If you’ve ever wondered “what is wrapped bitcoin?”, you’re not alone. In today’s rapidly evolving world of decentralized finance (DeFi), wrapped bitcoin (wBTC) has emerged as a powerful tool to unlock Bitcoin’s value in the Ethereum ecosystem.

As crypto investors, whether you’re just starting or have years of experience, understanding how different assets interact is essential to growing your portfolio safely and efficiently. By the end of this guide, you’ll gain clarity on what wBTC is, how it differs from BTC, who created it, and why it’s increasingly important for DeFi strategies. Let’s dive in with VN-US Trade.

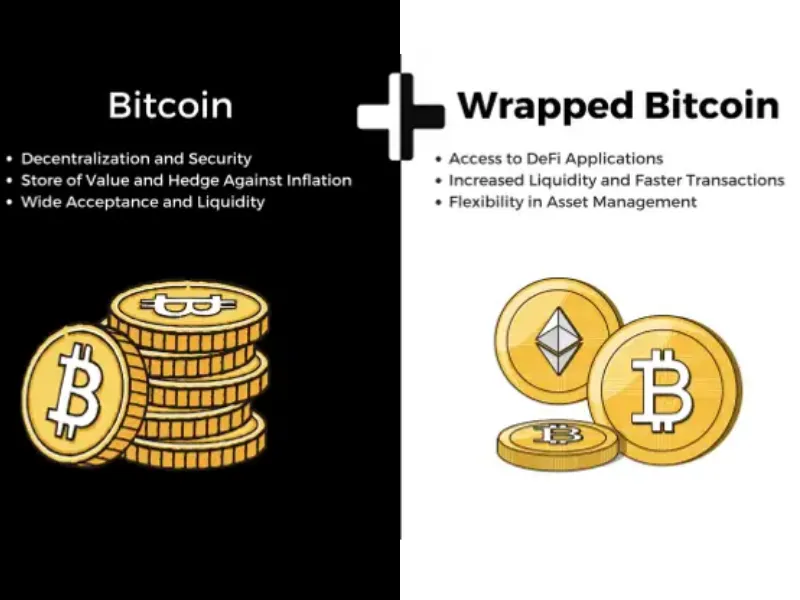

1. What is wrapped Bitcoin? Wrapped Bitcoin vs Bitcoin – How do they differ?

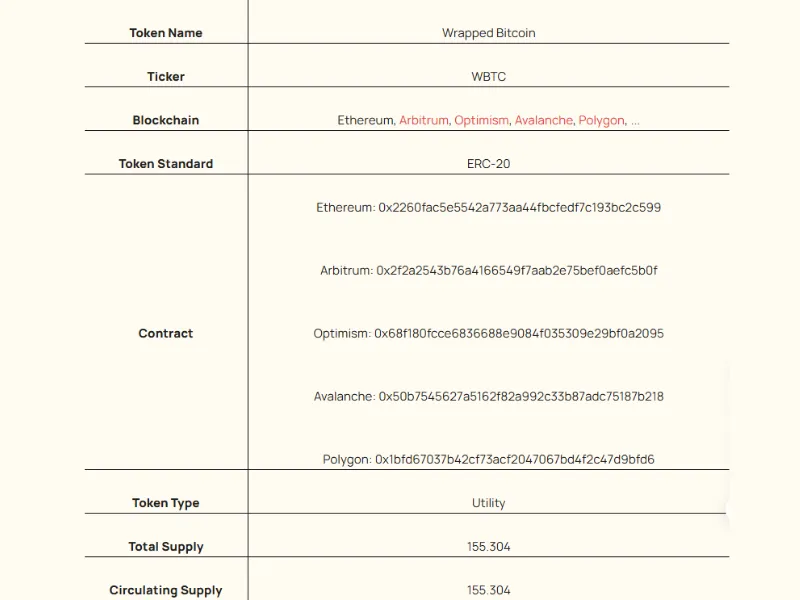

Through years of navigating crypto markets, one pattern consistently stands out: liquidity is king. Wrapped Bitcoin (wBTC) was born from this very need. It’s an Ethereum-based token that represents Bitcoin and is backed on a 1:1 ratio. In other words, each unit of wBTC is backed by exactly one BTC, held securely in reserve.

So, what’s the point?

Bitcoin, as revolutionary as it is, operates on a standalone blockchain. This limits its functionality when it comes to interacting with Ethereum’s thriving DeFi ecosystem, the place where decentralized lending, yield farming, and DEXs live. Ethereum’s dApps only accept ERC-20 tokens. That’s where wrapped coins like wBTC come into play.

The process involves wrapping Bitcoin into an Ethereum-compatible token, enabling BTC holders to participate in DeFi without selling their BTC.

For example, I’ve personally used wBTC to earn yield on platforms like Compound and Aave. Instead of my bitcoin sitting idle in a cold wallet, it’s earning 4-6% APY, while I maintain full exposure to BTC price movements. That’s a powerful use case for any long-term holder still wondering what is wrapped Bitcoin and how it benefits real-world crypto strategies.

Here’s a simplified analogy: Imagine Bitcoin is cash, and Ethereum is a high-tech shopping mall that only accepts digital gift cards. wBTC acts like a gift card that holds the same value as your cash but can be used in the Ethereum mall.

1.1. Wrapped Bitcoin vs Bitcoin: What are the key differences between them?

Let’s break this down in a comparison table:

| Feature | Bitcoin (BTC) | Wrapped Bitcoin (wBTC) |

| Blockchain | Bitcoin network | Ethereum blockchain (ERC-20 standard) |

| Use case | Store of value, peer-to-peer transactions | Used in Ethereum DeFi apps, smart contracts |

| Interoperability | Limited to Bitcoin ecosystem | Fully compatible with Ethereum dApps |

| Value peg | Native Bitcoin | Pegged 1:1 with BTC |

| Creation process | Mining (Proof of Work) | Minting by custodians after BTC deposit |

| Redemption | Direct use or sale | Burn wBTC to redeem BTC via a merchant |

| Custody model | Decentralized, miners secure the network | Centralized custodians like BitGo |

| Transparency | Public blockchain | Proof of reserve and on-chain audits |

In essence, BTC is the original asset, while wBTC is its Ethereum-compatible reflection, optimized for flexibility and utility in smart contracts. If you’re asking yourself what is wrapped Bitcoin, this is it: a tokenized version of BTC that maintains its value while unlocking new DeFi use cases. You don’t lose the value of Bitcoin, but you gain the usability of Ethereum.

2. Who created wrapped Bitcoin?

Wrapped Bitcoin was not the invention of a lone developer or startup. It was a collaborative effort between multiple major players in the crypto space:

- BitGo Inc.:The custodian responsible for holding BTC and minting wBTC.

- Kyber Network: A decentralized liquidity protocol.

- Ren (formerly Republic Protocol): A platform known for enabling interoperability between blockchains.

They officially launched wBTC in January 2019, after publishing a detailed whitepaper and setting up the necessary merchant-custodian infrastructure. Eight initial merchants were involved in converting BTC into wBTC. That number has grown steadily as more DeFi platforms adopted the token.

Importantly, governance is handled by the wBTC DAO (Decentralized Autonomous Organization). This DAO includes stakeholders from leading DeFi platforms and ensures no single party controls the minting or burning processes.

I find this setup particularly reassuring. Each DAO member holds a multi-signature key, meaning decisions, like updating the smart contract or adding new merchants, require collective agreement. That’s critical when you’re trusting the system with high-value assets.

Another layer of trust comes from BitGo’s regular audits and its proof-of-reserve mechanism on the Bitcoin blockchain. If you’ve ever asked yourself what is wrapped Bitcoin, this governance and transparency model offers a key part of the answer: every wBTC token is verifiably backed by real BTC, and anyone can confirm it on-chain.

3. How does wBTC work?

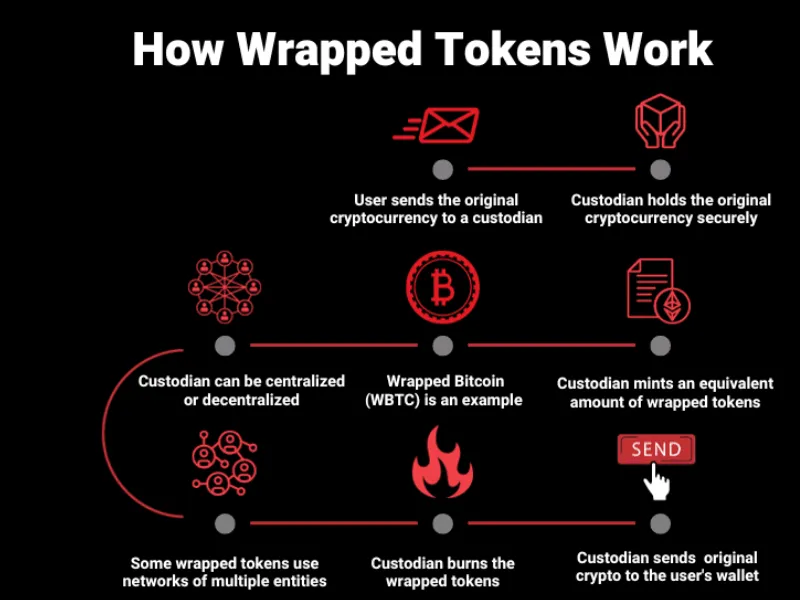

The inner workings of wrapped Bitcoin might sound technical, but they follow a straightforward principle: lock real BTC and issue an equal amount of wBTC.

Let me break it down with a real-use flow:

- User submits request: Suppose you want to mint 2 BTC worth of wBTC. You start by submitting a request via a merchant (like CoinList or Kyber).

- Merchant verification: The merchant will perform KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, essential for regulatory compliance.

- BTC transfer to custodian: You send 2 BTC to BitGo, the custodian.

- Minting of wBTC: Upon confirmation, BitGo mints exactly 2 wBTC on Ethereum and sends them to the merchant’s Ethereum wallet.

- Token distribution: The merchant then sends the wBTC to your wallet, completing the process.

This entire process is transparent, auditable, and backed by real bitcoin. Whenever you want to redeem your wBTC, the process happens in reverse:

- You send your wBTC back to the merchant.

- The merchant initiates a “burn” transaction to destroy the ERC-20 tokens.

- BitGo then releases your BTC back to your original wallet address.

If you’re still wondering what is wrapped Bitcoin, this redemption model offers a clear answer: it’s a token that mirrors Bitcoin’s value but functions smoothly within Ethereum’s DeFi ecosystem. What’s interesting is that you don’t even have to interact with a centralized exchange. Peer-to-peer platforms and DeFi-based swaps enable atomic swaps between BTC and wBTC.

Another key element is governance. The wBTC smart contracts are controlled by a multi-party DAO consisting of platforms like MakerDAO, Blockfolio, and Gnosis. These members ensure the system remains open, auditable, and secure for all users.

See more related articles:

- What is the best algorithm for Bitcoin mining? Explore the best algorithm for Bitcoin in 2025

- What is the best way to buy Bitcoins? Top 4 methods for investors

- What is the current Bitcoin price in US Dollars? The latest expert chart update for today, 2025

4. What is wrapped Bitcoin used for? What can investors gain from wrapped coins?

Wrapped Bitcoin is a game-changer. Why? Because it gives bitcoin liquidity legs to run through Ethereum’s decentralized finance (DeFi) infrastructure. By converting BTC into an ERC-20 token, you can deploy your BTC capital in lending platforms, liquidity pools, and smart contracts, without selling your bitcoin.

4.1. Wrapped Bitcoin unlocks DeFi utility

The Ethereum network dominates the DeFi space. But BTC, despite being the largest cryptocurrency by market cap, wasn’t natively compatible.

With wBTC, that changes.

You can use wrapped Bitcoin to:

- Access crypto loans: Lock wBTC into a smart contract and borrow DAI or USDC.

- Earn passive income: Provide wBTC liquidity in pools and earn trading fees or incentives.

- Swap assets easily across Ethereum using tools like MetaMask or Coin98.

From my own experience, converting BTC to wBTC allowed me to leverage idle bitcoin to earn interest, without giving up exposure to BTC price action.

4.2. More liquidity, more opportunity

“What is Wrapped Bitcoin used for?” It has also boosted liquidity across Ethereum-based protocols.

- More wBTC = more trading pairs = better price discovery.

- Liquidity on DEXs increases, benefiting both investors and traders.

The data backs this up. According to DeFi Pulse, total value locked in wBTC grew from $665M to $848M in less than two months in 2020. That’s a strong indicator of growing trust and adoption.

4.3. Faster transactions

Another perk? Speed.

- Bitcoin settles every 10 minutes.

- Ethereum settles every 15 seconds.

That means wrapped bitcoin transactions can clear much faster, especially when trading on Ethereum DEXs or moving funds between wallets.

It’s a practical advantage if you’re managing risk in volatile markets or need to exit positions quickly.

4.4. Portfolio diversification with exposure to BTC

Some investors want BTC exposure without dealing with Bitcoin’s blockchain directly.

wBTC makes that possible:

- Buy wBTC through Ethereum platforms and wallets.

- Trade or hold it just like any ERC-20 token.

- Stay exposed to bitcoin price movement while remaining active on Ethereum.

In summary, what is wrapped Bitcoin used for? It’s used to bring Bitcoin’s value into Ethereum, giving BTC holders more tools, speed, and earning potential.

5. What is wrapped Bitcoin price?

As of today, the current price of wrapped bitcoin (wBTC) is $107,643.25 per token, reflecting a -1.07% change in the last 24 hours. It mirrors Bitcoin’s value precisely because wBTC is pegged 1:1 to BTC.

The market capitalization of wBTC stands at approximately $13.88 billion USD, with a 24-hour trading volume of $297.53 million USD. There are 128,977.31 wBTC in circulation, and this supply changes based on minting (when BTC is wrapped) and burning (when it’s unwrapped back into BTC).

If you’re tracking the what is wrapped bitcoin price daily, note that it’s updated in real-time, much like BTC itself, since the token is always backed by a verifiable reserve.

6. Where can you buy and store wBTC?

Buying wBTC is easier than ever, especially with more exchanges and wallets supporting it.

You can purchase wBTC through:

- Centralized exchanges (CEXs) like Binance, Coinbase, Bybit, or Bitrue,…

- Decentralized exchanges (DEXs) such as Uniswap or Sushiswap.

If you’re purchasing through official merchants like CoinList, you’ll go through standard KYC (Know Your Customer) verification before wrapping your BTC. Once verified, you send your BTC to the custodian (such as BitGo) and receive wBTC on Ethereum in return.

Prefer DeFi? Use DEXs, no KYC required, just connect your Ethereum wallet and swap directly.

When it comes to storing wrapped Bitcoin, there are several ERC-20-compatible wallets you can trust:

- MetaMask: Widely used, supports all Ethereum tokens, including wBTC.

- Coin98 Wallet: Especially popular in the Vietnamese crypto community.

- Trust Wallet: Mobile-friendly and DeFi-compatible.

If you’re wondering what is wrapped bitcoin wallet, the answer lies in any secure Ethereum wallet that supports custom tokens. Just add the wBTC contract address and you’re ready to manage your funds across platforms.

From my experience, hardware wallets like Ledger or Trezor integrated with MetaMask offer the best combination of convenience and security.

7. FAQs: Common questions when searching for what is wrapped Bitcoin

7. 1. What is the process of going from BTC to wBTC?

To convert BTC to wBTC, you go through a merchant (like CoinList), send them your BTC, and they coordinate with BitGo to mint the equivalent wBTC on Ethereum. The entire process is transparent, audited, and verifiable on-chain.

7. 2. Is wrapped Bitcoin safe to use in DeFi protocols?

Yes, wBTC is backed 1:1 by real Bitcoin and audited regularly. Its minting and burning are controlled by a DAO, and BitGo holds the BTC in custody. While there’s some centralization, it’s trusted by major DeFi platforms.

7. 3. Can I earn interest with wrapped Bitcoin?

Definitely. You can lend wBTC on DeFi platforms like Aave, Compound, or Curve to earn passive income, often 3–6% APY. It’s one of the easiest ways to make your BTC work for you.

7. 4. Do I need KYC to get wrapped Bitcoin?

If you’re using an official wBTC merchant like CoinList, then yes, KYC is required. But if you’re using a DEX like Uniswap, you can swap into wBTC without KYC, assuming you already have ETH or another ERC-20 token.

7. 5. Why Not Just Use Ethereum?

You can use ETH in DeFi, but Bitcoin’s larger market cap makes it a valuable collateral option. wBTC brings Bitcoin’s value into Ethereum, expanding DeFi liquidity and collateral diversity. As DeFi grows, fast and stable transactions matter more. It’s no surprise that wBTC’s total value locked jumped 943% in just three months in 2020, according to DeFi Pulse.

8. Conclusion: Discover what is wrapped Bitcoin, unlocking smarter investment paths for crypto traders

By now, you’ve likely grasped the full picture of what is wrapped Bitcoin, from its DeFi utility to its price mechanics, and how to store and trade it securely. You’ve also seen how wrapped bitcoin empowers investors, making their BTC holdings far more flexible and productive in today’s DeFi world.

Understanding wBTC is a crucial step in maximizing your crypto investment strategy. You no longer have to choose between holding BTC and using Ethereum dApps. With wrapped bitcoin, you can do both.

If you’re ready to go beyond just holding BTC and want to unlock its full potential, it’s time to understand what is wrapped Bitcoin and how it fits into the cross-chain future of crypto. At VN-US Trade, we’re here to guide you. Dive into our website to learn how Wrapped Bitcoin can help you earn, borrow, and swap, without leaving the Ethereum ecosystem.