If you’ve ever wondered what is a Bitcoin NFT, you’re not alone. NFTs, or non-fungible tokens, have revolutionized digital ownership, especially in art and collectibles. While Ethereum-based NFTs have dominated the scene, Bitcoin NFTs are emerging as a fascinating alternative, leveraging the security and widespread adoption of the Bitcoin blockchain.

This article will explain in simple terms what a Bitcoin NFT is, how it works, and why it matters especially if you’re new to the world of blockchain and digital assets.

1. What is a Bitcoin NFT?

If you’re still wondering what is a Bitcoin NFT (non-fungible token), it refers to a unique digital asset stored directly on the Bitcoin blockchain. Unlike traditional Bitcoin transactions that simply record transfers of value, Bitcoin NFTs use a technology called Ordinals to inscribe data such as images, text, or even code onto individual satoshis, the smallest units of Bitcoin.

This means that each NFT is literally embedded in the Bitcoin chain itself, making it permanent, censorship-resistant, and verifiable. In contrast to NFTs on Ethereum and other blockchains, which often store metadata off-chain or rely on smart contracts, Bitcoin NFTs aim for on-chain immutability.

Originally, the Bitcoin network wasn’t designed for non-fungible assets. But with the launch of Ordinal Theory in early 2023, developers found a creative way to use the Taproot upgrade to embed extra data into transactions making NFTs possible on Bitcoin for the first time in a meaningful way.

2. How do Bitcoin NFTs work?

Before diving into how Bitcoin NFTs work, it’s important to understand that Bitcoin was never originally designed for NFTs. Unlike Ethereum, Bitcoin lacks a native smart contract system. However, thanks to creative innovations like the Ordinals protocol, Bitcoin NFTs became a reality.

Bitcoin NFTs function by inscribing digital content onto individual satoshis the smallest units of Bitcoin (1 BTC = 100 million satoshis). These inscriptions live entirely on-chain, making them immutable and permanent, as long as the Bitcoin blockchain exists.

2.1. The Ordinals protocol explained

The Ordinals protocol, introduced in early 2023 by Casey Rodarmor, is the foundation of Bitcoin NFTs. It assigns a unique number to every satoshi, allowing digital content (like images, text, or code) to be inscribed on it.

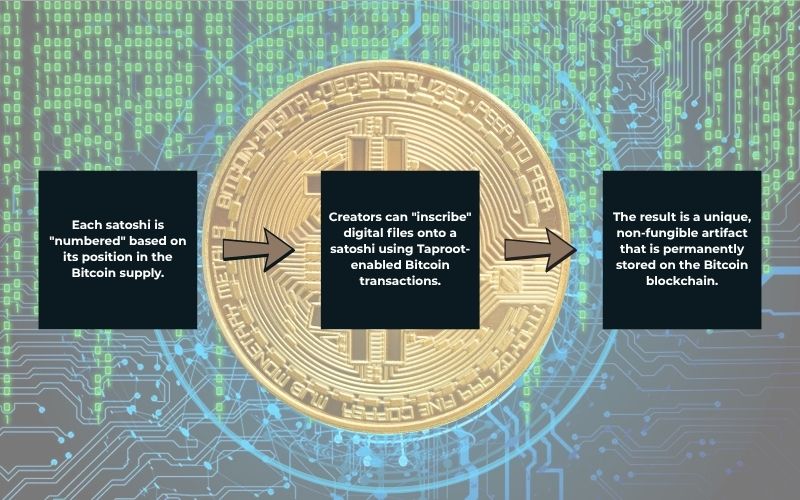

Here’s how it works in simple terms:

- Each satoshi is “numbered” based on its position in the Bitcoin supply.

- Creators can “inscribe” digital files onto a satoshi using Taproot-enabled Bitcoin transactions.

- The result is a unique, non-fungible artifact that is permanently stored on the Bitcoin blockchain.

This innovation does not require sidechains or separate tokens, which aligns with Bitcoin’s ethos of simplicity and decentralization.

2.2. Technical infrastructure

While Ethereum uses smart contracts (like ERC-721 or ERC-1155 standards) to create NFTs, Bitcoin NFTs rely entirely on the underlying Bitcoin protocol, with a few recent upgrades:

| Component | Description |

| Taproot | A major Bitcoin upgrade activated in 2021. It enabled more complex scripts and efficient data storage, which made Ordinals possible. |

| SegWit (Segregated Witness) | Introduced in 2017, it increased Bitcoin’s block capacity, making it more feasible to store additional data on-chain. |

| Ord client | Software used by creators and collectors to inscribe or read NFT data from satoshis. |

Bitcoin NFTs rely entirely on the underlying Bitcoin protocol, with a few recent upgradesNote: The technical simplicity of Bitcoin NFTs makes them more secure and durable but also limits programmability compared to Ethereum.

3. Bitcoin NFT vs Ethereum NFT: Key differences

Before you decide to invest or create, it’s crucial to understand how Bitcoin NFTs differ from their more established counterparts on Ethereum. Both serve the same core purpose representing ownership of unique digital assets but the way they function under the hood is vastly different.

| Feature | Bitcoin NFTs | Ethereum NFTs |

| Underlying Tech | Built using the Ordinals protocol and inscribed on satoshis | Built on smart contracts (e.g., ERC-721, ERC-1155) |

| Storage | Fully on-chain (no need for external storage) | Often metadata stored off-chain (e.g., IPFS) |

| Smart Contract Capability | Limited – Bitcoin lacks native smart contracts | Highly programmable with complex interactions |

| Maturity | New and experimental (since 2023) | Well-developed ecosystem (since 2017) |

| Ecosystem & Tools | Fewer wallets, marketplaces, and infrastructure | Mature tools, massive DeFi and NFT ecosystem |

| Security | Benefits from Bitcoin’s strong base-layer security | Relies on Ethereum’s layer-one security, but smart contract bugs possible |

| Cultural Alignment | Favored by Bitcoin maximalists, focused on permanence | Popular with digital artists, game developers, and NFT collectors |

Example: A digital art NFT on Ethereum might include royalties, metadata, interactive logic, and animations thanks to smart contracts. In contrast, a Bitcoin NFT is often a pure, immutable image permanently inscribed on-chain.

In short: Ethereum NFTs offer flexibility and rich interactivity, while Bitcoin NFTs offer permanence, decentralization, and minimalism. Your choice depends on whether you value functionality or longevity.

See more related articles:

4. Why artists are exploring Bitcoin NFTs in 2025

The rise of Bitcoin NFTs has caught the attention of many digital artists and creators in 2025. But what exactly motivates artists to choose Bitcoin NFTs over the more established Ethereum ecosystem?

4.1. Permanence and immutability

Bitcoin NFTs are inscribed directly onto satoshis (the smallest units of Bitcoin) using the Ordinals protocol. This means the NFT data is stored fully on-chain with no reliance on external servers or storage solutions.

- This guarantees that the art cannot be altered, deleted, or taken down.

- For artists concerned about digital permanence, Bitcoin NFTs offer a powerful solution.

- Unlike Ethereum NFTs, where metadata is sometimes stored off-chain and vulnerable to “link rot,” Bitcoin NFTs are truly immutable.

4.2. Security and decentralization

- Bitcoin’s blockchain is the most secure and decentralized blockchain in the world.

- Artists seeking to protect their work from censorship or centralized control find Bitcoin NFTs attractive.

- The decentralized nature of Bitcoin reassures creators that their NFTs won’t be arbitrarily censored or altered.

4.3. A unique cultural and philosophical appeal

- Bitcoin maximalists and some artists value the ethos of Bitcoin: decentralization, censorship resistance, and digital scarcity.

- Creating art as Bitcoin NFTs is seen as a statement aligning with these values.

- This cultural aspect adds a layer of meaning beyond just the art itself, resonating with niche communities.

4.4. Growing ecosystem and visibility

- Although still emerging, the Bitcoin NFT ecosystem has begun to develop marketplaces, wallets, and tools designed specifically for Bitcoin NFTs.

- Early adopters enjoy the benefits of being pioneers in this space with increasing media and collector attention.

- Artists also see new opportunities to reach Bitcoin-focused audiences.

Summary: In 2025, artists explore Bitcoin NFTs not only for technical benefits like permanence and security but also for the unique cultural identity and growing market opportunities this new form of NFT represents.

5. Pros and cons of Bitcoin NFTs

When considering Bitcoin NFTs, it’s important to understand both their advantages and potential drawbacks. This balanced view helps beginners make informed decisions about engaging with this emerging technology.

5.1. Benefits of Bitcoin NFTs

Bitcoin NFTs offer several distinct advantages that appeal to artists and collectors alike. Here are the main benefits:

- Immutability: Bitcoin NFTs are stored fully on-chain via the Ordinals protocol, ensuring that the artwork cannot be altered or deleted.

- Strong security: Bitcoin’s blockchain is the most secure and decentralized, providing a robust foundation for NFT ownership.

- Censorship resistance: Bitcoin NFTs cannot be easily censored or removed by third parties, making them ideal for artists seeking freedom of expression.

- Digital scarcity: Like Bitcoin itself, NFTs on Bitcoin benefit from a finite and scarce supply, increasing their potential value.

- Growing community: An expanding ecosystem of collectors and artists focused on Bitcoin NFTs offers new market opportunities.

- Cultural appeal: Associating art with Bitcoin’s ethos of decentralization and trustlessness adds symbolic value.

5.2. Drawbacks of Bitcoin NFTs

Despite their advantages, Bitcoin NFTs also face several challenges and limitations that users should be aware of:

- Higher fees: Bitcoin transaction fees tend to be higher than Ethereum Layer 2 solutions, making minting or transferring NFTs potentially costly.

- Limited tools and marketplaces: The Bitcoin NFT ecosystem is newer and less developed compared to Ethereum, with fewer user-friendly platforms.

- Technical complexity: Creating and managing Bitcoin NFTs often requires more technical knowledge due to the Ordinals protocol’s novelty.

- Storage limitations: Bitcoin NFTs store data directly on-chain, which can limit the size and complexity of digital artworks.

- Scalability issues: Bitcoin’s slower block times and limited throughput may constrain NFT activity compared to other blockchains optimized for NFTs.

Summary: Bitcoin NFTs offer unmatched security and permanence but come with challenges in cost, ease of use, and ecosystem maturity. Understanding these pros and cons helps users navigate the evolving landscape effectively.

6. How to buy or mint a bitcoin nft

Understanding how to buy or mint a Bitcoin NFT is essential for beginners interested in entering this new digital art space. Although the process is evolving, here’s a simplified guide to get started.

6.1. How to buy a bitcoin nft: key steps

To purchase a Bitcoin NFT, follow these main steps:

- Choose a marketplace: Bitcoin NFT marketplaces like Gamma.io and OpenOrdex are emerging platforms where you can browse and purchase Bitcoin NFTs.

- Set up a Bitcoin wallet: You need a compatible wallet that supports Bitcoin NFTs, such as Xverse or Hiro Wallet, to store your NFTs and Bitcoin securely.

- Fund your wallet: Transfer Bitcoin (BTC) into your wallet to cover NFT purchase costs and transaction fees.

- Browse and select: Explore available Bitcoin NFTs on marketplaces, and choose the ones you want to buy.

- Complete the purchase: Follow the marketplace’s process to buy the NFT, usually by signing a transaction in your wallet.

- Confirm ownership: After purchase, your Bitcoin NFT will be stored in your wallet, verifiable on the Bitcoin blockchain.

6.2. How to mint a bitcoin nft: essential steps

To understand what is a Bitcoin NFT and how to mint one, follow these essential steps:

- Prepare your digital artwork: Create or select the digital file you want to mint as a Bitcoin NFT.

- Choose a minting platform: Use platforms that support Ordinals minting, such as Gamma.io or UniSat Wallet.

- Connect your wallet: Link your Bitcoin wallet that supports NFTs to the minting platform.

- Upload your artwork: Submit your digital file for inscription onto the Bitcoin blockchain via the Ordinals protocol.

- Pay transaction fees: Confirm and pay the necessary Bitcoin fees to complete the minting process.

- Receive your Bitcoin NFT: Once the inscription is confirmed on the blockchain, your NFT will be available in your wallet.

7. Who should consider investing in Bitcoin NFTs?

Deciding whether to invest in Bitcoin NFTs depends on your interests, risk tolerance, and understanding of the NFT and cryptocurrency space. Here’s who might benefit from exploring Bitcoin NFTs.

Ideal candidates for bitcoin nft investment:

- Crypto enthusiasts: If you are already familiar with Bitcoin and blockchain technology, Bitcoin NFTs offer a new way to engage with the ecosystem.

- Digital art collectors: Collectors interested in unique, blockchain-backed digital art may find Bitcoin NFTs an intriguing addition to their portfolio.

- Artists and creators: Those wanting to leverage Bitcoin’s security and decentralization to showcase and monetize their digital creations.

- Speculative investors: People looking to diversify their crypto assets with emerging NFT trends might consider Bitcoin NFTs as a speculative opportunity.

- Long-term believers in bitcoin: Investors who trust Bitcoin’s long-term value may prefer Bitcoin NFTs due to their foundation on the Bitcoin blockchain.

Who might want to be cautious?

- Newcomers to crypto: Beginners without a solid understanding of blockchain and NFT risks should proceed carefully and do thorough research.

- Risk-averse investors: Those who prefer stable and well-established markets might find Bitcoin NFTs too volatile or experimental for now.

- Collectors focused on Ethereum: Since Ethereum dominates the NFT space, collectors may want to compare before committing to Bitcoin NFTs.

8. Risks and challenges to be aware of

Before diving into Bitcoin NFTs, it’s important to understand the potential risks and challenges involved. Awareness helps you make informed decisions and avoid common pitfalls.

Key risks and challenges of bitcoin nfts:

- Limited marketplace infrastructure: Compared to Ethereum NFTs, Bitcoin NFT marketplaces and tools are still in early development, limiting buying and selling options.

- Higher technical complexity: Minting and managing Bitcoin NFTs require more technical knowledge, which can be a barrier for beginners.

- Network limitations: Bitcoin’s blockchain was not originally designed for NFTs, so storage size and speed constraints can affect NFT functionality and cost.

- Price volatility: Like all cryptocurrencies and NFTs, Bitcoin NFT values can be highly volatile and speculative.

- Regulatory uncertainty: The evolving legal landscape for cryptocurrencies and NFTs means potential regulatory changes could impact the market.

- Risk of scams and fraud: As with any emerging asset class, caution is needed to avoid counterfeit NFTs or fraudulent sellers.

- Environmental concerns: Although Bitcoin’s proof-of-work security is robust, it also raises energy consumption concerns that may affect public perception.

9. Future outlook – are Bitcoin NFTs here to stay?

The future of Bitcoin NFTs is still unfolding, but many experts believe they have a promising place in the digital asset ecosystem. As technology improves and adoption grows, Bitcoin NFTs could offer unique advantages.

Trends shaping the future of Bitcoin NFTs:

- Improved protocols and tools: Innovations like the Ordinals protocol continue to enhance Bitcoin NFT functionality and usability.

- Growing artist and collector interest: More creators are exploring Bitcoin NFTs for their security and permanence.

- Integration with decentralized finance (DeFi): Future Bitcoin NFTs might unlock new financial uses beyond art and collectibles.

- Cross-chain interoperability: Solutions may allow Bitcoin NFTs to interact with other blockchains, expanding their utility.

- Regulatory clarity: Clearer regulations could increase investor confidence and market stability.

- Sustainability initiatives: Efforts to reduce Bitcoin’s energy footprint might make Bitcoin NFTs more attractive to eco-conscious users.

- Mainstream adoption: As awareness grows, Bitcoin NFTs could become a common part of digital ownership and culture.

Read more:

- What is wrapped Bitcoin? Expert insights into wBTC explained

- Who owns the most Bitcoins? Top holders 2025

10. Final thoughts

Bitcoin NFTs are more than just a technical curiosity – they represent a new chapter in the evolution of digital ownership and decentralized culture. For beginners and digital creators alike, understanding what a Bitcoin NFT is, how it works through the Ordinals protocol, and its unique advantages such as immutability, on-chain storage, and alignment with Bitcoin’s core values can unlock new creative and investment possibilities.

While Ethereum NFTs continue to dominate in terms of interactivity and tooling, Bitcoin NFTs appeal to those who prioritize permanence, censorship resistance, and ideological alignment with the original blockchain ethos. Artists in 2025 are increasingly drawn to this minimalist yet powerful infrastructure, even as the ecosystem matures slowly.

If you’re considering getting involved – whether as a creator, collector, or investor staying informed is key. Platforms like VN – US trade provide valuable resources and insights into blockchain innovations across the APAC region, including emerging trends in Bitcoin NFTs and decentralized finance.

As with any frontier technology, proceed with curiosity but also caution. Bitcoin NFTs are here to stay and for those who resonate with their philosophy, now is a great time to start exploring.