What is Bitcoin’s highest price? To truly answer that question, we first need to understand how Bitcoin’s price has evolved since its creation. Bitcoin’s journey is not just a financial timeline it reflects a profound shift in how people perceive money, value, and technology. Launched in 2009 at virtually zero value, Bitcoin has since grown into a globally traded asset with price surges that have stunned both skeptics and supporters.

From its humble beginnings on niche forums to reaching all-time highs in the tens of thousands of dollars, Bitcoin’s price trajectory has been shaped by innovation, media hype, global economic events, and increasing institutional interest. This section will introduce you to the evolution of Bitcoin’s value and set the stage for a deeper exploration of what is the highest price Bitcoin has ever been, including the key milestones that led to its most iconic peaks.

1. What is Bitcoin’s highest price?

As of May 22, 2025, Bitcoin reached its all-time highest price ever recorded a staggering $111,379 per BTC. For anyone asking what is bitcoin’s highest price ever, this number currently stands as the definitive answer.

This peak didn’t just set a new benchmark for Bitcoin but also cemented its position as a dominant force in the cryptocurrency market. But to truly appreciate what is Bitcoin’s highest price, it’s essential to understand the milestones and shifts that paved the way to this number.

2. Bitcoin price milestones through the years

Before Bitcoin reached its highest price ever of $111,379 in May 2025, its journey was marked by dramatic surges, corrections, and periods of relative stability. Understanding these key milestones gives us a clearer view of what is Bitcoin highest price in historical context.

2.1. Early stage (2009–2015)

Bitcoin was introduced in 2009 with virtually no monetary value. In 2010, the famous “Bitcoin Pizza Day” saw 10,000 BTC exchanged for two pizzas – valuing each Bitcoin at around $0.0025.

By 2011, Bitcoin reached $1, a symbolic breakthrough. It later climbed to around $31 before falling back due to early market volatility. Over the next few years, prices fluctuated between $2 and $1,000, with Mt. Gox’s rise and fall heavily influencing market perception.

2.2. Bull run era (2016–2020)

After years of relative obscurity, Bitcoin gained traction in 2016 and 2017. The cryptocurrency boom of 2017 pushed Bitcoin to a then-unprecedented $19,783 in December 2017, driven by speculative investment, ICO hype, and increasing global attention.

This was followed by a sharp correction throughout 2018, where Bitcoin dropped below $4,000, before gradually recovering toward $10,000 by 2020.

2.3. Institutional attention (2021)

The year 2021 was a pivotal turning point. Tesla’s $1.5 billion Bitcoin purchase, coupled with growing interest from hedge funds and payment platforms like PayPal, helped push the price to $64,863 in April 2021.

Later that year, in November 2021, Bitcoin hit a new record of $68,789, spurred by the launch of Bitcoin ETFs and broader institutional adoption. However, rising inflation concerns and tightening monetary policies began to weigh on the market.

2.4. Recovery & surge (2023–2025)

After a prolonged bear market in 2022, Bitcoin began recovering in 2023, fueled by:

- Optimism around regulatory clarity

- Ongoing halving anticipation

- Renewed institutional entry

By late 2024, Bitcoin was trading near $90,000, and finally, on May 22, 2025, it reached its current ATH of $111,379, answering definitively what is bitcoin’s highest price ever recorded.

3. What drives Bitcoin’s price so high?

Bitcoin’s price surges aren’t random they reflect global trends, technology adoption, and investor behavior. To truly grasp what is highest price ever for Bitcoin, we must look at the forces behind it.

3.1. Supply & demand

Bitcoin has a fixed supply of 21 million coins, making it inherently scarce. As more people want to own Bitcoin, especially during bull markets or after halving events (which cut block rewards in half), demand increases while supply growth slows. This classic supply-demand dynamic plays a critical role in pushing prices higher.

3.2. Market sentiment & speculation

Bitcoin’s value is heavily driven by investor sentiment. News cycles, social media trends, and influential figures like Elon Musk can move markets dramatically. Speculation, especially during bull runs, often fuels rapid price increases as seen in 2021 and again in 2025.

3.3. Institutional adoption

Increased interest from institutional investors such as Tesla, BlackRock, and MicroStrategy has significantly legitimized Bitcoin as a mainstream asset. When large-scale investors enter the market, they not only boost demand but also build confidence for retail investors. This played a major role in the surge to the all-time high.

3.4. Global events

Macroeconomic instability such as inflation fears, geopolitical tensions, or banking crises often drives investors to seek alternative stores of value. Bitcoin, with its decentralized and borderless nature, is increasingly viewed as a hedge during uncertain times, pushing demand (and prices) upward.

3.5. Competing cryptocurrencies

While altcoins and blockchain projects are gaining popularity, Bitcoin remains the benchmark of the crypto world. Its dominance fluctuates, but Bitcoin typically benefits from increased attention to crypto as a whole. When the market heats up, Bitcoin is usually the first to surge.

4. What can we learn from Bitcoin’s price history?

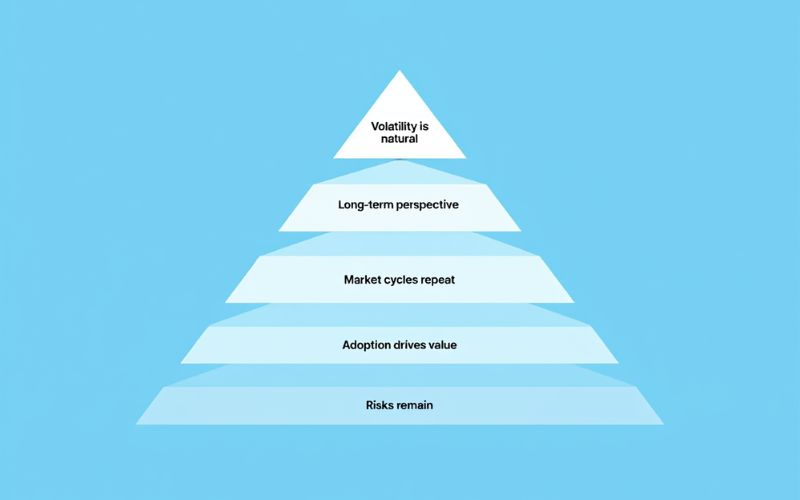

Bitcoin’s price journey over the past decade and a half offers valuable lessons for both new and experienced investors. Understanding these key takeaways can help you navigate the volatile crypto market with more confidence.

- Volatility is natural: Bitcoin’s price is known for wild swings, sometimes gaining or losing 20-30% in a single day. This volatility reflects market sentiment, regulatory news, and broader economic factors.

- Long-term perspective matters: Despite sharp corrections, Bitcoin’s overall trend has been upward since its inception. Those who held through the lows such as the 2018 crash or 2022 bear market often saw significant gains later.

- Market cycles repeat: Bitcoin experiences boom and bust cycles roughly every 3 to 4 years, often aligned with the halving events that reduce new supply. Recognizing these cycles can inform better timing decisions.

- Adoption drives value: Increased use cases, from institutional investments to mainstream acceptance, have historically coincided with price surges. The growing ecosystem strengthens Bitcoin’s role as “digital gold.”

- Risks remain: Regulatory uncertainty, security breaches, and technological challenges continue to pose risks. Staying informed and cautious is crucial.

By learning from Bitcoin’s past price behavior, you can better prepare for future opportunities and risks in the dynamic world of cryptocurrency.

5. FAQs – quick answers for beginners

Here are some common questions newcomers often ask about Bitcoin’s price, answered simply and clearly:

Q1: What is Bitcoin’s highest price ever?

Bitcoin reached its all-time highest price of $111,379 on May 22, 2025.

Q2: Why does Bitcoin’s price fluctuate so much?

Bitcoin’s price changes due to factors like market demand, investor sentiment, news events, and regulatory changes, making it highly volatile.

Q3: Can Bitcoin’s price go higher than its current highest?

Yes, many experts believe Bitcoin still has potential to reach new highs, especially as adoption grows and supply remains limited.

Q4: What influences Bitcoin’s price the most?

Key influences include supply and demand dynamics, institutional investment, global economic trends, and competition from other cryptocurrencies.

Q5: Is Bitcoin a good investment?

Bitcoin can offer high returns but comes with high risk. It’s important to do thorough research and only invest what you can afford to lose.

Q6: How can beginners track Bitcoin’s price?

Use trusted platforms like CoinMarketCap, Binance, or Coinbase to monitor real-time prices and market trends.

Read more: What is wrapped Bitcoin? Expert insights into wBTC explained

6. Conclusion – will bitcoin reach new highs again?

Bitcoin’s price journey has been nothing short of extraordinary, reaching an unprecedented peak of $111,379 in May 2025. While past performance does not guarantee future results, the factors that have driven Bitcoin’s growth including limited supply, increasing institutional adoption, and growing global acceptance suggest that new highs are still possible.

However, potential investors should remember that Bitcoin remains a highly volatile asset influenced by market sentiment, regulations, and broader economic events.

Understanding what is Bitcoin’s highest price helps set realistic expectations and highlights the dynamic nature of the cryptocurrency market. For anyone interested in the evolving world of digital assets, staying informed about market trends and price drivers is crucial.

If you want to learn more about Bitcoin, trading strategies, or cryptocurrency basics, explore our other in-depth guides on VN – US trade to deepen your knowledge and navigate the crypto landscape with confidence.