Curious about what date is Bitcoin halving and why it’s such a big deal? This pivotal event, scheduled for 2028, isn’t just another date on the crypto calendar it could reshape the entire Bitcoin market.

Whether you’re a seasoned investor or new to crypto, understanding halving cycles can give you a serious edge. In this guide, backed by expert insights and historical analysis, you’ll learn everything you need to prepare, position your portfolio, and seize potential opportunities. Let’s explore what makes Bitcoin halving such a game changer and how you can benefit from it.

1. What is Bitcoin Halving and why does it matter?

If you’re researching what date is Bitcoin halving, understanding what halving actually is and why it matters is the foundation of any smart investment decision. Bitcoin halving isn’t just a technical adjustment; it’s a cornerstone of Bitcoin’s design that directly influences price, scarcity, and long term value.

1.1 A simple look at block reward reduction

At the heart of each halving is a built in rule: every 210,000 blocks, the reward miners earn is slashed by 50%. The most recent halving in 2024 reduced the reward from 6.25 BTC to just 3.125 BTC per block, instantly cutting new supply and amplifying Bitcoin’s scarcity.

1.2 Halving powers Bitcoin’s fixed monetary policy

This event enforces Bitcoin’s strict supply cap of 21 million coins, making it immune to inflationary pressure. Think of halving as a scheduled tightening of Bitcoin’s “money printer,” reinforcing its role as digital gold. According to Andreas M. Antonopoulos, a respected Bitcoin educator, “Halvings are fundamental to Bitcoin’s credibility as a scarce asset.”

1.3 Why it moves the market

Each halving reduces the flow of new coins, which, if demand holds or grows, increases scarcity and historically, drives major bull runs. It’s no coincidence that Bitcoin’s biggest price surges have followed halving cycles.

Investor Tip: Use this knowledge to plan ahead. Don’t wait until the headlines hit position yourself before the momentum starts.

Bitcoin halving cuts block rewards, reduces new supply, and strengthens Bitcoin’s long term scarcity. For investors wondering what date is Bitcoin halving, this event is more than a calendar marker it’s a profit driving catalyst. Now is the time to understand it, track it, and get ready to act.

2. What is the exact Date of the next Bitcoin Halving?

If you’ve been researching what date is Bitcoin halving, you’re already ahead of the curve. Timing this pivotal event could give you a major edge in the market. For investors and traders alike, knowing when halving hits can be the difference between watching from the sidelines and capitalizing on one of Bitcoin’s most critical turning points.

2.1 Estimated date and block height

As of current projections, the next Bitcoin halving will occur around April 18, 2028, when the network reaches block 1,050,000. This timeline is based on Bitcoin’s average block production rate of one block every 10 minutes. Since mining speed varies slightly due to network factors, this estimate can change.

“Bitcoin halving is like a market reset a countdown to scarcity. Investors who track it closely are better positioned to act smartly,” says Philip Gradwell, former Chief Economist at Chainalysis.

This quote underlines the importance of planning your investment moves early. If you want to profit from the next halving cycle, now is the time to start preparing.

2.2 Why the Halving Date isn’t fixed on a calendar

You won’t find Bitcoin halving on a calendar like a central bank meeting or earnings release. Instead, it’s coded into the protocol every 210,000 blocks, the mining reward is cut in half. This math based system makes Bitcoin halving transparent, predictable, and uniquely decentralized.

This means the community must remain proactive. Real time trackers like NiceHash or Bitbo are essential tools for staying informed on block progress and anticipating the next halving window.

2.3 How Halving is calculated based on block production speed

Here’s how it works: one Bitcoin block is produced every 10 minutes on average. That adds up to roughly 144 blocks per day, and about 1,458 days (just under four years) between halvings. However, changes in mining difficulty and global hash rate can alter the pace.

As more miners join the network or mining hardware improves, blocks may be solved more quickly, pulling the halving date slightly earlier. Conversely, if mining slows down, the date can shift later.

The next Bitcoin halving is projected around April 2028 at block 1,050,000. Since it’s driven by block production and not the calendar, investors must actively monitor halving progress using trusted tools. If you’re serious about gaining an edge in the crypto market, start positioning yourself now by understanding what date is the bitcoin halving and how it impacts future prices.

View more:

- How can I find lost Bitcoins? Simple guide for beginners

- What network is Bitcoin on? A deep dive into Bitcoin’s network in 2025

- How do i buy bitcoins with a credit card

3. Historical Bitcoin Halving events and their market impact

Wondering why so many investors are closely tracking what date is Bitcoin halving? A look into Bitcoin’s halving history reveals powerful insights. Past halving events have repeatedly sparked massive bull runs, shaping long-term investor strategies. Understanding these milestones isn’t just fascinating it’s essential if you want to make smart moves ahead of the next halving.

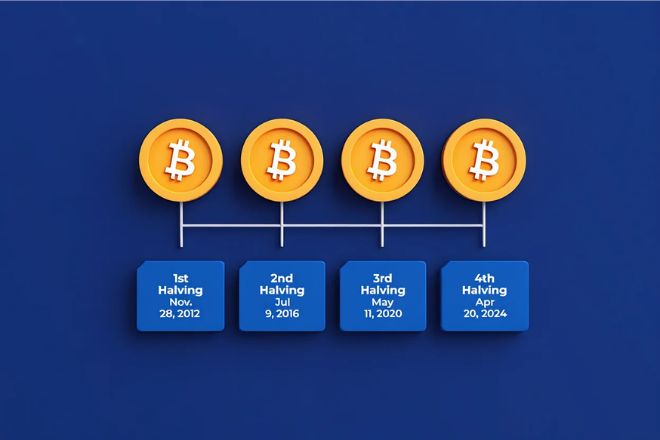

3.1 Highlights from 2012, 2016, 2020, and 2024

- 2012: Bitcoin jumped from just $12 to over $1,000 within a year of the first halving.

- 2016: BTC surged from around $650 to nearly $20,000 by the end of 2017.

- 2020: Post-halving, Bitcoin skyrocketed from $8,000 to over $60,000 in 2021.

- 2024: Still unfolding, but many market analysts and seasoned investors are forecasting a similar post-halving boom.

3.2 Price trends and timing after each Halving

One consistent trend? Bitcoin’s price usually experiences a significant rally within 12 to 18 months after each halving. But it doesn’t happen overnight. There’s typically a cool-down period where the market digests the supply shock before prices take off.

3.3 Key investment lessons from Halving History

Patience is often rewarded. Historical data suggests that holding Bitcoin before and after halving events can yield substantial long term returns. According to crypto research firm Delphi Digital, “Halvings compress supply growth at a time when long-term holders accumulate a perfect storm for price expansion.”

Investor Tip: Don’t try to time the top. Instead, study the past to understand the timing of accumulation and distribution phases around halving cycles.

Looking at historical Bitcoin halvings, one thing is clear they’ve consistently triggered powerful bull markets. For those wondering what date is the bitcoin halving, this isn’t just trivia. It’s a signal to prepare, position, and profit. Use history as your guide and start building your long-term strategy today.

4. The impact of Bitcoin Halving on price performance: What the Data really shows

The next Bitcoin halving isn’t just a technical milestone it’s a powerful market catalyst. For those tracking what date is Bitcoin halving, this moment can shape the next major price cycle.

As supply tightens and demand builds, traders and long term investors alike need to understand how price patterns behave before and after halvings. Backed by expert analysis and historical data, this section provides the insights you need to prepare and position with confidence.

4.1 Does the price always rise after a Halving?

Not always at least not immediately. While long term trends suggest that Bitcoin typically enters a bullish cycle after a halving, short term volatility is the norm. Prices can drop or stagnate in the weeks following the event before eventually gaining upward momentum. For example, after the 2016 halving, BTC dipped slightly before launching into a historic rally a few months later.

4.2 In depth price trends before and after each Bitcoin Halving

According to blockchain analytics firm Glassnode, Bitcoin has historically surged over 1,200% within 12 months after each previous halving. These numbers aren’t guaranteed, but they show a powerful correlation between Bitcoin’s programmed supply shock and long-term price appreciation. The pattern: reduced supply, sustained demand, upward trend.

4.3 Expert forecasts for the upcoming Halving

“Halving will tighten supply at a time when demand is likely to rise,” explains Willy Woo, respected on chain analyst. “This sets the stage for another explosive cycle.”

Analysts from ARK Invest and Fidelity Digital Assets echo this sentiment, noting that institutional demand has grown significantly since 2020 potentially amplifying the impact of the next halving.

Pro Tip: Stay focused on the big picture. Use reliable data sources like Glassnode, Messari, or Coin Metrics to monitor on chain trends, and develop a long-term mindset.

Bitcoin halving events don’t cause instant price explosions but they often light the fuse. If you’re asking what date is Bitcoin halving, don’t stop there. Use that information as a launchpad for deeper market analysis and strategic positioning.

5. Strategic Bitcoin buying: Before or after the Halving?

Timing your investment around what date is Bitcoin halving can be a game changing move if approached with the right strategy. Understanding how previous cycles behaved and aligning your actions with proven methods is crucial to success.

5.1 Trading strategies based on the Halving cycle

Experienced investors often enter the market months ahead of the halving in anticipation of a post event rally. Some choose to lock in profits early, while others ride out the full bull run. Long term holders, or HODLers, typically view halving events as long term catalysts for growth.

5.2 Evaluating risks and opportunities

While halvings historically precede bull markets, they’re also surrounded by heightened volatility and emotional trading. Short term price swings can test even seasoned traders. Applying strict risk management techniques, like using stop loss orders or setting position sizes, is essential.

5.3 Investment tips for beginners

If you’re new to Bitcoin investing, here’s how to prepare effectively for the upcoming halving:

- Use Dollar Cost Averaging (DCA): Invest a fixed amount regularly, regardless of price. This helps reduce timing risk.

- Plan Exit Points: Define your profit taking and stop loss levels in advance.

- Avoid Emotional Decisions: Don’t FOMO in when prices surge. Stick to your strategy.

Expert Insight: According to CoinShares research, “Investors who apply long term strategies during halving periods consistently outperform short term speculators.”

Whether you invest before or after the halving, your success hinges on having a plan. Understand what date is Bitcoin halving, stay disciplined, and follow proven strategies to reduce risk and maximize gains.

View more:

- How many bitcoins have been lost

- How does ethereum relate to bitcoin

- How can i sell my bitcoins for cash

6. Preparing for the next Bitcoin Halving

Knowing what date is Bitcoin halving is only the first step the real edge comes from how well you prepare. Successful investors don’t just react to halving events; they plan ahead using data, tools, and proven strategies. As the next halving approaches, now’s the time to get organized and align your actions with your financial goals.

6.1 Countdown tools and reliable racking Websites

To stay up to date, use trusted sources that track the halving in real time.

Recommended tools include:

- BitcoinHalving.com Live countdown and block tracking.

- Binance Academy Educational content with forecasts and expert insights.

- Glassnode On-chain analytics for timing market sentiment shifts.

These platforms can help you anticipate when the next block reward reduction will occur and adjust your strategy before the market reacts.

6.2 Using Halving as part of your investment plan

Whether you’re a long term investor or a short term trader, Bitcoin halving events are more than just technical milestones they’re strategic opportunities to reassess your entire investment plan.

Seasoned investors often use the halving period to:

Reevaluate crypto portfolio allocations

Example: If you’re holding 70% BTC and 30% altcoins, you might consider increasing your BTC exposure before the halving to capture potential post-halving upside.

Identify new entry points with managed risk: Halvings are often followed by high volatility. Traders may choose to enter during a pre halving dip or wait for a post-halving confirmation signal before positioning.

Hedge against market volatility: Use tools like stop loss orders, stablecoin hedging, or reallocating to lower-risk assets as ways to protect your capital during hype driven moves.

Example: An investor starts accumulating BTC 3-6 months before the halving, using a Dollar Cost Averaging (DCA) strategy to lower entry risk. After the halving, they take profits gradually during price rallies.

6.3 Key reminders for Traders during Halving season

The period surrounding the halving often sees increased volatility and deceptive price action.

Here’s how to stay sharp:

- Avoid fake breakouts by confirming moves with volume and momentum indicators

- Monitor on chain metrics such as miner reserves, exchange inflows, and long-term holder activity

- Stay alert for market manipulation, especially during low liquidity phases

Tracking tools and strategic planning are your best allies as we near the next halving. By knowing what date is Bitcoin halving and preparing with reliable data and disciplined execution, you’ll be in a strong position to act not react as the crypto market shifts. Start planning now to stay ahead.

7. What the future holds after all 21 million Bitcoins are mined

The question of what happens after all 21 million Bitcoins are mined isn’t just theoretical it’s a key part of Bitcoin’s long term monetary design. For forward-thinking investors, understanding this future helps shape smarter strategies today, especially if you’re already asking what date is Bitcoin halving and planning ahead. This stage marks the end of new BTC issuance but not the end of Bitcoin’s utility or security.

7.1 When will Bitcoin hit its supply limit?

The total supply of Bitcoin is hard coded at 21 million. According to projections by blockchain experts and developers, the final Bitcoin will be mined around the year 2140. This ultra long timeline underscores Bitcoin’s gradual, transparent release schedule one reason it’s viewed as a scarce digital asset.

7.2 Miner rewards after the final Halving

After the last halving, miners will no longer receive block rewards in Bitcoin. Instead, they’ll be compensated through transaction fees from users moving BTC on the blockchain. This shift is designed to ensure the network remains secure and decentralized even without new coin issuance.

7.3 Is Bitcoin still secure and functional in the long run?

Yes. While halving cuts the supply over time, Bitcoin’s core protocols are built to adapt. As usage increases and more people transact on the network, fee-based mining is expected to become viable, sustaining security and transaction processing even after block rewards vanish.

Even after all 21 million BTC are mined, Bitcoin remains secure, usable, and investable. For those wondering what date is Bitcoin halving, remember it’s not just about the short-term price. It’s about positioning yourself for a future where Bitcoin continues to evolve. Now is the time to learn, plan, and stay ahead.

8. Frequently asked questions About Bitcoin Halving

8.1. Can We Predict the Exact Halving Date?

No. While we can estimate the halving around April 2028, the exact date depends on mining activity and the rate at which blocks are completed. If you’re asking what date is Bitcoin halving, remember it’s based on block height, not a fixed calendar day.

8.2. How Many Halvings Are Left?

There will be a total of 32 halving events in Bitcoin’s lifetime. As of 2025, 4 have occurred, meaning 28 are still ahead.

8.3. Does Halving Affect Wallets or Transactions?

No. Bitcoin halving only impacts mining rewards. Wallet balances, transaction speeds, and user experience are unaffected by the halving itself.

8.4. Will Transaction Fees Change After the Halving?

Transaction fees are determined by network demand and not directly influenced by halving events. However, as block rewards decrease, fees may gradually rise to maintain miner incentives.

9. Conclusion: Prepare Now for the Next Bitcoin Halving Cycle

Bitcoin halving events aren’t just technical milestones they are pivotal market signals. In this article, we’ve explored the exact halving date estimates, explained how halving works, analyzed historical trends, and offered investment strategies you can apply right now. Whether you’re a beginner or a seasoned investor, understanding what date is Bitcoin halving helps you align with broader market behavior, prepare your portfolio, and avoid emotional decision making.

Read more:

- What is a Bitcoin NFT? Explained simply for beginners

- Who owns the most Bitcoins? Top holders 2025

- What is Bitcoin’s highest price? Full history explained

With expert insights, historical data, and practical tips, this guide empowers you to act strategically not reactively. As Bitcoin approaches its next halving around April 2028, now is the time to stay informed, track block height progress, and assess opportunities based on facts, not hype.

👉 Take action today: Set alerts, monitor the market, and start building your halving strategy now. The earlier you prepare, the better positioned you’ll be to benefit from the next cycle.

This guide is brought to you by Vietnam-USTrade your trusted source for global market insights and digital economy updates. Visit the Bitcoin directory for curated tools, platforms, and news tailored to every investor.