Margin Trading is a term that is no longer unfamiliar to investors, especially stock investors. But it is also used in the field of cryptocurrency trading. Thanks to its profit-enhancing capabilities, Margin Trading has become more popular. Are you curious about what Margin Trading is? How does the trading process work, what are its pros and cons, and how should you engage in Margin Trading? The following article will help answer those questions.

What is Margin Trading?

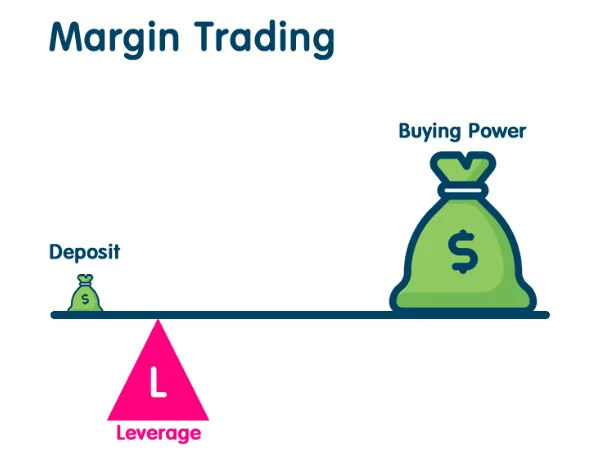

Margin Trading, also known as margin trading, is an activity utilizing leverage in investment. Previously, it was mainly used in stock investment. However, nowadays, it is also applied in cryptocurrency trading. Margin Trading helps you trade with a larger volume than your available capital. In other words, you borrow from the platform an amount of coin you lack to make an investment.

Easy-to-understand example of margin trading

To better understand Margin Trading, consider the following example:

Suppose, your initial capital is $10,000 to buy 1 BTC, and you use a 10x leverage, meaning you borrow $90,000 from the platform.

If the price of Bitcoin is $11,000, you close the buy order. This means you have sold 10 Bitcoin at $11,000 each, earning a revenue of $111,000.

You pay back the $90,000 you borrowed from the platform, leaving you with $21,000, which is a $21,000 profit compared to your initial capital.

However, if the Bitcoin price is $9,000, the platform will sell 10 BTC and collect $90,000, which you still owe. This results in a loss.

The margin trading process

To understand the trading process, follow the steps below, but first, you need to familiarize yourself with some terms related to Margin Trading:

Some terms related to margin trading

- Leverage: Using leverage to trade with an amount x times your available funds, where x is a non-negative integer.

Example: You have $1,000 but want to trade with $10,000, use 10x leverage.

- Position: In Margin Trading, there are two types of positions to consider: Long Position and Short Position.

- Long Position: It is a long or buy position. In a buy position, you use borrowed USD from the platform or your own USD to buy Bitcoin, waiting for the price to rise before selling for profit.

- Short Position: It is a short or sell position. In a sell position, you borrow coins from the platform or use your coins and sell them at the current price. If favorable, the Bitcoin price will decrease afterward, and you can buy back more coins with the USD you have, then return the borrowed coins to the platform.

- Liquidation Price: This is a specific price level set so that when the coin’s price reaches this point, the platform will immediately liquidate your coins.

Margin trading process

When you open a LONG/SHORT order with a leverage x and your capital y. Based on this, the platform will calculate the amount you want to borrow using the formula (x-1)*y and then execute the LONG/SHORT order. After closing the LONG/SHORT order (i.e., finishing the Buy/Sell order), you need to repay the borrowed amount plus a borrowing fee.

In case you opened a LONG/SHORT order but the actual market movement goes against your prediction. If the coin’s price reaches the liquidation price, the platform will immediately liquidate your coins.

Advantages and disadvantages of Margin Trading

Below is a list of some pros and cons of margin trading to help you consider and do so with minimized losses and maximized profits:

Advantages

- Increase trading capital: If your capital does not allow you to carry out desired trades, leverage can help you do that, and if successful, your profits can also significantly increase.

This type of trading is suitable for skilled and experienced traders who lack funds. Taking advantage of this trading form allows you to profit from small price increases rather than waiting for large price jumps.

- Earn profits during market downturns: Compared to traditional trading, where you only profit during market rises by selling high and buying low, if the market declines, you would not profit.

However, Margin Trading’s Short order can help you overcome this limitation.

Disadvantages

Margin trading can be a double-edged sword, capable of multiplying your profits but also your losses. If you predict correctly, your gains can be substantial, but wrong predictions and overly aggressive leverage can wipe you out entirely.

Margin Trading allows a certain loss threshold at the start of an order. Although you haven’t realized a loss because the position isn’t closed, if your calculated loss exceeds the permissible limit, your order will be liquidated immediately, leading to a significant loss. This early liquidation is often termed “account fire” by traders.

Some advice for using Margin Trading

- Only engage in Margin Trading if you have sufficient knowledge about it.

- If you are a beginner, choose a low leverage to avoid risks due to lack of experience and skills.

- When trading with Margin, do not keep the order open too long if you have achieved the desired profit level.

- Do not use borrowed funds from others to engage in Margin Trading, because if you “fire your account”, it will cause losses to both borrower and lender.

- Improve your judgment and market analysis skills.

- Try trading with a small capital to gain experience and see if you are suitable for this trading style.

Conclusion

The above article presented what Margin Trading is, how it works, its pros and cons, along with some tips for engaging in Margin Trading. Hopefully, this information has been helpful for your investment activities. Wishing you good luck and success in your endeavors.