How many people own 1 Bitcoin in the world? This isn’t just a question of numbers, it’s a lens into how wealth and power are distributed in the world’s most valuable digital asset. As Bitcoin adoption continues to grow, owning just 1 BTC has become a milestone fewer and fewer individuals can claim.

In this article, we’ll break down the data behind 1 Bitcoin ownership: how many addresses qualify, what the wholecoiner status really means in 2025, and why owning a full Bitcoin is more exclusive than ever. From blockchain stats to socio-economic analysis, discover why 1 BTC is a bigger deal than you think.

1. What does it mean to own 1 Bitcoin?

Owning a whole Bitcoin isn’t as simple as it seems. Technically, it means controlling one or more Bitcoin wallet addresses whose combined balance equals at least 1 BTC. Bitcoin is pseudonymous: addresses are strings of characters with no direct link to real-world identities.

A single person may hold multiple addresses across cold wallets, mobile apps, or custodial exchanges. Conversely, one address, especially those held by exchanges or custodians, may contain BTC belonging to thousands of users. This complexity makes it challenging to determine how many individuals truly own one full Bitcoin.

To interpret on-chain metrics, analysts use tools like address clustering, behavioral heuristics, and exchange address tagging. Still, the true number of people who own ≥1 BTC remains an approximation. The growing use of privacy tools like CoinJoin and multisig wallets makes this analysis even harder.

This is why we distinguish between addresses and owners. In the following sections, we’ll use both metrics carefully, providing context for each.

But the real question remains: how many people own 1 Bitcoin in the world, and what does it mean to be among them?

2. How many people own 1 Bitcoin in the world?

A frequently asked question in the Bitcoin space is how many addresses hold 1 BTC or more, a metric often used to estimate user adoption.

As of mid-2025, there are approximately 985,000 unique Bitcoin addresses holding ≥1 BTC, according to Bitinfocharts. This figure has grown from ~827,000 in early 2023, signaling continued accumulation despite Bitcoin’s high price.

However, most blockchain researchers agree that this overstates the number of individuals. Estimates adjust the actual number of unique owners to around 800,000–900,000 globally, after accounting for:

- Multi-address users (a single user with many wallets)

- Institutional cold wallets (one address, thousands of users)

- Exchange-held BTC (not counted as ownership on-chain)

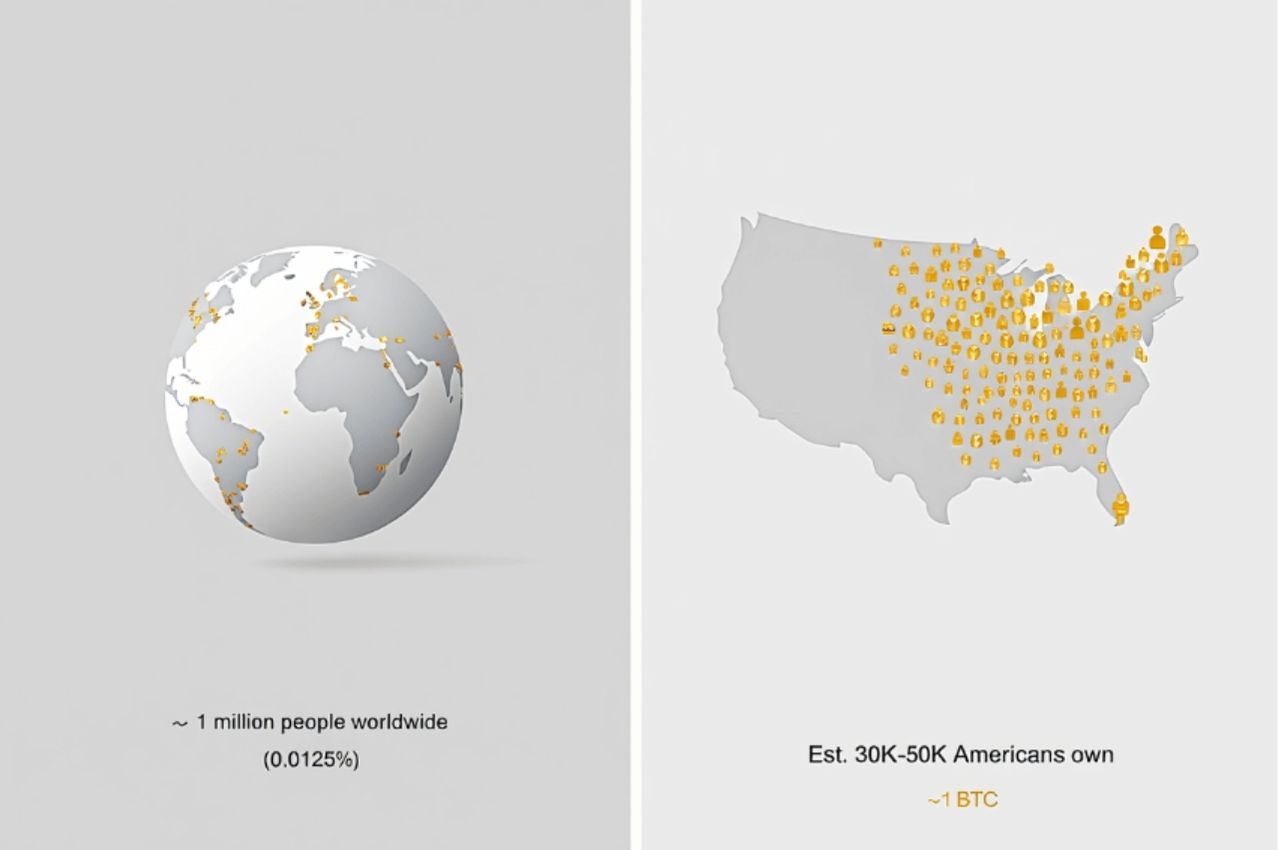

According to recent 1 bitcoin owner statistics, fewer than 0.0125% of the global population belong to the 1 BTC club.

To understand how Bitcoin ownership breaks down geographically, we’ll examine both U.S. and global figures.

Learn more about these from articles below:

- What are Bitcoins made of? Understanding how Bitcoin really works [2025]

- How can I invest in Bitcoin safely? A beginner’s guide [2025]

- How many Bitcoins to the Dollar? The real value of 1 USD in Bitcoin terms

2.1. U.S. and global context

The United States has one of the highest crypto adoption rates. Surveys suggest ~22% of American adults have owned crypto, but few have reached 1 BTC. Assuming U.S. ownership mirrors the global rate (~0.0125%), perhaps 30,000–50,000 Americans qualify as wholecoiners.

Globally, out of 8 billion people, <1 million own at least 1 BTC → that’s <0.0125% of the population. Owning one full Bitcoin puts you in an exclusive global club.

3. The rise of the wholecoiner club over time

The journey toward owning one full Bitcoin has changed dramatically over the years. From early adopters mining coins on laptops to modern investors slowly stacking sats, the makeup of the 1 BTC club has evolved along with Bitcoin itself.

3.1. Historical price milestones

Bitcoin’s price history reflects its transition from a niche experiment to a globally recognized asset. In its early years, BTC was accessible to nearly anyone with modest capital or basic mining knowledge.

- 2011: 1 BTC traded for less than $5

- 2017: Price peaked near $20,000

- 2021: Surpassed $60,000 for the first time

- 2025: Fluctuates around $100,000

As the price rose, the path to 1 BTC became steeper, both financially and psychologically. What once took weeks now may take years, reinforcing the significance of reaching this milestone today.

Bitcoin’s price journey is not just a chart, it’s a historical filter separating casual interest from deep conviction.

3.2. Growth of wholecoiner addresses

Alongside rising prices, the number of addresses holding at least 1 BTC has continued to grow. These metrics offer a glimpse into adoption patterns and the expanding base of long-term holders.

| Year | Addresses ≥1 BTC |

| 2015 | ~150,000 |

| 2017 | ~500,000 |

| 2020 | ~700,000 |

| 2023 | ~827,000 |

| 2025 | ~985,000 |

Most modern wholecoiners did not acquire their coins in a single purchase. Instead, they accumulated over time, often through Dollar-Cost Averaging (DCA). This gradual approach contrasts with early adopters, who acquired large amounts when BTC was cheap or mineable at home.

Despite rising prices, the number of wholecoiners continues to climb, proving that conviction often outweighs market barriers.

3.3. The psychological milestone

More than just a numerical goal, owning 1 BTC has become a psychological and social milestone within the Bitcoin ecosystem. It represents foresight, discipline, and alignment with the long-term vision of decentralized money.

Reaching 1 BTC often becomes a deeply personal mission. Community forums are filled with countdowns, encouragement threads, and celebration posts as users cross this threshold.

Real Example: In 2022, a Reddit user documented a 5-year journey of DCA-ing $50 per week into BTC. By early 2025, they had reached 1.02 BTC, sparking over 2,000 congratulatory comments. Their story resonated with thousands who shared similar goals.

For many, becoming a wholecoiner isn’t just about price, it’s about identity, belonging, and belief in Bitcoin’s future.

4. Bitcoin’s wealth distribution: Whales, small holders, and centralization

Understanding bitcoin distribution is essential to grasp the wealth dynamics of the network, from whales to shrimps.

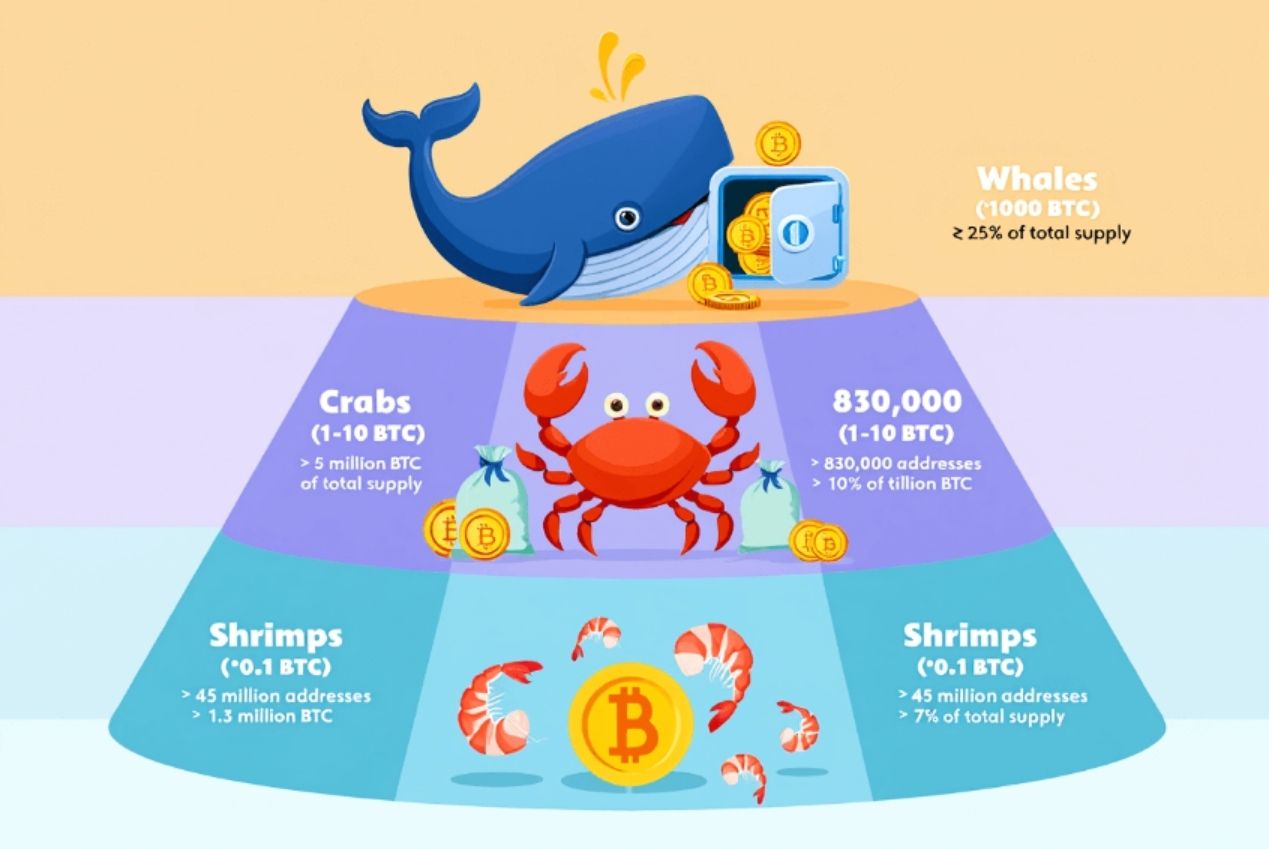

Bitcoin wealth is far from evenly distributed. Consider these stats:

- Top 1.9% of addresses hold over 92% of BTC supply

- Top 100 addresses hold >15% of BTC

- Exchanges manage ~1.89 million BTC across <100 wallets

At the bottom, most users are shrimps, holding <0.1 BTC. Despite being the majority, they hold <10% of total supply.

Bitcoin Rich List analysis shows extreme concentration:

| Holder Type | Range (BTC) | Est. Addresses | Approx. BTC Held | % of Supply |

| Whales | ≥1000 BTC | ~2000 | >5 million | >25% |

| Crabs | 1–10 BTC | ~830,000 | ~2 million | ~10% |

| Shrimps | <0.1 BTC | ~45 million | ~1.3 million | <7% |

These figures expose bitcoin wealth inequality: a small minority controls the majority. While some wallets belong to exchanges, the imbalance remains stark.

5. How lost Bitcoins increase ownership scarcity

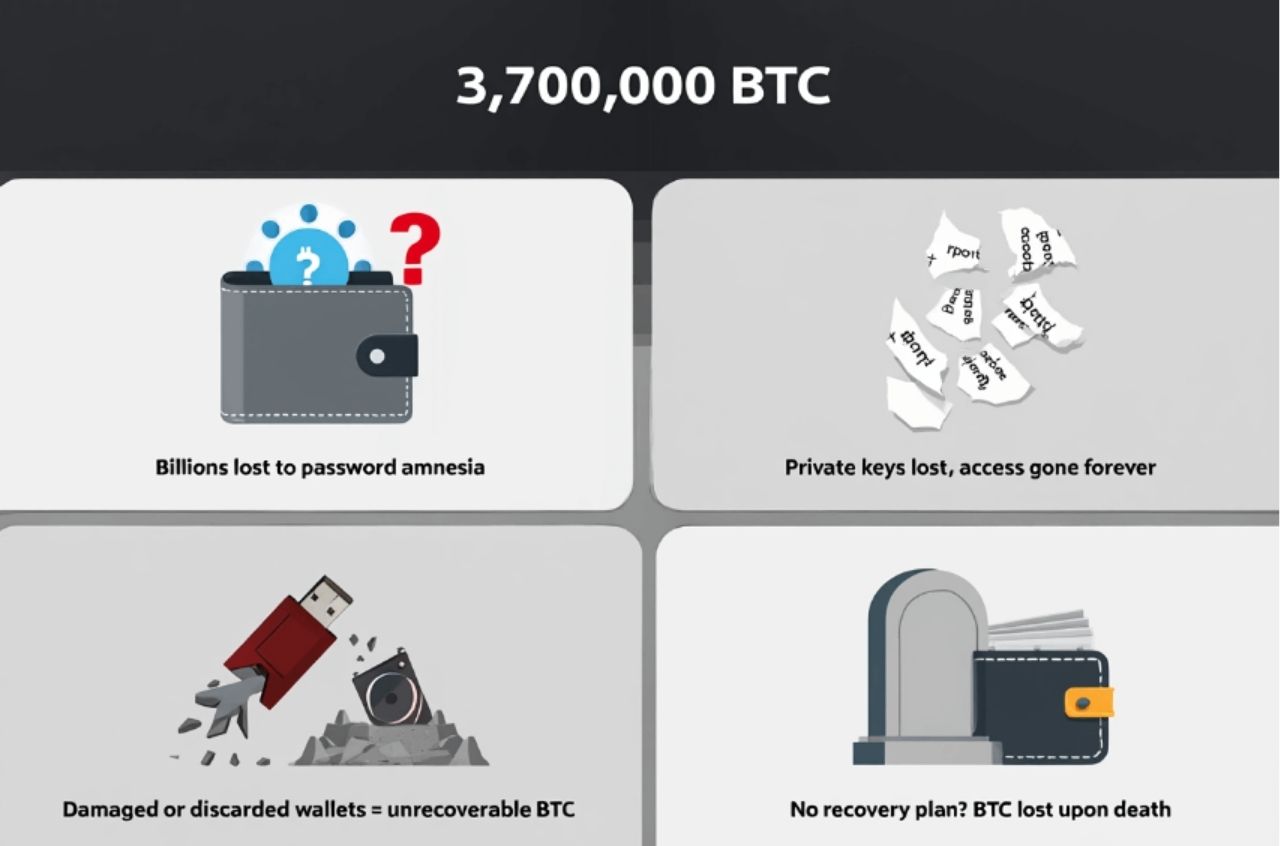

Lost coins amplify scarcity. Chainalysis estimates ~3.7 million BTC may be lost forever due to:

- Forgotten passwords

- Misplaced private keys

- Lost hardware

- Death of holders without recovery plans

This reduces the effective supply from 21 million to possibly ~17 million or less. If ~1 million people hold ≥1 BTC, then only 16 million BTC are left for the rest of the world.

Scarcity is a key narrative in Bitcoin’s value proposition. When demand grows but supply cannot expand (and part of it is gone forever), value per unit rises.

Being a wholecoiner becomes more exclusive as time passes.

View more:

- How Can I Earn Free Bitcoins: 7 Proven and Safe Strategies

- How do I buy Bitcoins for cash? A 2025 beginner’s guide

- What are the Bitcoin ETFs? Top Picks and How To Buy

6. Why is owning one Bitcoin so significant?

The owning 1 Bitcoin significance extends far beyond financial value; it reflects a commitment to decentralization and monetary independence. The significance of reaching this milestone continues to grow as Bitcoin adoption accelerates.

6.1. Scarcity with Purpose

Bitcoin’s hard cap of 21 million coins is its most defining feature. If you hold even one BTC, you own 1/21,000,000 of that finite supply, a mathematically guaranteed share of a non-inflationary asset.

But the real scarcity is even greater. With millions of BTC estimated to be lost forever, the effective supply is closer to 17–18 million. That means every wholecoiner owns a larger slice of what’s truly left.

This scarcity gives Bitcoin its digital gold status. It also drives long-term demand, as supply cannot be diluted like fiat currency or stocks.

6.2. Symbolism in the Community

Within the Bitcoin community, becoming a wholecoiner is more than a financial milestone, it’s a rite of passage. It symbolizes commitment to a decentralized future and belief in sound money principles.

Online forums and social platforms are filled with proud declarations like:

- Just stacked my 1st BTC!

- Joined the 1 BTC club today.

These moments are shared with excitement and celebrated by others, reinforcing a shared culture of ownership and conviction. Being a wholecoiner is often seen as reaching the threshold of true participation in the Bitcoin ethos.

6.3. Financial weight

In 2025, owning 1 BTC isn’t just symbolic, it’s financially substantial. At a valuation of ~$100,000 per coin, 1 BTC is equivalent to major life assets or investments.

It can realistically cover:

- A down payment on a house in many markets

- One to two years of college tuition

- A seed fund for retirement or starting a business

This level of purchasing power makes BTC a serious store of value. For many, it’s a hedge against inflation, economic instability, or weakening fiat systems. And as Bitcoin’s price rises, so does its wealth preservation role.

6.4. Long-term conviction

Wholecoiners are typically long-term thinkers. They often buy and hold based on macroeconomic beliefs, such as the decline of fiat credibility or the rise of decentralized networks.

Their investment is not just financial, it’s ideological. Many are privacy advocates, monetary reformists, or tech optimists who see Bitcoin as a tool for individual sovereignty.

Because of this mindset, wholecoiners rarely panic sell. They contribute to lower supply volatility and form the backbone of Bitcoin’s resilient holder base.

This long-term conviction plays a critical role in Bitcoin’s stability, reputation, and eventual mainstream adoption.

7. Owning 1 BTC vs. being a Millionaire: A wealth redefinition

As Bitcoin matures, owning one full BTC is increasingly viewed not just as an investment, but as a new form of status. While becoming a USD millionaire is a more familiar financial goal, wholecoiner status introduces a different kind of scarcity-based wealth narrative.

7.1. Global comparison table

Let’s compare the rarity of owning 1 BTC to being a USD millionaire in 2025. The table below highlights the striking difference in scarcity and global distribution.

| Metric | Wholecoiners | USD Millionaires |

| Estimated Count (2025) | <1,000,000 | ~58,000,000 |

| % of Global Population | ~0.0125% | ~0.7% |

| Supply Cap (BTC/USD) | 21 million max | Unlimited (inflationary) |

Even if every millionaire wanted 1 BTC, only 1 in 3 could get one. This makes 1 BTC rarer than a million dollars.

As Bitcoin gains institutional acceptance, more wealthy individuals seek allocation. The window to become a wholecoiner is narrowing.

7.2. Social perception shift

Beyond financial comparison, the social meaning of owning 1 BTC is also evolving. In the near future, holding a whole Bitcoin may be perceived similarly to owning legacy assets like prime real estate, rare art, or gold.

Already, among crypto-native communities, wholecoiner is a badge of honor. It signals commitment, early adoption, and belief in the future of decentralized finance.

As digital assets go mainstream, this social capital may extend beyond crypto circles. Owning 1 BTC could become a symbol of financial foresight and tech-savvy identity.

Ultimately, the comparison isn’t just numeric, it’s philosophical. While fiat wealth inflates and dilutes, Bitcoin ownership becomes increasingly finite and significant.

8. Wholecoiner psychology: Why they Hodl

The mindset of wholecoiners sets them apart from most other investors. Central to their behavior is the concept of HODLing, a term that originated from a 2013 Bitcoin forum typo of hold and later evolved into a backronym: Hold On for Dear Life.

HODLing reflects a long-term conviction in Bitcoin’s future value, regardless of short-term price volatility. Wholecoiners are not swayed by market panic or hype cycles; instead, they focus on fundamentals, purpose, and time.

Wholecoiners are unique among investors. Here’s what motivates them:

- Ideological belief: They see Bitcoin as a financial revolution

- Low time preference: They’re willing to wait years, even decades

- Inflation hedge: BTC is viewed as digital gold

- Self-custody: Many wholecoiners prioritize owning private keys

These investors aren’t easily shaken by volatility. In fact, some accumulate more during dips. Their mindset supports network resilience and long-term adoption.

9. The road to 1 BTC: How people accumulate

There are multiple ways individuals reach the 1 BTC milestone. Below are the most common accumulation strategies.

Most wholecoiners didn’t buy 1 BTC in one go. Common strategies include:

9.1. Dollar-cost averaging (DCA)

This is one of the most popular and beginner-friendly accumulation strategies. Investors commit to buying a fixed amount of BTC, say $10 to $100, on a weekly or monthly basis regardless of market price.

By spreading out purchases over time, DCA helps reduce the risk of buying at market peaks and avoids emotional trading. It also builds financial discipline and encourages long-term thinking.

Many modern wholecoiners rely on DCA because it’s simple, automated, and effective. Over time, these small purchases add up to a significant stack. Even when markets dip, DCA encourages consistency instead of fear.

Pro Tip: Use apps like Swan or River to automate DCA straight from your paycheck, this reduces friction and enforces savings.

9.2. Crypto profits rotation

Another common strategy is converting profits from altcoin trades into Bitcoin. When altcoins rally strongly, savvy investors take profits and rotate them into BTC, which is viewed as a more stable long-term asset.

This method relies on timing and portfolio management skills. It’s best suited for active traders who monitor the market closely and can identify profitable exit points.

By consistently rotating altcoin gains into Bitcoin, investors can grow their BTC stack without additional fiat investment. However, it carries more risk than DCA due to volatility and market timing.

Over time, this strategy can compound effectively, but it requires discipline and a clear exit plan.

9.3. Reinvesting fiat income

Some wholecoiners set aside a portion of their regular income, such as salaries, bonuses, or freelance earnings, to invest in Bitcoin consistently.

This approach is straightforward and sustainable. It turns traditional income into digital savings without needing to time the market or speculate on altcoins.

Allocating a small percentage of each paycheck helps build exposure gradually. Some individuals treat it like a retirement fund or hedge against fiat devaluation.

The key is consistency. Over months or years, these contributions grow into a whole BTC or more.

9.4. Mining (early days)

In Bitcoin’s early years, individuals could mine BTC using basic home computers. This was one of the original ways to acquire whole coins before centralized exchanges existed.

Back then, mining difficulty was low, and rewards were high. Many early wholecoiners built their stacks through solo or pool mining using standard CPUs and GPUs.

Today, mining is highly industrialized and no longer accessible for most individuals. However, it played a crucial role in distributing coins during Bitcoin’s infancy.

These early miners became the first generation of wholecoiners and often continue to influence the ecosystem.

9.5. Gifts & airdrops

Some people received BTC as gifts, tips, or airdrops, especially during the early community-building years. These gestures helped spark interest and encourage adoption.

In crypto forums, it was common to reward helpful users with small BTC amounts. Some companies also distributed BTC during promotional campaigns or airdrops to wallets.

Although rare today, these methods enabled a surprising number of users to start stacking early. In some cases, forgotten gift wallets later turned into wholecoin holdings.

These stories are reminders that early engagement with crypto often pays off unexpectedly.

10. FAQs: People also ask about owning 1 Bitcoin

Q1: How many people actually own at least 1 Bitcoin?

A: As of mid-2025, it’s estimated that between 800,000 to 900,000 unique individuals worldwide own at least one full Bitcoin. While over 985,000 wallet addresses hold ≥1 BTC, this overstates the true number due to exchange wallets and multi-address ownership.

Q2: What is a wholecoiner and why does it matter?

A: A wholecoiner is someone who owns a full 1 BTC. In the Bitcoin community, reaching this milestone is symbolic of long-term belief, financial preparedness, and early adoption of a scarce digital asset. With fewer than 1 million wholecoiners worldwide, it’s a rare achievement.

Q3: Is 1 Bitcoin really worth owning in 2025?

A: Yes. In 2025, 1 BTC is valued around $100,000. It holds long-term potential as a hedge against inflation, a store of value, and access to a decentralized financial system. It’s also increasingly seen as a prestige asset due to its scarcity.

Q4: How long does it typically take to accumulate 1 BTC?

A: It depends on income and strategy. Most wholecoiners use dollar-cost averaging (DCA) over months or years, buying small amounts consistently. With patience and planning, 1 BTC is achievable for many disciplined investors.

Q5: How many Bitcoin addresses hold 1 BTC or more?

A: As of 2025, about 985,000 unique Bitcoin addresses hold at least 1 BTC. However, this includes exchange wallets and duplicate ownership, so it doesn’t reflect the exact number of individuals. It’s more accurate to say fewer than 1 million people are wholecoiners.

Q6: Why is Bitcoin ownership so unequal?

A: Bitcoin wealth distribution is skewed. The top 1.9% of wallets hold over 92% of the supply. Early adopters, whales, and exchanges dominate holdings. Most users (shrimps) own less than 0.1 BTC, revealing significant bitcoin wealth inequality.

Q7: Is it too late to become a wholecoiner?

A: Not necessarily. While it’s harder today than in previous years due to rising prices, it’s still possible through consistent accumulation. Even 0.1 BTC is increasingly valuable and puts you in a rare subset of global Bitcoin users.

11. Conclusion

So, how many people own 1 Bitcoin in the world? Not everyone needs to become a wholecoiner. But if you believe in Bitcoin’s long-term future, aiming for 1 BTC can be:

- A wealth preservation strategy

- A symbol of commitment

- A rare financial milestone

Even owning 0.1 BTC puts you in the top fraction of Bitcoiners. With 21 million coins and 8 billion people, time is on the side of early accumulators.

Whether your goal is 0.1 or 1 BTC, understanding that own 1 Bitcoin in the world gives context to your position in this exclusive club.

Vietnam-Ustrade is committed to helping you understand the future of digital assets with accuracy, depth, and clarity. Explore more insights in our Bitcoins category