You’ve likely heard about Bitcoin trading, but a fundamental question often arises: What is Bitcoin trading for? Why do individuals dedicate time, capital, and effort to buying and selling this leading cryptocurrency? It’s certainly more than just random clicks on a screen. This guide aims to unravel the primary purposes and motivations driving people to engage in Bitcoin trading. We’ll explore the diverse objectives, from seeking profit to diversifying portfolios, and understand the potential benefits traders hope to achieve by participating in this dynamic market.

1. Understanding the core concept: Trading vs. long-term holding

Before we dive into the specific reasons why people trade Bitcoin, it’s essential to briefly revisit the definition of what is Bitcoin trading and the fundamental difference between Bitcoin trading and Bitcoin investing (or HODLing).

- Bitcoin Investing (HODLing) typically involves buying Bitcoin with the intent to hold it for the long term (months or years), based on a belief in its fundamental value and future appreciation. The primary purpose is wealth accumulation over an extended period.

- Bitcoin Trading, on the other hand, involves more frequent buying and selling to capitalize on shorter-term price movements. The purposes behind trading, therefore, often differ significantly from those of long-term holding.

This distinction sets the stage for understanding the varied answers to the question, “What is Bitcoin trading for?“

(A quick overview) So, what is Bitcoin trading for?

At a glance, people engage in Bitcoin trading for several key reasons, each with its own set of goals and strategies. These primary motivations, which we will explore in detail throughout this article, include:

- Profit generation: Seeking to make money from Bitcoin’s price fluctuations.

- Portfolio diversification: Using Bitcoin to potentially reduce overall investment risk.

- Hedging & risk management: Employing Bitcoin as a tool against inflation or to protect other assets.

- Other motivations: Including access to a 24/7 market, intellectual stimulation, and participation in an emerging asset class.

Let’s delve into each of these purposes.

2. Primary purpose: Profit generation through price speculation

Undoubtedly, the most common answer to “What is Bitcoin trading for?” is the pursuit of profit. Many individuals are drawn to Bitcoin trading by the potential to generate financial returns by speculating on its price movements. This objective drives a significant portion of the activity in the Bitcoin market.

2.1. Capitalizing on volatility

Bitcoin is renowned (and sometimes notorious) for its significant price volatility. This means its price can experience large and rapid swings in relatively short periods. While this volatility can be a source of risk, it’s precisely what traders aim to capitalize on.

Traders seek to profit from these price changes by:

- Going long (buying): Purchasing Bitcoin when they anticipate its price will rise, intending to sell it later at a higher price. This is the classic “buy low, sell high” strategy.

- Going short (selling): More advanced traders might also engage in short selling, where they speculate on a price decrease. This typically involves borrowing Bitcoin to sell it, hoping to buy it back cheaper later to return to the lender, pocketing the difference (minus fees). For beginners, understanding the concept of profiting from upward movements is the primary focus.

The core idea is to correctly predict the direction of the price movement and execute trades accordingly to capture the difference. This dynamic is central when considering what Bitcoin trading is for from a profit-seeking perspective.

2.2. Short-term vs. medium-term gains

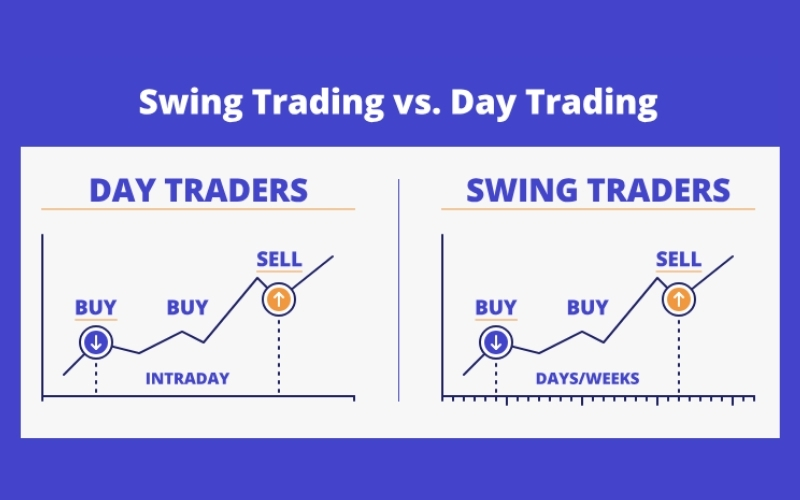

The timeframe for these profit-seeking activities can vary significantly, aligning with different trading strategies:

- Day traders and scalpers aim for quick, relatively small profits by making numerous trades throughout a single day. They focus on minor price fluctuations and rarely hold positions overnight. For them, what Bitcoin trading is about is accumulating these small wins consistently.

- Swing traders, on the other hand, aim for more substantial gains by capturing larger price “swings” or trends that can last from several days to a few weeks. They are less concerned with minute-by-minute fluctuations and focus on broader market movements.

2.3. The role of market analysis

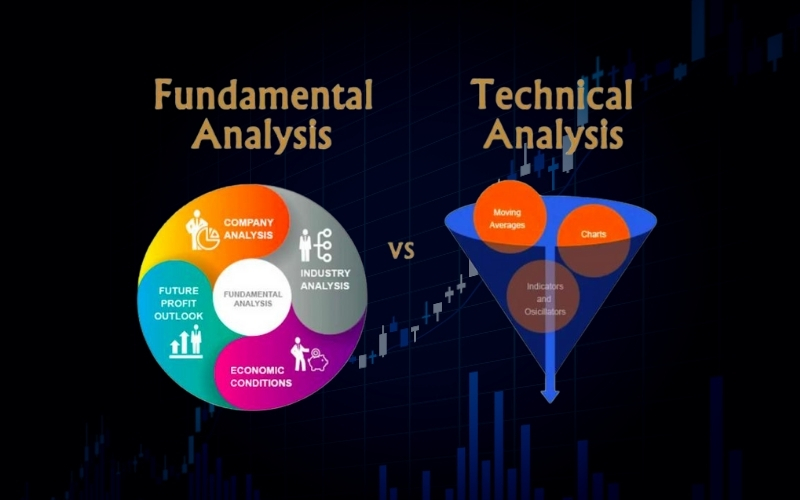

The effective use of market analysis is crucial for those whose primary answer to “What is Bitcoin trading for?” is to generate profit through speculation. To identify these potential profit opportunities, traders rely on various forms of market analysis. While we won’t delve deeply into these here, it’s important to know that:

- Technical Analysis (TA) involves studying historical price charts and trading volumes to identify patterns and predict future price movements.

- Fundamental Analysis (FA) involves assessing Bitcoin’s intrinsic value by examining underlying factors like adoption rates, technological developments, regulatory news, and macroeconomic trends.

Both TA and FA are tools traders use to inform their speculative decisions, helping them determine potential entry and exit points in their quest for profit.

3. Bitcoin trading for portfolio diversification

Beyond direct profit generation, another significant answer to “what is Bitcoin trading for?” lies in its potential role in portfolio diversification. Diversification is a core investment strategy aimed at reducing overall risk by spreading investments across various asset classes that don’t all move in the same direction at the same time.

3.1. Bitcoin as a non-correlated asset (historically)

One of the arguments for including Bitcoin in a diversified portfolio stems from its historical tendency to have a low correlation, or sometimes even a non-correlation, with traditional financial assets like stocks and bonds. This means that Bitcoin’s price movements have, at times, been largely independent of the movements in these established markets.

- Why this matters for diversification: If one part of your portfolio (e.g., stocks) is performing poorly, a non-correlated asset like Bitcoin might perform differently (either positively, neutrally, or less negatively), potentially cushioning the overall portfolio’s losses.

- Important caveat: It’s crucial to understand that correlations can and do change over time. In recent periods, Bitcoin has sometimes shown increased correlation with tech stocks, for example. Therefore, relying on historical non-correlation as a guaranteed future trait is unwise. This potential for diversification is a dynamic factor, not a fixed one.

3.2. Potential for higher risk-adjusted returns

The theory behind adding a volatile, high-potential-return asset like Bitcoin to a traditional portfolio (even in a small allocation) is that it could potentially improve the overall risk-adjusted returns of the portfolio.

Here’s the idea:

- Even a small allocation to an asset with Bitcoin’s historical upside potential could significantly boost overall portfolio returns if Bitcoin performs well.

- If Bitcoin’s correlation to other assets remains low, its inclusion might not drastically increase the overall portfolio’s volatility in proportion to the added return potential.

Critical warning: This is a theoretical concept that comes with significant caveats. Bitcoin remains an extremely volatile and risky asset. Attempting to use Bitcoin trading for diversification requires a deep understanding of portfolio construction, risk management, and the specific characteristics of Bitcoin.

The high risk of Bitcoin itself means that even a small allocation can lead to substantial losses if not managed carefully. For many, simply holding a small, long-term allocation for diversification might be considered, but actively trading Bitcoin for diversification adds another layer of complexity and risk.

3.3. Active management vs. passive holding for diversification

When considering what Bitcoin trading is for in the context of diversification, some individuals may opt for a more active approach rather than simply buying and holding a small amount.

- Passive holding for diversification: This involves buying a certain amount of Bitcoin and holding it as a long-term diversifying component of a portfolio, largely ignoring short-term price swings.

- Active trading for diversification: Some more experienced investors or traders might actively manage their Bitcoin allocation. This could involve increasing or decreasing their Bitcoin exposure based on market conditions, perceived changes in correlation, or specific trading signals, attempting to optimize its diversifying effect or capture additional alpha. This approach demands more skill, time, and risk management than passive holding.

Ultimately, using Bitcoin trading as a tool for diversification is a sophisticated strategy that should be approached with caution and significant prior research.

4. Hedging and risk management purposes

While often viewed as a speculative asset, for some, another answer to “what is Bitcoin trading for?” involves using it, or related instruments, for hedging or broader risk management strategies. These use cases are generally more niche or advanced compared to direct profit seeking.

4.1. Hedging against inflation or currency devaluation (a niche use case)

One debated use case for Bitcoin is as a potential hedge against traditional economic risks like high inflation or the devaluation of fiat currencies.

The argument is rooted in Bitcoin’s fixed supply (only 21 million BTC will ever exist), which contrasts with fiat currencies that can be printed by central banks, potentially leading to a decrease in their purchasing power over time.

- How it’s envisioned: In countries experiencing severe economic instability or hyperinflation, some individuals might turn to Bitcoin, acquiring it (which can be a form of trading if done actively) as a way to preserve their wealth or purchasing power when their local currency is rapidly losing value.

- Important considerations and limitations:

- This is a highly debated and niche use case.

- Bitcoin’s own extreme volatility can make it an unreliable short-term hedge. A significant price drop in Bitcoin could negate any benefits gained from avoiding fiat devaluation.

- It is not a perfect or guaranteed hedge. While the fixed supply argument is compelling for some, the practicalities of using such a volatile asset for capital preservation are complex and risky.

4.2. Using derivatives to hedge crypto portfolios (For advanced users)

For more sophisticated market participants, Bitcoin trading, particularly through derivative instruments, can serve a more direct risk management function within their existing cryptocurrency portfolios.

- What are derivatives? Bitcoin derivatives include financial contracts like futures and options, whose value is derived from the price of Bitcoin itself.

- How they can be used for hedging: Experienced traders or investors holding a significant amount of Bitcoin (or other cryptocurrencies) might use these derivatives to protect their portfolios against potential adverse price movements. For example:

- They could sell Bitcoin futures contracts to lock in a future selling price, offsetting potential losses if the Bitcoin spot price falls.

- They might buy put options, giving them the right (but not the obligation) to sell Bitcoin at a predetermined price, acting as a form of insurance against price drops.

Critical warning: Trading Bitcoin derivatives is complex, involves leverage, and carries substantial risk. These strategies are generally not suitable for beginners and require a deep understanding of financial markets and the specific instruments involved. We mention it here solely to illustrate another, more advanced, answer to “what is Bitcoin trading for?” from a risk management perspective within the crypto space itself.

Using Bitcoin trading for hedging purposes, whether against macroeconomic factors or for intra-portfolio risk management, requires careful consideration and often a higher level of expertise.

5. Other motivations for Bitcoin trading

While financial goals like profit, diversification, or hedging are primary drivers, the answer to “what is Bitcoin trading for?” can also encompass a range of other, sometimes more personal or experiential, motivations. These factors often contribute to the appeal and engagement individuals find in the Bitcoin market.

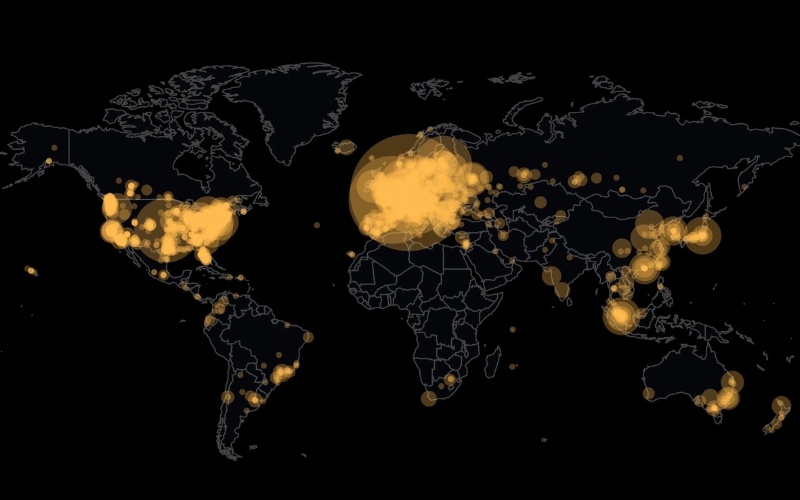

5.1. Access to a 24/7 global market

Unlike traditional stock markets that operate within fixed daily hours and are often geographically limited, the Bitcoin market operates continuously, 24 hours a day, 7 days a week, globally.

This non-stop nature offers several attractions:

- Flexibility: Traders can participate at times that suit their schedules, regardless of their time zone or other commitments.

- Constant opportunity (and risk): The market is always open, meaning price movements and trading opportunities can arise at any hour. This also means risks are ever-present.

- Global accessibility: Anyone with an internet connection can potentially access and trade Bitcoin, making it a truly global marketplace.

5.2. Intellectual challenge and skill development

For many individuals, Bitcoin trading presents a significant intellectual challenge and an opportunity for continuous skill development. The process involves:

- Analytical thinking: Learning to interpret charts, understand market indicators, and assess fundamental factors.

- Strategic planning: Developing and refining trading strategies, setting goals, and managing risk.

- Emotional discipline: Learning to control fear, greed, and other emotions that can negatively impact trading decisions.

- Continuous learning: The crypto market is constantly evolving, requiring traders to stay updated on new technologies, trends, and regulatory changes.

For these individuals, the journey of learning and mastering the complexities of the market is a reward in itself, beyond just monetary gains.

5.3. Participation in an emerging asset class

Bitcoin represents a novel and innovative asset class, underpinned by blockchain technology, which many believe has transformative potential. For some, what Bitcoin trading is about is more than just financial transactions; it’s about actively participating in and learning about this emerging technological and financial frontier.

- Gaining firsthand experience: Trading provides a direct way to interact with the asset, understand its price dynamics, and experience the ecosystem.

- Staying at the forefront of innovation: It allows individuals to be involved in a rapidly developing space that could reshape aspects of finance and technology.

- Community and engagement: The cryptocurrency world has a vibrant and active global community, and trading can be a way to connect with like-minded individuals.

These less tangible motivations often play a significant role in why people choose to engage with Bitcoin trading, complementing the more direct financial objectives.

6. Important considerations: Risks remain regardless of purpose

As we’ve explored the various answers to “what is Bitcoin trading for?” – from profit seeking and portfolio diversification to hedging and intellectual curiosity – it’s paramount to underscore a critical point: the inherent risks of Bitcoin trading do not disappear or diminish based on your motivations.

Regardless of why you choose to trade Bitcoin, you will still face:

- Extreme price volatility: The potential for rapid and significant price swings.

- Security vulnerabilities: The risk of exchange hacks or personal account compromises.

- Regulatory uncertainties: The evolving and sometimes unpredictable legal landscape.

- Emotional challenges: The psychological pressures of FOMO, FUD, and managing greed.

Your purpose for trading might shape your strategy or timeframe, but it doesn’t alter the fundamental nature of the risks involved. Therefore, clearly understanding what Bitcoin trading is for you personally, and honestly assessing whether your risk tolerance aligns with these persistent dangers, is a non-negotiable step before engaging with the market.

A personal reflection: Aligning purpose with reality

When I first ventured into the crypto space, my initial answer to “what is Bitcoin trading for?” was largely driven by a desire to understand this emerging technology and, admittedly, the allure of potential quick profits. My initial purpose was a mix of education and speculation.

One of the first hurdles was the sheer overwhelm of information and the hype cycle. Every new coin or trend seemed like the “next big thing,” making it easy to get sidetracked from a disciplined approach. I learned quickly that chasing hype without a solid understanding often led to poor decisions. My strategy to overcome this was to narrow my focus, stick to learning the fundamentals of Bitcoin itself, and find a few trusted, unbiased educational sources rather than following every social media “guru.”

Another significant challenge was emotional management. After a couple of small, successful trades, overconfidence crept in. I increased my trade sizes prematurely and deviated from my initial, more cautious plan. This inevitably led to a larger-than-anticipated loss on one trade, which was a stark lesson. The experience taught me the critical importance of having a predefined trading plan (including risk limits like stop-losses) and sticking to it, regardless of how “certain” a trade felt. It also highlighted the value of starting incredibly small until I had a better grasp of my own emotional responses to market swings.

My journey has reinforced that no matter your “why” for trading Bitcoin, the “how” – particularly how you manage risk and educate yourself – is what ultimately determines your ability to navigate this challenging but fascinating market sustainably. My advice to anyone starting is to clearly define your personal answer to “what is Bitcoin trading for?”, be brutally honest about your risk tolerance, and prioritize continuous learning and disciplined execution above all else.

7. FAQs about the purposes of Bitcoin trading

Here are some frequently asked questions that arise when people consider “what is Bitcoin trading for?” and its various motivations:

Is Bitcoin trading primarily for getting rich quickly?

While Bitcoin’s history includes periods of rapid price appreciation leading to significant profits for some, approaching Bitcoin trading as a “get-rich-quick” scheme is highly risky and often leads to substantial losses. The same volatility that creates profit potential also creates the potential for swift losses. A sustainable approach requires education, strategy, risk management, and realistic expectations, not the pursuit of instant wealth.

Can Bitcoin trading replace a traditional investment portfolio?

For the vast majority of individuals, Bitcoin trading should not replace a well-diversified traditional investment portfolio (which might include stocks, bonds, real estate, etc.). Due to its high volatility and inherent risks, Bitcoin is often considered a speculative asset. It might serve as a small, complementary part of a broader investment strategy for those who understand and can tolerate the risks, but relying on it entirely is generally not advisable.

If I’m not a financial expert, what is Bitcoin trading for me?

If you’re not a financial expert, your primary purpose for engaging with Bitcoin trading should lean heavily towards education and cautious exploration. You might consider it:

- A way to learn firsthand about a new asset class and blockchain technology.

- An opportunity to experience market dynamics with a very small amount of capital, you are entirely prepared to lose.

- Potentially, to aim for modest gains if approached with extreme caution, significant prior learning, and a robust risk management plan.

Always prioritize education and understanding before risking capital.

What preparations are essential before I start Bitcoin trading?

Key preparations include:

- Thorough education: Understand Bitcoin, blockchain, market analysis basics, and trading terminology.

- Risk assessment: Honestly evaluate how much you can afford to lose.

- Goal setting: Define what you hope to achieve (your personal “what is Bitcoin trading for?”).

- Choosing a reputable exchange: Research security, fees, and user experience.

- Developing a basic trading plan: Outline your strategy, entry/exit criteria, and risk management rules (e.g., stop-losses).

- Practicing with a demo account: Gain experience without risking real money.

I’ve decided to try Bitcoin trading. What’s a crucial ongoing practice?

If you’ve decided to trade, one of the most crucial ongoing practices is continuous learning and adaptation. The crypto market is dynamic and evolves rapidly. Stay updated on market news, technological developments, and regulatory changes. Regularly review your trading performance, learn from both wins and losses, and be willing to adjust your strategies as you gain more experience and as market conditions change. Never stop learning.

Conclusion: Aligning your goals with Bitcoin trading

Understanding what Bitcoin trading is for is a deeply personal yet critical first step before engaging with this volatile market. As we’ve explored, the motivations can be diverse:

- Primary Goal: Often, it’s the pursuit of profit through price speculation, capitalizing on Bitcoin’s volatility.

- Strategic Addition: For some, it serves as a tool for potential portfolio diversification, aiming to add a non-correlated asset.

- Risk Management: In niche cases, it might be used for hedging against inflation or managing existing crypto portfolio risks.

- Other Motivations: These can include the appeal of a 24/7 global market, the intellectual challenge, or the desire to participate in an emerging asset class.

Ultimately, there’s no single “right” reason to trade Bitcoin. However, it is crucial that you:

- Clearly define your personal objectives. Why are you considering Bitcoin trading?

- Honestly assess your risk tolerance. Can you stomach the potential for significant and rapid losses?

- Commit to continuous education. The learning curve is steep and ongoing.

- Implement robust risk management practices from day one.

Bitcoin trading is not a guaranteed path to riches, nor is it suitable for everyone. By thoughtfully considering your own answer to “what is Bitcoin trading for?” and aligning it with a realistic understanding of the market and its inherent risks, you can make a more informed decision about whether this endeavor is right for you.

Get to know what is Bitcoin trading for, and understanding your ‘why’ is crucial. Curious about different trading styles? Wanna explore how to manage the risks in Bitcoin trading? Get access to our Bitcoin category to gain more useful information that Vietnam-US Trade is sharing!