Nowadays, many electronic wallets have been launched to support online transactions. Do you ever find it difficult to choose a reputable, reliable wallet that still offers convenience in usage? In this article, we introduce you to a widely loved and used electronic wallet, Momo Wallet. So, what is Momo Wallet? How to use it? Should you trust Momo Wallet? All will be explained in this post.

Momo Wallet is a type of electronic wallet that allows users to perform buy and sell transactions directly on their mobile phones thanks to linked banks with Momo Wallet.

Linked banks include: Vietcombank, Agribank, Eximbank, VietinBank, TPBank, BIDV, VPBank, SCB, Shinhan, ACB, VIB Bank, OCB, VRB, Sacombank, and Bảo Việt Bank. Currently, Momo Wallet is supported on Android, IOS, and Windows Phone.

Guide to download and register a Momo account

Step 1: Download the app to your smartphone by searching “Momo Wallet” on App Store, CH Play, Google Play Store.

Step 2: Register your phone number: Open the app and enter the phone number you use for registration (this must match the number used for your Internet Banking with the linked bank).

Step 3: Enter OTP: The system will send you a verification code via message, enter the received code and press “Continue”.

Step 4: Set password: You need to enter a 6-digit numeric password, and both fields must match.

Step 5: Fill in personal information: Enter your personal information as instructed and press “Confirm” to complete registration.

Guide to top-up and withdraw from Momo Wallet

Top-up the wallet

- From a bank: By linking Momo Wallet with your bank, you can transfer money from your bank account into your wallet.

Step 1: From the main interface, tap “Deposit into Wallet”.

Step 2: Enter the amount you wish to deposit, ranging from 10,000 VND to 10,000,000 VND per transaction and up to 50,000,000 VND daily from your linked bank account.

Step 3: Verify: Review all information and confirm.

- Deposit from Visa, JCB Debit, MasterCard:

Step 1: On the main interface, select “Top-up Wallet”.

Step 2: Enter the deposit amount and choose the source of funds: The minimum deposit is 10,000 VND, with a transaction fee of 2,200 VND + 1.5% of the amount deposited.

Step 3: Confirm: Review all information and click “Confirm”.

Step 4: Enter password: For transaction authentication, input your password to complete the process.

- Deposit via domestic credit cards:

Step 1: On the main interface, tap “Deposit into Wallet”.

Step 2: Enter the amount you want to deposit, with a minimum of 20,000 VND. Select “Other sources of funds”, however, your bank account must be registered for online payment and have a minimum balance of 70,000 VND.

Step 3: Under “Other deposit methods”, select “ATM Card”.

Step 4: Choose your preferred bank for deposit to Momo.

Step 5: Review your information and tap “Deposit”.

Step 6: Confirm the transaction details, and if everything is correct, press “Confirm”.

Step 7: Enter your password for authentication.

Step 8: Enter card details:

- Cardholder name: the characters printed on the front lower part of the card, in Vietnamese without diacritics.

- Card number: The 16-19 digit number on the front of the card. Make sure to enter it continuously without spaces.

- CVV/CSC: a 3-4 digit security code, which may be printed on the front or back of the card.

- Card expiry date: the validity period printed on the front of the card.

- OTP: a one-time password provided by your bank.

Step 9: If all information provided is correct and valid, the transaction is complete at this step.

- Deposit from Momo transaction points:

Step 1: On the main interface, tap “Deposit/Withdraw Points”.

Step 2: A map of Momo transaction points will appear, choose the point you want to visit.

Step 3: The deposit is now completed.

- Deposit via money transfer feature:

Step 1: On the main interface, select “Transfer Money”.

Step 2: Choose “Transfer to Momo Wallet” and enter the recipient’s phone number.

Step 3: Enter the amount you want to transfer, noting that your Momo Wallet must have sufficient balance.

Step 4: Confirm the transaction by reviewing all details and tapping “Confirm”.

Withdraw from wallet

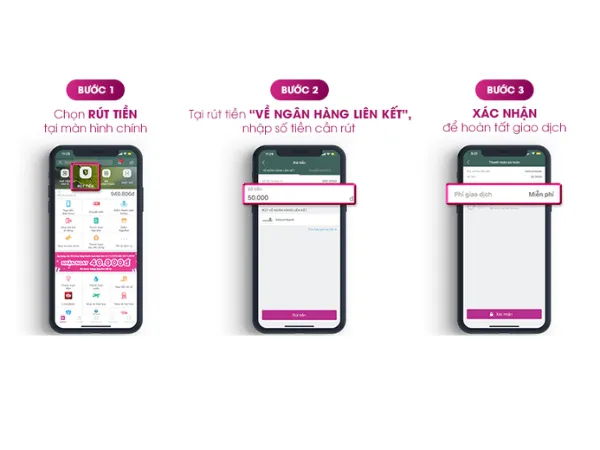

Withdrawing cash from Momo Wallet is very simple, just follow these steps:

Step 1: On the main interface, tap “Withdraw”.

Step 2: Select withdrawal method “To linked bank”.

Step 3: Enter the amount to withdraw, with the minimum allowed being 10,000 VND. Check “Learn about withdrawal fees” for specific fee details.

Step 4: Review all information, and if correct, tap “Confirm”.

Step 5: Enter your Momo account password for authentication and complete the transaction.

Advantages

The following points demonstrate many conveniences of Momo:

- Can pay up to 50 services and bills:

Momo allows users to pay various bills: electricity, water, prepaid and postpaid mobile top-ups, Internet, dining services… Momo also keeps transaction and expenditure history to help users monitor and manage their finances conveniently.

- Book tickets and choose seats for movies as desired:

When the hottest movies are released, the hassle of queuing for tickets and hunting for good seats is resolved by Momo. Additionally, Momo helps you find films to watch by summarizing content and IMDB ratings… Users can select movies and showtimes up to 3 hours in advance.

- 5% discount on phone top-up cards:

Momo makes it convenient to buy phone top-up cards directly on your phone, avoiding interrupted conversations. Momo also refunds 5% of the card value as a commission, which is hard to get when buying outside stores. Not only mobile recharge cards, but game cards also receive attractive offers.

- Money transfer just by phone number:

By syncing contacts who also use Momo, you can send money quickly to friends and family via phone numbers. The app will notify you if there are new Momo users in your contacts.

Disadvantages

However, Momo, like any e-wallet, has some disadvantages:

- Fees: Most transactions and payments on Momo are free, except for withdrawals from Momo Wallet.

- Security: The provider always emphasizes protecting users’ information and accounts, but some incidents are hard to avoid, especially if users are not cautious enough.

How to mitigate Momo Wallet drawbacks:

To address these vulnerabilities and risks, users mainly need to be careful, only transact on reputable websites, and be cautious about sharing information and choosing safe services.

Given these pros and cons, the question remains: should you use Momo Wallet? Rest assured, users can confidently use Momo because it has very good security, certified PCI DSS, which few others can match. Additionally, users need to be smart and alert. Compared to the convenience Momo offers, such as quick and easy transactions, diverse bill payments, and more, Momo deserves trust from users.

This article has comprehensively shared all necessary information about Momo Wallet: What it is, how to download, install and use, the pros and cons, and some tips for usage. Wishing you success.

See also: What is ViettelPay?