When investors ask what is Bitcoins potential, they’re really trying to decode the future of one of the most volatile yet intriguing assets of our time. From a digital experiment to a trillion-dollar asset class, Bitcoin has outpaced stocks and gold, but can it reach six or seven figures in the next decade? Discover what’s driving Bitcoin’s growth and experts’ forecasts about Bitcoin’s price in the following article of VN-US Trade.

1. What is Bitcoins potential? A comprehensive forecast from leading experts

Bitcoin’s potential lies in becoming a global store of value, like digital gold, and possibly a widely used medium of exchange. With limited supply and growing adoption, it could see strong long-term price growth. This potential is further reinforced by bullish forecasts from leading industry experts.

In this section, we dive deep into projections from experts, quantitative analysts, institutional giants, and renowned investors to offer you a clearer, more nuanced view of the potential Bitcoin price. Let’s explore various models and predictions that attempt to answer the million, or perhaps billion, dollar question.

1.1. Bitcoin price prediction using the Monte Carlo method with the Nakamoto portfolio approach

Through our extensive research, we found that traditional forecasting models often fall short when applied to a disruptive asset like Bitcoin. That’s where the Nakamoto Portfolio Theory and Monte Carlo simulations offer a new lens.

The Nakamoto Portfolio Theory evaluates how an asset like Bitcoin can improve portfolio performance, not just through returns, but by optimizing risk-adjusted gains. We used a Monte Carlo simulation to model potential Bitcoin price paths over the next year, running thousands of iterations based on historical volatility and return data.

Here’s what stood out:

- Average Expected Price in 1 Year: $144,000

- 95% Confidence Interval: Between $30,000 and $448,000

- Best-Case Scenario: $901,000

- Worst-Case Scenario: $6,500

- Positive Outcomes: 77% of simulations delivered a profit

- Risk-to-Reward Ratio: Among the best in any asset class

While the average price sounds appealing, it’s not a reliable indicator. Think of it like standing with one foot in freezing water and the other in boiling water; on average, you’re fine, but reality is more complex.

What the simulation really tells us is that Bitcoin’s price prediction is inherently uncertain, yet its upside potential is immense, and that’s a key part of answering the question, what is Bitcoins potential, in a meaningful way.

The simulation also affirms Bitcoin’s role as an asymmetric asset, where the upside vastly outweighs the downside. That’s what makes it a unique and powerful component in any modern investment portfolio.

1.2. Peter Brandt’s Bitcoin price forecast: $120,000 to $200,000 by September 2025

Veteran trader Peter Brandt has updated his bullish Bitcoin forecast after analyzing recent market structure developments. According to him, Bitcoin has:

- Broken out of a 15-month trading channel, confirming a major trend shift.

- Shown signs of a sustained upward move, not just a short-term rally.

Brandt initially projected Bitcoin to top at $120,000. However, given the asset’s strong performance and growing macro tailwinds, he revised his forecast to $200,000 by September 2025.

We’ve followed Brandt for years, and what sets his analysis apart is its foundation in decades of market behavior, not hype. His outlook reflects growing confidence in Bitcoin’s resilience and increasing institutional interest.

For investors evaluating what is Bitcoins potential price, Brandt’s view offers a solid short-to-medium-term benchmark backed by technical fundamentals.

1.3. Fidelity’s bold projection for potential Bitcoin price: $1 billion per BTC by 2038–2040

Fidelity Investments is one of the most influential institutions in the financial world, and its long-term Bitcoin forecast is bold.

Jurrien Timmer, Director of Global Macro at Fidelity, outlines a scenario where:

- Bitcoin could hit $1 million by 2030.

- And potentially reach $1 billion per coin by 2040.

His analysis is grounded in Metcalfe’s Law, which states that a network’s value is proportional to the square of its users.

Fidelity’s research suggests Bitcoin is entering a feedback loop of adoption and valuation. As more users join the network, especially through platforms like Fidelity Digital Assets, the value of each Bitcoin rises exponentially.

In 2022, Fidelity acquired a 7.4% stake in Marathon Digital Holdings and has since deepened its involvement in the Bitcoin ecosystem. This isn’t a casual endorsement, it’s a strategic investment. By recognizing Bitcoin as fundamentally different from other digital assets, Fidelity signals that this is more than a trend. It’s a generational opportunity.

For investors asking what is Bitcoins potential value in the long term, Fidelity’s thesis is compelling: Bitcoin may emerge as a foundational layer of future financial systems.

1.4. Chamath Palihapitiya projects Bitcoin could reach $500,000 by October 2025 and $1 million by 2040–2042

Chamath Palihapitiya, a leading tech investor and venture capitalist, views Bitcoin as “digital gold”, but with greater utility and superior scarcity. His forecast includes:

- $500,000 per Bitcoin by October 2025.

- $1 million per Bitcoin by 2040–2042.

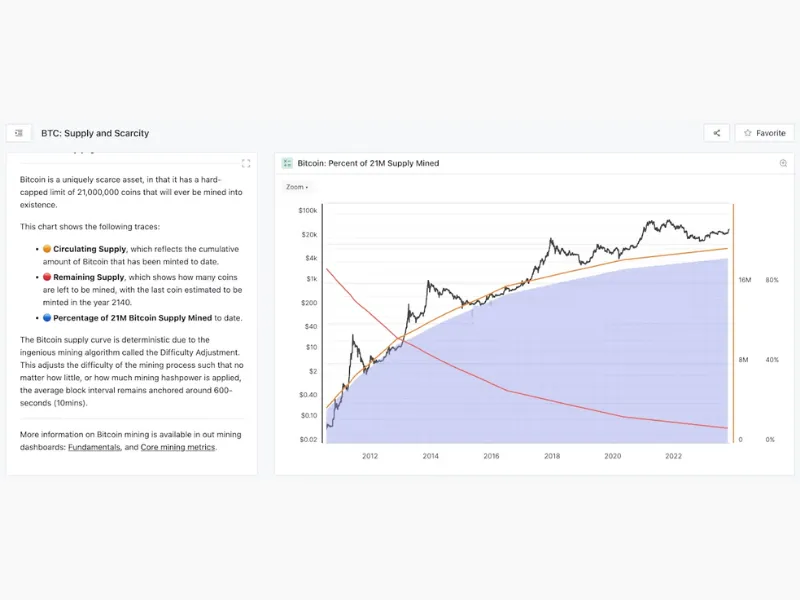

Palihapitiya’s thesis centers around Bitcoin’s finite supply (21 million coins), its deflationary monetary policy (with a post-halving inflation rate of just 0.84%), and rising distrust in traditional financial systems. In volatile times, investors are increasingly seeking uncorrelated hedges, and Bitcoin fits that role perfectly.

We’ve observed that institutions like Tesla, MicroStrategy, and PayPal have validated Bitcoin’s role in treasury strategies. As adoption increases, demand may vastly outpace supply, especially as retail investors, sovereign wealth funds, and ETFs enter the arena.

Palihapitiya’s long-term prediction reflects more than optimism, it’s a logical extrapolation of Bitcoin’s trajectory, built on scarcity, utility, and trust.

1.5. So, what is Bitcoins potential price according to leading experts?

After reviewing insights from quantitative simulations, seasoned traders, institutional analysts, and billionaire investors, here’s a recap of Bitcoin price predictions:

| Source | Predicted Price | Timeline |

| Monte Carlo Simulation | $30,000 – $448,000 | Next 12 months |

| Peter Brandt | $200,000 | By September 2025 |

| Fidelity Investments | $1M – $1B | 2030 – 2040 |

| Chamath Palihapitiya | $500K – $1M | 2025 – 2042 |

See more related articles:

- How Safe Is Bitcoin? A Complete Explanation and How to Invest Safely in Bitcoin

- What do you do with Bitcoins? 6 profitable secrets you should know in 2025

- What is Bitcoins market cap? An essential update for many investors’ success

2. What is Bitcoins potential according to expert reports and forecasts from Binance?

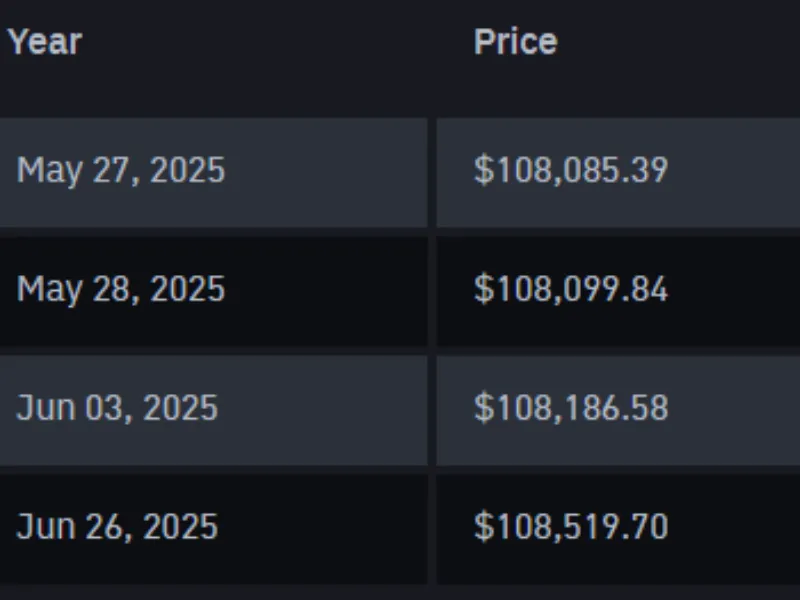

As of now, Bitcoin is trading at $108,085.39 (BTC/USD), with a market capitalization of $2.15 trillion. The 24-hour trading volume stands at $45.55 billion. The circulating supply currently totals 19.87 million BTC. Prices are updated in real time at the time of writing. Next, let’s take a look at our expert’s potential Bitcoin price predictions.

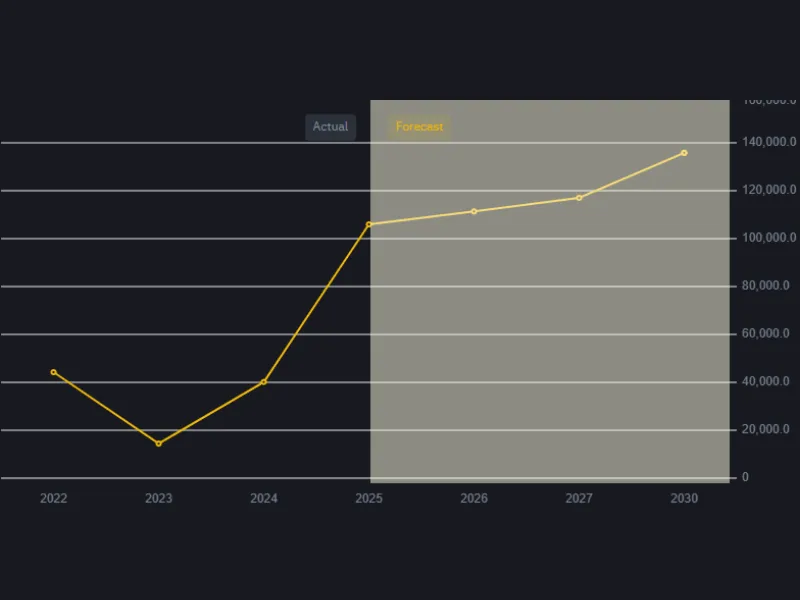

- You can visualize our Bitcoin price prediction through the chart below:

- Explore more BTC price forecasts for today, tomorrow, this week, and the next 30 days:

Bitcoin’s price is forecasted to rise by approximately 5%, potentially reaching $108,519.70 within the next 30 days, based on current prediction data.

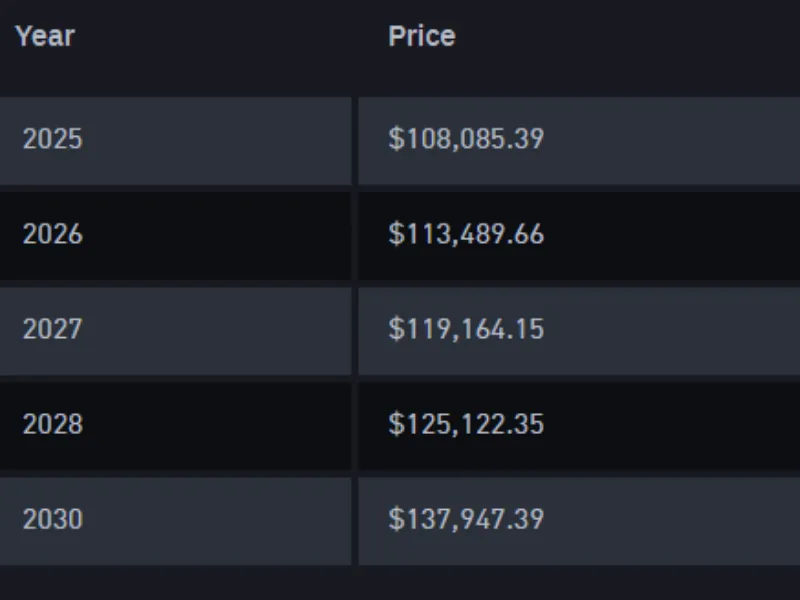

- Check out BTC price predictions through 2030 to discover Bitcoin’s long-term potential:

Bitcoin is projected to gain around 5% and reach $137,947.39 by 2030, according to recent price prediction models. Market sentiment remains bullish based on the current consensus outlook.

3. Explore the factors influencing what is Bitcoins potential

To answer what is Bitcoin potential, we must first understand the core drivers that shape its price. Bitcoin is influenced by a combination of political developments, supply-demand economics, investor psychology, and technological evolution. These elements don’t just explain where Bitcoin has been; they hint at where it could go next.

3. 1. Political developments

As of May 2025, Bitcoin trades near $146,000 AUD, recovering from a dip earlier this year. This rebound came after U.S. elections brought a pro-crypto administration to power, renewing investor optimism. Prices had peaked at $169,000 AUD but slipped to $126,000 AUD during political turbulence before bouncing back in April. Such swings reveal how the regulatory climate and government sentiment impact short-term pricing.

3. 2. The economics of supply and demand in Bitcoin

More fundamentally, Bitcoin operates under a deterministic supply model. The block reward halving, which happens every four years, limits new issuance. This scarcity, paired with rising institutional demand, creates strong upward pressure. Historically, halving years have preceded major bull runs, making it a crucial event in every Bitcoin price prediction model.

3. 3. Market sentiment and investor behavior

Sentiment also plays a massive role. Positive news, like ETF approvals or tech adoption, often sparks retail FOMO and drives prices higher. But fear, triggered by hacks or regulation, can lead to rapid sell-offs. Recognizing these emotional cycles is essential for evaluating what is the potential future of Bitcoin price realistically.

4. What is Bitcoins potential through the lens of its price history?

Bitcoin’s history reveals a pattern: high volatility followed by new highs. In 2013, it jumped to $754 USD, then crashed to $200. In 2017, it surged to $20,000, only to fall back below $4,000. Then in 2021, it soared to $69,000 USD before another major correction.

Yet each time, Bitcoin returned stronger, supported by broader adoption and improving infrastructure. y analyzing these cycles and considering Bitcoins potential market cap, we understand that Bitcoin behaves like a young tech stock: volatile in the short term, but upward trending in the long term.

The 2024 halving has already begun to show bullish results, and many forecasts, from Adam Back’s $100,000 ETF-driven target to Chamath Palihapitiya’s $500,000 by 2025, highlight how the past often sets the tone for future expectations. Still, investors should always remember: past performance doesn’t guarantee future results.

5. FAQs: Common questions when exploring what is Bitcoins potential

- 1. What factors most influence Bitcoin’s price potential?

Bitcoin’s price is driven by regulatory policies, supply-demand dynamics, especially around halving events, investor sentiment, and technological advances in blockchain. Institutional adoption and products like Bitcoin ETFs often trigger price surges. Political developments and market psychology also cause short-term fluctuations, but long-term trends hinge on adoption and scarcity.

- 2. How reliable are Bitcoin price predictions?

Price forecasts for Bitcoin are inherently uncertain due to high volatility and many influencing factors. Models like Monte Carlo simulations provide ranges of potential outcomes but cannot guarantee precise prices. Investors should view predictions as guides rather than certainties and always factor in risk management and a long-term perspective.

- 3. What impact does halving have on Bitcoin’s price?

Halving events reduce the block rewards miners receive by half, cutting new Bitcoin supply. Historically, halvings have preceded significant bull runs, often within 12 to 18 months afterward. This scarcity effect is a key factor in Bitcoin’s price appreciation over time and is closely watched by traders and investors as a major catalyst.

- 4. How could Bitcoin change the future financial system?

Bitcoin is expected to become a foundational layer in global finance, serving as a decentralized store of value, often called “digital gold.” Its transparent blockchain and scarcity make it attractive for institutional adoption and could reshape how value is stored and transferred worldwide.

- 5. How will upcoming technological upgrades impact Bitcoin?

Upgrades like the Lightning Network improve transaction speed and reduce fees, while Taproot enhances privacy and security. These technological advancements increase Bitcoin’s usability and could boost investor confidence, positively affecting its long-term value.

6. Conclusion: Understanding what is Bitcoins potential – A journey into one of the most profitable investment opportunities

So, what is Bitcoin’s potential? Based on its price history, economic model, and adoption trends, Bitcoin could evolve from a speculative asset into a global store of value. Estimates range from $200,000 to $1 million+ per coin over the next decade, depending on macro conditions and user adoption.

We’ve explored how market sentiment, regulation, halving cycles, and historical trends all converge to shape the potential Bitcoin price. Each insight helps investors better position themselves for the opportunities and risks ahead.

If you’re truly committed to unlocking Bitcoin’s opportunities, now is the time to go beyond the headlines and focus on informed decision-making. Understanding what is Bitcoins potential requires insight, discipline, and trusted guidance. At VN-US Trade, we provide expert-backed resources to help you start your next chapter with confidence, and take meaningful steps toward mastering your Bitcoin investment journey.