Risks and technical section of watchlist trading view understand is more than just two columns on your screenit’s your shortcut to confident, profitable trading in 2025. By clearly showing potential risks and highlighting strong technical signals, these tools empower you to make faster, smarter, and safer decisions.

In this guide from Vietnam USTrade, we’ll break down how to master both sections, combine them for maximum impact, and customize your watchlist into a personal trading powerhouse. Let’s turn your TradingView into a tool that works for you, not the other way around.

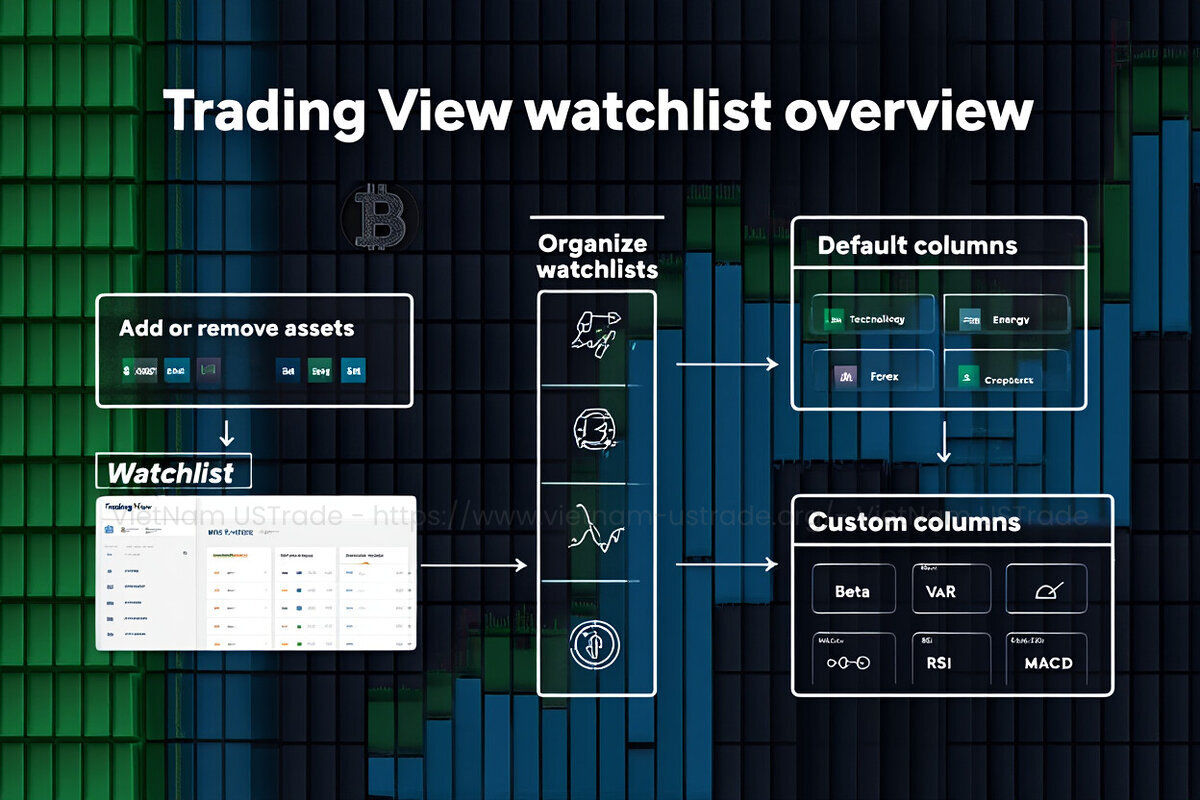

1. Trading View watchlist overview

The risks and technical section of watchlist trading view understand begins with knowing how the TradingView watchlist works at its core. A TradingView watchlist is a personalized panel where traders monitor selected financial instruments in real timeallowing them to track price changes, volume, volatility, and market signals without jumping between multiple charts.

You can access the watchlist by opening Trading View and locating the side panel labeled “Watchlist.” From here, traders can:

-

Add or remove assets using their ticker symbols

-

Organize watchlists by market sectors, asset classes, or trading strategies

-

Choose from default or customizable columns to display the most relevant data

Default columns often include basic metrics like price, percentage change, and volumeideal for quick market checks.

Custom columns can be set to display advanced data such as risk metrics (Beta, Value at Risk) and technical indicators (RSI, MACD).

Understanding this structure is essential because it’s the foundation for using the Risks and Technical sections effectively. By tailoring the watchlist layout to your strategy, you create a streamlined dashboard that supports faster decision-making and better trade execution.

2. Risks and Technical Section of Watchlist Trading View Understand

2.1. Risks section explained

The risks and technical section of watchlist trading view understand starts with the Risks columna compact yet powerful tool for evaluating potential downsides before committing to a trade. Instead of scanning full charts or running separate analyses, you get an instant read on how volatile or risky an asset might be.

2.1.1. Definition & purpose

The Risks section summarizes critical market risk metrics in a single view, helping traders:

-

Gauge volatility and potential drawdowns quickly

-

Avoid overexposed or unstable assets during uncertain markets

-

Size positions appropriately based on risk tolerance

-

Maintain a balanced portfolio by diversifying across lower and higher risk assets

This is especially valuable in fast markets like crypto or high-beta stocks, where conditions can change within minutes.

2.1.2. Key metrics in the Risks section

Common indicators you’ll find in the Risks column include:

-

Volatility: The degree of price fluctuation, often measured as standard deviation.

-

Average True Range (ATR): Average range between daily highs and lows, showing short-term volatility.

-

Beta: Sensitivity of an asset’s movement compared to the market (Beta > 1 means higher volatility).

-

Maximum Drawdown: The largest historical peak-to-trough loss.

-

Value at Risk (VaR): Estimated maximum loss over a given period with a set confidence level.

-

Sharpe Ratio: Risk-adjusted return, where higher values indicate better performance relative to volatility.

2.1.3. Practical trading examples

-

In a volatile week, filter your watchlist for Beta < 1.2 and moderate ATR to avoid excessive swings.

-

Before market open, rank assets by lowest Maximum Drawdown to preserve capital during drawdowns.

-

Combine a low VaR reading with bullish technical signals for a balanced risk-reward trade setup.

By mastering the Risks section, you ensure that every trade decision is backed by objective risk datareducing the chance of emotional or impulsive moves.

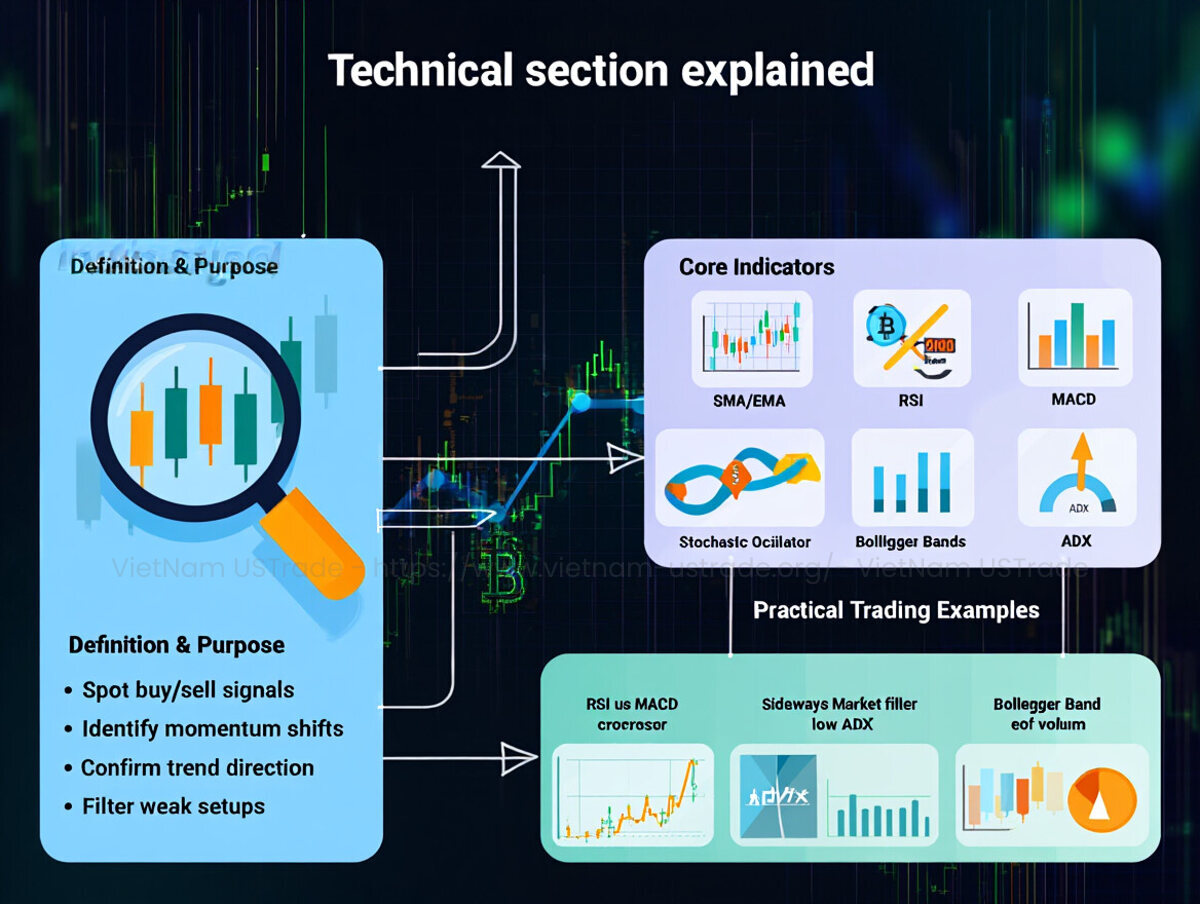

2.2. Technical section explained

Alongside the Risks column, the technical column in the risks and technical section of watchlist trading view understand delivers a quick, aggregated view of market signalsallowing traders to assess trend strength, momentum, and potential reversals without opening multiple charts.

2.2.1. Definition & purpose

The Technical section consolidates data from multiple indicators into a clear, visual summary. Traders use it to:

-

Identify assets with strong buy or sell signals

-

Spot early momentum shifts for entry or exit points

-

Confirm trend direction before placing a trade

-

Filter out assets with conflicting or weak technical setups

2.2.2. Core indicators in the Technical section

Typical metrics you’ll find include:

-

Moving Averages (SMA, EMA): Identify trend direction over specific periods.

-

Relative Strength Index (RSI): Measures momentum; above 70 is overbought, below 30 is oversold.

-

MACD (Moving Average Convergence Divergence): Detects trend changes and momentum shifts.

-

Stochastic Oscillator: Highlights overbought/oversold zones with higher sensitivity than RSI.

-

Bollinger Bands: Show volatility and potential breakout points.

-

ADX (Average Directional Index): Quantifies trend strength without indicating direction.

2.2.3. Practical trading examples

-

Use RSI + MACD crossover to confirm bullish or bearish momentum before entering.

-

In sideways markets, filter for assets with low ADX to avoid choppy price action.

-

Spot early breakout potential when price breaches Bollinger Bands alongside a strong volume spike.

By combining the Technical section’s fast-read signals with the objective numbers from the Risks section, you can create a disciplined, data-backed trading workflowreducing guesswork and improving consistency.

3. Combining risks & technicals for better trades

The true strength of the risks and technical section of watchlist trading view understand lies in using both columns together. While the Risks section ensures you avoid high-exposure setups, the Technical section guides you toward trades with favorable market momentum. This combination creates a balanced, data-driven approach that minimizes downside while maximizing upside potential.

3.1. Why integration matters

Relying solely on technical indicators can lead to overexposure in volatile assets, while focusing only on risk metrics may cause missed opportunities. Integrating both allows you to:

-

Identify assets with strong technical buy signals and controlled volatility

-

Avoid trades where positive technicals are overshadowed by excessive risk metrics

-

Fine-tune position sizing based on both risk tolerance and trend confidence

3.2. Practical filter combinations

-

Low Beta (<1.2) + RSI between 40–60: Targets assets in stable conditions with room for upward movement.

-

VaR below market average + MACD bullish crossover: Finds trades with low downside risk and positive momentum.

-

Moderate ATR + Strong Buy rating: Focuses on assets with predictable price swings and high technical confidence.

3.3. Workflow example

-

Sort your watchlist by VaR to isolate lower-risk assets.

-

Apply a secondary sort by Technical Rating to highlight those with strong momentum.

-

Cross-check for alignment between both columns before placing orders.

By consistently applying this dual-filter method, you reduce emotional decision-making, improve entry timing, and maintain a more resilient trading portfolio.

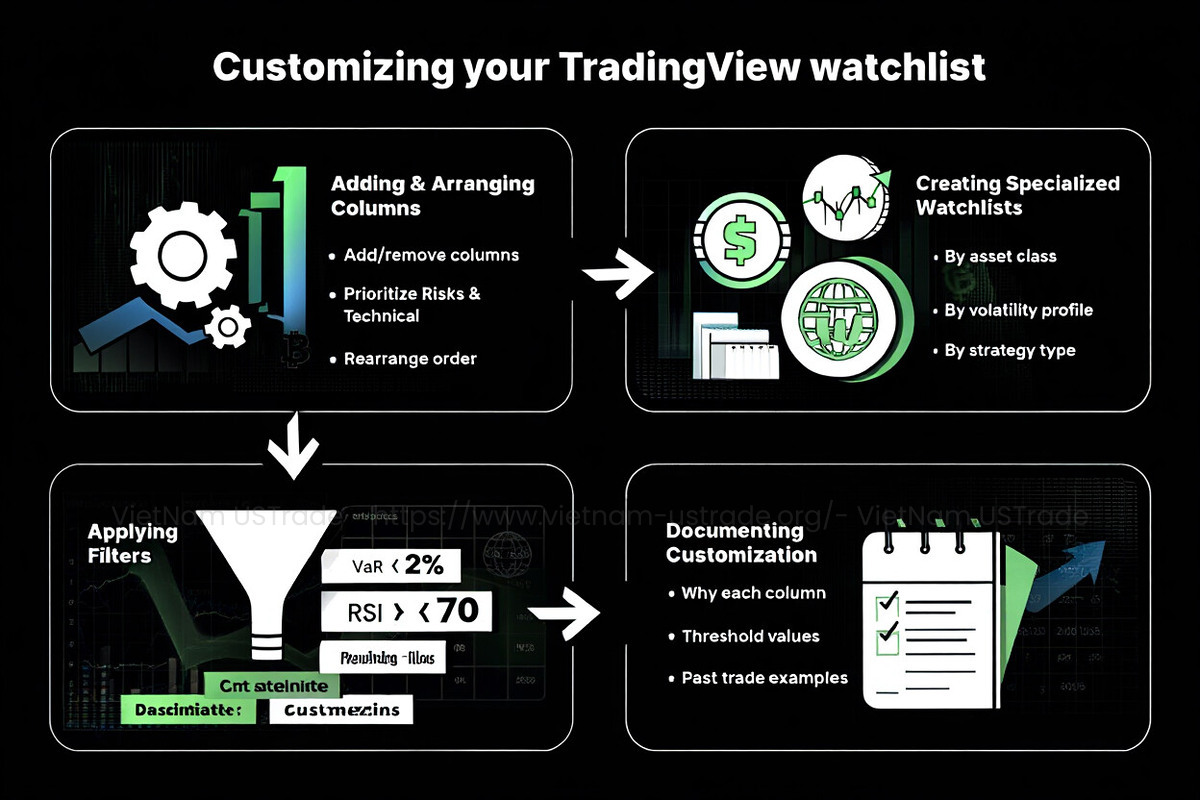

4. Customizing your TradingView watchlist

To maximize the value of the risks and technical section of watchlist trading view understand, you need to customize your TradingView watchlist so it matches your trading style and objectives. The more relevant and streamlined your watchlist is, the faster you can interpret signals and act with confidence.

4.1. Adding and arranging columns

-

Click the gear icon in the watchlist panel to add or remove columns.

-

Prioritize the Risks and Technical sections at the front for quick scanning.

-

Move less critical datalike 52-week highs/lows or dividend yieldstoward the end of your column list.

4.2. Creating specialized watchlists

-

By asset class: Separate watchlists for stocks, crypto, commodities, or forex.

-

By volatility profile: One watchlist for low-beta, stable assets and another for high-volatility opportunities.

-

By strategy type: Momentum trades, swing trades, dividend plays, etc.

4.3. Applying filters for faster decisions

-

Use TradingView’s column filter to instantly hide assets that don’t meet your criteria (e.g., VaR < 2%, RSI < 70).

-

Combine multiple filters to isolate trades with both low risk and strong technical momentum.

4.4. Document your customization logic

For better trading discipline and credibility, keep a written record of:

-

Why each column is included

-

Your threshold values for risk and technical metrics

-

Examples of past trades where the watchlist setup contributed to success

This not only helps you refine your process over time but also serves as a knowledge base if you collaborate with other traders or share insights publicly.

By tailoring your watchlist to highlight the Risks and Technical columns most relevant to your style, you turn TradingView from a simple monitoring tool into a decision-making powerhouse.

5. Pro tips & automation strategies

Once you’ve mastered the risks and technical section of watchlist trading view understand, the next step is to automate and refine your process so you can act faster and more consistently. Automation ensures you don’t miss critical opportunities or get caught in high-risk trades due to slow manual checks.

5.1. Setting alerts linked to Risks & Technicals

-

Risk-based alerts: Notify you if an asset’s Beta or VaR spikes above a set threshold.

-

Technical-based alerts: Trigger when RSI crosses key levels or when MACD signals a bullish/bearish shift.

-

Dual-condition alerts: Combine both risk and technical criteria (e.g., VaR < 2% and Technical rating = Strong Buy).

5.2. Using Pine Script for custom filters

-

Write scripts that flag assets matching your ideal risk/technical profile.

-

Example: Highlight all assets with Beta < 1.2, RSI between 40–60, and ADX > 25.

-

Save these scripts for recurring scans instead of rebuilding filters daily.

5.3. Integrating with external tools

-

Use TradingView’s API or third-party services to export watchlist data into Google Sheets or Excel for advanced modeling.

-

Create dashboards that visualize your portfolio’s overall risk profile alongside active technical signals.

5.4. Continuous optimization

-

Review your alert and filter results weekly to ensure they still align with your market outlook.

-

Adjust thresholds during high-volatility periods (e.g., earnings season, macroeconomic news).

-

Document changes and results to build a personal performance database.

Adjust thresholds during high-volatility periods (e.g., earnings season or how to use supply and demand zones when trading options).

By combining automation with a disciplined workflow, you turn the Risks and Technical sections into a 24/7 monitoring systemhelping you filter noise, focus on high-quality setups, and stay ahead in fast-moving markets.

Related reads to deepen your knowledge:

- Can You Sell Solana On Trustwaler In 2025

- how a layer foundation wallet large transfer to exchange deposit address affects crypto markets?

- Which crypto exchanges are legal in NY BitLicense, and why does it matter?

6. FAQs – Risks and technical section of watchlist TradingView understand

Below are the most common questions traders ask about the risks and technical section of watchlist trading view understand and how to use it effectively.

6.1. Can I customize which risk and technical stats are shown?

Yes. TradingView allows you to add, remove, and reorder both risk metrics and technical indicators. This means you can prioritize the columns most relevant to your strategy.

6.2. How often are risk metrics updated?

Most technical indicators update in real time, but some risk metrics like Beta or Sharpe Ratio may only refresh daily or weekly, depending on the asset class.

6.3. What does “N/A” mean in these columns?

It indicates that the data is either not applicable for that asset or not available for the selected timeframe.

6.4. How is the risk/reward ratio calculated?

It’s the ratio of expected profit to potential loss, typically based on your entry point, stop-loss, and take-profit levels.

6.5. Are the same metrics used for stocks, crypto, and forex?

Core indicators remain consistent across asset classes, but some risk calculations may adjust depending on market structure and volatility profiles.

7. Conclusion

Mastering the risks and technical section of watchlist trading view understand can transform the way you trade in 2025. When you harness the Risks column to safeguard your capital and the Technical column to spot high-potential opportunities, you’re no longer reacting to the market you’re proactively shaping your success.

Here’s your winning checklist:

-

Know how to set up and customize your TradingView watchlist

-

Read risk metrics like volatility, drawdown, and VaR with confidence

-

Interpret technical signals to capture trends and momentum shifts

-

Combine both sections for powerful, data-backed trade decisions

-

Automate alerts to stay ready for the right opportunity at the right time

By mastering this dual approach, you give yourself the clarity, confidence, and control every trader needs. Your watchlist becomes more than a monitoring toolit’s your personal command center for smarter, faster, and safer trading.

Ready to level up? Explore more strategies in the Trader & Trading section at Vietnam USTrade and start building the trading workflow that puts you in charge of your future.