Bitcoin’s meteoric rise has captured global attention, and with it, intense curiosity surrounds the concept of “What is Bitcoin trading?” If you’ve heard the term but are unsure exactly what Bitcoin trading is, how it functions, or how it differs from simply buying and holding, you’re in the right place.

This comprehensive guide is designed specifically for beginners, breaking down complex ideas into easy-to-understand language. We’ll explore the fundamentals of what Bitcoin trading is, how it operates, crucial differences from long-term investing, basic analysis methods, and the essential risks every aspiring trader must understand.

1. What is Bitcoin Trading? Distinguish from Bitcoin Investing

Before diving deeper into the mechanics, it’s crucial to understand precisely what Bitcoin trading is and, just as importantly, how it fundamentally differs from Bitcoin investing. These are two distinct approaches to engaging with the world’s first cryptocurrency, each with its own objectives, strategies, and mindset.

1.1. Define what is Bitcoins trading

At its core, Bitcoin trading refers to the practice of buying and selling Bitcoin (BTC) with the primary goal of profiting from its price fluctuations, typically over shorter timeframes. Unlike long-term investors, traders aim to capitalize on market volatility, making frequent transactions based on technical or fundamental analysis to generate returns. Understanding this active approach is central to grasping what Bitcoin trading is.

1.2. The core difference: Bitcoin Trading vs. Bitcoin Investing (HODLing)

While both involve acquiring Bitcoin, the philosophies and methodologies behind trading and investing are vastly different. Grasping this distinction is essential for anyone considering entering the Bitcoin market.

Bitcoin Investing (Often called “HODLing”):

- Explanation: Investing in Bitcoin typically involves a “buy-and-hold” strategy. Investors purchase Bitcoin with the intention of holding it for an extended period, often years, believing in its long-term value appreciation and potential to act as a store of value or a transformative technology.

- Objective: The primary goal is to benefit from Bitcoin’s potential significant price increase over the long run. Investors often see Bitcoin as a revolutionary asset with fundamentals that will drive its value higher over time.

- Mindset: Investors are generally less concerned with short-term price swings. They focus on the bigger picture and are often prepared to “HODL” (a crypto community term meaning “hold on for dear life”) through periods of high volatility. Their decisions are usually based on fundamental analysis of Bitcoin’s technology, adoption, and macroeconomic factors.

Bitcoin Trading:

- Explanation: What is Bitcoin trading at practice? It’s a more active strategy involving frequent buying and selling of Bitcoin to capitalize on short-to-medium-term price movements. Traders aim to profit from the market’s inherent volatility.

- Objective: The main goal is to generate profits from market fluctuations, regardless of Bitcoin’s long-term prospects. A trader might not necessarily believe Bitcoin will succeed in the long run but sees opportunities in its price swings.

- Mindset: Traders are highly focused on price charts, market news, trading volume, and technical indicators to identify potential entry and exit points. They are more sensitive to short-term market sentiment and news catalysts.

Here’s a simple table to highlight the key differences:

| Feature | Bitcoin Investing (HODLing) | Bitcoin Trading |

| Primary Goal | Long-term wealth accumulation | Short/medium-term profit from price swings |

| Time Horizon | Years | Days, weeks, months (sometimes minutes) |

| Activity Level | Low (buy and hold) | High (frequent buying and selling) |

| Focus | Fundamental value, long-term potential | Price action, technical analysis, and volatility |

| Risk Tolerance | Tolerant of short-term volatility for long-term gains | Aims to manage/profit from volatility |

| Approach to Volatility | Generally ignores or sees as a buying opportunity | Actively seeks to capitalize on it |

Understanding these distinctions will help you determine which approach aligns better with your financial goals, risk tolerance, and time commitment when considering Bitcoin trading.

2. How does Bitcoin Trading work?

Now that you understand what Bitcoin trading is and how it differs from investing, let’s delve into the basic mechanics of how it actually happens. Several key components come together to facilitate the buying and selling of Bitcoin for trading purposes.

2.1. Cryptocurrency exchanges: The marketplace

At the heart of Bitcoin trading are cryptocurrency exchanges. These are online platforms that function as marketplaces where users can buy, sell, and trade Bitcoin and various other digital currencies. Think of them as digital stock exchanges, but for cryptocurrencies. The primary function of an exchange is to provide liquidity and a secure environment for users to trade digital assets.

Cryptocurrency exchanges connect buyers with sellers, facilitating transactions based on current market prices determined by supply and demand. Users deposit funds (either fiat currency like USD or other cryptocurrencies) into their exchange accounts to begin trading. Some well-known examples of these marketplaces include Binance, Coinbase, and Kraken.

2.2. Trading pairs: What are you trading against?

When you trade Bitcoin, you’re not just buying or selling it in a vacuum; you’re trading it against another asset. This is known as a “trading pair.” The price of Bitcoin is quoted in terms of the other asset in the pair. Understanding these pairs is fundamental to grasping what Bitcoin trading is in practical terms. Common types include:

- Crypto-to-Fiat Pairs (e.g., BTC/USD, BTC/EUR): This is where you trade Bitcoin against a traditional government-issued currency (fiat money). For example, if the BTC/USD pair is priced at $40,000, it means one Bitcoin is worth $40,000 USD. These pairs are often the starting point for beginners.

- Crypto-to-Crypto Pairs (e.g., BTC/ETH, BTC/SOL): Here, you trade Bitcoin against another cryptocurrency, such as Ethereum (ETH) or Solana (SOL). The price indicates how much of the second cryptocurrency you can get for one Bitcoin, or vice versa.

2.3. Read the market to know how traders make decisions

Successful Bitcoin traders don’t just guess; they employ various methods to analyze the market and make informed decisions about when to buy or sell. While there are many complex strategies, two primary analytical approaches form the foundation for most trading decisions:

Technical Analysis (TA)

This method involves studying historical price charts and trading volume data to identify patterns and predict future price movements. TA operates on the belief that past market activity and price trends can indicate future performance. Traders using TA utilize a variety of tools and indicators, including:

- Candlestick Charts: These are the most common type of price chart used by traders. Each “candlestick” represents price action over a specific time period (e.g., one minute, one hour, one day) and displays the open, high, low, and close prices. Patterns formed by candlesticks can provide clues about potential future price direction.

- Moving Averages (MAs): MAs smooth out price data to create a single flowing line, making it easier to identify the overall trend direction. Common examples include the Simple Moving Average (SMA) and Exponential Moving Average (EMA). Traders often look for crossovers between different MAs or between the price and an MA as potential buy or sell signals.

- Oscillators: These are indicators that fluctuate above and below a centerline or between set levels as prices change. They can help identify overbought (prices may be too high and due for a correction) or oversold (prices may be too low and due for a rebound) conditions. Popular oscillators include the Relative Strength Index (RSI) and the Stochastic Oscillator.

- Chart Patterns: These are recognizable formations that appear on price charts, such as triangles, head and shoulders, flags, and wedges. Traders believe these patterns can indicate potential continuations or reversals of a trend.

- Other key concepts in TA include identifying trends (uptrend, downtrend, or sideways) and support and resistance levels (price levels where Bitcoin historically tends to stop falling or stop rising).

Fundamental Analysis (FA)

This approach focuses on evaluating the intrinsic value of Bitcoin by examining underlying economic, financial, and qualitative factors. For Bitcoin, FA might involve looking at:

- News and Developments: Major announcements, partnerships, or technological upgrades.

- Adoption Rate: How widely Bitcoin is being used by individuals, businesses, and institutions.

- Regulatory Environment: Government regulations and policies regarding cryptocurrencies.

- Network Health and Security: Factors like hash rate and transaction volume.

- Macroeconomic Factors: Broader economic conditions that might influence investor sentiment towards alternative assets like Bitcoin.

Here’s a brief comparison:

| Feature | Technical Analysis (TA) | Fundamental Analysis (FA) |

| Primary Focus | Price charts, patterns, trading volume, indicators | Intrinsic value, news, adoption, macro factors |

| Data Used | Historical market data | Economic, project-specific, industry news |

| Timeframe | Often shorter-term predictions | Can be short or long-term outlook |

| Guiding Question | “What is the market likely to do next based on past behavior and chart signals?” | “What is the underlying value and future potential?” |

Many traders use a combination of both TA and FA to get a more holistic view before making trading decisions. This analytical aspect is a significant part of understanding what Bitcoin trading is.

See more related articles:

3. Common Bitcoin trading strategies for beginners to know

Once you grasp how Bitcoin trading works, you’ll discover there isn’t a one-size-fits-all approach. Traders employ various strategies based on their risk tolerance, time commitment, and market outlook. While there are many advanced techniques, understanding a few common strategies is a good starting point for anyone learning what is Bitcoin trading.

3.1. Day trading

Day trading involves buying and selling Bitcoin within the same trading day. The primary goal is to profit from small, short-term price fluctuations. Day traders typically do not hold any open positions overnight, closing all trades before the market day ends (though the crypto market operates 24/7, day traders often define their own “trading day”). This strategy requires significant time commitment, intense focus, and the ability to make quick decisions, as traders are often glued to their screens looking for fleeting opportunities.

3.2. Swing trading

Swing trading is a strategy where traders aim to capture “swings” or medium-term trends in Bitcoin’s price. Positions are typically held for more than a day but usually not longer than a few weeks, or sometimes a few months. Swing traders try to identify the start of a potential price movement, ride it out, and then exit before the counter-movement begins or the trend shows signs of reversing. This approach generally requires less constant monitoring than day trading but still demands a good understanding of market analysis to time entries and exits effectively.

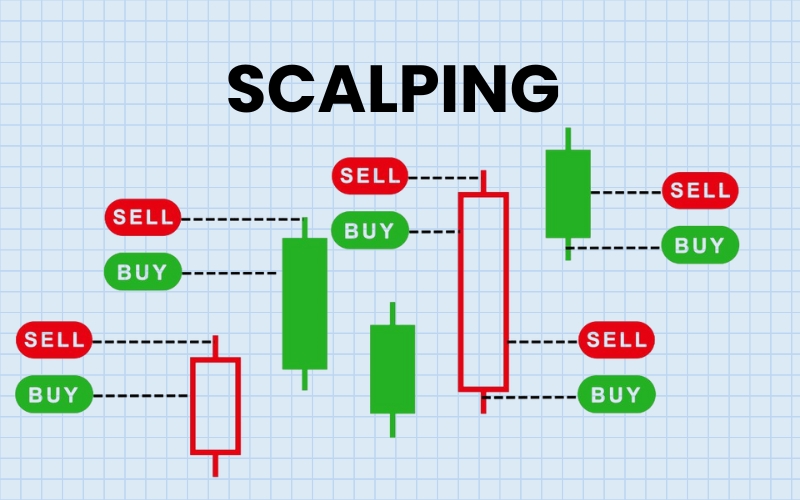

3.3. Scalping

Scalping is an extremely short-term, high-frequency trading strategy, often considered a subset of day trading. Scalpers aim to make numerous small profits from tiny price changes throughout the day. They might execute dozens or even hundreds of trades in a single session, with each trade lasting only seconds or minutes.

This strategy demands immense concentration, quick reflexes, and access to highly liquid markets and low-latency trading platforms. Due to its intensity and high risk, scalping is generally not recommended for beginners.

3.4. Position trading

Position trading is a longer-term trading strategy where traders hold positions for extended periods, typically ranging from several weeks to months, or even years. Unlike investors who might hold indefinitely based on fundamental belief, position traders still make decisions based on technical and fundamental analysis, aiming to profit from major, overarching market trends. They are less concerned with short-term noise and focus on the bigger picture. This strategy requires patience and a strong conviction in the identified long-term trend.

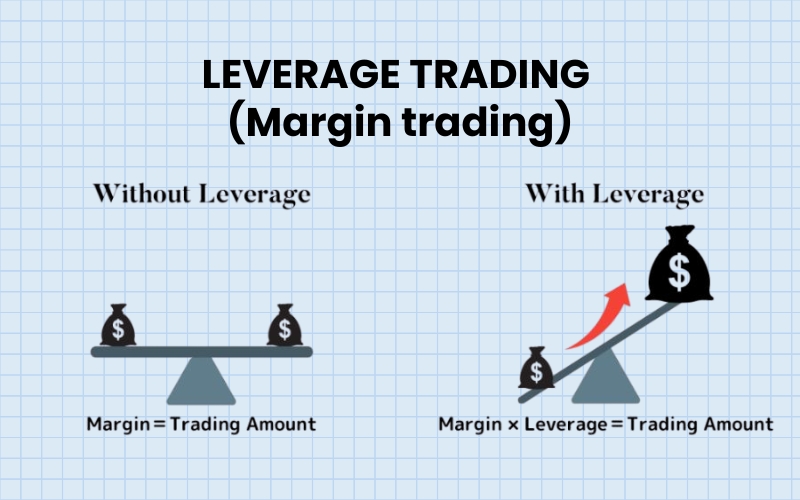

3.5. Leverage trading (Margin trading)

Leverage trading, also known as margin trading, is not a standalone strategy in the same way as the others, but rather a method of amplifying potential profits (and losses) by borrowing funds from an exchange or broker to increase the size of a trading position. For example, with 5x leverage, a $100 move in your favor (or against you) effectively becomes a $500 move.

While leverage can magnify gains, it equally magnifies losses and significantly increases risk. A small adverse price movement can lead to substantial losses or even the liquidation of the entire position. Leverage trading is extremely risky and generally not advisable for beginners. It should only be considered by experienced traders who fully understand the risks and have robust risk management strategies in place.

Here’s an updated table to help differentiate these common trading styles and methods:

| Feature | Day Trading | Swing Trading | Scalping | Position Trading | Leverage Trading (Method) |

| Holding Period | Intra-day (minutes to hours) | Days to weeks/months | Seconds to minutes | Weeks to months/years | Varies (can be applied to any strategy) |

| Trade Frequency | Multiple trades per day | Fewer trades, over days/weeks/months | Very high (dozens to hundreds per day) | Very few trades, long-term holds | Varies (depends on underlying strategy) |

| Profit per Trade | Small to moderate | Moderate to larger | Very small | Potentially very large (but infrequent) | Amplified (profits & losses) |

| Time Commitment | High (requires constant monitoring) | Moderate (periodic monitoring) | Extremely high (requires continuous focus) | Low to moderate (less frequent monitoring) | Adds complexity to any strategy |

| Focus | Short-term volatility, intra-day patterns | Medium-term trends, “swings” | Micro price movements, order flow | Major long-term market trends, fundamentals | Magnifying position size and potential outcomes |

| Suitability for Beginners | Challenging, requires experience | More manageable than day trading/scalping | Not recommended | Requires patience, strong conviction | Extremely risky, not recommended for beginners |

Exploring these different approaches helps provide a fuller picture of what Bitcoin trading is and the diverse ways individuals try to profit from market movements, as well as the tools they might use.

4. The inherent risks of Bitcoin trading you MUST understand

While the potential for profit in Bitcoin trading can be alluring, it’s absolutely crucial to understand that it comes with significant risks. Acknowledging and preparing for these risks is fundamental to responsible trading and a core part of understanding what Bitcoin trading is in its entirety. Ignoring them can lead to substantial financial losses.

4.1. Extreme volatility

Perhaps the most well-known risk associated with Bitcoin is its extreme price volatility. The value of Bitcoin can experience sudden, sharp, and often unpredictable movements, both upwards and downwards. It’s not uncommon for Bitcoin to see double-digit percentage changes within a single day. This high volatility is what attracts many traders, but it’s also what makes it incredibly risky, especially for newcomers.

How to approach this risk:

- Only trade with money you can afford to lose: This is the golden rule. Never trade with funds essential for living expenses, education, or emergency savings.

- Use stop-loss orders: A stop-loss order is an instruction to your exchange to automatically sell your Bitcoin if it drops to a certain price, helping to limit potential losses on a trade.

- Start small: Begin with very small trade sizes to get a feel for the market’s volatility without risking significant capital.

- Avoid leverage (initially): Many exchanges offer leverage, which allows you to trade with more money than you have. While it can amplify profits, it equally amplifies losses and is extremely risky for beginners.

4.2. Security risks

The digital nature of Bitcoin and cryptocurrencies introduces unique security challenges. These are critical considerations for anyone involved in Bitcoin trading.

- Exchange hacks: Cryptocurrency exchanges, despite their security measures, can be targets for sophisticated hackers. If an exchange is compromised, users’ funds stored on the platform could be stolen.

- Personal security breaches: Your own accounts and devices can be compromised through phishing scams, malware, or weak passwords, leading to unauthorized access to your Bitcoin.

- Irreversible transactions: Unlike traditional banking, Bitcoin transactions are generally irreversible. If you send Bitcoin to the wrong address or fall victim to a scam, it’s often impossible to recover the funds.

How to approach this risk:

- Enable Two-Factor Authentication (2FA) everywhere: Use 2FA (e.g., Google Authenticator, Authy) on your exchange accounts and email. This adds a crucial layer of security.

- Use strong, unique passwords: Create complex passwords for each platform and consider using a password manager.

- Be wary of scams: Educate yourself about common phishing tactics and never share your private keys or seed phrases.

- Consider cold storage for long-term holdings: While traders keep funds on exchanges for active trading, if you accumulate significant amounts, consider moving non-trading funds to a more secure offline “cold” wallet (like a hardware wallet).

4.3. Regulatory uncertainty

The regulatory landscape for Bitcoin and cryptocurrencies is still evolving globally. This creates an element of uncertainty that can impact the market.

- Changing laws: Governments can introduce new regulations, restrictions, or even bans on Bitcoin trading or ownership, which can dramatically affect its price and accessibility.

- Lack of investor protection: Compared to traditional financial markets, the crypto space often has fewer investor protections and less oversight.

How to approach this risk:

- Stay informed: Keep up-to-date with regulatory developments in your jurisdiction and globally, as they can be significant market movers.

- Understand your local laws: Be aware of the legal and tax implications of Bitcoin trading in your country.

- Diversify information sources: Don’t rely on a single news outlet; seek information from various reputable sources.

4.4. Emotional trading

The psychological aspect of trading is often underestimated but can be a major pitfall. The highly volatile and fast-paced nature of Bitcoin trading can easily trigger strong emotions.

-

FOMO (Fear Of Missing Out): Seeing prices rise rapidly can lead to impulsive buying at high prices, fearing you’ll miss out on profits.

-

FUD (Fear, Uncertainty, and Doubt): Negative news or price drops can cause panic selling, often at a loss.

-

Greed and Overconfidence: After a few successful trades, it’s easy to become overconfident, take bigger risks, or deviate from your strategy.

How to approach this risk:

- Have a trading plan and stick to it: Define your entry and exit points, risk per trade, and overall strategy before you start trading. Don’t let emotions override your plan.

- Avoid impulsive decisions: If you feel emotional, step away from the charts. Give yourself time to think rationally.

- Keep a trading journal: Record your trades, including your reasoning and emotions. This helps identify patterns in your emotional responses.

- Practice patience: Not every market movement requires a trade. Sometimes the best action is no action.

Understanding these risks is not meant to scare you away, but to empower you. Successful Bitcoin trading involves not just finding opportunities but also diligently managing these inherent dangers. Before you even think about placing your first trade, internalize these risks and commit to responsible practices. The next section will guide you on how to get started in a more measured and safer way.

5. How to get started with Bitcoin trading

Embarking on your Bitcoin trading journey can be exciting, but approaching it with caution and a clear plan is paramount. Given the risks discussed, a measured and educated start is crucial. This isn’t about getting rich quick; it’s about understanding what Bitcoin trading is and building a sustainable approach. Here’s a step-by-step guide to getting started more safely:

Step 1: Educate yourself continuously.

This is, without a doubt, the most important step. Before you even consider risking any real money, invest your time in learning. Understand the basic concepts of Bitcoin, blockchain technology, market dynamics, different trading strategies, and, critically, risk management. The mantra here should be: “Learn before you risk.”

Read books, follow reputable financial news sources (like the educational content on H2T Finance), explore online courses, and absorb as much quality information as you can. The more you know, the better equipped you’ll be to make informed decisions.

Step 2: Choose a reputable cryptocurrency exchange.

Your chosen exchange will be your primary platform for trading. When selecting one, don’t just go for the first one you see. Research and compare exchanges based on critical factors such as:

- Security features: Look for robust security measures like 2FA, insurance funds, and a good track record.

- Fees: Understand their trading fees, deposit/withdrawal fees, and any other charges.

- Liquidity: Higher liquidity generally means you can buy or sell Bitcoin quickly without significantly impacting the price.

- User interface: Choose a platform that you find intuitive and easy to navigate as a beginner.

- Customer support: Check their support options and responsiveness.

- Reputation and reviews: See what other users are saying about the exchange.

Step 3: Secure your account diligently.

Once you’ve chosen an exchange and created an account, security is your top priority. Immediately:

- Enable Two-Factor Authentication (2FA): This is non-negotiable. Use an authenticator app rather than SMS if possible.

- Use a strong, unique password: Combine uppercase letters, lowercase letters, numbers, and symbols. Don’t reuse passwords from other sites.

- Be vigilant against phishing: Double-check website URLs and be suspicious of unsolicited emails or messages asking for your login details.

- Never share your private keys or login credentials with anyone.

Step 4: Start with a small amount or use a demo account.

When you’re ready to make your first trades, only use an amount of money that you are entirely prepared to lose. This cannot be stressed enough. The crypto market is volatile, and losses are a real possibility, especially for beginners.

Many exchanges also offer demo accounts or “paper trading” features. These allow you to practice trading with virtual money in a real market environment. This is an invaluable way to test your strategies, get familiar with the platform, and experience the emotional ups and downs of trading without risking actual capital.

A relatable journey: Navigating the early days

Many who start exploring what Bitcoin trading is share similar initial experiences. When I first began, the sheer volume of information felt overwhelming – countless “gurus” online, conflicting advice, and a new technical term at every turn. It was easy to feel lost. What helped immensely was finding a few trusted, neutral educational resources that focused on foundational knowledge rather than hype. This allowed me to filter out the noise and build a solid understanding, step by step.

Choosing an exchange was another hurdle. I remember comparing fee structures, security protocols, and user reviews for days. Initially, I might have undervalued security, but after reading about exchange hacks (even if they didn’t affect me directly), the importance of robust 2FA and a strong password policy became crystal clear.

I also started with a demo account, and it was a humbling experience! My first “paper trades” weren’t all winners, which taught me valuable lessons about market unpredictability and the need for a strategy before I risked even a small amount of real money. This hands-on, risk-free practice was probably the single most beneficial part of my early learning curve.

6. FAQs about Bitcoin trading

As you delve into the world of Bitcoin trading, several common questions are likely to arise. Here are answers to some frequently asked questions:

What is the difference between Bitcoin trading and stock trading?

While both involve speculating on price movements, there are key differences. Bitcoin markets operate 24/7, unlike traditional stock markets with fixed trading hours. Bitcoin typically exhibits higher volatility and is subject to fewer regulations compared to the stock market. Furthermore, you’re trading a digital asset (Bitcoin) rather than shares representing ownership in a company.

Do I need a lot of money to start trading Bitcoin?

No, you generally don’t need a large amount of capital to begin. Most cryptocurrency exchanges allow you to buy fractions of a Bitcoin (called “Satoshis”). The most important principle is to start small, only investing an amount you are comfortable with potentially losing, especially as you are learning.

Is Bitcoin trading legal?

The legality of Bitcoin trading varies significantly from country to country. In many major economies, it is legal, but regulations can change. It’s crucial for individuals to research and understand the specific laws and regulations concerning Bitcoin trading and taxation in their own jurisdiction before participating.

What is a Bitcoin wallet, and do I need one for trading?

A Bitcoin wallet is a digital tool used to securely store your Bitcoin. When you’re actively trading on an exchange, the exchange typically holds your Bitcoin in an “exchange wallet” linked to your account. However, for long-term storage and enhanced security (especially for significant amounts), it’s widely recommended to transfer your Bitcoin to a personal wallet that you control (e.g., a hardware wallet or a reputable software wallet).

Conclusion: Is Bitcoin trading right for you?

Ultimately, understanding what Bitcoin trading involves, recognizing it as a high-risk, potentially high-reward speculative activity, is distinctly different from long-term Bitcoin investing. It demands a significant investment in education, a disciplined approach, robust risk management strategies, and emotional control. There are no guaranteed profits, and the learning curve can be steep.

If you are considering Bitcoin trading, proceed with caution. Continue to educate yourself thoroughly, start with a very small amount of capital you can afford to lose (or practice extensively with a demo account), and prioritize understanding and managing the inherent risks involved. Bitcoin trading is not suitable for everyone, but for those willing to put in the effort and approach it responsibly, it can be a fascinating, albeit challenging, endeavor.

Ready to learn more about the tools traders use? Want to understand what is Bitcoin trading and its risks better? Read our detailed article on the Bitcoin category of Vietnam-US Trade!