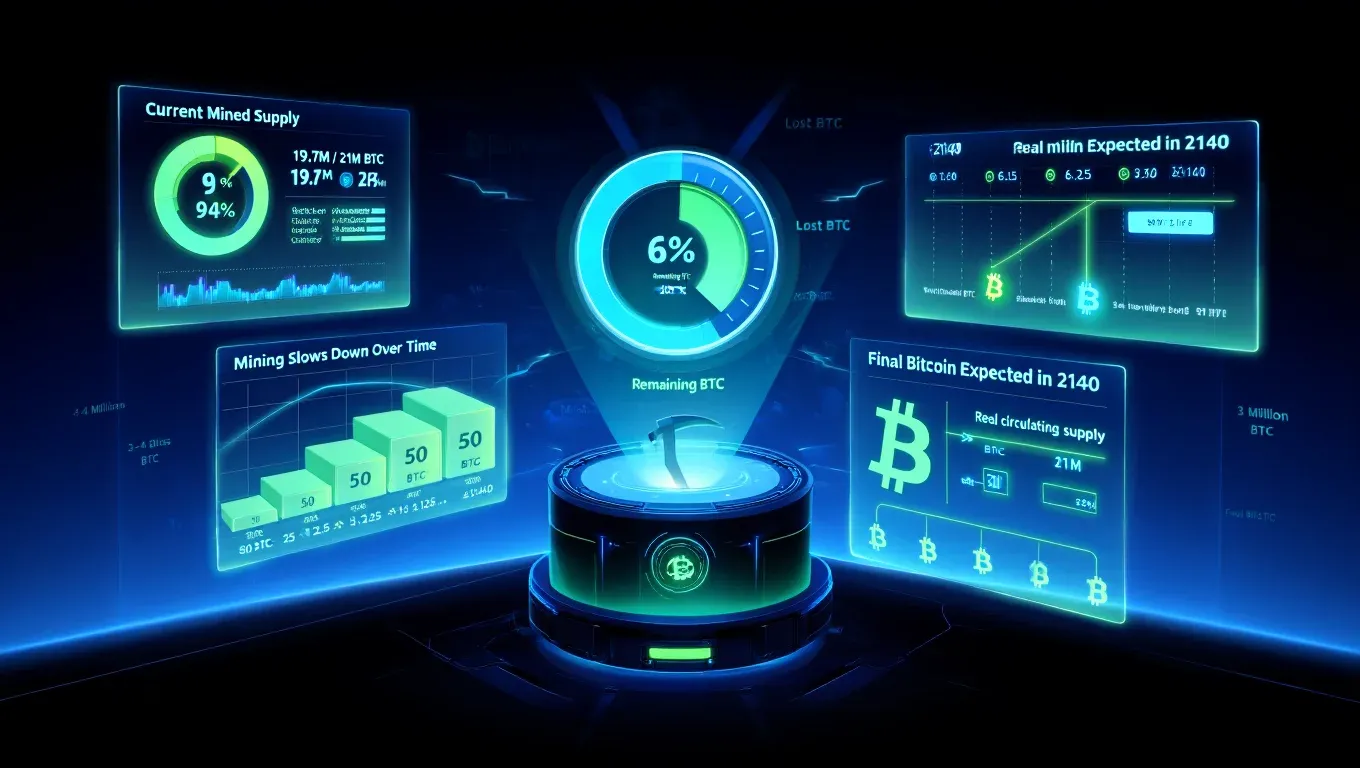

7.1. Current mined supply

Over 19.7 million BTC have already been mined, representing about 94% of the total supply. This leaves fewer than 1.3 million BTC still available to miners.

7.2. Mining slows down over time

Thanks to Bitcoin’s halving mechanism, the block reward is cut in half roughly every four years. This makes the mining of remaining Bitcoins increasingly slower and less profitable over time.

7.3. Final Bitcoin expected in 2140

It’s estimated that the last Bitcoin will be mined around the year 2140, at which point miners will rely solely on transaction fees for rewards.

When combined with estimates on how many Bitcoins have been lost forever (around 3–4 million), the real circulating supply is much lower than expected, making Bitcoin even scarcer than originally designed.

8. Frequently asked questions (FAQ)

8.1. Are lost Bitcoins gone forever?

Yes. If a user loses their private key or seed phrase, the coins are effectively unspendable. There is no recovery method.

8.2. How do analysts estimate how many Bitcoins have been lost?

By studying inactivity in wallets, known “burn” addresses, and movement history. Coins that haven’t moved in over 7 years are often considered lost.

8.3. Can Satoshi’s Bitcoins ever be recovered?

They have never moved since being mined in the early days of Bitcoin. Many believe the keys are inaccessible, but there’s no way to confirm.

8.4. What’s the difference between lost and stolen Bitcoins?

Lost Bitcoins are irretrievable and inaccessible; stolen Bitcoins are still on the blockchain and may be moved, even if they are no longer with the original owner.

8.5. How can I ensure I won’t lose my Bitcoins?

Use hardware wallets, securely back up your seed phrases, educate yourself on security, and plan for inheritance.

9. Conclusion

So, how many Bitcoins have been lost forever? Estimates suggest that over 3 million Bitcoins are permanently inaccessible, lost to forgotten keys, discarded devices, or irreversible mistakes. This reflects the core of Bitcoin’s design: full ownership comes with full responsibility.

These lost coins reduce the circulating supply, increasing scarcity and potentially driving long-term value. For holders, the message is: protect your assets through secure backups, trusted wallets, and thoughtful inheritance planning to avoid irreversible loss. Stay informed by following the Bitcoin section on Vietnam-UStrade for expert guidance and reliable insights into the crypto space.