Every four years, the Bitcoin network undergoes a major event known as the halving but what exactly does that mean? And more importantly, what happens when Bitcoin halves?

If you’re new to crypto or just curious about how Bitcoin works, this guide will help you understand the basics of Bitcoin halving, why it matters, and how it affects the entire crypto market including altcoins, mining rewards, and even your own BTC holdings.

Let’s break it all down in simple terms, so you can build a solid foundation before diving deeper into crypto investing.

1. What happens when bitcoin halves?

When Bitcoin “halves,” the reward that miners receive for validating transactions is reduced by 50%. This is a built-in feature of the Bitcoin protocol, designed to occur approximately every four years or after every 210,000 blocks mined. Understanding what happens when Bitcoin halves is crucial for investors because it impacts the rate at which new coins are created and can influence market dynamics.

1.1. Understanding block rewards and supply control

The total number of Bitcoins that can ever exist is capped at 21 million. To maintain scarcity and control inflation, new Bitcoins are introduced into circulation through a process called mining. However, the rate of issuance slows down over time thanks to halving:

- Initial reward in 2009: 50 BTC per block

- First halving in 2012: 25 BTC per block

- Second halving in 2016: 12.5 BTC per block

- Third halving in 2020: 6.25 BTC per block

- Next expected halving (2024-2025): 3.125 BTC per block

This progressive reduction ensures Bitcoin remains a deflationary asset. If you’re wondering what happens when Bitcoin halves, this predictable mechanism is what limits supply growth and contributes to its long-term value proposition.

1.2. Does halving affect your bitcoin?

No. Halving only affects the rate at which new Bitcoin enters circulation. If you already own Bitcoin, its quantity in your wallet remains unchanged. However, what happens when Bitcoin halves can indirectly influence its market value, as reduced supply combined with constant or increasing demand may lead to upward price pressure.

2. What happens to bitcoin price when it halves?

In the past, Bitcoin halving events have often been followed by notable surges in its price. This is primarily due to the reduction in new supply combined with steady or growing demand.

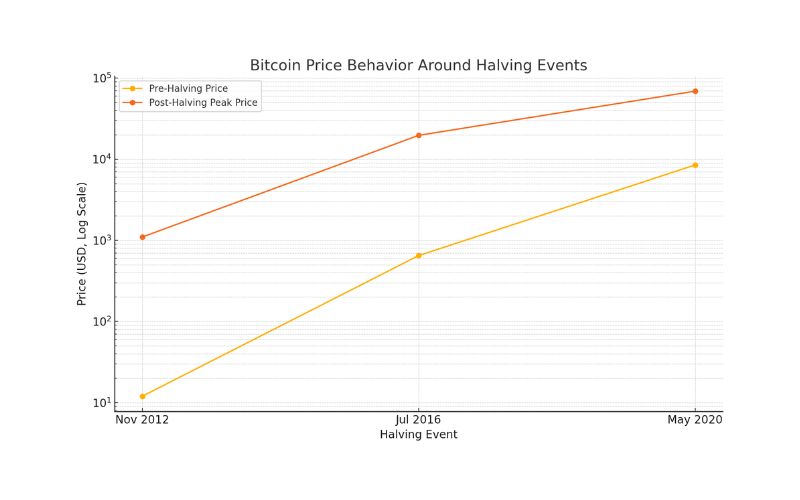

2.1. Price trends from past halving cycles

Let’s look at Bitcoin’s price behavior around previous halving events:

| Halving Event | Pre-Halving Price | Post-Halving Peak | Time to Peak |

| Nov 2012 | ~$12 | ~$1,100 | ~1 year |

| Jul 2016 | ~$650 | ~$19,700 | ~1.5 years |

| May 2020 | ~$8,500 | ~$69,000 | ~1.5 years |

While past performance doesn’t guarantee future results, halving tends to act as a bullish signal due to reduced issuance.

2.2. Market psychology and supply dynamics

The reduced inflow of new BTC can create a supply shock. Combined with investor anticipation, this can lead to price appreciation over time. However, traders should be cautious short-term volatility is common, and price surges aren’t guaranteed immediately after the halving.

3. What happens to altcoins when bitcoin halves?

Altcoins (alternative cryptocurrencies) often experience indirect effects during Bitcoin halving cycles. Since Bitcoin sets the tone for the entire crypto market, its movements often influence the behavior of other coins.

How bitcoin’s price moves echo across the market:

- Market sentiment: When Bitcoin rallies, altcoins often follow but not always.

- Rotation of capital: Traders may initially flock to Bitcoin during hype phases, and then diversify into altcoins later.

- Performance divergence: Some altcoins benefit from Bitcoin bullishness, while others remain flat or even drop due to reduced attention.

Essential insights for new traders:

- Don’t assume all coins will rise post-halving.

- Prioritize core principles over market buzz.

- Use halving as a time to reassess portfolio allocation.

Read more: How to Buy Bitcoins in 2025 – Step-by-Step Guide for Beginners

4. Other key effects of bitcoin halving on the crypto market

Bitcoin halving impacts more than just price. It has technical and economic effects across the entire ecosystem.

Impact on miners:

- Lower rewards: Miners earn less BTC for the same amount of work.

- Efficiency pressure: Only miners with low-cost operations may survive.

- Potential hash rate dip: As unprofitable miners exit, the network’s total computing power may decrease temporarily.

Safeguarding the network through decentralization: While the hash rate may drop post-halving, the network is designed to adjust its difficulty level to maintain security. Long-term, only efficient and serious miners remain, contributing to decentralization.

Growing attention from institutions and individual investors: Another important angle of what happens when Bitcoin halves is the renewed interest from both media and market participants. Halving events often act as a narrative catalyst for Bitcoin’s “digital gold” appeal, drawing in new investors from institutions to retail traders and expanding adoption.

5. FAQs: Quick answers about bitcoin halving

5.1. Will halving affect the bitcoin I already own?

No. Your BTC holdings remain unchanged. The event only affects newly mined coins, so what happens when Bitcoin halves doesn’t directly impact your wallet balance.

5.2. Will bitcoin’s price go up after the halving?

Historically, yes but not immediately. Price increases usually happen months later.

5.3. How does halving impact ethereum or altcoins?

Indirectly. Bitcoin sets market sentiment, but altcoin performance varies widely.

5.4. Does halving make bitcoin more valuable?

Yes, from a scarcity perspective. Less new supply often leads to higher perceived value.

5.5. Is it better to invest in bitcoin before or after the halving?

It depends on your goals. Since what happens when Bitcoin halves can trigger long-term market shifts, it’s best to focus on strategy rather than timing.

5.6. Will Bitcoin go up or down after halving?

Both are possible in the short term. While past halvings led to long-term price increases, short-term volatility is common. It’s important to be prepared for price swings in either direction.

5.7. What is the result of Bitcoin halving?

The main result is a 50% reduction in mining rewards. This slows the issuance of new Bitcoin, increases scarcity, and often shifts market sentiment across the entire crypto ecosystem.

6. Conclusion: Why Bitcoin Halving Is Worth Understanding

Now that you understand what happens when Bitcoin halves, it’s clear that this event is more than just a technical adjustment. Bitcoin halving plays a central role in the asset’s monetary policy, investor sentiment, and long-term price dynamics.

Whether you’re holding Bitcoin or simply learning about crypto, knowing how halving affects supply, price, and the broader market helps you make more informed decisions. Continue exploring with other beginner-friendly guides on Viet Nam – US Trade.