Bitcoin has become one of the most talked-about innovations in modern finance, sparking curiosity among investors and traders worldwide. If you’re wondering what are the advantages of Bitcoins and why this digital currency continues to gain popularity, it’s essential to explore its unique benefits and how it differs from traditional financial systems. Understanding these advantages will help you make informed decisions about whether Bitcoin fits into your financial plans.

1. Why people are talking about Bitcoin

Bitcoin is no longer just a buzzword on financial news or a mysterious asset discussed among tech enthusiasts. It has become a central topic in the global conversation about the future of money and digital finance. As more individuals and institutions look for alternatives to traditional financial systems, Bitcoin continues to rise as a symbol of innovation, independence, and financial inclusion.

One of the main reasons Bitcoin is attracting attention is its ability to operate outside of government control and banking institutions. In countries with inflation, capital controls, or limited banking access, Bitcoin offers an open, decentralized financial option. Even in stable economies, people are drawn to its potential for long-term gains and transparent technology.

Moreover, the underlying blockchain technology is being applied across industries, from logistics to healthcare. But Bitcoin, as the first successful use of blockchain in digital currency, remains the most prominent use case earning it the title of “digital gold” in many investment circles.

Whether you’re a beginner curious about cryptocurrencies or a forex enthusiast exploring broader financial tools, understanding why Bitcoin matters is the first step toward making informed decisions in today’s evolving economy.

2. What are the advantages of Bitcoins?

Bitcoin brings a new financial model one that challenges traditional banking systems and fiat currencies. Its advantages go beyond simple speculation. From self-custody to censorship resistance, Bitcoin offers meaningful benefits for individuals, especially those seeking control, transparency, and access in a decentralized world.

Let’s explore 10 major advantages of Bitcoins that have made it one of the most talked-about innovations in modern finance.

2.1. Full control over your money – be your own bank

With Bitcoin, you are in full control of your assets. There is no need for a third-party bank or institution to manage your funds. As long as you hold your private keys, only you can access and transfer your Bitcoins. This is particularly valuable in regions with weak banking infrastructure or strict capital controls.

Unlike traditional banks, which can freeze accounts or delay transactions, Bitcoin puts power back into the hands of individuals.

2.2. Security and privacy by design

Bitcoin uses advanced cryptographic techniques to secure transactions and protect users. No personal information is required to send or receive BTC. Instead, users transact using wallet addresses, which can be changed or created as needed to maintain privacy.

This privacy-centric model helps reduce the risk of identity theft an increasing concern in today’s digital world.

2.3. Resistance to censorship and seizure

Thanks to its decentralized nature, Bitcoin is nearly impossible for governments or institutions to shut down or seize. No central authority can block your transaction or freeze your funds. As long as you have internet access and your wallet, you can send or receive Bitcoins from anywhere.

This feature is especially powerful in oppressive regimes or situations where freedom of transaction is restricted.

2.4. Global accessibility – just an internet connection needed

Bitcoin is borderless. Anyone with a smartphone or computer and an internet connection can participate in the Bitcoin economy. You don’t need a bank account, credit history, or government ID.

This inclusivity empowers the unbanked over 1.4 billion people globally to gain access to the digital economy and financial tools previously out of reach.

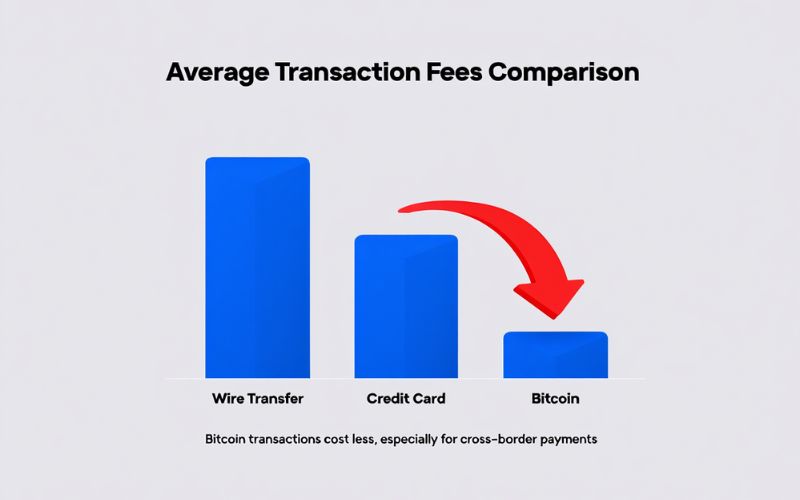

2.5. Low transaction fees compared to traditional systems

Traditional banking systems and payment processors often charge high fees, especially for international transfers. Bitcoin transactions, in contrast, usually cost far less even for cross-border payments.

While fees can vary depending on network congestion, they are still significantly cheaper than wire transfers or credit card processing.

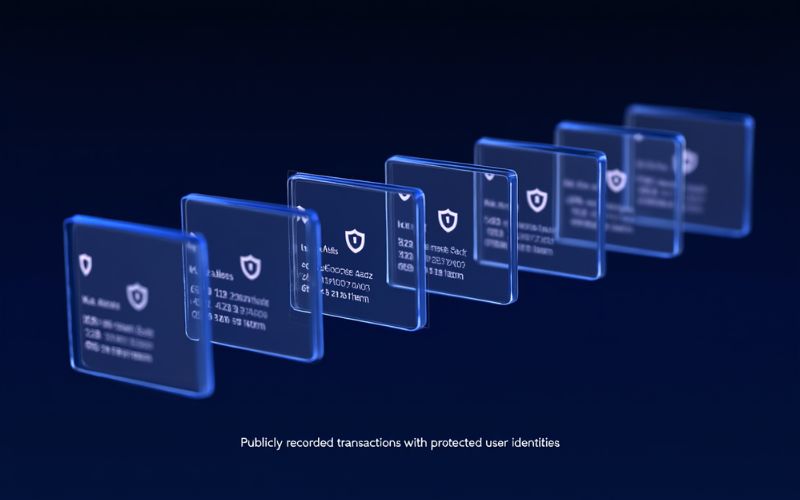

2.6. Transparency with privacy – blockchain advantage

Every Bitcoin transaction is publicly recorded on the blockchain, providing a transparent and immutable history. However, this does not compromise user privacy. Wallet addresses are pseudonymous, and no names or personal identifiers are attached.

This balance of transparency and anonymity gives users confidence while preserving individual rights.

2.7. Limited supply = scarcity and potential store of value

Bitcoin has a hard cap of 21 million coins. This limited supply makes it a scarce digital asset similar to gold and a potential hedge against inflation. Unlike fiat currencies, which can be printed at will, Bitcoin’s predictable issuance schedule makes it appealing to long-term investors.

Many view Bitcoin as a modern store of value, particularly in times of economic uncertainty.

2.8. High potential for long-term returns

Bitcoin has consistently outperformed other asset classes over the past decade. Early adopters have seen exponential gains, and despite short-term volatility, the overall trend has been upward.

While past performance doesn’t guarantee future results, the long-term outlook for Bitcoin remains optimistic among many financial analysts and institutions.

2.9. No chargebacks – finality of transactions

Once a Bitcoin transaction is confirmed, it cannot be reversed. This “push” model protects sellers from chargeback fraud a common issue with credit cards and online payments.

This is particularly useful for merchants operating in high-risk regions or industries, offering added security and peace of mind.

2.10. A gateway to the future of finance

Bitcoin is more than just a currency. It’s an entry point into the broader world of decentralized finance (DeFi), smart contracts, and digital asset innovation. Holding or using Bitcoin often leads users to discover other blockchain applications building financial literacy and participation in the digital future.

See more related articles:

- How Bitcoin Works for Beginners: A Simple Explanation for Everyone

- What Is 1 Bitcoin Worth? A Beginner’s Guide to Bitcoin Value

- What is the Bitcoin halving? Why it matters for investors and the next predicted event

3. Comparing Bitcoin with traditional cash

As more people explore digital assets, a common question arises: how does Bitcoin compare to traditional cash? While both function as mediums of exchange, their characteristics, strengths, and limitations are vastly different. Understanding these differences can help beginners see why Bitcoin is considered revolutionary by many investors and economists.

Below is a side-by-side comparison of key features:

| Feature | Bitcoin | Traditional Cash (Fiat) |

| Supply Limit | Capped at 21 million BTC | Unlimited – central banks can print more |

| Control & Custody | Controlled by the individual (if self-custodied) | Held and controlled by banks or government |

| Censorship Resistance | Cannot be frozen or blocked by authorities | Can be seized or restricted by institutions |

| Transaction Reversibility | Irreversible – no chargebacks | Reversible (e.g., bank chargebacks, fraud claims) |

| Privacy | Pseudonymous – no personal data required | Linked to identity through bank notes, cards |

| Global Accessibility | Available worldwide with internet access | Limited by borders and currency compatibility |

| Transaction Fees | Generally low, especially cross-border | High fees for international transfers or cash handling |

| Security | Protected via cryptography and private keys | Susceptible to theft, forgery, or loss |

| Transparency | Public ledger (blockchain) visible to all | Transactions are private but untraceable |

| Inflation Risk | Low, fixed supply | High, due to money printing and fiscal policy shifts |

Bitcoin isn’t here to immediately replace cash. Instead, it offers a parallel financial system with unique advantages particularly in digital commerce, global payments, and long-term wealth preservation.

While fiat currencies are deeply integrated into everyday life and supported by government structures, Bitcoin presents an open alternative for those seeking control, security, and financial innovation.

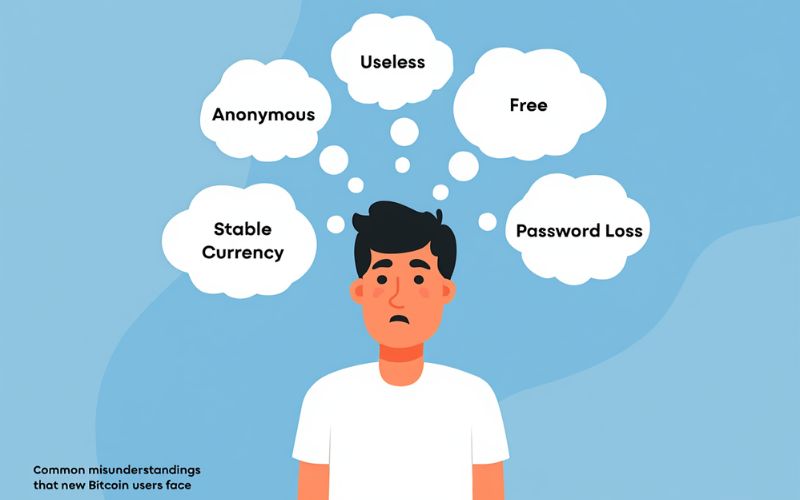

4. Common misconceptions about Bitcoin advantages

Despite Bitcoin’s growing popularity, many myths and misunderstandings still surround it especially among beginners. These misconceptions often prevent people from seeing the real value Bitcoin can offer. Let’s clarify some of the most common myths related to Bitcoin’s advantages.

4.1. “Bitcoin is completely anonymous”

While Bitcoin provides privacy through pseudonymous wallet addresses, it is not fully anonymous. All transactions are permanently recorded on a public blockchain. If a wallet address is ever linked to your identity (e.g., through a centralized exchange), your transaction history could be traced.

→ Truth: Bitcoin offers privacy, not full anonymity. Advanced users can enhance privacy with coin mixing or privacy-focused wallets, but it’s not built-in by default.

4.2. “Bitcoin has no real use, it’s just speculative”

It’s true that many people buy Bitcoin for investment purposes, but its utility goes beyond speculation. Bitcoin is used globally for remittances, online purchases, donations, and as a store of value in inflation-prone economies. It also enables cross-border payments that are faster and cheaper than traditional banking systems.

→ Truth: Bitcoin is not just a trading asset; it’s a functioning payment and savings tool.

4.3. “Bitcoin transactions are free”

While fees are often much lower than with banks or PayPal, Bitcoin transactions aren’t always free. Network fees are required to incentivize miners to confirm transactions, and these fees vary depending on blockchain activity.

→ Truth: Fees are typically low, but not zero. Users can choose to pay higher fees for faster confirmation.

4.4. “Bitcoin is useless in countries with stable currencies”

Many assume Bitcoin is only useful in places with economic instability. However, its advantages such as low fees, borderless payments, and long-term wealth protection apply everywhere. In developed economies, Bitcoin also offers an investment hedge against future uncertainty.

→ Truth: Bitcoin’s value extends beyond crisis situations it’s a tool for financial empowerment globally.

4.5. “You can lose all your Bitcoin if you forget your password”

While it’s true that losing your private key or seed phrase means losing access to your coins, this is no different from losing access to your cash or valuables. Tools like hardware wallets, backup systems, and multisig setups exist to protect against such risks.

→ Truth: With proper self-custody practices, managing Bitcoin securely is entirely achievable.

Read more:

- What is Bitcoins potential over the next decade? Stay ahead to succeed

- What is Bitcoin’s highest price? Full history explained

5. Final thoughts – Is Bitcoin right for you?

Bitcoin is more than just a digital asset it offers a new financial model with many important advantages. If you’re asking what are the advantages of Bitcoins and whether you should consider including Bitcoin in your investment or financial toolkit, it’s crucial to understand its key benefits.

Bitcoin puts users in full control of their funds without relying on banks or intermediaries, secures transactions through advanced cryptography, and ensures transparency via blockchain technology. Additionally, Bitcoin protects against censorship and account freezes while enabling fast, low-cost global transactions compared to traditional financial systems.

However, like any financial instrument, Bitcoin comes with its own risks and may not suit everyone, especially those unprepared for its volatility or lacking sufficient knowledge. Knowing what are the advantages of Bitcoins can help you make informed decisions and adopt strategies aligned with your financial goals.

Vietnam – US Trade is dedicated to sharing comprehensive knowledge, tools, and strategies to help you confidently navigate the evolving world of digital finance.

Follow us to learn more valuable insights and stay updated with the latest knowledge on Bitcoin, trading strategies, and financial innovation!