What are Bitcoin Runes? They’re a fascinating new development in the world of Bitcoin! Bitcoin Runes are an innovative way to create and transfer tokens directly on the Bitcoin network. Designed to be faster and more efficient than older methods like Ordinals or BRC-20, they’re shaking things up in the crypto space.

Whether you’re a developer building projects, an investor looking for opportunities, or just someone curious about cryptocurrency, understanding how Bitcoin Runes differ from other token protocols is well worth your time. It’s a key to navigating the ever-evolving Bitcoin ecosystem.

In this post, we’ll break down what Bitcoin Runes are, compare them in detail to Ordinals and BRC-20, and offer some practical insights to help you decide what to do with these emerging asset standards on Bitcoin. Let’s dive in and explore what we can learn!

1. Overview of Bitcoin Runes, Ordinals, and BRC-20

Before diving into the specifics of Bitcoin Runes, it is essential to understand their position among other token standards that have shaped the Bitcoin ecosystem.

Short definitions and quick comparison

| Standard | Definition | Key Concept |

| Bitcoin Runes | A new fungible token protocol native to Bitcoin, designed to be efficient and scalable | Fungible tokens, UTXO-based |

| Ordinals | A method for numbering and inscribing data directly onto individual satoshis | Digital artifacts, NFTs |

| BRC-20 | A token standard leveraging Ordinals for creating fungible tokens via text inscriptions | Fungible tokens, text-based |

- Bitcoin Runes: This is a protocol that allows for the creation and transfer of fungible tokens natively on Bitcoin using UTXO (Unspent Transaction Output) architecture. It aims to solve many scalability and efficiency issues present in earlier approaches.

- Ordinals: Ordinals provide a way to assign serial numbers to satoshis (the smallest Bitcoin unit) and embed arbitrary data, thus enabling “inscriptions” such as NFTs and other digital artifacts directly on-chain.

- BRC-20: BRC-20 is an experimental token standard that uses Ordinals inscriptions to issue and transfer fungible tokens, but with notable limitations in efficiency and complexity.

2. What are Bitcoin Runes? A complete guide to the protocol

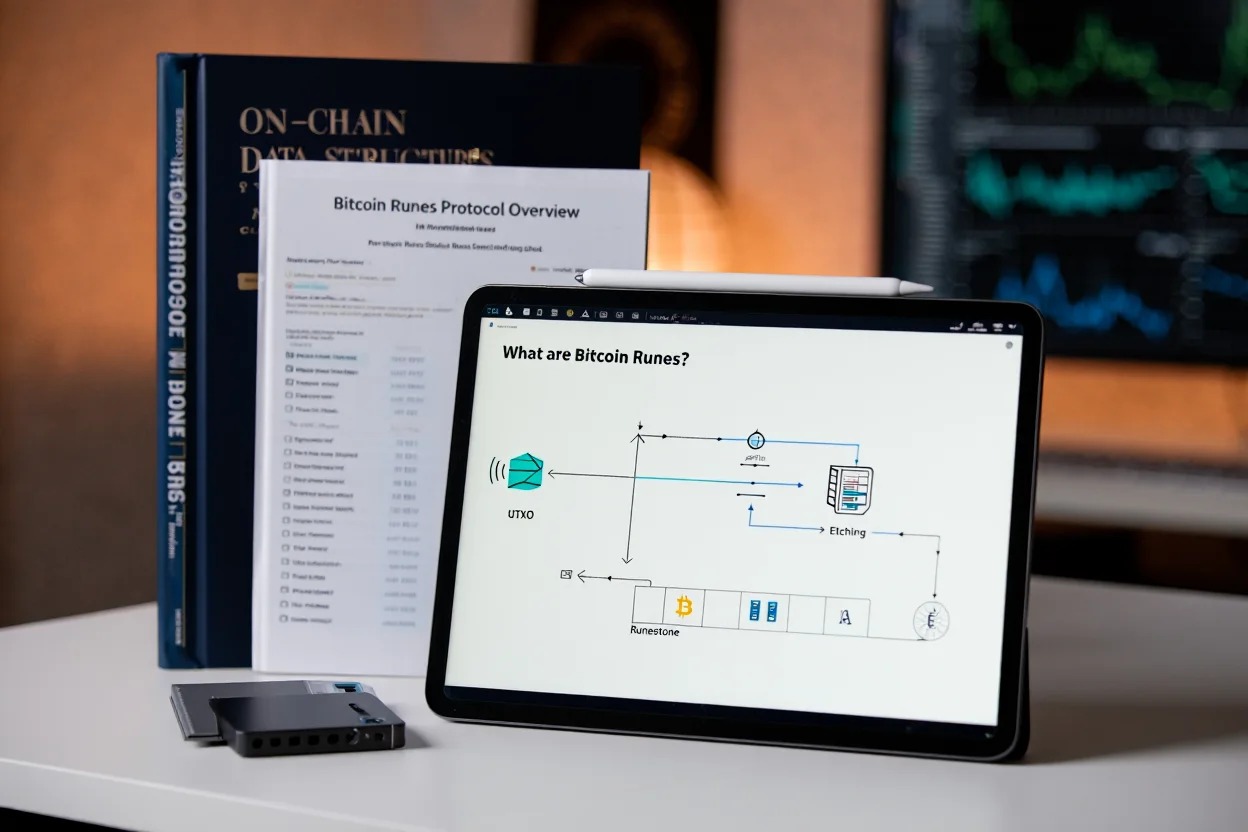

Bitcoin Runes is an innovative protocol designed to create and manage fungible tokens directly on the Bitcoin blockchain. Engineered for simplicity and efficiency, Runes leverage the UTXO model and the OP_RETURN opcode to streamline token handling.

Unlike other Bitcoin token standards, Runes operate independently of the Ordinals protocol, offering a promising and straightforward approach to token development on the Bitcoin network.

2.1. Origins and motivation

Bitcoin Runes were introduced in early 2024 by Casey Rodarmor, the same developer who created the Ordinals protocol. The idea behind Runes was to create a simple, scalable, and native method to launch fungible tokens on the Bitcoin blockchain.

This innovation was largely a response to the rapid growth and congestion caused by BRC-20 and Ordinals-based token solutions, which, while creative, strained Bitcoin’s transaction processing and made it expensive for ordinary users.

Key milestones:

- First proposed by Casey Rodarmor (creator of Ordinals).

- Launched in April 2024, coinciding with Bitcoin’s fourth halving event.

- Rapid adoption: Thousands of Runes tokens were minted within days of the launch.

2.2. How Bitcoin Runes work and technical highlights

Unlike BRC-20, which relies on text inscriptions, Bitcoin Runes leverage the Bitcoin UTXO model and encode data within the OP_RETURN field of a transaction. This approach offers significant benefits:

- Efficiency: By using UTXOs instead of arbitrary text data, Bitcoin Runes are less likely to bloat the blockchain and can be processed more efficiently.

- Security: Native compatibility with Bitcoin’s transaction logic means Runes are as secure as Bitcoin itself.

- Scalability: The design reduces network congestion and high fees that plagued previous standards.

Example:

When you mint a new Rune, you actually create a specific UTXO carrying the data about the token (name, supply, rules). Transactions with Runes work just like Bitcoin: you can send, receive, and split tokens without the need for sidechains or complex off-chain solutions.

In my experience as a blockchain researcher, the simplicity of UTXO-based assets is a game-changer. Managing assets in wallets and exchanges becomes more straightforward, reducing risks and potential bugs that were common in earlier token standards.

2.3. Main advantages and disadvantages

Advantages:

- Native integration with the Bitcoin blockchain.

- Lower transaction fees (in normal conditions).

- Easier for wallets and exchanges to support.

- Less prone to “spam” transactions than BRC-20 or complex Ordinals inscriptions.

Disadvantages:

- Still very new, with limited wallet and marketplace support compared to Ethereum-based tokens.

- Subject to the same limitations as Bitcoin itself (no smart contracts, limited programmability).

- Initial periods after launch saw high transaction fees due to hype and minting activity.

2.4. Practical applications and examples

Bitcoin Runes are quickly gaining traction across various use cases:

- Launching community tokens and memes (e.g., RSIC•GENESIS•RUNE, SATOSHI•NAKAMOTO).

- Experimenting with new forms of on-chain governance.

- Integrating fungible assets into Bitcoin-native games and platforms.

Table: Top Bitcoin Runes tokens by market cap (as of mid-2025)

| Token Name | Market Cap (USD) | Supply | Notable Use Case |

| RSIC•GENESIS•RUNE | $325,000,000+ | Variable | Early community token |

| SATOSHI•NAKAMOTO | $66,000,000 | 21,000,000 | Bitcoin meme & homage |

| DOG•RUNE | $40,000,000 | Variable | Meme token |

Runes are supported by several wallets and have begun appearing on marketplaces, though the ecosystem is still young and rapidly evolving.

View more:

- How to delete a EA account? 4 simple methods to remove EA from your platform

- What is Bitcoin trading for? Key purposes explained

- What is LetMeTrade? Comprehensive Knowledge about LetMeTrade A-Z

3. Comparing Bitcoin Runes, Ordinals, and BRC-20 – What’s the real difference?

With multiple standards in play, a clear comparison is vital to understand which solution is best for different needs. Let’s break down their differences across several key aspects.

3.1. Detailed comparison table

| Criteria | Bitcoin Runes | Ordinals | BRC-20 |

| Core Purpose | Fungible token creation on Bitcoin | Data inscription, NFTs | Fungible tokens (experimental) |

| Data Storage | UTXO, OP_RETURN | Inscriptions on satoshis | Text inscriptions on satoshis |

| Efficiency | High | Moderate | Low |

| Fees | Lower (post-hype) | Variable | High during hype |

| Ecosystem Support | Growing (new wallets, some exchanges) | Broad for NFTs, artifacts | Limited, experimental |

| Flexibility | Limited (no smart contracts) | Flexible for NFTs | Limited |

| Security | Bitcoin-native, high | High | High, but complex |

3.2. Strengths and weaknesses of each token standard

Bitcoin Runes:

- Strengths: Native to Bitcoin, simple, lower fees, scalable, easier for wallets.

- Weaknesses: Less flexible than smart contract chains, very new, limited ecosystem.

Ordinals:

- Strengths: Enables unique digital artifacts and NFTs directly on Bitcoin, and creative uses.

- Weaknesses: Higher fees, potential for blockchain bloat, less efficient for fungible tokens.

BRC-20:

- Strengths: First attempt at fungible tokens on Bitcoin using Ordinals.

- Weaknesses: Not scalable, high fees, complex, and experimental.

As someone who has closely followed the evolution of token standards, I believe Bitcoin Runes offer the most practical path forward for those wanting fungible assets on Bitcoin without the operational headaches of older models.

3.3. When should you choose Bitcoin Runes?

You should consider Bitcoin Runes if:

- You want to launch or hold fungible tokens natively on Bitcoin.

- You value efficiency and lower transaction fees.

- You prefer a solution with growing support and future-proof design.

You should NOT choose Bitcoin Runes if:

- You require smart contract flexibility.

- You are mainly interested in unique, non-fungible assets (NFTs).

- You want broad exchange and wallet support immediately.

Always assess your needs and risk tolerance, especially as the Runes ecosystem matures.

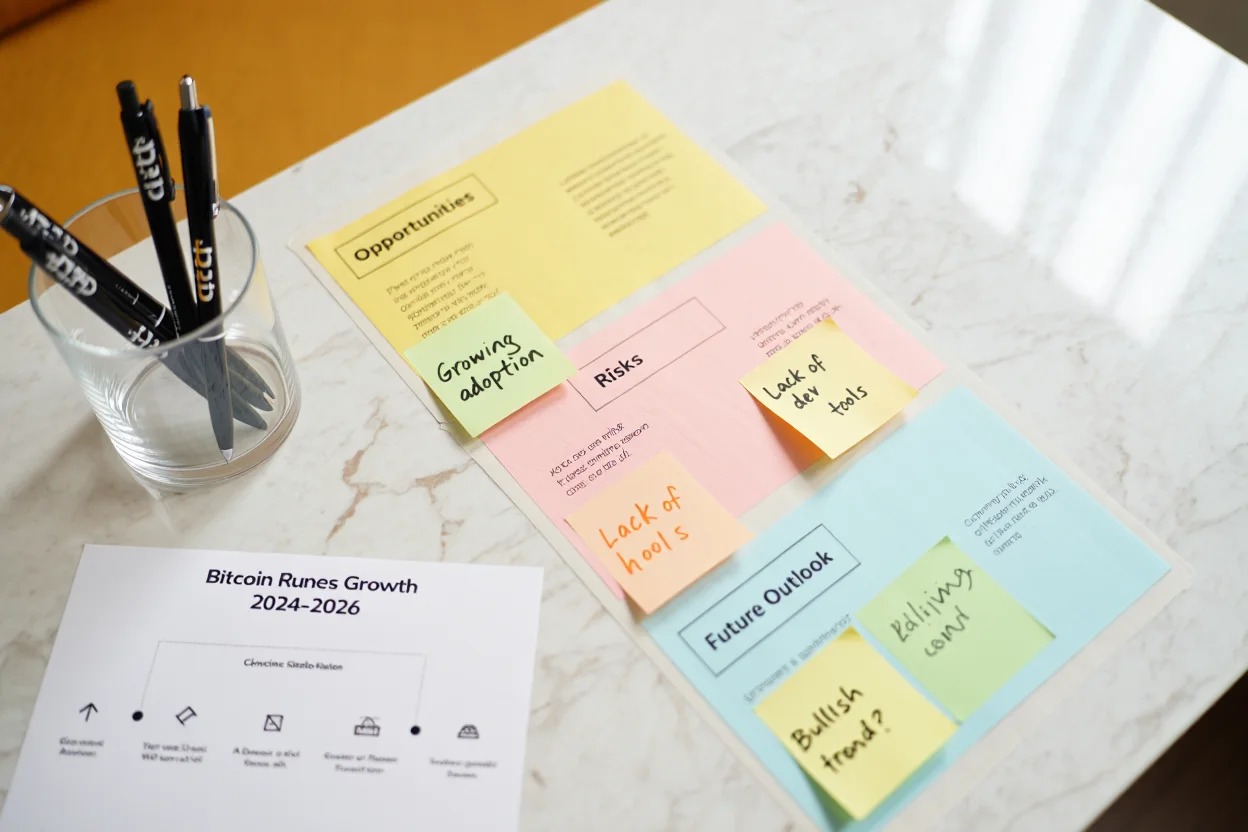

4. Opportunities, risks, and future outlook of Bitcoin Runes

Understanding what are bitcoin runes also means looking at the opportunities they create, the risks involved, and what experts foresee for their future in the Bitcoin ecosystem.

4.1. Opportunities in the Bitcoin ecosystem

Bitcoin Runes expand Bitcoin’s use beyond store of value by enabling fungible tokens natively. This allows developers to create community tokens, game currencies, and governance tokens directly on Bitcoin, attracting users who favor more flexible blockchains like Ethereum.

Some of the key opportunities include:

- New financial products: Tokens for DeFi-like applications without leaving Bitcoin.

- Community building: Issuing tokens to incentivize participation and governance.

- Gaming and NFTs: Integrating fungible and non-fungible assets seamlessly.

- Lower costs: Reduced transaction fees compared to previous token standards on Bitcoin.

Opportunities, risks, and future outlook of Bitcoin Runes

4.2. Risks to consider

While promising, Bitcoin Runes come with risks:

- Network congestion: Early adoption phases saw spikes in transaction fees due to high minting activity.

- Ecosystem immaturity: Wallet and marketplace support are still limited.

- Scams and spam tokens: As with any new token standard, risks of worthless or fraudulent tokens exist.

- Technical limitations: Bitcoin’s lack of smart contracts means Runes are less flexible than Ethereum tokens.

Users should always conduct thorough research, use trusted wallets, and be cautious with new projects.

4.3. Expert opinions and future outlook

Many experts see Bitcoin Runes as a natural step in Bitcoin tokenization. Its efficient design solves issues of earlier standards, offering better scalability and usability. With growing ecosystem support, Runes may become the preferred method for creating fungible tokens on Bitcoin, driving new innovations.

5. Basic guide to getting started with Bitcoin Runes

To join the Bitcoin Runes ecosystem, you need to know the essential steps to mint, buy, and manage these tokens. This section will guide you through the basics, including required tools and trusted platforms for a smooth start.

5.1. Requirements for participation

To interact with Bitcoin Runes, users typically need:

- A Bitcoin wallet that supports Runes (e.g., Xverse, Hiro Wallet).

- Some BTC to pay for transaction fees.

- Basic understanding of Bitcoin transactions.

5.2. Steps to mint, buy, and sell Bitcoin Runes tokens

Here is a simplified checklist:

- Choose a compatible wallet and set it up.

- Acquire some BTC in the wallet to cover fees.

- Use a platform or wallet feature to mint or buy Runes tokens.

- Transfer or sell Runes tokens through supported marketplaces or peer-to-peer.

- Monitor transactions via block explorers supporting Runes.

5.3. Notable wallets and marketplaces

| Wallet | Features | Notes |

| Xverse | Supports minting and transfers | User-friendly interface |

| Hiro Wallet | Early supporter of Runes | Integrates with Bitcoin apps |

| Marketplace A | Listing of popular Runes | Emerging ecosystem |

5.4. Tips for safe participation

- Always verify the authenticity of tokens before purchasing.

- Avoid sharing private keys or seed phrases.

- Keep wallets and software up to date.

- Follow official announcements and updates from trusted sources.

Related reads to deepen your understanding of Bitcoin:

6. Frequently asked questions (FAQ) about Bitcoin Runes

6.1 What are Bitcoin Runes explained, and how are they different from Ordinals?

Bitcoin Runes are a fungible token standard native to Bitcoin, while Ordinals focus on unique, non-fungible inscriptions on individual satoshis.

6.2 Can I mint my own Bitcoin Runes tokens?

Yes, using supported wallets and platforms, you can create your own Runes tokens.

6.3 What are the risks of using Bitcoin Runes?

Risks include high transaction fees during congestion, scams, and limited ecosystem maturity.

6.4 Which wallets support Bitcoin Runes?

Popular wallets such as Xverse and Hiro Wallet currently support Runes.

6.5 Is Bitcoin Runes adoption growing?

Yes, adoption is rapidly increasing with new tokens and projects emerging regularly.

7. Conclusion

In this article, we have explored what are bitcoin runes, how they differ from Ordinals and BRC-20 tokens, and the opportunities and risks involved in using this innovative token standard. We also covered a practical guide to getting started with Bitcoin Runes, helping you take the first steps confidently.

Here’s a quick check list of the key points to remember:

- Bitcoin Runes allow you to create fungible tokens directly on the Bitcoin blockchain in a natural and efficient way.

- They stand out from Ordinals and BRC-20 due to their design, scalability, and ecosystem support.

- Despite being promising, there are risks like network congestion and limited wallet support.

- To get started, you’ll need a compatible wallet and some BTC to cover transaction fees.

Don’t forget to follow the Bitcoin section on Vietnam-ustrade to stay updated with the latest news and expert insights in the world of Bitcoin and crypto assets.

Are you ready to explore Bitcoin Runes? Share your thoughts in the comments!