As Bitcoin continues to dominate headlines in the world of finance and digital assets, many new investors and curious minds are asking: What is 1 Bitcoin worth? This guide breaks down the current value of 1 Bitcoin, explores how it’s priced in different currencies, and explains the key factors that influence its market price. Whether you’re a beginner or just looking for up-to-date information, this article provides a clear, neutral overview to help you understand Bitcoin’s value today.

1. What is the current value of 1 bitcoin?

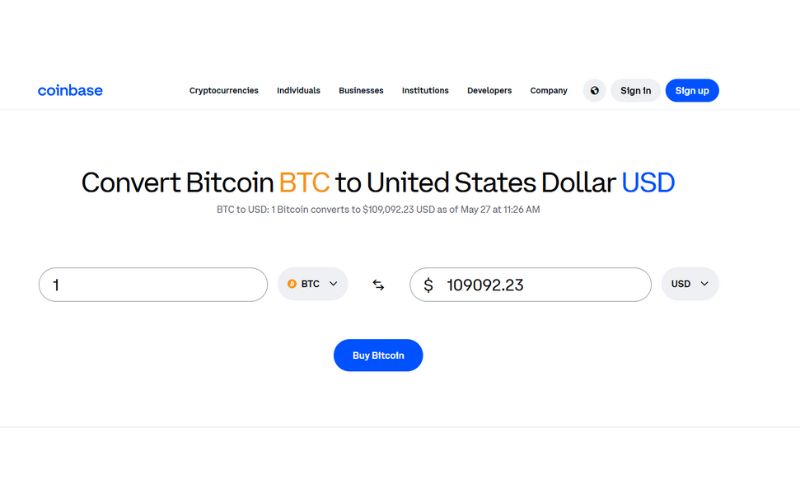

The value of Bitcoin (BTC) is highly dynamic, it changes constantly based on supply and demand on global cryptocurrency exchanges. As of May 27, 1 Bitcoin is valued at approximately $109092.23 USD.

Unlike traditional fiat currencies, Bitcoin’s price is not controlled by a central authority. Instead, it is determined by real-time trading activity across crypto exchanges like Coinbase, Binance, Kraken, and Bitstamp. These platforms connect buyers and sellers who determine the price through continuous bidding and asking.

Where to find real-time btc prices:

If you want to track the most accurate value of Bitcoin, here are some recommended sources:

- CoinMarketCap – Bitcoin Price

- CoinGecko – BTC Market Data

- TradingView BTC Chart

- Binance BTC Live

These platforms provide live price tracking, historical data, market cap, volume, and sentiment indicators. They also include conversion tools for multiple currencies.

Note: Bitcoin prices may vary slightly across exchanges due to regional liquidity and latency differences.

2. How much is 1 bitcoin worth in other currencies?

Bitcoin’s value isn’t just quoted in USD. Investors around the world track BTC in their local currencies. Let’s look at how much 1 BTC is worth in some of the most commonly used currencies.

2.1. USD – What is 1 bitcoin worth in US dollars?

In the United States, Bitcoin is primarily traded in US Dollars (USD), which also acts as a global benchmark for the crypto market. As of now, 1 BTC ≈ $109092.23 USD.

The BTC/USD pair is the most liquid in the world, often setting the tone for Bitcoin’s value globally.

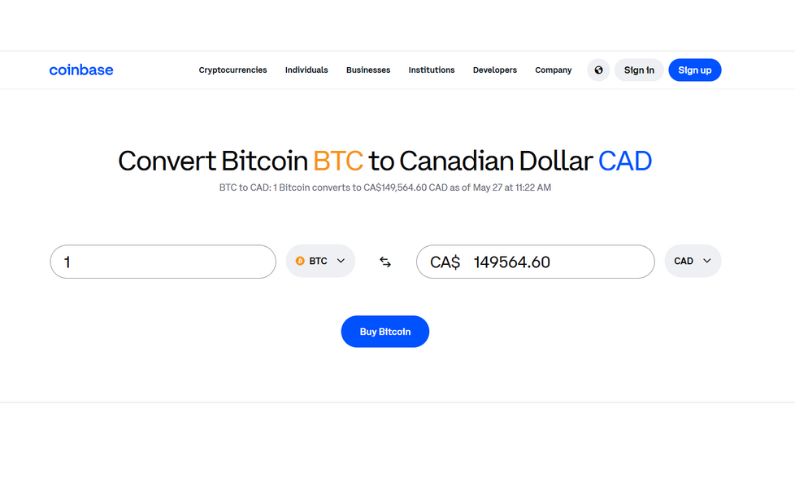

2.2. CAD – What is 1 bitcoin worth in Canadian dollars?

Canadians typically trade Bitcoin in CAD. Local exchanges like NDAX or Bitbuy quote real-time values. You can also convert USD value to CAD using financial APIs or conversion tools.

Current value: 1 BTC ≈ $149674.40 CAD

2.3. AUD – What is 1 bitcoin worth in Australian dollars?

Australia has a robust crypto scene and Bitcoin is actively traded in Australian Dollars (AUD). Market prices are affected by both forex exchange rates and global crypto movements.

Current value: 1 BTC ≈ $168121.92 AUD

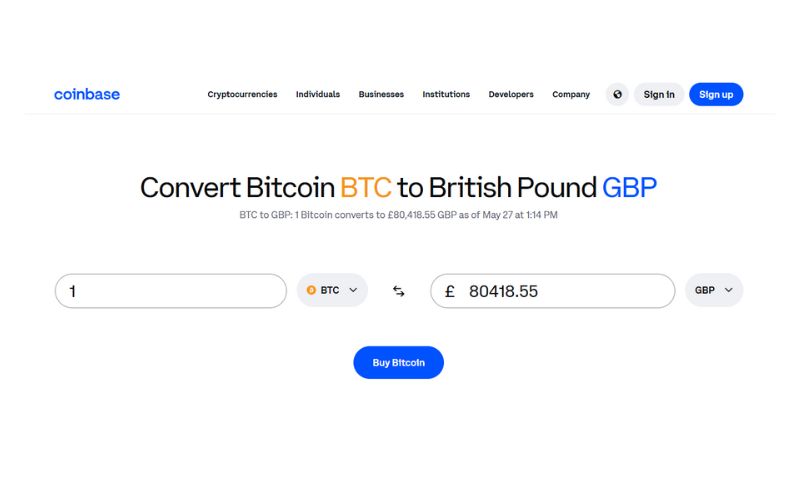

2.4. GBP – What is 1 bitcoin worth in British pounds?

UK investors monitor BTC in British Pounds (GBP). Due to fluctuations in the GBP/USD forex rate, Bitcoin’s price in pounds can differ significantly from the USD equivalent.

Current value: 1 BTC ≈ £80418.55 GBP

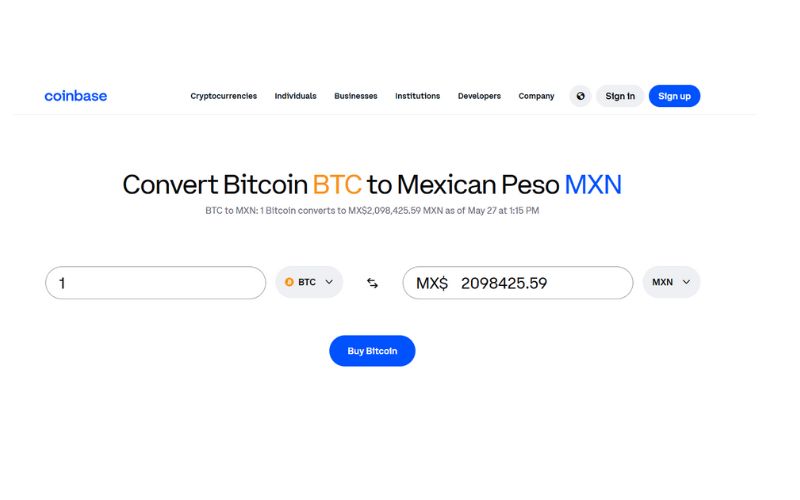

2.5. MXN – What is 1 bitcoin worth in Mexican pesos?

In Mexico, Bitcoin is frequently used as a hedge against inflation and currency devaluation. BTC is traded in Mexican Pesos (MXN) on platforms like Bitso.

Current value: 1 BTC ≈ $2098425.59 MXN

Tip: Use platforms like CoinMarketCap or your exchange’s native currency settings for accurate local values.

3. What determines the value of Bitcoin in the market?

Understanding why Bitcoin’s price changes is critical for anyone considering crypto investments. Several interconnected factors shape its valuation.

3.1. Supply and demand

The total supply of Bitcoin is capped at 21 million units. This limited supply model mimics scarcity-driven assets like gold.

Prices tend to rise when demand outpaces available supply. Bitcoin’s supply is gradually released into the market through mining, and every four years, a “halving” reduces the amount of BTC miners receive tightening supply further.

3.2. Market sentiment and news

Crypto markets are extremely sensitive to sentiment. News about regulatory changes, institutional adoption, or even celebrity endorsements can drastically shift prices.

For example:

- Elon Musk’s tweets often trigger short-term price spikes.

- Rumors of ETF approvals tend to push prices up.

- Government crackdowns can drive prices down quickly.

3.3. Macroeconomic trends

In times of economic uncertainty, Bitcoin is often viewed as a “digital safe haven.” Events like high inflation, rising interest rates, banking instability, or geopolitical tensions can cause capital to flow into Bitcoin.

Many investors treat BTC as a hedge against fiat devaluation.

3.4. Adoption and utility

As more institutions, merchants, and fintech platforms adopt Bitcoin, its real-world utility grows. Whether it’s payment processors like PayPal or Layer-2 solutions like the Lightning Network, each new use case enhances Bitcoin’s perceived value.

3.5. Exchange liquidity and volume

Bitcoin’s price is also affected by the volume and liquidity on exchanges. High liquidity generally leads to more stable prices, while thin trading can amplify volatility.

In bull markets, large buy orders push prices up fast; in bear markets, sell-offs trigger sharp declines.

See more related articles:

4. A Look Back at Bitcoin’s Price Movements Over Time

Analyzing Bitcoin’s price history helps understand its volatility and growth over time. Here’s a quick overview:

| Year | Price Range (USD) | Key Events |

| 2010 | <$0.10 | First BTC exchange (Mt. Gox) created |

| 2013 | $100–$1,000 | First major rally and crash |

| 2017 | $1,000–$19,000 | ICO boom, media attention |

| 2020 | $5,000–$29,000 | Pandemic response, institutional interest |

| 2021 | $30,000–$69,000 | All-time high amid inflation and ETF speculation |

| 2022 | $15,000–$25,000 | Bear market, central bank tightening |

| 2023 | $25,000–$45,000 | Banking turmoil, macro instability |

| 2024 | $25,000–$70,000+ | Halving anticipation, spot ETF approval |

5. Can Bitcoin serve as a reliable store of value?

Bitcoin is often compared to gold due to its scarcity and decentralization. But is it really a good store of value (SoV)?

Arguments in favor:

- Limited supply: Only 21 million coins, with predictable issuance.

- Decentralized: Operates independently of government oversight or interference.

- Portable: Can be transferred globally, almost instantly.

- Adoption by institutions: Companies like MicroStrategy, Tesla, and various ETFs now hold BTC.

Risks and challenges:

- Extreme volatility: Daily swings of 5–10% are common.

- Uncertain regulations: Some countries ban or restrict crypto.

- Security risk: Wallet hacks or user errors can lead to loss of funds.

- Technology dependency: Requires internet and software infrastructure.

Advice for Beginners: Bitcoin may be a long-term hedge but it’s not without risk. Always diversify your portfolio and avoid emotional investing.

6. FAQs About Bitcoin Price

Why does Bitcoin’s value change so much?

Bitcoin’s price reacts quickly to news, regulations, macro trends, and investor sentiment. Its limited supply and speculative nature contribute to high volatility, which is common across the crypto market.

What are the best platforms to view real-time Bitcoin prices?

You can track Bitcoin’s real-time price on trusted platforms like Coinbase, CoinGecko, CoinMarketCap, and Binance.

Can I buy less than 1 Bitcoin?

Yes. One Bitcoin can be broken down into 100 million smaller units known as satoshis. This allows anyone to purchase small fractions of a Bitcoin, such as 0.01 or even 0.0001 BTC.

Is Bitcoin’s price affected by halving events?

Historically, yes. Bitcoin halving events which occur approximately every four years have often preceded significant price increases. Past trends should not be seen as a reliable indicator of what’s to come.

Can I legally use Bitcoin where I live?

Bitcoin is legal in many countries including the U.S., Canada, EU nations, and Australia. However, some countries like China and Algeria have restricted or banned its use. Be sure to review your country’s regulations before making any investment.

Is there any inherent value in Bitcoin?

This is debated. Supporters argue that Bitcoin has intrinsic value due to its decentralized infrastructure, censorship resistance, and fixed supply. Critics say its value is mostly speculative, as it lacks backing by physical assets or government.

What sets Bitcoin apart from other digital currencies?

Bitcoin was the original cryptocurrency and remains the most widely used. It focuses on being a store of value and a peer-to-peer digital currency. Other cryptocurrencies may offer different functionalities, such as smart contracts or governance features.

Can Bitcoin go to zero?

While highly unlikely due to global adoption and institutional investment, Bitcoin’s value could theoretically collapse if confidence disappears. Like all speculative assets, it carries risk.

7. Conclusion: Why Bitcoin Price Matters for New Traders

So, what is 1 Bitcoin worth today? The short answer is: it depends on market dynamics and your local currency. More importantly, understanding Bitcoin’s value helps you grasp:

- How crypto markets work

- Why BTC is volatile yet promising

- What factors influence pricing

- Whether it’s suitable for your investment goals

Whether you’re a complete beginner or ready to explore crypto further, tracking Bitcoin’s value is a key step toward building financial literacy in the digital age.

At Viet Nam – US Trade, we’re here to help you learn the fundamentals without hype or hidden agendas. Want to stay informed? Subscribe to our newsletter for weekly updates on Bitcoin, Forex, and more.