How to transfer money to Bitcoins in 2025? It means converting your traditional currency like USD or EUR into Bitcoin, a decentralized digital asset used globally.

Whether you’re investing or sending money overseas, transferring cash to Bitcoin has never been easier.

In this guide by Vietnam-UStrade, we’ll walk you through secure, legal, and beginner-friendly methods to convert your money into Bitcoin quickly and safely.

1. Bitcoin and fiat money: Key concepts every beginner must know

Before exploring how to transfer money to Bitcoins, you need to understand some basic terms. Fiat money is government-issued currency like the US dollar or euro used for everyday transactions. It’s backed by trust in the issuing authority.

Bitcoin, on the other hand, is a digital-only cryptocurrency that runs on blockchain technology. It enables secure, transparent transactions without needing banks.

Unlike fiat, Bitcoin is decentralized and limited in supply, making it appealing as a store of value. Ownership is managed through wallets, which store your private keys. Hot wallets are internet-connected and convenient, while cold wallets are offline and offer greater protection from hacks.

Think of sending fiat currency abroad using a bank transfer there can be delays and fees involved. Sending Bitcoin, by contrast, can be faster and cheaper if done correctly. Your Bitcoin wallet plays a crucial role in this process because it securely stores the Bitcoin you buy and lets you send or receive payments.

Learn more Bitcoin wallet here

| Feature | Fiat Money | Bitcoin |

|---|---|---|

| Issuer | Central Banks | Decentralized network |

| Physical Form | Paper, coins | Digital only |

| Supply | Unlimited, controlled by policy | Limited to 21 million |

| Ownership | Bank accounts or cash holders | Wallet private keys |

| Transaction Speed | Varies, hours to days | Usually minutes |

Understanding these basics ensures you’re ready to explore how to turn your cash into Bitcoin safely and effectively.

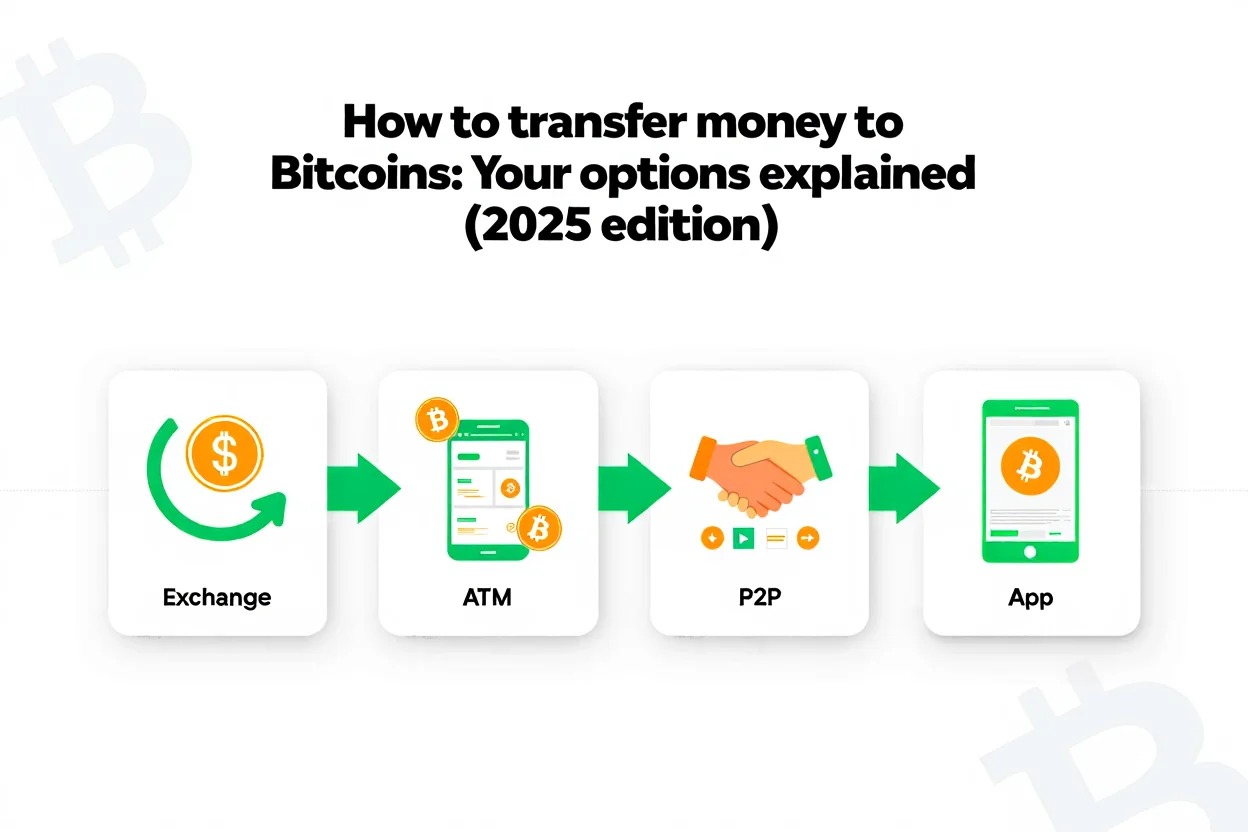

2. How to transfer money to Bitcoins: Your options explained (2025 edition)

There are several ways to convert your money into Bitcoin. If you’re wondering how to transfer money to Bitcoins safely in 2025, the main methods include exchanges, payment apps, ATMs, and peer-to-peer platforms.

| Method | Description | Best For | Pros | Cons |

|---|---|---|---|---|

| Online Exchanges | Websites where you buy Bitcoin using bank transfers or cards | Most users, beginners to experts | Secure, regulated, flexible payment options | May have complex interfaces, KYC required |

| Payment Apps | Mobile apps like Cash App or PayPal offering Bitcoin purchases | Mobile-first users wanting simple setup | Easy to use, fast purchases | Limited transfer-out options, higher fees |

| Bitcoin ATMs | Physical machines accepting cash to buy Bitcoin | Users valuing privacy or cash payments | Fast, private, no bank needed | High fees, limited locations |

| Peer-to-Peer (P2P) | Direct trading with individuals on trusted platforms | Experienced users wanting privacy or flexibility | Flexible payments, often lower fees | Higher risk of scams, requires caution |

Each of these methods follows strict safety practices to protect your money and Bitcoin. For example, exchanges use identity checks and encryption, while P2P platforms offer escrow services to secure transactions. Understanding these options helps you pick the best fit for your needs and risk comfort.

Pros and Cons Summary

- Exchanges offer versatility but require verification.

- Apps are simple but come with spending limits.

- ATMs allow cash payments but charge higher fees.

- P2P is private but demands caution and trust verification.

View more:

- How to transfer bitcoins to wallet

- What is Bitcoin trading for? Key purposes explained

- What is RSI? How to Effectively Use the RSI Indicator Tool

3. Step-by-step: Transferring money to Bitcoins using an online exchange

If you’re looking for how to transfer money to Bitcoins in the most secure and regulated way, using an online exchange is often the best choice.

- Choose a reputable exchange. Look for platforms regulated in your country. Popular options include Coinbase, Binance, and Kraken. Check for strong security, good reviews, and manageable fees.

- Create an account. Register with your email, create a secure password, and complete identity verification (KYC). Enable two-factor authentication (2FA) for extra safety.

- Fund your account. Deposit money via bank transfer or credit/debit card. Bank transfers usually have lower fees but take a day or two. Card payments are faster but cost more.

- Buy Bitcoin. Decide your purchase amount, review current market prices, and place the order. You can choose a market order (immediate buy at current price) or a limit order (buy when price hits your target).

- Check your Bitcoin balance. After the transaction confirms, your Bitcoin will appear in your exchange wallet. You can keep it there or transfer it to your private wallet for better security.

Prioritize setting security options like 2FA and withdrawal whitelist to protect your account. These steps will ensure a smooth and safe Bitcoin purchase experience.

4. How to transfer money to Bitcoins using payment apps (Cash App, PayPal, Venmo)

Payment apps offer an easy way to buy Bitcoin, especially for beginners. Unlike exchanges, apps focus on simplicity but have limits on withdrawal and exporting Bitcoin to other wallets.

Here’s a quick process:

- Download the app and create an account.

- Verify your bank account or card inside the app.

- Navigate to the Bitcoin buy section and enter the amount you want.

- Confirm your purchase and wait for it to process.

- If supported, transfer the Bitcoin to your personal wallet for more control.

Note that fees vary by app. For example, buying $50 in Bitcoin on Cash App as a U.S. user involves small fees but offers instant access. Check the app’s country and age restrictions before starting.

5. Transferring cash to Bitcoin using a Bitcoin ATM: The in-person route

Bitcoin ATMs let you convert cash directly to Bitcoin without using the internet. They’re useful for users who prefer privacy or don’t have bank accounts.

To use a Bitcoin ATM:

- Find a legitimate Bitcoin ATM near you using online locator tools.

- Scan your Bitcoin wallet’s QR code on the ATM screen.

- Insert the cash amount you wish to convert.

- Confirm the transaction and wait for the Bitcoin to be sent to your wallet address.

Keep in mind, Bitcoin ATMs often charge higher fees (up to 10% or more). Also, verify the ATM operator’s credibility to avoid scams. While these machines offer privacy, this comes with trade-offs in cost and support.

6. Peer-to-peer (P2P) methods: Private, flexible, but riskier

P2P platforms connect buyers and sellers directly. You can choose payment methods, times, and negotiate prices. They often use escrow services to hold Bitcoin until both parties confirm the deal.

Popular P2P markets include LocalBitcoins, Paxful, and Bisq. These platforms appeal to users wanting privacy or flexible payments like cash deposits or gift cards.

Safety tips for P2P trading:

- Always use escrow services provided by the platform.

- Check seller/buyer reviews and reputation scores.

- Avoid deals that seem too good to be true.

- Communicate only through official channels.

Creating an offer involves stating your price and payment method, waiting for counteroffers, then completing the payment and releasing Bitcoin from escrow once confirmed.

While this method offers flexibility, it also comes with risks. If you bypass platform protections, mistakes or scams can result in permanent loss of funds. Always stay alert especially when choosing how to transfer money to Bitcoins through peer-based options.

7. Essential safety, legal, and preparation checklist for buyers

Before you learn how to transfer money to Bitcoins, it’s essential to prepare properly to avoid legal issues, scams, or technical mistakes. This checklist helps ensure a safe and compliant experience, especially for beginners entering the Bitcoin space in 2025.

Start by understanding your local laws and platform requirements:

- Check legality in your country: Make sure Bitcoin purchases are permitted in your region and whether Know Your Customer (KYC) verification is mandatory.

- Choose regulated platforms: Using licensed exchanges or apps greatly reduces fraud risk.

Security should be a top priority from the start:

- Use strong, unique passwords for all accounts linked to your Bitcoin activity.

- Enable two-factor authentication (2FA) on every app or exchange you use.

- Avoid public Wi-Fi when logging into wallets or making transactions.

- Back up your recovery phrases and store them securely offline never online or in shared locations.

Stay alert and educate yourself:

- Recognize common scams, such as phishing emails or too-good-to-be-true offers promising guaranteed Bitcoin returns.

- Only send Bitcoin to verified wallet addresses, as transactions are irreversible.

- Start with small amounts to test platforms before committing larger funds.

- Use secure devices that are regularly updated with antivirus and security patches.

Lastly, stay current with the evolving regulations in your region. Laws around Bitcoin and digital assets can change quickly and affect your ability to trade or store crypto legally.

By following this checklist, you’ll be well-prepared to navigate the process of transferring money to Bitcoins confidently and securely.

| Region | Legality | Key Restrictions |

|---|---|---|

| USA | Legal | KYC required; must be 18+ |

| EU | Legal | Varies; AML & KYC enforced |

| China | Banned | No official exchanges allowed |

| Saudi Arabia | Restricted | Bank bans; informal trading active |

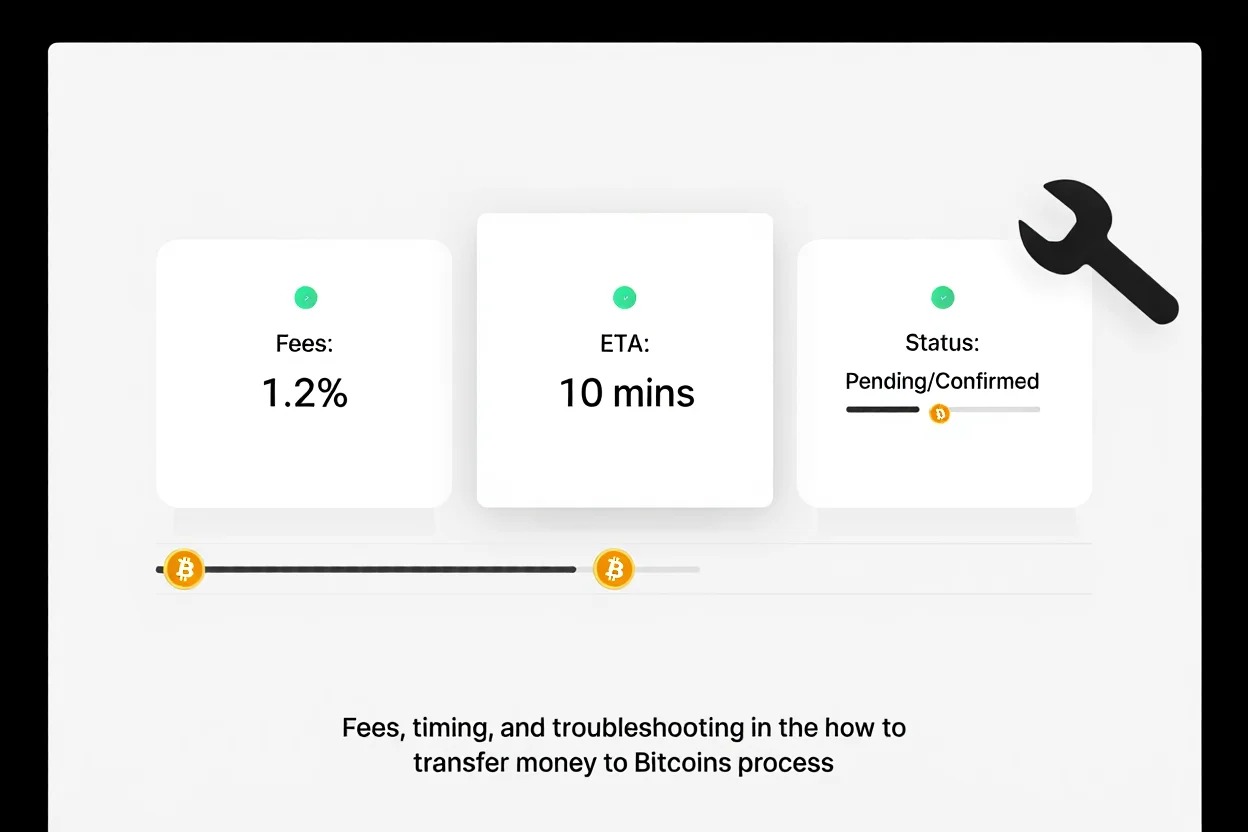

8. Fees, timing, and troubleshooting in the how to transfer money to Bitcoins process

| Method | Typical Fees | Transaction Speed |

|---|---|---|

| Exchanges (Bank transfer) | 0.5%-1.5% | 1-3 business days |

| Exchanges (Card payment) | 2%-4% | Minutes |

| Payment Apps | 1%-3% | Instant to minutes |

| Bitcoin ATMs | 5%-10% | Minutes |

| P2P | 0%-2% | Varies (minutes to hours) |

If your funds appear missing or delayed during the how to transfer money to Bitcoins process, start by checking your transaction status on a blockchain explorer. Then, contact the platform or app support for clarification. Many exchanges provide step-by-step assistance and active community forums to help users resolve issues efficiently.

For example, if a bank transfer to an exchange is delayed, it might take a day or two due to bank processing times. Patience and staying in touch with support usually solve most cases.

9. Must-know security practices when handling Bitcoin in 2025

As you explore how to transfer money to Bitcoins, protecting your assets is just as important as acquiring them. In 2025, cyber threats are more advanced, making it crucial to apply strong security habits when dealing with Bitcoin.

Here are essential practices every user should follow:

- Create strong, unique passwords for each platform or wallet. Avoid reusing passwords across accounts.

- Always enable two-factor authentication (2FA) to add an extra layer of protection against unauthorized access.

- Use reputable wallets whether hot or cold and never store large amounts on exchanges for the long term.

- Back up your wallet recovery phrase and store it offline in a safe, physical location. Treat it like cash.

- Avoid public Wi-Fi when sending or receiving Bitcoin, as unsecured networks increase hacking risks.

- Be cautious with email links and Bitcoin offers. Phishing scams are common; never click suspicious messages.

- Keep all software and devices updated, including wallets, browsers, and antivirus tools.

- Double-check wallet addresses before sending. One wrong character means your Bitcoin is gone forever.

Security isn’t a one-time setup it’s an ongoing practice. The more consistently you apply these protections, the safer your Bitcoin holdings will be in a rapidly evolving digital landscape.

Explore more trading insights:

- What is a godzilla candle in bitcoin

- How can i buy bitcoins with debit card

- How do i deposit bitcoins

10. Frequently asked questions about transferring money to Bitcoins

10.1 Can I buy Bitcoin anonymously?

Most platforms require identity verification (KYC), so full anonymity is uncommon. However, some P2P or ATM options may offer more privacy.

10.2 What is the smallest amount of Bitcoin I can buy?

Many exchanges allow you to start with as little as $10 worth of Bitcoin.

10.3 Are there country restrictions for buying Bitcoin?

Yes. While Bitcoin is legal in many countries, others like China ban its purchase through official exchanges.

10.4 What if I send Bitcoin to the wrong address?

Bitcoin transactions are irreversible. If you send it to the wrong address, the funds are likely lost.

10.5 Can a Bitcoin transaction be reversed?

No. Once confirmed on the blockchain, the transaction is final and cannot be undone.

10.6 Is there an age requirement to buy Bitcoin?

Most platforms require users to be at least 18 years old.

10.7 How long does it take to buy Bitcoin?

Depending on the method, it can take from a few minutes to a few days.

10.8 Is it safe to store Bitcoin on an exchange?

While many exchanges are secure, using a personal wallet is generally safer for long-term storage.

11. Conclusion

How to transfer money to Bitcoins is no longer a complex process in 2025. With multiple secure methods available, users can easily convert their cash into Bitcoin based on their needs and risk tolerance.

This guide has helped you understand:

- The differences between fiat and Bitcoin

- The main conversion methods: exchanges, apps, ATMs, and P2P

- Step-by-step instructions for each option

- Legal, safety, and technical best practices

- FAQs that cover common beginner concerns

Don’t forget to follow the Bitcoins category on Vietnam-UStrade to stay updated with the latest Bitcoin insights and trends!