What does O/C mean in trading, and why is it so important to get it right? Misunderstanding this abbreviation can lead to invoice errors, insurance confusion, or costly delays. Whether you’re a trader, shipper, or analyst, knowing the exact meaning of “O/C” in each context protects you from mistakes that cost time and money.

In this article, you’ll uncover the clear definitions of “O/C” across trade, shipping, and financial documents backed by practical examples you can apply immediately.

Let’s dive into the full breakdown of this term with expert guidance from VietNam-UStrade.

1. What does O/C mean in trading?

In trading, “O/C” most commonly stands for:

- Overcharge: An extra fee added to invoices or bills.

- Open Cover: A type of insurance covering multiple shipments under one policy.

- Other Meanings: Less common uses include Open Charter (vessel agreement), Old Charter (expired contract), and Old Crop (previous harvest in commodities).

It’s important to note that “O/C” changes meaning depending on the document and context. Also, “O/C” is often mistaken for “OTC” (Over-the-Counter), which relates to different trading activities outside exchanges. For example, an invoice might show “O/C: $200 handling fee,” indicating an overcharge, or an insurance document might state “Policy applied under O/C #98765,” meaning Open Cover.

2. Full definition and practical context of O/C in trading

2.1 Overcharge (O/C) in commercial documents

“Overcharge” in trading and shipping refers to an extra or unexpected fee added to an invoice. These can appear as line items marked “O/C” for additional costs such as late processing or special handling.

For example, an invoice might list: “O/C: $150 – documentation surcharge.” Recognizing this term helps avoid disputes or surprises on billing statements.

Understanding what does O/C mean in trading in this context helps avoid billing disputes and late payment issues.

2.2 Open cover (O/C) in insurance & shipping

When reviewing insurance policies, knowing what does O/C mean in trading can clarify whether your shipment is protected under a blanket agreement.

“Open Cover” is a type of insurance (see how bitcoin blockchain provides similar decentralization and protection in finance) that protects multiple shipments over a period under one blanket policy. Instead of buying separate policies for each cargo, traders use Open Cover to simplify coverage.

For instance, a shipping company might declare: “All consignments shipped from January to June 2025 are covered under O/C #12345.” This approach reduces paperwork and ensures continuous protection.

2.3 Other “O/C” meanings in trade and shipping

- Open Charter: A flexible vessel charter agreement allowing varied cargoes or scheduling.

- Old Charter: Refers to an expired or previous shipping contract.

- Old Crop: In commodity trading, this indicates stock from an earlier harvest season.

In commodity pricing, seeing “O/C” might signal that the goods are from the old crop season, affecting value and availability.

While definitions are helpful, the true importance of understanding “O/C” becomes clear when you consider how easily it’s misinterpreted in practice. Let’s explore a few real-world scenarios that show how costly such confusion can be.

2.4 Real-world scenarios: What does O/C mean in trading when misunderstood?

Understanding “O/C” is not just academic it has real financial consequences when misinterpreted in global trade.

Scenario 1: Overcharge mistaken for insurance clause

A logistics manager at a mid-sized export firm received an invoice stating “O/C: $250.” Believing it referred to “Open Cover,” the team skipped reconciliation, assuming it was a recurring insurance term. However, it was actually an overcharge fee for delayed customs documentation. This misreading led to accounting inconsistencies and late dispute filing costing the company both time and penalties.

Scenario 2: Banking document confusion

In a letter of credit, a supplier interpreted “O/C #99872” as a surcharge line and omitted it in their invoice. In reality, it referenced an Open Cover policy required for cargo coverage. As a result, the bank rejected the LC presentation, delaying payment and requiring contract renegotiation.

Scenario 3: Trader chat miscommunication

In a commodities trading desk chat, a junior analyst typed “O/C crop might be weaker this year,” referring to Old Crop yields. Another team member misread it as Overcharge, triggering an unnecessary price review and pricing error in the client quote leading to reputational damage.

3. Where does “O/C” appear in trading? Documents & settings

To quickly identify what does O/C mean in trading, always examine where the abbreviation appears and the related document type.

- Shipping and trade invoices often list “O/C” as additional charges.

- Bills of lading or shipment records may reference “O/C” related to handling or insurance.

- Insurance contracts and certificates use “O/C” mainly to denote Open Cover policies.

- Letters of credit and banking documents might include “O/C” as trade-related terms or fees.

- Investor and trader chat logs or emails sometimes use “O/C” as shorthand, which can cause confusion without context.

Recognizing where “O/C” typically appears helps traders verify its meaning quickly. For example, if you see “O/C” on an invoice line, it usually concerns extra charges, whereas in insurance paperwork, it often means Open Cover.

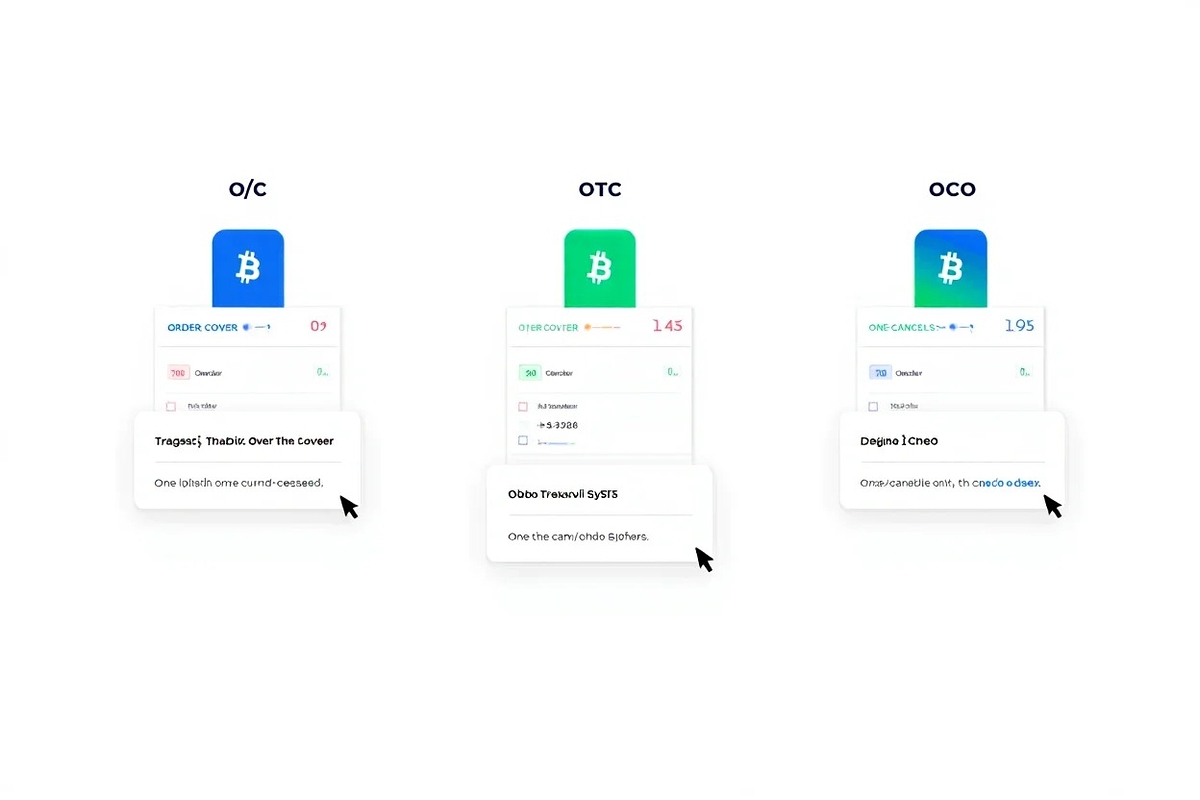

4. O/C vs. OTC vs. OCO: Understanding the differences

To prevent confusion, here is a side-by-side comparison of these common acronyms:

| Acronym | Full Form | Context | Meaning |

|---|---|---|---|

| O/C | Overcharge, Open Cover, etc. | Trade, Shipping | Extra fees, insurance policy, or other trade terms |

| OTC | Over-the-Counter | Markets | Trading outside formal exchanges |

| OCO | One Cancels Other | Trading Orders | Placing two linked orders where execution of one cancels the other |

Confusion arises because these acronyms look similar but relate to very different concepts. For example, OTC (Over-the-Counter) is a type of bitcoin trading that happens off exchanges, “OTC” involves trading stocks or forex outside exchanges, while “O/C” focuses on charges or insurance. Understanding the setting helps you avoid costly errors.

Tips to avoid mix-ups include checking document type carefully and noting surrounding terms. For example, if you see “O/C” in a chat message, it’s rarely insurance-related. In contracts, look for policy numbers or cargo details.

5. How to interpret O/C in trading documents: A step-by-step guide

If you’re unsure what does O/C mean in trading, this checklist helps you interpret it accurately in any business document.

- Identify the document type: invoice, insurance policy, shipment record, or chat.

- Look for related terms: amounts, policy numbers, cargo descriptions.

- Check the surrounding text: are other surcharges listed? Is there a mention of insurance?

- Confirm with official resources or contact the shipping/trade agent if uncertain. You can also check bitcoin transaction methods to see how similar processes work in crypto.

For example, if you find “O/C” on an invoice line with a dollar amount, it likely means Overcharge. If “O/C” appears in an insurance certificate with a reference number, it indicates Open Cover.

Further reading for curious traders:

- How many bitcoins to the dollar

- How many confirmations for bitcoin

- How many days after halving does bitcoin peak

6. Glossary: Key acronyms in trading and shipping

- O/C – Overcharge or Open Cover depending on context

- OTC – Over-the-Counter: trading outside formal exchanges

- OCO – One Cancels Other: linked trading orders

- FOB – Free On Board: shipping term indicating seller responsibility until goods pass ship’s rail

- CIF – Cost, Insurance, and Freight: seller covers cost, insurance, and freight to destination

7. Frequently asked questions about O/C in trading

7.1 Is “O/C” used the same way worldwide?

Meanings can vary by region and industry. Always check context and local trade practice.

7.2 Can “O/C” ever mean “Open Container”?

While rare, sometimes “O/C” might refer to Open Container in shipping, but this is uncommon and should be verified by context.

7.3 Where do I find the full definition if it’s not clear in my document?

Consult official trade glossaries, contact your logistics provider, or review insurance policy definitions.

7.4 What’s the risk if I misunderstand O/C on legal documents?

Misinterpretation can lead to overpaying fees, missing insurance coverage, or contractual disputes.

7.5 Are there other confusing abbreviations like O/C in trading?

Yes, abbreviations like FOB, CIF, and others also vary by context and should be understood carefully.

8. Conclusion

Understanding what does O/C mean in trading is essential for anyone involved in international trade, shipping, or finance. This term can indicate overcharges, insurance policies, or other trade-specific references, depending on context.

Here’s a quick check list to remember:

-

“O/C” on invoices often means extra charges (Overcharge).

-

In insurance documents, “O/C” typically refers to Open Cover.

-

Always confirm meaning based on document type and supporting terms.

Don’t forget to follow the Trader & Trading category on Vietnam-UStrade to stay up to date with the latest insights.

Have you ever come across “O/C” and misunderstood it?

Hopefully, this guide has helped you feel more confident in handling trade documents. Feel free to leave a comment or question below if anything’s unclear or if you’ve encountered other tricky abbreviations worth exploring!