What is stop and limit order, and why do smart traders rely on them to manage risk? Stop and limit orders are two of the most essential tools in any trader’s arsenal especially for those dealing in cryptocurrencies, stocks, or forex.

These order types allow you to automate your trades based on specific price points, giving you the ability to control how much you pay or receive, and to protect your positions from market volatility.

Whether you’re trying to enter the market at an ideal price or safeguard against unexpected losses, understanding how stop and limit orders work can make the difference between a calculated trade and a costly mistake.

In this guide, Vietnam-UStrade breaks down the core definitions, use cases, pros and cons, and real-world examples of each order type. You’ll also discover how to combine them for smarter trading strategies.

1. What is stop and limit order? Core definitions

To fully grasp what is stop and limit order, it’s important to define each type clearly. A limit order lets you set the exact price at which you want to buy or sell. For example, if a stock is trading at $50 but you only want to buy it at $48, you place a buy limit order at $48. Your order will only execute if the price falls to that level or better. This way, you control the price but risk the order not filling if the market doesn’t reach it.

A stop order is triggered when the price hits a certain point, at which your order becomes active and executes as a market order. For instance, a stop-loss order might sell your shares if the price drops below $45 to limit losses. Unlike limit orders, stop orders focus on price movement activating the trade rather than the exact execution price.

There is also a stop-limit order, which combines both. It triggers when the stop price hits but executes as a limit order at a specified price, giving you more control but with the chance the order might not fill.

Understanding these differences helps you manage risk and execute trades on your terms.

Quick Comparison: Stop vs Limit vs Stop-Limit Order

| Attribute | Stop Order | Limit Order | Stop-Limit Order |

|---|---|---|---|

| Trigger | Price reaches stop point | Price at or better than limit | Price reaches stop point |

| Execution | Market order upon trigger | Limit order at set price | Limit order after stop trigger |

| Visibility | Hidden until triggered | Visible in order book | Hidden until triggered |

| Use Case | Stop-loss, momentum entry | Buy/sell at target price | Precise control in volatile markets |

| Pros | Automated risk control | Price control, no slippage | Combined control & execution limit |

| Cons | Risk of slippage | May not fill | May miss fill if price jumps |

1.1. How does a limit order work?

To clearly understand the difference between stop order and limit order, it’s essential to first break down how a limit order functions in real trading scenarios.

A limit order allows you to specify the price you want to buy or sell, helping you control how much you pay or receive. For example, imagine a cryptocurrency trading at $100. You want to buy it if the price drops to $95. You place a buy limit order at $95. The order waits until the market price hits $95 or lower before executing.

Here’s how it works step-by-step:

- You decide the target price you’re comfortable with (e.g., $95).

- You place the limit order with your broker or trading platform.

- The order sits waiting in the system, visible to the market.

- When the market price reaches or improves beyond $95, your order executes.

- If the price never falls to your limit, the order stays unfilled or can be canceled.

Limit orders offer great price control, avoiding “slippage” which is especially important when buying volatile assets like bitcoins. However, their downside is uncertainty you may never buy or sell if the target price isn’t met, potentially missing out on opportunities.

Limit orders work best for entering trades at preferred prices or taking profits at target levels. They suit traders who prioritize price precision over speed of execution.

1.2. How does a stop order work?

A stop order activates a market order once the price hits a specific trigger, helping traders react quickly to price moves. There are two common types:

- Stop-loss: Automatically sells an asset to limit losses if the price falls below a set level.

- Buy stop: Used to buy when the price rises above a certain point, often to catch upward momentum.

For example, you buy a stock at $60 but want to limit losses. You set a stop-loss order at $55. If the price drops to $55, the stop triggers, and your shares sell at the next available price.

Step-by-step process:

- You set a stop price below (for sell) or above (for buy) the current price.

- When that stop price is reached, the stop turns into a market order.

- The market order executes at the next available price, which could be different from the stop price.

Stop orders help manage risk by automating exits, removing emotion. They are vital to protect profits and limit losses.

However, risks include slippage where the execution price is worse than the stop price, especially during volatile or fast markets. Market gaps can also cause orders to fill far from your stop level.

Recognizing when and how to use stop orders will deepen your knowledge of what is stop and limit order in practical trading.

1.3. What is a stop-limit order?

A stop-limit order combines the features of stop and limit orders. It triggers when the stop price is reached, but instead of executing as a market order, it becomes a limit order at a specified price.

For example, you own shares trading at $80 but want to sell if the price falls to $75. You place a stop-limit sell with a stop at $75 and a limit at $74.50. When the price hits $75, your order activates but will only sell at $74.50 or better. This helps avoid selling at prices lower than you want.

Stop-limit orders give precise control over execution price and risk but can fail to fill if prices move too quickly past your limit.

They are useful in volatile markets where you want to avoid unexpected price drops but still need automatic triggers.

| Order Component | Stop Price | Limit Price |

|---|---|---|

| Trigger | Price that activates order | N/A |

| Execution | N/A | Limit price or better |

This hybrid approach highlights the full scope of what is stop and limit order, especially for traders operating in high-volatility environments.

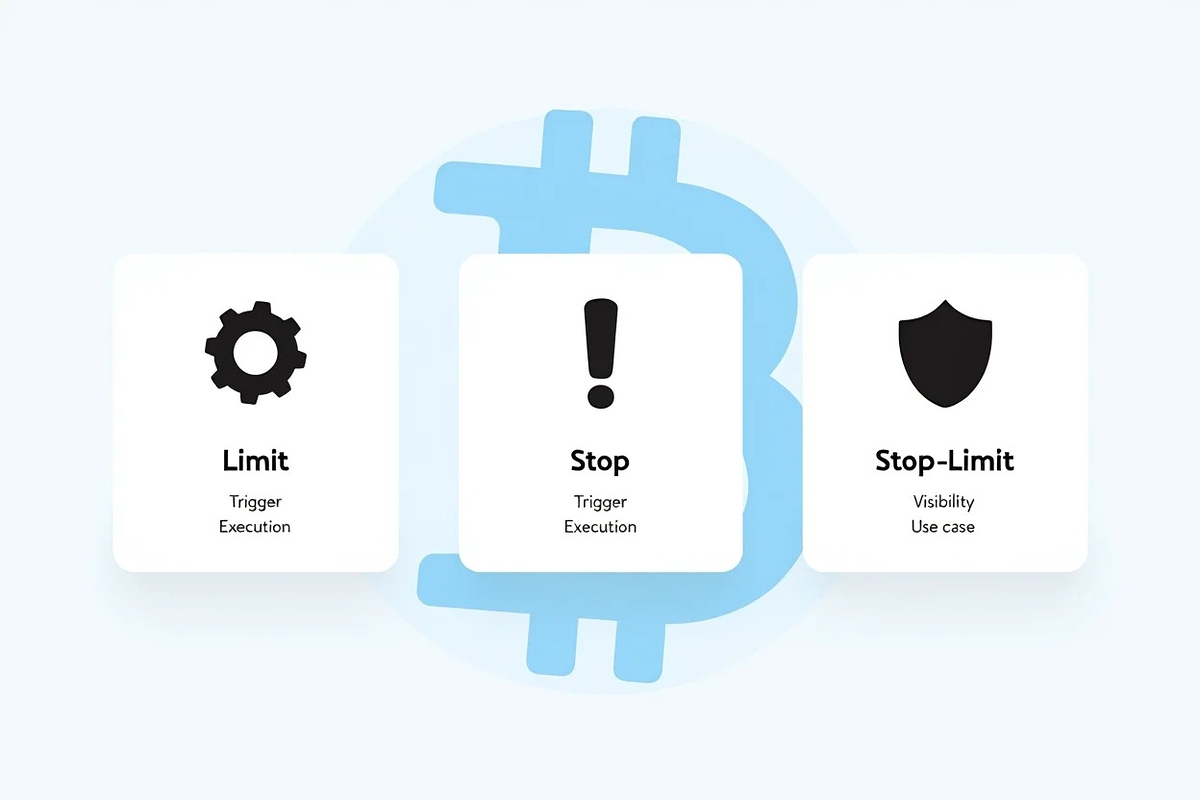

2. Key differences between stop, limit, and stop-limit orders

Understanding what is stop and limit order also means knowing how they differ in function and purpose.

- Trigger: Stop and stop-limit orders activate on price triggers; limit orders do not trigger but set a price.

- Execution: Stop orders become market orders; limit orders execute at set prices; stop-limit orders execute as limits after trigger.

- Control: Limit and stop-limit orders offer price control; stop orders prioritize speed but risk slippage.

- Fill certainty: Stop orders usually fill but price can vary; limit orders may not fill if prices don’t match; stop-limit may not fill if limit is missed.

- Who should use: Stop orders are best for risk management; limit orders suit precise trading entry/exits; stop-limit assists in volatile markets needing strict price control.

| Order Type | When Triggered | Execution Price | Risk | Who Should Use |

|---|---|---|---|---|

| Stop | Price hits stop | Next market price | Slippage, gaps | Risk managers, momentum traders |

| Limit | No trigger needed | At or better than set price | No fill risk | Price-sensitive traders |

| Stop-Limit | Price hits stop | Limit price or better | Missed fill risk | Volatile market traders |

3. Practical examples: How to use each order type in real trading

Real-life use cases can help clarify what is stop and limit order and when to use them. Consider three common scenarios:

1. Buying on a Dip with a Limit Order

You want to buy Bitcoin currently priced at $30,000 but only if it drops to $28,500. You place a buy limit order at $28,500. If Bitcoin’s price falls to this level, your order executes at $28,500 or better, saving you from paying more.

To understand how Bitcoin behaves around these levels, read more about what happens when Bitcoin halves

2. Using Stop Orders as Stop-Loss in Downtrends

You hold shares bought at $100 but want to protect yourself if the price falls. You set a stop-loss at $95. If the price drops to $95, your shares sell automatically, limiting further losses.

3. Stop-Limit for Controlled Exits During Volatility

In a fast-moving forex market, you want to sell EUR/USD if it drops to 1.1000 but not lower than 1.0995. You place a stop-limit sell order with stop at 1.1000 and limit at 1.0995. This avoids getting a worse price from sudden slippage.

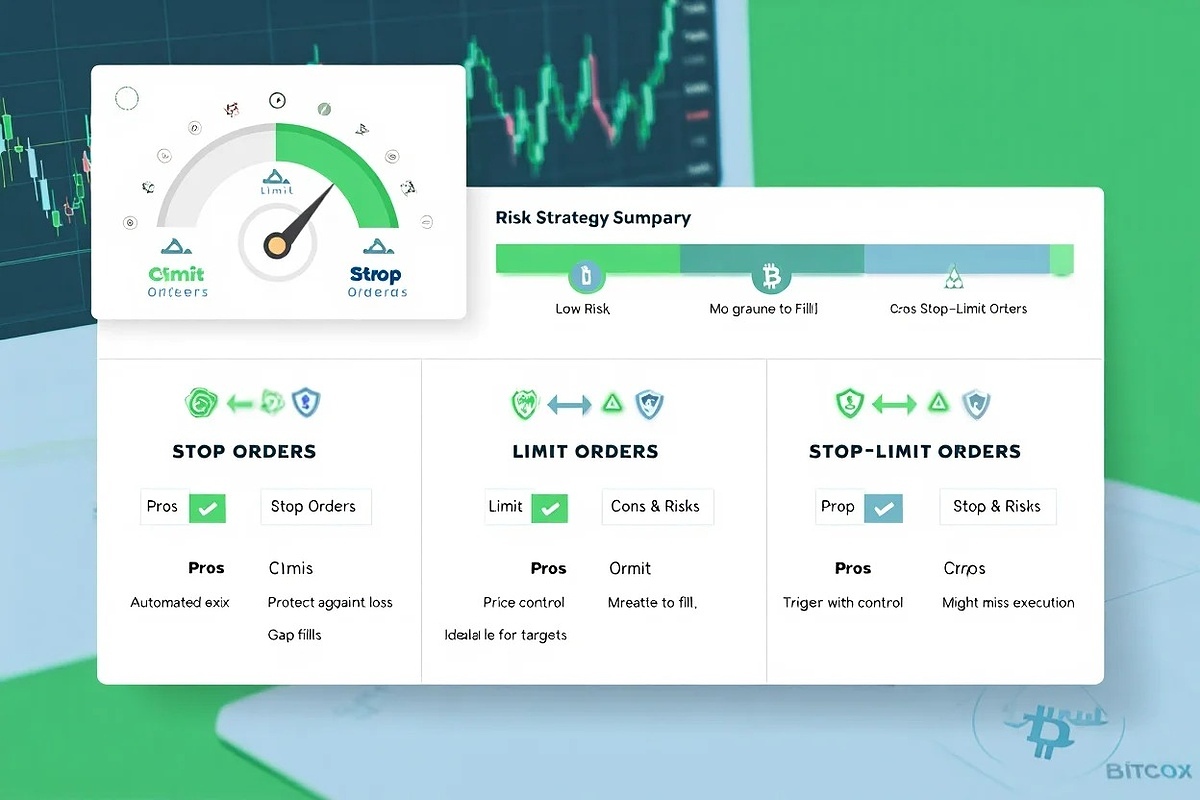

4. Pros, cons, and risks of stop, limit, and stop-limit orders

Each component of what is stop and limit order comes with unique advantages and limitations you need to understand.

Stop Orders

- Pros: Automate exits, protect from large losses, easy to set.

- Cons: Possible slippage, no price guarantee, risk gaps.

- Tip: Use stops with awareness of market volatility to avoid unexpected fills.

Limit Orders

- Pros: Control purchase/sale price, avoid slippage, good for entries and profits.

- Cons: Risk order never fills if price doesn’t hit limit.

- Tip: Adjust limit prices gradually to improve fill chances.

Stop-Limit Orders

- Pros: Combines price control with triggered execution, useful in volatile conditions.

- Cons: May not execute if market jumps beyond limit price.

- Tip: Use where you monitor price action closely and can adjust limits.

5. Expert tips for trading with stop and limit orders

If you’re still unsure what is stop and limit order, these expert tips will help you apply them more effectively. In fast or less liquid markets, set stop and limit orders with a buffer to avoid unwanted execution due to price spikes.

Use layered orders place multiple limit prices at intervals to improve chances of filling without chasing the market.

Periodically review and adjust your stops and limits as market conditions change rather than setting and forgetting.

Understand each broker’s order execution policies. Some may route stop orders as market orders, which can lead to slippage in volatile markets.

When possible, combine stop-limit orders to balance execution certainty and price control during market jumps.

Continue learning with these articles:

6. Frequently asked questions about stop and limit orders

Many new traders wonder what is stop and limit order and how these orders behave in real trading environments.

6.1. Can limit orders be guaranteed to fill?

Limit orders only fill if the market reaches your set price or better. There is no guarantee they will execute if prices don’t meet the limit.

6.2. What if the market gaps past my stop?

If the price jumps below or above your stop price suddenly, your stop order will execute at the next available market price. This can cause slippage where execution price differs from your stop.

6.3. Can you cancel or change orders after placing them?

Yes, most platforms allow you to modify or cancel open orders before they execute, giving you flexibility to react to market changes.

6.4. How do commissions/fees affect order use?

Broker fees apply to executed trades, not orders. Frequent order placement or cancellations might incur charges depending on your broker’s policies.

6.5. Are there broker restrictions on stops/limits?

Some brokers may limit minimum stop distances or types of orders depending on the market or regulations. Always check your platform rules before placing orders.

6.6. Can you use multiple order types together?

Yes, traders often combine stops, limits, and stop-limit orders to manage entries and exits strategically for better risk control.

7. Conclusion

What is stop and limit order and how can it improve your trading decisions? Stop and limit orders are key tools that give traders greater control over price execution and risk management. By understanding how these orders work, you can make more strategic and disciplined trading decisions.

Here’s a quick checklist:

- Stop orders help automate exits during adverse market moves.

- Limit orders provide price control and prevent overpaying or underselling.

- Stop-limit orders offer a balanced approach, combining control and automation.

Don’t forget to follow the Trader & Trading category on Vietnam-UStrade to stay updated with the latest trading strategies, expert tips, and market insights tailored for both beginners and experienced traders.