How much are Bitcoins right now? They’re around $100,000 as of June 2025. Learn why prices change, what affects BTC to USD, and how to invest wisely today.

Bitcoin’s current price is approximately $100,000 as of June 2025. However, this value fluctuates continuously due to market dynamics. This article explains clearly why Bitcoin’s price changes and how it impacts investors.

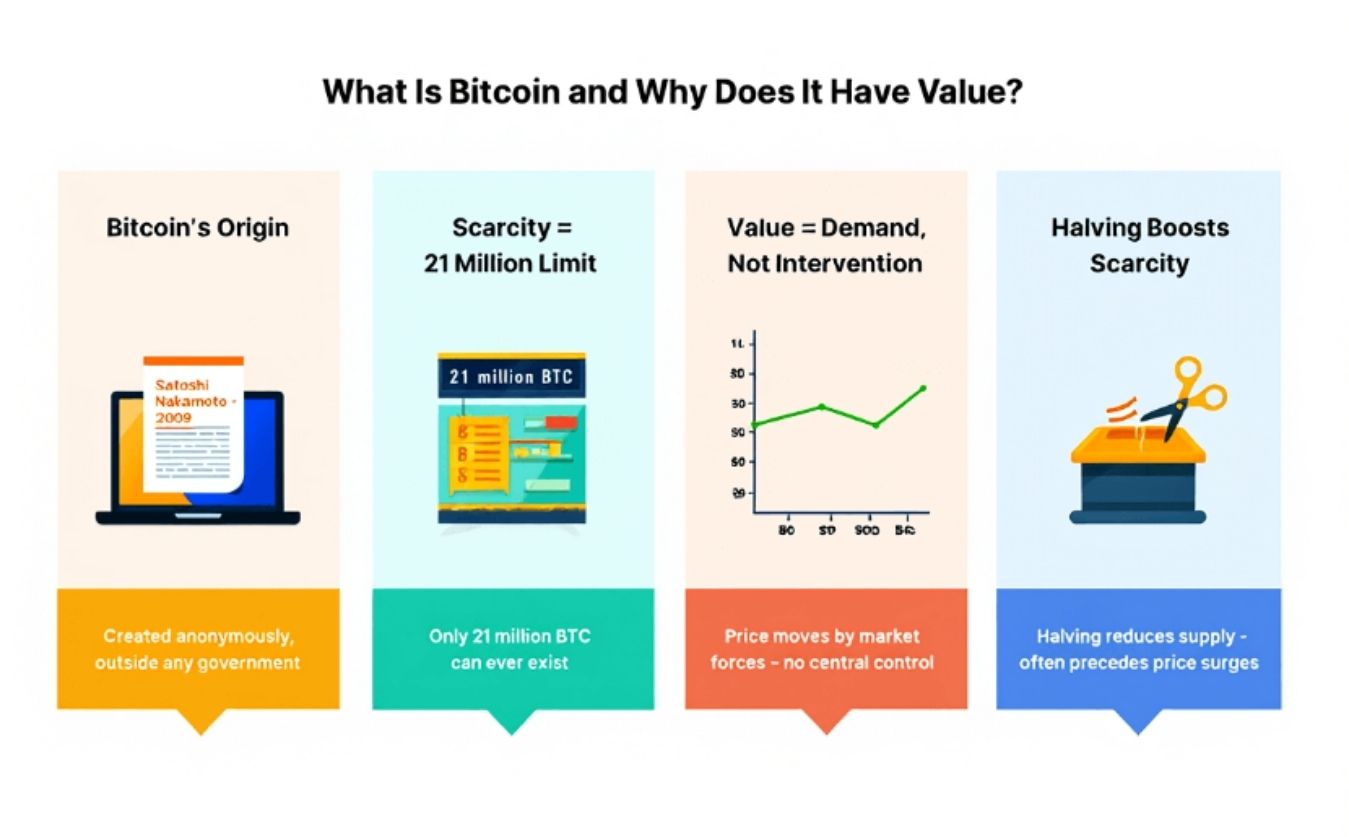

1. What is Bitcoin and why does it have value?

Bitcoin was created anonymously by Satoshi Nakamoto in 2009. It primarily has value due to its scarcity, only 21 million Bitcoins can ever exist, community acceptance, and its reputation as digital gold. Bitcoin’s price is determined purely by supply and demand rather than government intervention, creating notable volatility.

For example, after each Bitcoin halving event, where block rewards for miners are cut in half, the reduced supply typically increases demand, historically affecting Bitcoin’s price significantly.

Understanding this fundamental principle helps investors assess Bitcoin’s potential and risk.

2. How much are Bitcoins right now (BTC to USD)?

Currently, 1 Bitcoin (BTC) equals approximately $100,000 USD (June 2025). The price continuously fluctuates 24/7, with small discrepancies between international exchanges due to arbitrage opportunities. Investors can find real-time Bitcoin current prices on platforms like CoinMarketCap, Coindesk, or through quick Google searches (BTC to USD).

Pro Tip: Consider using price-alert features on these platforms to receive instant notifications when Bitcoin’s price reaches your desired threshold, allowing you to capitalize on timely investment opportunities.

Given Bitcoin’s volatility, staying updated is critical for making timely investment decisions.

Below showing articles that might interest you:

- How much are 3 Bitcoins worth? Why 3 BTC is worth a fortune

- How many people own 1 Bitcoin in the world? The surprising reality of the 1 BTC club

- How many Bitcoins to the Dollar? The real value of 1 USD in Bitcoin terms

3. Factors influencing Bitcoin’s price

Bitcoin price volatility heavily depends on various factors like market demand, news sentiment, and macroeconomic conditions.

Below are factors that influence the Bitcoin’s price:

3.1. Market supply and demand

The capped supply of Bitcoin paired with growing global demand increases price sensitivity.

High buying activity (often driven by Fear of Missing Out, FOMO) rapidly pushes prices upward, whereas selling pressure (Fear, Uncertainty, Doubt, FUD) drives prices down.

3.2. Scarcity and Bitcoin halving

Every four years, Bitcoin undergoes a halving event, cutting the issuance rate in half. This halving increases scarcity significantly, historically triggering notable upward price cycles shortly thereafter.

Real Example: After the 2020 halving, Bitcoin surged dramatically from approximately $9,000 to nearly $64,000 within a year.

3.3. News and market sentiment

Positive news such as major corporate adoptions or favorable regulatory announcements significantly elevates Bitcoin’s price. Conversely, negative news, exchange hacks, governmental restrictions, drastically depresses market confidence and prices.

Reviewing Bitcoin historical price charts helps investors better understand how market sentiment has historically impacted price movements.

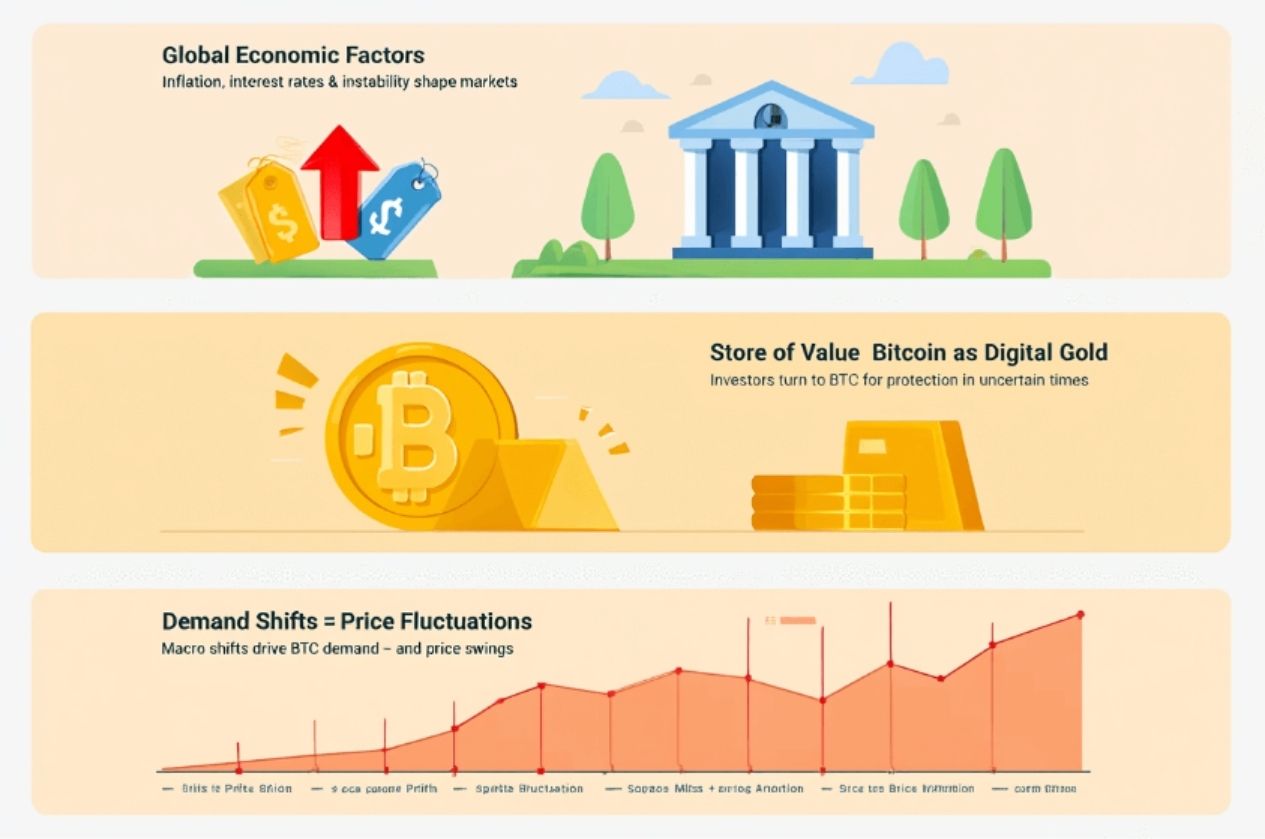

3.4. Macroeconomic conditions

Bitcoin is sensitive to global economic changes.

Inflation, shifting monetary policies, and economic instability often drive investors to view Bitcoin as digital gold, affecting demand and price significantly.

3.5. Market manipulation and whales

Market manipulation is another key factor influencing Bitcoin’s volatility. Large holders (whales) of Bitcoin can manipulate markets with substantial buying or selling activities, causing immediate and significant price swings.

Investors should pay attention to large-volume transactions, often reported by crypto analytics platforms, to better anticipate potential short-term market movements.

Understanding these market dynamics helps investors navigate the inherent volatility and manage investment risk effectively.

3.6. Regulatory environment

The regulatory environment heavily impacts Bitcoin prices. Positive regulations legitimizing cryptocurrencies lead to increased adoption and price appreciation, as seen when El Salvador adopted Bitcoin as legal tender in 2021.

Conversely, restrictive regulatory measures, such as China’s 2021 cryptocurrency ban, can negatively affect market sentiment and lead to significant price declines. Investors must closely monitor regulatory developments to anticipate potential market impacts.

Pro Tip: Regularly follow updates from reliable sources like government financial regulators, SEC announcements, or trusted cryptocurrency news platforms to stay informed on regulatory shifts that could impact Bitcoin’s value.

Understanding these factors is crucial for predicting Bitcoin’s price trends and managing investment risk.

4. History of Bitcoin price fluctuations

Analyzing Bitcoin historical price movements helps investors understand past volatility and potential future trends.

| Year | Notable Price Points |

| 2010 | $0.0025 per BTC (10,000 BTC = 2 pizzas) |

| 2013 | BTC peaked near $1,000 |

| 2017 | BTC surged to ~$20,000, crashed to ~$3,000 in 2018 |

| 2021 | Record highs around $69,000 |

| 2022 | Price fell sharply to ~$20,000 |

| 2025 | BTC surpassed $100,000 |

This trajectory underscores Bitcoin’s rapid growth potential, despite its inherent volatility.

5. What Bitcoin’s current price means for new investors

What Bitcoin’s current price means for new investors underscores the importance of understanding how much are Bitcoins right now and how price affects investment strategies.

Bitcoin’s price around $100,000 might seem daunting, yet it’s divisible into smaller units called satoshis (1 satoshi = 0.00000001 BTC), enabling investments as small as $50 or $100 (0.001 BTC).

While Bitcoin’s large market cap ($2 trillion) implies maturity, investors must acknowledge high volatility, with potential price drops of 50-80%.

Pro Tip: Rather than focusing solely on the current high price, new investors should adopt a long-term investment strategy, cautiously entering the market while carefully managing risk.

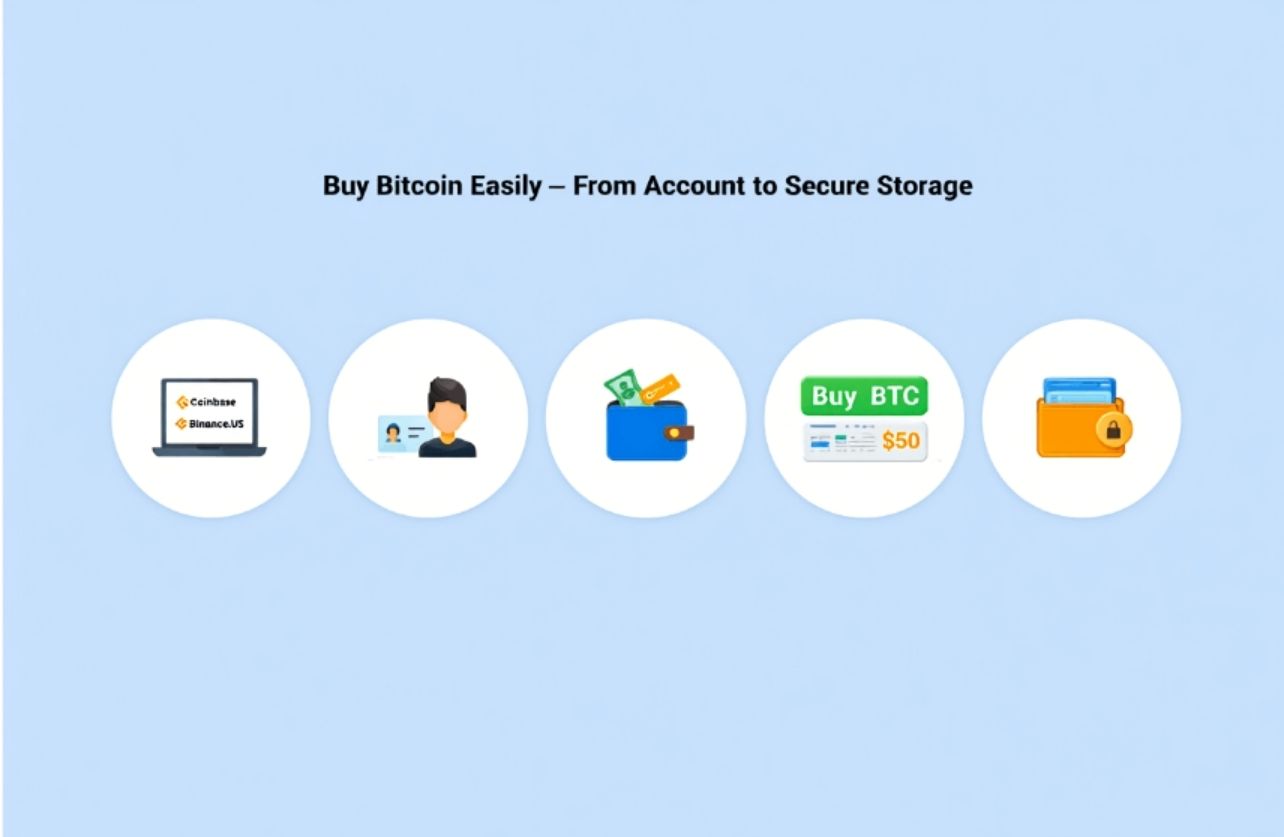

6. How to buy Bitcoin at current prices

Buying Bitcoin is straightforward if you follow these simple steps:

- Choose a Reliable Exchange: Popular U.S. exchanges include Coinbase, Binance.US, and Kraken.

- Register and Verify: Complete Know Your Customer (KYC) verification.

- Deposit Funds: Deposit USD to purchase Bitcoin.

- Purchase BTC: Execute market buy orders, even in fractional amounts as low as $50.

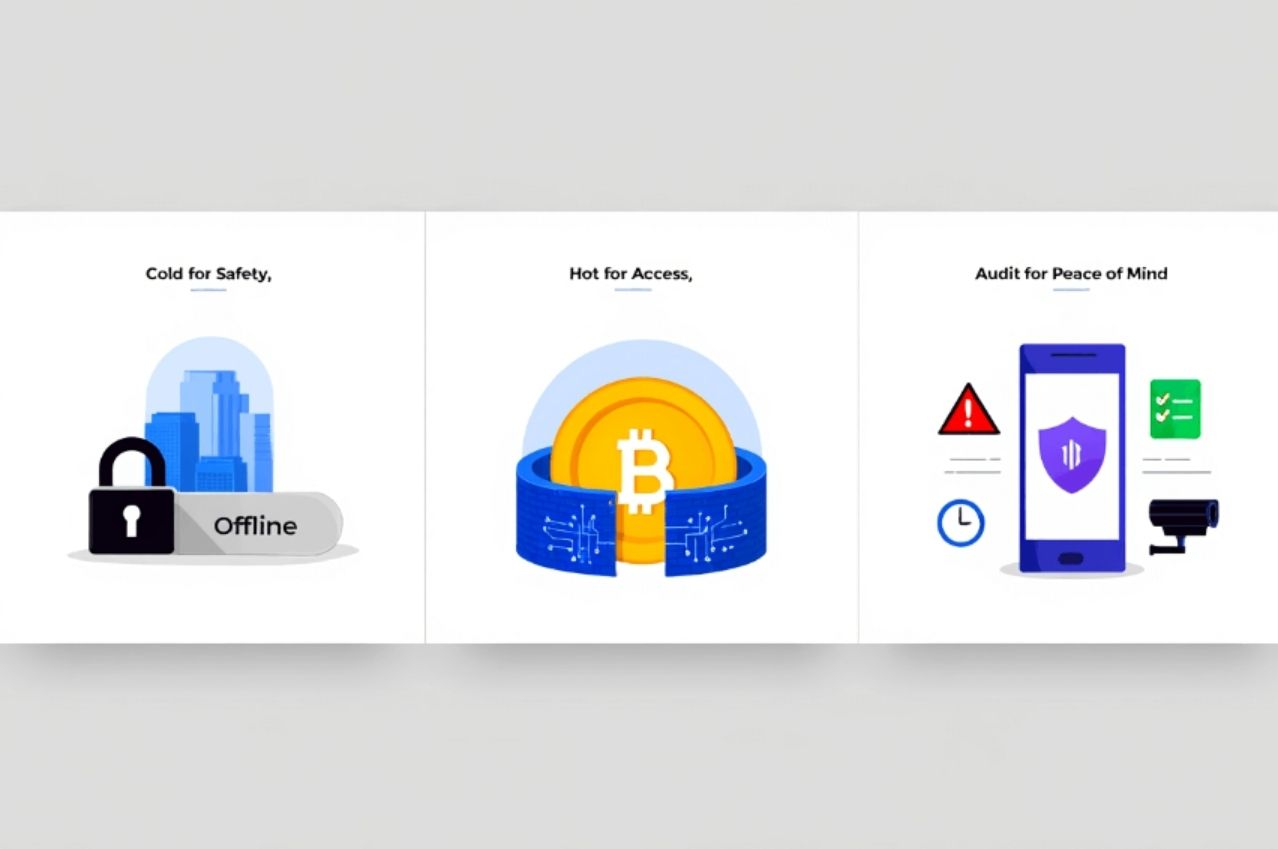

- Secure Storage: Securely store your Bitcoin in cold wallets (offline, highly secure) or hot wallets (online, convenient).

Always consider transaction fees, price fluctuations post-purchase, and security best practices to protect your investment.

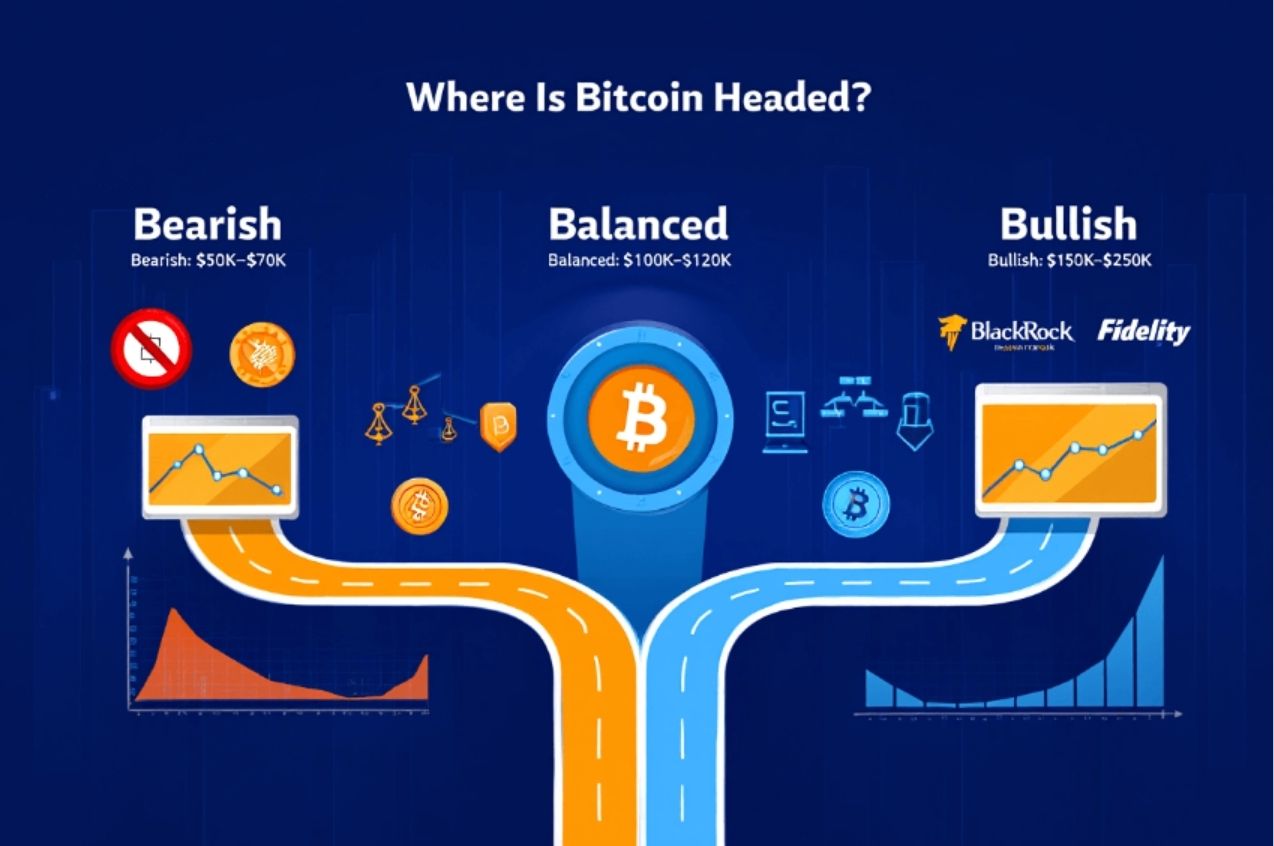

7. Potential future Bitcoin price scenarios

Understanding potential future price scenarios helps investors make informed decisions and strategically position their portfolios.

Below are possible paths.

7.1. Bullish scenario

In the bullish scenario, experts predict Bitcoin could surpass $150,000–$250,000 by 2030, driven by increased institutional adoption and scarcity from Bitcoin halving events.

Institutional players such as BlackRock and Fidelity expanding their Bitcoin ETF offerings may significantly boost investor confidence and drive higher price momentum.

Investors embracing this optimistic scenario should closely follow major financial institutions’ crypto adoption announcements as early indicators of potential price increases.

7.2. Bearish scenario

Conversely, the bearish scenario could see Bitcoin stagnating or declining significantly to around $50,000–$70,000, driven by strict global regulatory measures or severe security breaches.

Historical examples, such as China’s 2021 cryptocurrency ban or major exchange hacks like Mt. Gox in 2014, demonstrate the severe downward pressure regulatory and security issues can exert on Bitcoin’s valuation.

Thus, investors must regularly assess security infrastructure and regulatory trends to mitigate potential losses under bearish conditions.

7.3. Balanced scenario

A balanced perspective suggests Bitcoin’s price may stabilize around $100,000–$120,000, characterized by reduced volatility and enhanced regulatory clarity.

Under this scenario, Bitcoin price volatility decreases as more countries provide clear regulatory guidelines, reducing uncertainty and stabilizing investor sentiment.

Such conditions may encourage broader adoption, creating a more predictable investment environment favorable for long-term planning.

Pro Tip: Investors should periodically rebalance their portfolio to align with market stability, securing profits during calmer market conditions.

8. Detailed steps to securely store Bitcoin

Securing your Bitcoin investment is critical due to rising cyber threats.

Below are most popular ways to secure your Bitcoin:

8.1. Cold storage solutions

Cold wallets like Ledger and Trezor offer the highest security by keeping your Bitcoin offline, safe from hackers. By storing your private keys offline, you eliminate the vulnerability posed by internet-connected devices.

Ensure you purchase hardware wallets directly from reputable manufacturers or authorized dealers to avoid tampering risks.

Real Example: In 2020, a phishing scam involved fake Ledger hardware wallets. Purchasing directly from Ledger’s official site could have prevented this scenario.

Ultimately, cold storage is considered the gold standard in Bitcoin security for significant holdings.

8.2. Hot wallet precautions

Hot wallets such as Coinbase Wallet or Exodus offer convenience but require strict security measures like multi-factor authentication (MFA). Always activate MFA to create an additional protective layer beyond basic passwords.

Regularly update your wallet software to ensure you benefit from the latest security patches.

Pro Tip: Limit the amount of Bitcoin you store in hot wallets to what you actively trade or spend, moving larger holdings to cold storage for enhanced security.

By adopting these precautions, investors can significantly enhance the safety of their digital assets.

8.3. Regular security checks

Regular audits of your security practices significantly reduce the risk associated with storing Bitcoin. Routinely verify wallet addresses before executing transactions and consistently monitor wallet balances.

Consider performing quarterly security audits to detect vulnerabilities or unauthorized access attempts promptly.

These proactive measures enable investors to maintain high security standards and swiftly respond to potential threats.

9. FAQs

Q1: Why does Bitcoin’s price fluctuate so dramatically?

A: Price fluctuations arise from supply-demand dynamics, speculative investment, global economic conditions, and market manipulation.

Q2: Can Bitcoin’s price drop to zero?

A: Highly unlikely. Although severe price declines can occur, total collapse requires a complete loss of market confidence, which is improbable due to Bitcoin’s wide adoption.

Q3: Is Bitcoin considered a bubble?

A: Bitcoin has exhibited bubble-like characteristics historically, yet its limited supply and increasing acceptance suggest long-term sustainability despite volatility.

Q4: Should I invest in Bitcoin right now?

A: Your decision should depend on personal risk tolerance, financial situation, and investment goals. If you understand and accept volatility risks, cautious investing can be advisable.

Q5: How do I cash out my Bitcoin?

A: Sell Bitcoin on exchanges, converting BTC to USD or other currencies, then transfer funds directly to your bank account.

Q6: What is Bitcoin halving, and how does it impact price?

A: Bitcoin halving reduces block rewards by half every four years, increasing scarcity, historically leading to price increases.

Q7: How can I track Bitcoin’s historical prices?

A: Historical prices can be tracked via CoinMarketCap, Coindesk, or TradingView charts.

10. Conclusion

How much are bitcoins right now is more than a question, it’s a signal of global demand, market maturity, and long-term growth. Currently valued at approximately $100,000, Bitcoin’s value exemplifies rapid growth potential tempered by volatility. Investors must regularly monitor Bitcoin’s price dynamics and remain informed on market conditions.

Vietnam-Ustrade’s Bitcoins category offer extensive resources to deepen your cryptocurrency knowledge and investment strategies.

Consider the following actions for further success in Bitcoin investing:

- Stay updated on market movements to optimize your investment decisions.

- Explore more articles for comprehensive investment guidance.

- Bookmark this page or share it to easily access the latest Bitcoin updates.

By doing so, you equip yourself to navigate Bitcoin’s complex yet promising landscape effectively.